The smart money is liquidating assets, paying off debt and moving capital into collateral that isn’t impaired by debt or speculative valuations. The Federal Reserve’s sudden return to “accommodative” dovishness in response to the stock market’s swoon telegraphs its intent to fire up QE once the recession kicks into gear. QE (quantitative easing) are monetary policies designed to ease borrowing and the issuance of credit, and to prop up assets such as stocks and real estate. The basic idea is that the Fed creates currency out of thin air and uses the new money to buy Treasury bonds and other assets. This injects fresh money into the financial system and lowers the yield on Treasury bonds, as the Fed will buy bonds at

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

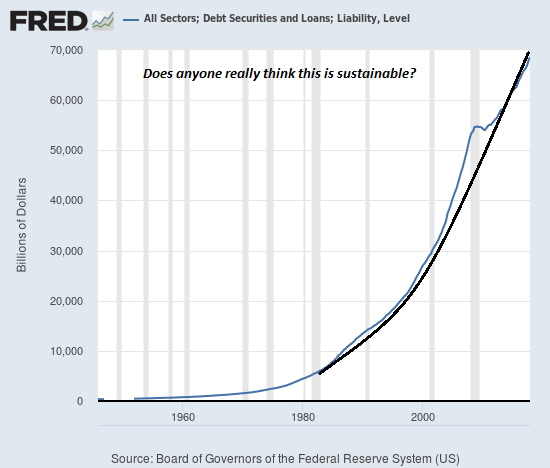

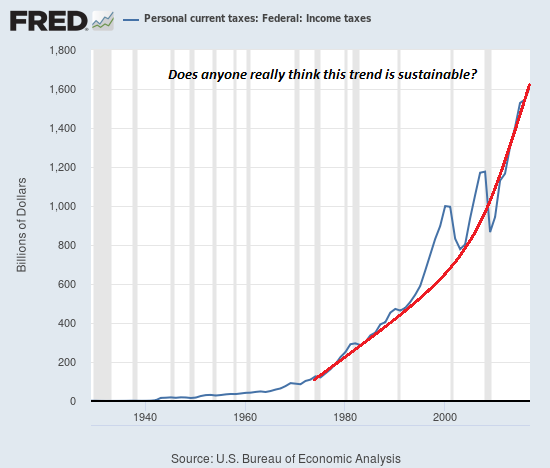

| The smart money is careful to mask the selling so as to avoid panicking the market. Smart money sells out slowly, in pieces small enough to avoid banging the bid lower. Alas, the Smart Money strategy is to count on greater fools to believe the shuck and jive of QE and the rest of the flim-flam: real estate never goes down, the economy will grow strongly through 2040, the next target for the S&P 500 is much higher, and so on.Take a look at these charts of total liabilities/debt and federal income tax collected and ask yourself: are these trends sustainable in an economy growing by a few percent a year? |

All Sectors; Debt Securities and Loans; Liability, Level 1960-2018 |

| Federal income taxes collected have practically doubled from the recessionary nadir of 2009: does anyone really think they can double again in the next 9 years?

These geometrically rising trendlines are the acme of unsustainability. The limits have been reached and reversal looms. Ask yourself why multiple bids for real estate have vanished and why the Fed is so anxious to publicly trumpet its dovishness. If the limits were far from being reached, why the tone of desperation? |

Personal current taxes: Federal: Income taxes 1940-2018 |

As I observed yesterday, the smart money is liquidating assets, paying off debt and moving capital into collateral that isn’t impaired by debt or speculative valuations. The Smart Money has secured the good seats at the banquet of consequences, the seats reserved for those with no debt, unimpaired collateral and little dependence on central bank stimulus or central state statistical legerdemain.

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the book's website.Tags: Featured,newsletter