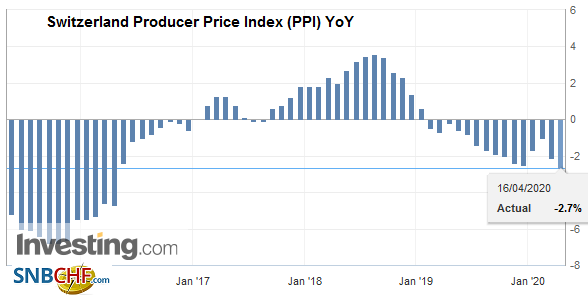

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in the U.S., diminished the overvaluation. In 2017, however, producer prices are rising again – in both Europe and Switzerland. See more in Is the Swiss Franc overvalued? 16.04.2020 – The Producer and Import Price Index fell in March 2020 by 0.3% compared with the previous month, reaching 99.4 points

Topics:

George Dorgan considers the following as important: 2.) Swiss Statistics - Press Releases, 2) Swiss and European Macro, Featured, newsletter, Switzerland Producer Price Index

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in the U.S., diminished the overvaluation. In 2017, however, producer prices are rising again – in both Europe and Switzerland. See more in Is the Swiss Franc overvalued?

| 16.04.2020 – The Producer and Import Price Index fell in March 2020 by 0.3% compared with the previous month, reaching 99.4 points (December 2015 = 100). This decline is due in particular to lower prices for petroleum products. Compared with March 2019, the price level of the whole range of domestic and imported products fell by 2.7%. These are the results of the Federal Statistical Office (FSO).

In particular, lower prices for petroleum products were responsible for the decrease in the Producer Price Index compared with the previous month. Food products as well as motor vehicles and motor vehicle parts were cheaper. In contrast, increasing prices were observed for scrap. The Import Price Index also registered lower prices compared with February 2020, particularly for petroleum products. Price decreases were also seen for petroleum and natural gas, wearing apparel, basic metals and semi-finished metal products, food products, textiles, other transport equipment, other parts and accessories for motor vehicles as well as leather and travel goods. In contrast, pome and stone fruits were more expensive. |

Switzerland Producer Price Index (PPI) YoY, March 2020(see more posts on Switzerland Producer Price Index, ) Source: investing.com - Click to enlarge |

Tags: Featured,newsletter,Switzerland Producer Price Index