Listen to the Audio Mises Wire version of this article. Quite a few people may wonder why the global fiat money system has not yet collapsed. The fiat money system did not crash in the financial and economic crisis of 2008/2009, when a great many people feared the debt pyramid would come crashing down. And it has not gone belly-up in the current coronavirus crisis, in which governments all over the world have shut down economic activity, making production fall over the cliff and unemployment skyrocket. Doesn’t all this contradict the Austrian business cycle theory (ABCT), which says that a fiat money–induced boom must end in a bust? The answer is no, it does not. The ABCT, as developed in particular by Ludwig von Mises, is an a priori theory. Its statements are

Topics:

Thorsten Polleit considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| Listen to the Audio Mises Wire version of this article.

Quite a few people may wonder why the global fiat money system has not yet collapsed. The fiat money system did not crash in the financial and economic crisis of 2008/2009, when a great many people feared the debt pyramid would come crashing down. And it has not gone belly-up in the current coronavirus crisis, in which governments all over the world have shut down economic activity, making production fall over the cliff and unemployment skyrocket. Doesn’t all this contradict the Austrian business cycle theory (ABCT), which says that a fiat money–induced boom must end in a bust? The answer is no, it does not. The ABCT, as developed in particular by Ludwig von Mises, is an a priori theory. Its statements are consistently grounded in the irrefutably true logic of human action. As such, the ABCT tells us precisely what will happen to the economy if and when the central bank, in close cooperation with commercial banks, increases the quantity of money through credit expansion: the market interest rates will be artificially suppressed, consumption increased at the expense of savings, and additional investment induced. The economy, starting to live beyond its means, enters a boom period. Once the additional credit and money injection have worked their way through the economic system, affecting wages and goods prices, the market interest rate returns to its original level. Consumption declines, savings increase, and new investments turn out unprofitable—as entrepreneurs realize that their economic calculation has been corrupted by the artificial suppression of the market interest rate. It turns out that overconsumption and malinvestment are the consequences of the boom, that the production structure has been misguided and must be corrected, which happens through the bust. |

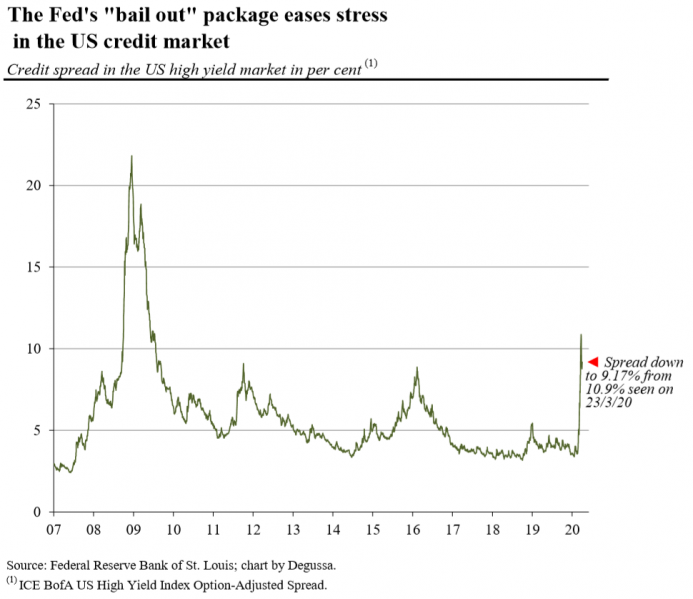

The Fed's "bail out" package eases stress in the US credit Market, 2007-2020 |

It is in this sense that the ABCT informs us that the boom must (sooner or later) end in a bust. Its reasoning, as irrefutably correct as it is in terms of the logic of human action, cannot be used without caveat to explain the real world, though. This is because the ABCT, like any other theory, holds true ceteris paribus, under the notion of other things being equal. To give a simple illustration: if the central bank injects new money into the economy through credit expansion, and if the free market is allowed to work, and if there are no other factors such as increases in productivity, changes in consumer tastes, etc., then the boom will turn into bust.

The real world, however, is a different place. Not only do consumers and producers change their behavior as time goes by, but there is also government action, which affects the working of the economic system. Most importantly, government interference in the marketplace is on the rise. It clamps down on the very forces that can, and usually do, turn a boom into bust. After the latest financial and economic crisis in 2008/2009, central banks put a “safety net” under the financial markets and the economies: businesses and investors can be assured that central banks, in time of need, will come to their rescue and bail them out.

The same happened in late March 2020, when governments all over the world—as a reaction to the political decision to shut down economic activity—put together gigantic “bailout” packages—meant to support credit markets and extending loans and unemployment benefits to struggling businesses and consumers. Of course, governments do not have all the money promised to the victims of the “lockdown” at hand. And the money cannot be obtained by raising taxes or by issuing new bonds in the capital markets without making interest rates go up.

Central banks have started doing the dirty work by rolling out the biggest “backstop” ever. To prevent the bust, they are manipulating the interest rates downwards and will print up ever greater amounts of money if necessary. In particular, and most importantly, central banks have entered corporate and long-term bank credit markets. They have lowered the cost of credit and capital in general. The beneficiaries are big business, Wall Street and, of course, highly leveraged investors, banks, and the financial industry in general.

Does this not just postpone the inevitable bust, one may ask? The ABCT even helps to find an answer to this question. For one thing, of course there would be a recession-depression-like bust at some point, if and when market forces have the space to restore the economy to equilibrium. However, neither politicians, bankers, entrepreneurs, nor employees want this to happen. This gives governments and their central banks—supported by a public that is becoming increasingly fearful of job losses and personal ruin—carte blanche to go ahead and do away with what little is left of the free market system.

To escape the bust, the free market system is transformed into a Befehlswirtschaft: a system in which the means of production remain formally in private hands but in which the state, and the special interest groups running it, are really in the driver’s seat, dictating and controlling goods prices, interest rates, wages, incomes, labor conditions, and even nationalizing and managing banks and entire industries. This was the model that the German National Socialists erected in the late 1930s: the state dictated what was to be produced, by whom, when, where, and at what costs.

History does not repeat itself, but sometimes it rhymes. The Western world is increasingly, and quite rapidly, bidding farewell to the idea of the free market system, driven by the attempt to fend off the inevitable bust, which is the consequence of a decade-long debt binge caused and made possible by central banks’ fiat money regime. Although this may indeed keep away the bust for quite some time, it will weaken output and employment gains. People’s standard of living will no longer improve at an acceptable clip, and it may even decline; with this comes impoverishment.

These are the very ingredients that facilitate the rise of the totalitarian state. So, the unpalatable truth is that without allowing for a bust—a big crash—the fiat money system and all the forces working toward the aggrandizement of the state are here to stay and will predictably get worse. The hefty price of upholding the current boom and the economic and social structure that it has brought about is the end of the free market society as we know it. That said, one should hesitate to feel relieved that the central banks seem to have succeeded once again in fighting the bust.

The ABCT in its traditional formulation enlightens us about the consequences of how the free market system turns an artificial fiat money–induced boom into bust. It thereby also helps us understand what actions will most likely be taken by those who want to prevent the boom from ending in a bust: the free society, the free market order, will become the victim. Fiat money—other things being equal—is a sure way of gradually overthrowing the present order. In this sense, it is a tool of stealthy agitation for Marxists seeking to overthrow capitalism, the private property society.

In retrospect, it therefore seems to have been premature to interpret the latest crash of stock prices—the S&P 500 stock market index shed 33 percent from February 12, 2020 to its low on March 24, 2020—as an indication of the approaching end of the fiat money regime. The power of governments and central banks over economic and societal affairs has not been broken. On the contrary, one must fear that it has gathered further strength in the course of the latest “lockdown”: more and stronger than ever, states and their central banks dismantle the free market system, cementing their fiat money and ultimately erecting the almighty state.

The ABCT is a boom and bust theory that does not crash. It offers timeless truths about the economic consequences of injecting fiat money into the economy. We know that a boom must result in a bust. But we do not and cannot forecast with certainty when it will occur. It all depends on the “special conditions” under which the fiat money regime operates. In a hampered market economy, the boom might very well last longer than one would expect. And the final crash might appear in a rather different format if and when governments increasingly shut down the free market system: namely tyranny.

Tags: Featured,newsletter