European investment opportunities remain, despite financial repression in the region. The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019. With Europeans set to live with interest rates at zero (or negative) for longer, many are wondering if Europe now...

Read More »GERMANY: ECONOMY & SOVEREIGN BOND

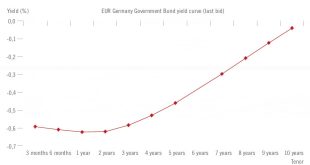

After a difficult second half of 2018, the outlook for Germany’s economy and sovereign bonds turns brighter. A host of factors weighed on German growth in H2 2018: a sharp slowdown in global demand on the external side and several transitory factors on the domestic side impacted industrial activity. At the same time, the 10-year German Bund yield has been trending downward. The steep fall in the oil price in late 2018,...

Read More »Germany: economy and sovereign bonds

After a difficult second half of 2018, the outlook for Germany's economy and soverign bonds turns brighter.A host of factors weighed on German growth in H2 2018: a sharp slowdown in global demand on the external side and several transitory factors on the domestic side impacted industrial activity. At the same time, the 10-year German Bund yield has been trending downward. The steep fall in the oil price in late 2018, the economic slowdown and the Bund’s safe haven status are all factors...

Read More »Spreads for investment grade credits torn in different directions

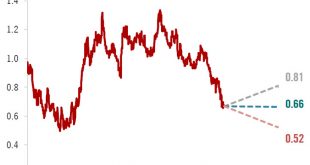

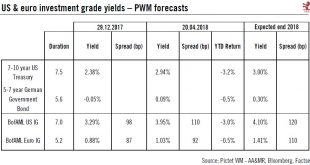

After a difficult start to the year, we remain neutral on prospects for developed market investment grade credits for the coming 12 months.Although US investment grade (IG) and euro IG have posted a negative total return so far this year, credit continues to offer interesting yield pick-up for investors (especially in euro).Overall, we are neutral on prospects for US and euro IG over the coming 12 months. We see US and euro credit yields rising due to higher sovereign yields (especially for...

Read More »Down Go the Hopes and Dreams of Three Generations

Summary On Wednesday, Janet Yellen pressed on the broken buttons again. After the two day FOMC meeting, the Fed Chair announced they’d continue pressing the federal funds rate down to just a ¼ to ½ percent – effectively zero. What type of insanity is this? If she keeps it up, and whole thing doesn’t implode, the yield on the 10-Year Treasury note could also slip below zero…along with the hopes and dreams of three...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org