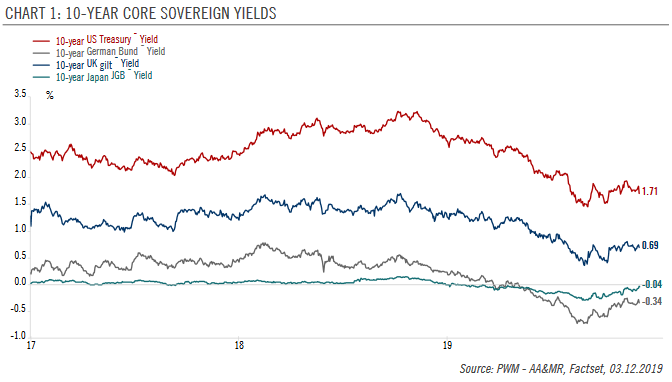

Neutral US Treasuries. We expect the US 10-year yield to fall towards 1.3% in H1 as US growth falters and the US Federal Reserve starts signalling additional rate cuts. However, continued monetary easing and election promises (i.e. fiscal stimulus) could boost inflation expectations in H2, with the 10-year yield ending 2020 at around 1.6% in our central scenario. Overall, we expect a positive single-digit total return for 10-year Treasuries next year and a steepening of the yield curve. Underweight core euro sovereign bonds. We expect the 10-year German Bund yield to remain negative in 2020, although our central scenario sees it ending next year slightly heigher (-0.2% compared with -0.36% currently). European Central Bank (ECB) rate expectations have recently

Topics:

Perspectives Pictet considers the following as important: 2.) Pictet Macro Analysis, 2) Swiss and European Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Neutral US Treasuries. We expect the US 10-year yield to fall towards 1.3% in H1 as US growth falters and the US Federal Reserve starts signalling additional rate cuts. However, continued monetary easing and election promises (i.e. fiscal stimulus) could boost inflation expectations in H2, with the 10-year yield ending 2020 at around 1.6% in our central scenario. Overall, we expect a positive single-digit total return for 10-year Treasuries next year and a steepening of the yield curve.

Underweight core euro sovereign bonds. We expect the 10-year German Bund yield to remain negative in 2020, although our central scenario sees it ending next year slightly heigher (-0.2% compared with -0.36% currently). European Central Bank (ECB) rate expectations have recently been a key factor in the direction of the 10-year Bund yield, but we see limited room for additional ECB rate cuts in 2020. However, we also expect growth momentum to be progressively less negative in the euro area in 2020 than in 2019, with GDP growth stabilising at a low level of 1.0%. Underweight UK government bonds (gilts). The 10-year UK gilt yield is likely to fall slightly in 2020, to about 0.5% by the end of the year according to our central scenario. While we expect total returns from gilts to be slightly positive next year, political uncertainty (Brexit and fiscal policy) leads us to remain underweight UK government bonds in general. Underweight Japanese government bonds (JGBs). Unchanged monetary policy from the Bank of Japan (BoJ) along with a subdued growth environment could mean the 10-year JGB yield stays close to zero, contributing to meagre total returns. |

10-year Core Sovereign Yields, 2017-2019 |

Tags: Featured,newsletter