It seems one cannot make a name for one’s self on the Left, unless one has a proposal to tax wealth. Academics like Tomas Piketty have proposed it. And now the Democratic candidates for president in the US propose it too, while Jeremy Corbyn proposes it in the UK. Venezuela finally added a wealth tax in July. A Wealth Tax So how does a wealth tax work? The politicians quibble among themselves, as if the little implementation details that differ between them are important. But they share the key idea. The wealth taxman is to go to the people who have wealth, and take some. And next year, come back and take more. And so on. It should be obvious that this is morally wrong. But we want to focus on the economics. To do that, we need to drill down into the nature of

Topics:

Keith Weiner considers the following as important: 6a.) Keith Weiner on Monetary Metals, 6a) Gold & Bitcoin, Basic Reports, capital consumption, Central Bank, dollar price, falling interest, Featured, gold basis, Gold co-basis, newsletter, ocasio-cortez, Piketty, sanders, silver basis, Silver co-basis, warren, Wealth tax

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

It seems one cannot make a name for one’s self on the Left, unless one has a proposal to tax wealth. Academics like Tomas Piketty have proposed it. And now the Democratic candidates for president in the US propose it too, while Jeremy Corbyn proposes it in the UK. Venezuela finally added a wealth tax in July.

A Wealth Tax

So how does a wealth tax work? The politicians quibble among themselves, as if the little implementation details that differ between them are important. But they share the key idea. The wealth taxman is to go to the people who have wealth, and take some. And next year, come back and take more. And so on.

It should be obvious that this is morally wrong. But we want to focus on the economics. To do that, we need to drill down into the nature of wealth. What is wealth?

The socialist would say that it’s a pile of consumer goods that the rich intend to greedily consume and not share with everyone else. The more nuanced would say that it’s stored purchasing power. It is not literally a pile of consumer goods, but something that in the future can be traded for consumer goods.

Everyone is supposed to picture a Las Vegas bender, a Bentley, a Bombardier jet, Bordeux wine, and a penthouse in a skyscraper on Billionaires Row in New York.

They’re wrong. The fact is that consumption is the effect of wealth, not the cause and not the nature of it.

Say’s Law

Economist Jean Baptiste Say, in the early 19th century, observed one of those ironclad universal truths. It is often stated as:

“supply constitutes its own demand”

This is often misinterpreted to mean that aggregate supply creates aggregate demand (especially in a central planning context). Such as, if the Directorate of Planning orders the production of 1,000,000 tires of one size, that the drivers will demand them.

Say had a sophisticated understanding that he expressed succinctly:

“products are paid for with products”

In other words, to consume you must first produce. What can you consume? You can consume what you produce, or what someone else produces that he is willing to trade for what you produce. If you grow 1,000 apples then you can eat 1,000 apples. Or if you can trade 100 apples for 100 potatoes then you can consume 900 apples and 100 potatoes.

If you produce nothing, then you cannot consume anything. The socialists regard this iron law as an injustice. And seek to remedy it by a variety of means, including a wealth tax.

Wealth as Consumer Goods

So of course, they regard wealth as consumer goods. And many of those who speculate to increase their purchasing power, i.e. receive others’ wealth converted to their income, agree. Wealth is purchasing power, in this view. The way to maximize the value of a farm, according to this view, is to sell off pieces of it to buy groceries.

We think that a farm should be operated to grow food, not liquidated to buy groceries.

Ahah. That gives us an insight into wealth. A farm is not a pile of consumer goods, in storage, waiting to be consumed. It is not stored purchasing power. It is a capital good. That is a good, not used for consumption, but used to produce other goods.

Capital adds leverage to human effort. We do not work harder today, than they did in the ancient world. Yet we produce so much more. That is, because we have accumulated a great deal of capital.

This is what Thomas Piketty, Elizabeth Warren, Bernie Sanders, Jerry Yang, and Jeremy Corbyn want to take away. And the purpose of taking wealth—capital—away from those who have it, is not merely to put it into the government’s hands. It is not the simple mantra of owning the means of production.

It is to consume it.

By the very words of Warren et al, there are millions of people who lack the food, housing, and medical care they need. So they seek to strip the capital from the rich to pay for all this. Plus to prevent global warming, floating plastic in the oceans, and other environmental ills. (Plus for the sake of fixing inequality—i.e. to make the rich more like the poor as an explicit policy goal—but we won’t address that here).

It is to consume it.

Liquidation

Let’s consider an example. Suppose Richard Filthy owns a 1000-acre farm. Richard is rich. To make him less rich, and to feed the hungry, doctor the sick, and heal the Earth, the government takes 3% of his wealth every year. Assuming Richard has no other wealth than his farm, then he can pay this tax either by selling off some land or going into debt.

So Richard sells some acres to satisfy the wealth taxman. Then again next year. And so on.

After 24 years, Richard has less than half of the farm left. And it’s probably worse than that. If the 1,000 acre farm was enough to support his lifestyle, then as the acreage dwindles he must supplement his farm income by selling even more than what the wealth taxman takes (which triggers the income taxman too).

In this example, the land won’t be used to grow food after it’s sold. The government is trying to house the homeless, so it converts the farmland into housing lots. The land has been taken out of productive use. A house is a durable good, but it’s a consumer good.

Now consider Richard’s brother, William. He also sells some land, to pay the wealth taxman. The buyer is Happy Debtmore, a farmer who is expanding his acreage. At least there is no destruction of food production in this Happy case.

But how does Mr. Debtmore—who is also being stripped of 3% of his capital every year—pay to buy the land that William is forced to sell? You guessed it. He goes to ConBank up in Conversionville.

That bank has a lot of funds to lend cheap, because the town is home to several farm equipment recyclers. They buy tractors from the Richard’s and William’s. With smaller farms, they need fewer tractors. But they do need the cash. So they turn to the recyclers in Conversionville.

The recyclers pay them a few bucks. They sell off some of the parts to make objets d’art where they can, and melt the rest down and sell it to the steel mills. With the wealth tax squeezing the farmers, the recyclers do a brisk business. And they deposit a lot of cash at ConBank.

Perverse Incentives

So Mr. Debtmore borrows to buy Mr. Filthy’s farmland. The wealth tax perversely aids in transferring land from a prudent farmer to a debt-fueled one. And the wealth tax does not impact Debtmore. He has a liability—the loan—to balance against the land asset. So the additional land does not add to his net worth, and the wealth taxman ignores him. It works, so long as the interest expense is less than the additional revenue from crop sales.

We said that there is no destruction of food production. That is true, but only in the limited context of William Filthy’s farmland, sold to Happy Debtmore. When we zoom out and look at the bigger picture, we see that Debtmore’s borrowing is possible because someone else is destroying capital (which happens to be capital used in food production in this example, but it is not necessarily so).

As an aside, one could quibble that banks lend savings, and savings is not liquidation of capital. That is true, in a normal world, people don’t melt down working farm tractors for the steel melt value, enriching a few recyclers and impoverishing the farmers and their customers—i.e. the people who must eat their daily bread. But this is not a normal world, there is now a tax slapped on wealth.

Preserving Purchasing Power

And it’s a world with a central bank, and a falling interest rate. So let’s get back to Richard Filthy. Suppose the interest rate were falling just fast enough to drive up land prices by 1.030928% per year (asset go up, as interest goes down).

For example, an acre is initially worth $1,000. And Richard has 1,000 acres, so his farm is worth $1,000,000. Next year, he is forced to sell 3% of his land, but the Fed engineers a proportionate rise in the value of an acre of land. So 3% less land is worth the same as before. And so on. His farm remains at the same $1,000,000 value, year after year.

After 24 years, Richard is left with just 496 acres. But thanks to the Fed, each of them is worth $2,015. The much-smaller farm, at the much-higher land price, is still worth $1,000,000. Should Richard be happy with this?

This illustrates Keith’s concept of yield purchasing power in one picture. $1,000,000 worth of land produces half the crop yield that it did before.

Those who think only in terms of the liquidation value—the purchasing power of the dwindling acres—don’t understand Richard’s pain. They think he still has a farm worth $1,000,000. His farm stores the same consumer goods as before.

But those who think like a farmer see that the half-sized farm produces half as much wheat and generates half as much income for Richard to live on.

Envy

This is not a bug. It’s a feature. Thomas Piketty proposed his wealth tax, not to pay for the burgeoning cost of healing Mother Gaia, but to right a great wrong. He says:

“R > G”

R is the rate of return on capital. And G is the rate of growth of the economy. Piketty is like an accident victim, who after lying in a coma for decades, suddenly comes-to. He sits up and observes a random factoid. The rate of return on capital is higher than economic growth. But, being in a coma for decades, he does not observe that we have a central bank that presides over falling interest rates. And he does not think, with his mind half in a stupor, that falling interest causes rising assets.

So Piketty proposes a wealth tax. It is supposed to remedy this imagined ill that the rich get richer at a rate faster than the economy is growing. But it’s wrong even on this ground. A doubling in the price of land does not make Richard richer. It just means that liquidating land will enable one to buy twice as many groceries.

The politicians are not so erudite as academics like Piketty. They don’t write pseudo-mathematical formulas. They appeal to envy. Some people just aren’t happy when others have something. We are reminded of an old Soviet joke:

A farmer is digging in a field. He finds a genie lamp. Genie comes out.

“I will grant you one wish. But whatever I do for you, I will do double for your neighbor.”

“OK then blind me in one eye.”

Capital Consumption

Whatever the motives of the wealth tax proponents, we can see the tax takes capital away from those who have it. And we can see that this taking is a conversion of productive capital into income, to be consumed by others.

The wealth tax is the consumption of capital.

Which is the same as what we have said many times about the Fed’s falling interest rates and rising asset prices. Each new speculator forks over his capital to the seller of an asset, who consumes it as his income. Speculators do this, because they expect subsequent speculators to give them even more of their capital. With each increase in price, and each turnover in assets, someone’s capital is converted to someone else’s income and consumed.

Socialism, whether central banking or old fashioned confiscation of wealth, is a deliberate and purposeful process of consuming capital.

Socialism must not be allowed to continue to consume our precious capital, and hollow out the base on which our civilization depends. No one knows when the moment of collapse will occur. But we can say with certainty that this is the end stage of socialism. Like in Venezuela.

Supply and Demand

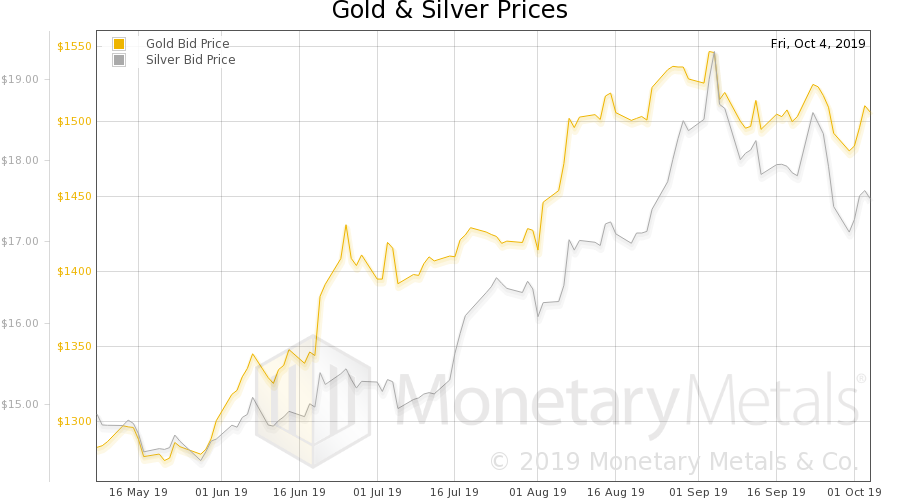

The price of gold went up 8 bucks, and the price of silver went up a penny. This week, these weren’t the capital assets that could be liquidated for greater quantities of consumer goods. Nor were equities.

However, the consumer goods stockpile stored in Treasury bonds (to extend our half sarcastic, half tongue-in-cheek analogy) increased this week. As the rate on the 10-year fell from 1.675% to 1.515%—almost 10% of the yield was sucked out of this bond—the price rose. It went from $130.39 to 131.91 (near futures contract).

Speculators this week forked over about 1.2% more capital for that same piece of paper, than they did last week. In a rational world, this would be a joke. People would be laughing, that in the deepest, most liquid bond market in the word, the price is so unstable!

If there were any merit to the idea of central planning (there isn’t), if the Fed had any legitimate mandate to fix a price (it hasn’t), it would be the price of Treasurys. Of all the things that should be subject to unleashed speculation (no things should, though certain commodities are subject to production risk), the last thing in the financial universe that ought to suffer this malady is the asset deemed to be risk-free (it isn’t), and the basis of the monetary system!

Keynes smirked that not one in a million people could see the problem. That’s because they’re all wagering around the table, rolling the dice and yelling “come on, baby needs a new pair of shoes!”

Not so many people bet “DO NOT PASS” (i.e. gold) this week. Who would be so antisocial, when the shooter has hot dice? OK, so the stock market didn’t go up. But bonds are a respectable speculation, that your mother-in-law would not worry what would the neighbors think.

Bitcoin is not a respectable bet (though it’s improving) and it increased the amount of groceries by about a week’s worth. Oil is more respectable, but groceries drained out of it like oil drains out of an old British car sitting on the driveway.

We read some stories this week that another highly-respectable asset went down. High-end real estate in Manhattan (we have also read about this phenomenon in London and Sydney).

With WeWork cancelling its IPO and becoming the latest equities scandal, it raises the question will speculators want to keep feeding capital-consuming enterprises such as Uber? Can the zombie corporations keep borrowing to spend, while the number of zombies grows due to monetary policy?

The Fed and other central banks will be fighting to keep the music going, liberally putting pennies in the fuse boxes at the first sign that a credit circuit might shut down. But the Fed is neither omnipotent nor omniscient. It cannot fix everything, or even know about everything. What is it doing about the cash flow pressure on banks due to the inverted yield curve (banks borrow short—which is now a higher interest rate—and lend long). What is it doing to address that banks are obliged to start giving up some of their lending income via “repo” transactions on bonds?

Our gut feel is that this explains why gold is $1,500 whereas it had been hundreds of dollars less as recently as May. After so many years of the consumer goods dripping out of the gold storage tank, to pour into the stock tank, it seems like the markets may be ready to reverse.

We have one additional thought. If the Fed is not successful in suppressing a crisis, then obviously stocks will sell off. And people will likely buy gold. But if the Fed is successful, people may buy gold in response to whatever monetary actions the Fed will take.

The term zugzwang from chess seems applicable.

Gold and Silver PricesWe will look at the only true picture of the supply and demand fundamentals. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

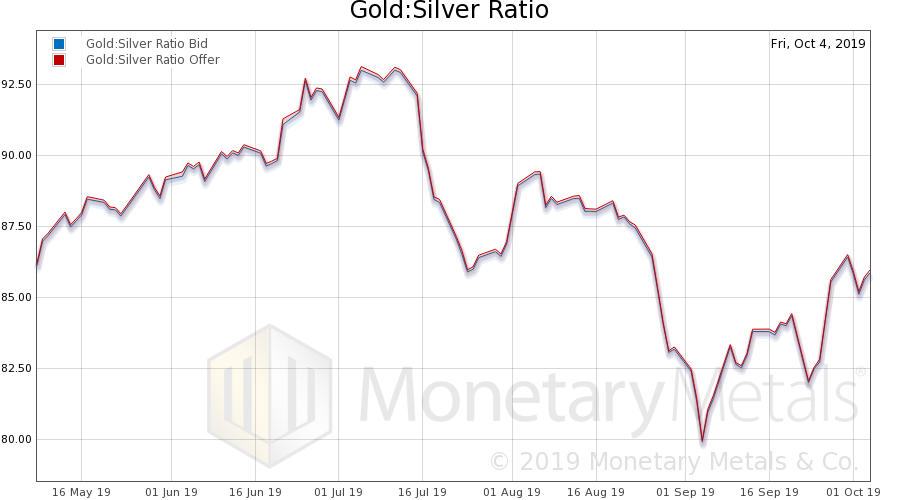

Gold to Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose slightly this week. |

Gold: Silver Ratio(see more posts on gold silver ratio, ) |

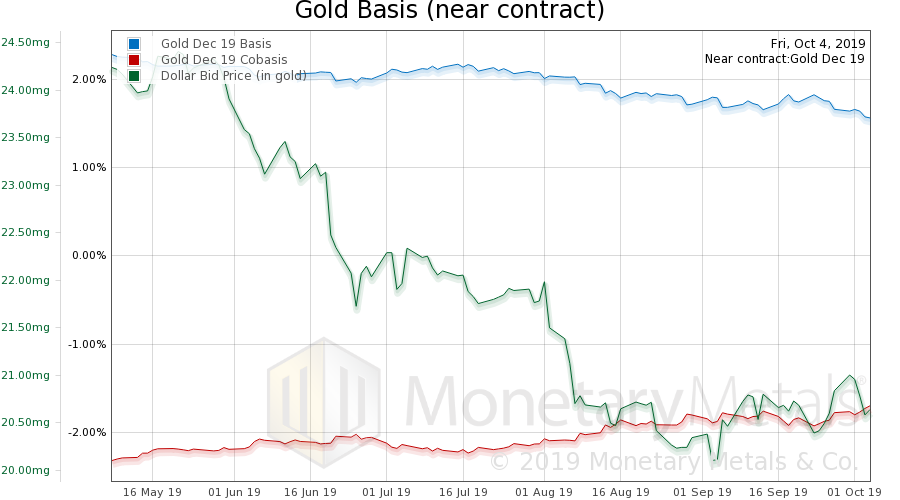

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. The scarcity (i.e. cobasis) rose a little bit this week. But the Monetary Metals Gold Fundamental Price dropped $19, to $1,440. This is not only below the market price, but it’s falling since the start of September. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

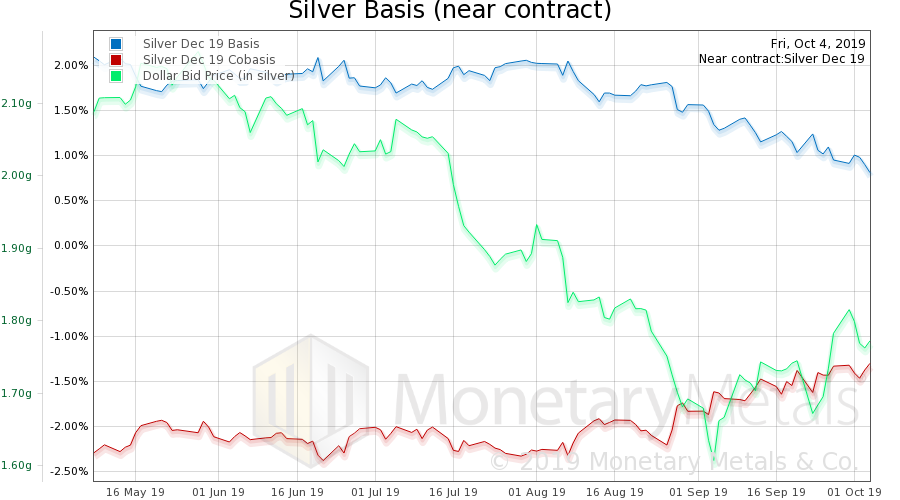

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. In silver, there was a small rise in the scarcity also. And like in gold, the Monetary Metals Silver Fundamental Price dropped, 49 cents to $16.81. Like in gold, the fundamental price has been dropping since the start of last month. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2019 Monetary Metals

Tags: Basic Reports,capital consumption,Central Bank,dollar price,falling interest,Featured,gold basis,Gold co-basis,newsletter,ocasio-cortez,Piketty,sanders,silver basis,Silver co-basis,warren,Wealth tax