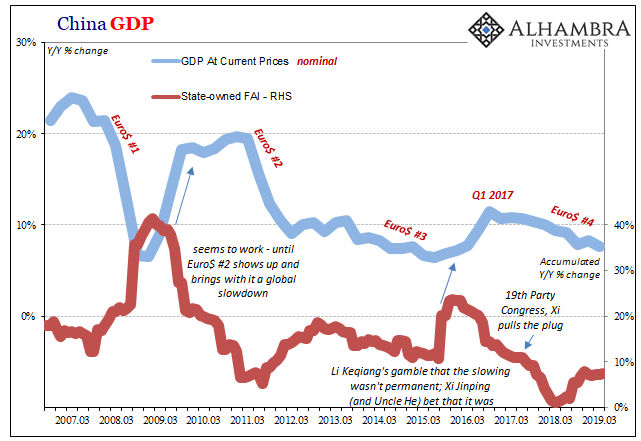

China was the world economy’s best hope in 2017. Like it was the only realistic chance to push out of the post-2008 doldrums, a malaise that has grown increasingly spasmatic and dangerous the longer it goes on. Communist authorities, some of them, anyway, reacted to Euro$ #3’s fallout early on in 2016 by dusting off their Keynes. A stimulus panic that turned out to be more panic than stimulus. China GDP, 2007-2019(see more posts on China Gross Domestic Product, ) - Click to enlarge It never got very far, peaking in the first quarter of 2017. Therefore, while the Western world filled with “news” of globally synchronized growth the inevitable globally synchronized downturn was already set in motion. Did Euro$ #3 ever actually end? Isn’t Euro$ #4 merely a

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, 5) Global Macro, China, currencies, economy, Featured, Federal Reserve/Monetary Policy, ism chicago business barometer, manufacturing, Markets, newsletter, PMI, Rebalancing, services

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| China was the world economy’s best hope in 2017. Like it was the only realistic chance to push out of the post-2008 doldrums, a malaise that has grown increasingly spasmatic and dangerous the longer it goes on. Communist authorities, some of them, anyway, reacted to Euro$ #3’s fallout early on in 2016 by dusting off their Keynes. A stimulus panic that turned out to be more panic than stimulus. |

China GDP, 2007-2019(see more posts on China Gross Domestic Product, ) |

| It never got very far, peaking in the first quarter of 2017. Therefore, while the Western world filled with “news” of globally synchronized growth the inevitable globally synchronized downturn was already set in motion. Did Euro$ #3 ever actually end? Isn’t Euro$ #4 merely a continuation? In some ways: no and yes.

That’s more academic trivia while the consequences are very real. The faction in China’s government which led the 2016 Keynesian effort has been effectively sidelined – and maybe not just when it comes to economic matters. In terms of the economy, though, that’s a big deal as China’s system more and more meets, equals, and surpasses the depths of 2016. |

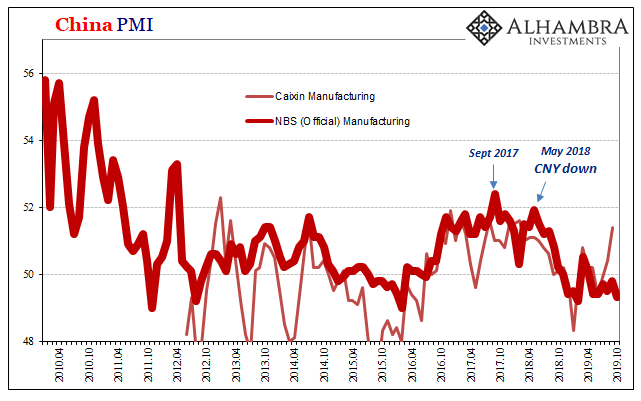

China PMI, 2010-2019 |

| There won’t be another government panic this time. It’s already been proven ineffective and maybe more than a little dangerous (by squandering so much time and allowing more negative pressures, like debt, to build up).

While many on both sides of the Pacific keep forecasting, predicting, and counting on the Chinese economy to bottom out and start heading even a little higher, it just isn’t happening. The best it can seem to manage is the occasional monthly bump, statistical noise rather than legitimate upside potential. Quickly reaffirmed going the wrong way. That has been the case on the manufacturing side, where economic accounts like Industrial Production will (briefly) accelerate only to fall back (to record lows). Chinese official (NBS) Manufacturing PMI, having been down around 49.4 midyear suddenly “accelerated” to 49.8 in September. And now it has slumped back to 49.3 for October, as the NBS reported earlier today. While the PMI’s index for current production fell 1.5 points from September, new orders dropped back below 50 (for the fifth time in the last six months, September being the lone 50+) and orders for exports slipped back to 47. |

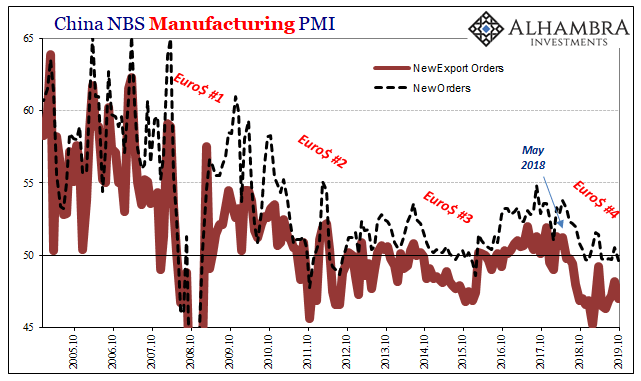

China NBS Manufacturing PMI, 2005-2019(see more posts on China Manufacturing PMI, ) |

| Ever since last May, when CNY really tumbled (so much for that export stimulus), the manufacturing sector at the base of China’s economy cannot seem to pick itself back up. Having been on this downward trend for seventeen months and counting, no end, no bottom yet in sight defying traditional conventions about how this is all supposed to work.

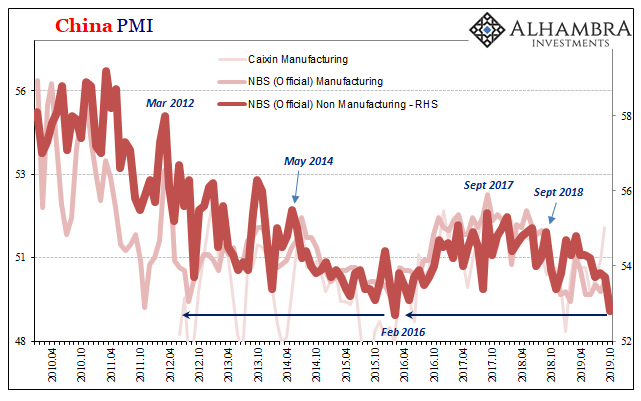

And that was actually the good news out of China; that the manufacturing PMI while below expectations as well as below 50 wasn’t worse. It was for the non-manufacturing. According to the NBS, the official services (mostly) PMI dropped to just 52.8 in October. That’s the second lowest on record, only the second time in the series it has been below 53. |

China PMI, 2010-2019 |

I wrote elsewhere:

The only question now is, does October’s stumble represent that low point everyone has been looking for? If you think it does, why? Again, there’s no Li pushing his best Keynes this time unlike February 2016. |

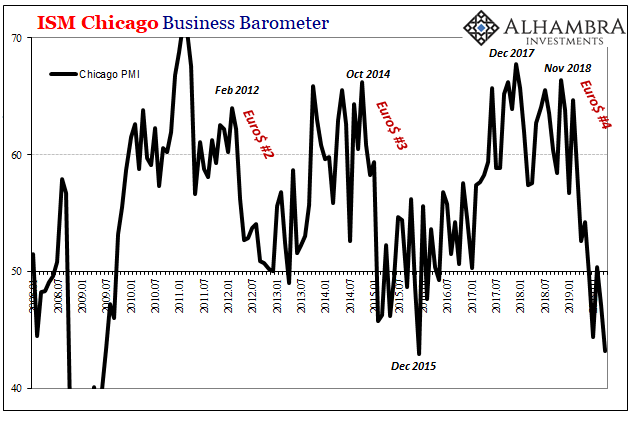

ISM Chicago Business Barometer, 2008-2019 |

| There’s no dollar turnaround in sight, either. What would be the catalyst for China to bank on (literally)?

Jay Powell would answer, of course, the US labor market and the underlying strength it provides the US and therefore global economy. Fret not, Emperor Xi, Powell’s not-a-series series of rate cuts will ensure America will be available for the second half rebound – even though the first half of the second half is already over with and the data keeps looking like this: The ISM also reported today that its Chicago Business Barometer (a narrow, key regional PMI) fell to just about 43. A level that, like China’s sentiment indices, just about equals the worst of Euro$ #3. Maybe that is just the manufacturing sector, a limited downturn and therefore limited damage that won’t completely dent the rest of the US economy’s structure. Then again, when looking at it as a whole, as with all these PMI’s the trend in US GDP doesn’t appear favorable, either. |

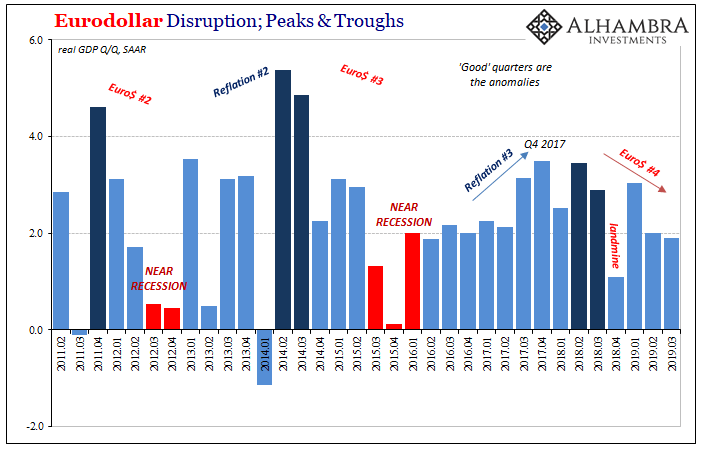

Eurodollar Disruption, 2011-2019 |

Even if the US manages to avoid a recession like it did at the bottom of Euro$ #3, it very likely means that for China, anyway, the Americans despite Powell aren’t going to be of much help in turning anything around anywhere. We’ve got our own growing problems.

In other words, globally synchronized growth was as much hopes for China as anything. Instead, pretty much inevitable, there’s now the globally synchronized downturn getting more synchronized by the month with more downturn appearing in most of them.

Tags: China,currencies,economy,Featured,Federal Reserve/Monetary Policy,ism chicago business barometer,manufacturing,Markets,newsletter,PMI,rebalancing,services