It does seem, at first, a huge contradiction. On the one hand, what we know so far of China’s 14th 5-year plan apparently will lean heavily on new technologies not-yet invented to rescue the country’s economy from the pit of de-globalization the eurodollar system had thrown it into years ago. If the global economy isn’t going to recover, and there’s absolutely no sign that it will, then the one seemingly logical (though far-fetched) way forward would be if the...

Read More »More Synchronized, More Downturn, Still Global

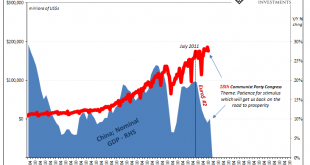

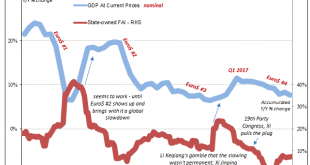

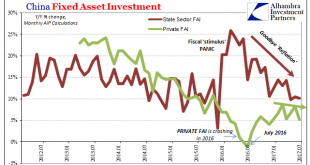

China was the world economy’s best hope in 2017. Like it was the only realistic chance to push out of the post-2008 doldrums, a malaise that has grown increasingly spasmatic and dangerous the longer it goes on. Communist authorities, some of them, anyway, reacted to Euro$ #3’s fallout early on in 2016 by dusting off their Keynes. A stimulus panic that turned out to be more panic than stimulus. China GDP, 2007-2019(see more posts on China Gross Domestic Product, )...

Read More »China’s Global Slump Draws Closer

By the time things got really bad, China’s economy had already been slowing for a long time. The currency spun out of control in August 2015, and then by November the Chinese central bank was in desperation mode. The PBOC had begun to peg SHIBOR because despite so much monetary “stimulus” in rate cuts and a lower RRR banks were hoarding RMB liquidity. Late 2015 was not a fun time in China. The idea of economic...

Read More »Losing Economic ‘Reflation’

The backbone of China’s internal economy has been its ghost cities, but not as they may be ghost towns now, rather in how little time they might take to fill up. If the lag was relatively small because of restored growth, more would be needed and the Chinese building economy rolling ever onward. “Reflationary” prices were often Chinese prices of just that perceived process. The perceptions of a possible “hard landing”...

Read More »China: Losing Economic ‘Reflation’

The backbone of China’s internal economy has been its ghost cities, but not as they may be ghost towns now, rather in how little time they might take to fill up. If the lag was relatively small because of restored growth, more would be needed and the Chinese building economy rolling ever onward. “Reflationary” prices were often Chinese prices of just that perceived process. The perceptions of a possible “hard landing”...

Read More »Competing CPI,PPI, Industrial Production and Retail Sales: No Luck China, Either

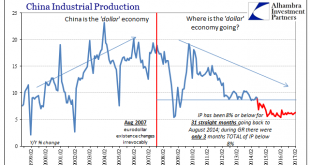

Former IMF chief economist Ken Rogoff warned today on CNBC that he was concerned about China. Specifically, he worried that country might “export a recession” to the rest of Asia if not the rest of the world. I’m not sure if he has been paying attention or not, but the Chinese economy since 2012 has been doing just that to varying degrees often just shy of that level. If there’s a country in the world which is really...

Read More »Assessing China’s Economic Risks

First quarter GDP in China rose 6.9%, better than expected and above the government’s target (6.5%) for 2017. It stands to reason, however, that if Communist officials thought they could get 6.9% to last for the whole year they would have made it their target, especially since 6.5% would be less than the GDP growth rate for 2016 (6.7%). In only that one way is China’s GDP statistic meaningful. Due to unanswered...

Read More »China Starts 2017 With Chronic, Not Stable And Surely Not ‘Reflation’

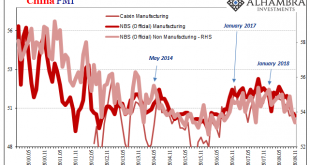

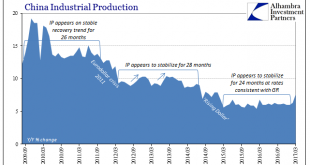

The first major economic data of 2017 from China was highly disappointing to expectations of either stability or hopes for actual acceleration. On all counts for the combined January-February period, the big three statistics missed: Industrial Production was 6.3%, Fixed Asset Investment 8.9%, and Retail Sales just 9.5%. For retail sales, the primary avenue for what is supposed to be a “rebalancing” Chinese economy,...

Read More »Investment Lessons

In the FT, looking back at ten years of The Long View, John Authers offers investment lessons that may be summarized in five points: Always worry about costs and don’t try to outsmart the market. That is, hold index funds. Rebalancing pays off. Since getting the timing right is very hard, being out of the market is as risky as being in it. To beat the market, buying at low prices is key. But know what you know and what you don’t. Public markets are efficient. Money isn’t everything; in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org