There were no surprises in today’s US GDP data. As expected, output sharply decelerated, modestly missing much-reduced expectations. The continuously compounded annual rate of change for Q3 2021 compared to Q2 was the tiniest bit less than 2% (1.99591%) given most recent expectations had been closer to 3%. It was only two months ago, mid-August, when the Blue Chip consensus pegged quarterly growth at better than 7%. Such a fast drop-off immediately brings up delta...

Read More »Spending Here, Production There, and What Autos Have To Do With It

While the global inflation picture remains fixed at firmly normal (as in, disinflationary), US retail sales by contrast have been highly abnormal. You’d think given that, the consumer price part of the economic equation would, well, equate eventually price-wise. Consumers are spending, prices should be heading upward at a noticeable rate. To begin with, consumer spending – as pictured by the Census Bureau – was obviously boosted during January by the previous...

Read More »Nine Percent of GDP Fiscal, Ha! Try Forty

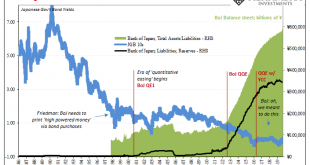

Fear of the ultra-inflationary aspects of fiscal overdrive. This is the current message, but according to what basis? Bigger is better, therefore if the last one didn’t work then the much larger next one absolutely will. So long as you forget there was a last one and when that prior version had been announced it was also given the same benefit of the doubt. Most people don’t like looking to Japan mainly because it is too depressing; unless one is an Economist who...

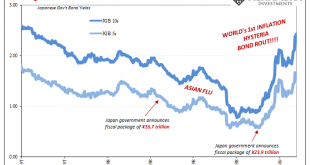

Read More »They’ve Gone Too Far (or have they?)

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months. The JGB 10-year yield had dropped to a low of just 77.2 bps during the depths of 1998’s Asian Financial Crisis (or “flu”, so noted for its regional contagious dollar...

Read More »There’s Always A First Time

Is it a race against time? Or is it trying to set aside today so as to focus entirely on a specific kind of tomorrow? It’s easy to do the latter especially when today is what it is; you can’t change what’s already gone on. You can, however, think that today won’t impede or even impact a much better tomorrow yet to be determined, especially when the heavy hand of government is anticipated to intervene after sunset. On the one side, more fiscal “stimulus” is purported...

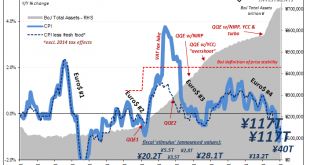

Read More »Six Point Nine Times Two Equals What It Had In Twenty Fourteen

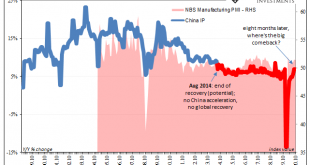

It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.” In 2014, the clock was ticking but expectations were extremely high nonetheless. In September 2014, however, massive setback. Though it had been building all year by...

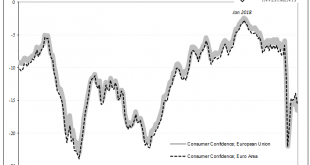

Read More »Consumer Confidence Indicator: Anesthesia

Europeans are growing more downbeat again. While ostensibly many are more worried about a new set of restrictions due to (even more overreactions about) COVID, that’s only part of the problem. The bigger factor, economically speaking, is that Europe’s economy has barely moved, or at most not moved near enough, off the bottom. To interrupt now what has already proved to be a seriously impaired rebound should get people thinking more realistically about 2021. Once...

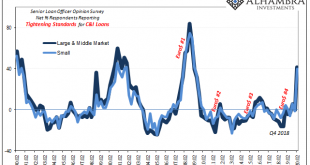

Read More »Not COVID-19, Watch For The Second Wave of GFC2

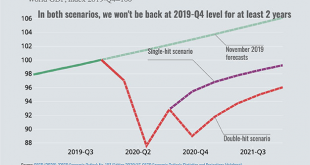

I guess in some ways it’s a race against the clock. What the optimists are really saying is the equivalent of the old eighties neo-Keynesian notion of filling in the troughs. That’s what government spending and monetary “stimulus” intend to accomplish, to limit the downside in a bid to buy time. Time for what? The economy to heal on its own. Fill up the bathtub, so to speak, with artificial stimulus water (aggregate demand) until such time as the basin stops...

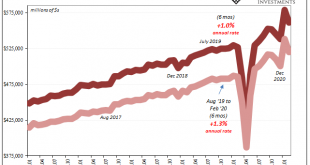

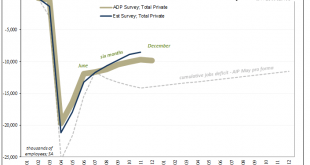

Read More »This Thing Is Only Getting Started; Or, *All* The V’s Are Light On The Right

The Federal Reserve’s models really are the most optimistic of the bunch. With the policy meeting conducted today, no surprises as far as policies go, we now know what ferbus has to say about everything that’s happened this year. Skipping the usual March projections, what with the FOMC totally occupied at the time by a complete global monetary meltdown Jay Powell now says “we saw it coming”, the central bank staff released the calculations performed by its DSGE...

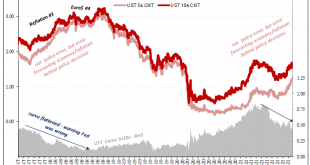

Read More »From QE to Eternity: The Backdoor Yield Caps

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and then no recovery....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org