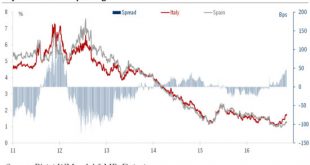

Spreads on Italian debt could continue to drop, as Italy’s relations with Brussels become calmer. But much will depend on the new government’s durability and its commitment to reducing the debt burden.President of the Republic Sergio Mattarella has instructed Giuseppe Conte to form a new government backed by a coalition of the Five Star Movement (M5S) and the Democratic Party (PD). Importantly, there are still many hurdles to overcome, and a last-minute breakdown in discussions cannot be...

Read More »Outlook for euro periphery bonds

Economic fundamentals should come back into focus, but politics still a factor. After a year when peripheral countries’ old demons made a reappearance, with, in particular, Italy’s public debt back in the spotlight, the focus should shift to economic fundamentals in 2019. Both the Spanish and Italian economies are set to slow down, although the situation is more serious in Italy. In both countries, the political...

Read More »Outlook for euro periphery bonds

Economic fundamentals should come back into focus, but politics still a factor.After a year when peripheral countries’ old demons made a reappearance, with, in particular, Italy’s public debt back in the spotlight, the focus should shift to economic fundamentals in 2019. Both the Spanish and Italian economies are set to slow down, although the situation is more serious in Italy. In both countries, the political equilibrium remains fragile, with a risk of snap elections in 2019.With the end...

Read More »Referendum at heart of Italian uncertainties

A ‘No’ vote in the 4 December referendum would be seen as a negative by investors in Italy, adding to the challenges the country must face.The 4 December referendum on senate reform is the next big event on the European political calendar, coming just ahead of the next ECB and Fed policy meetings on 8 December and 14 December, respectively.We believe a ‘Yes’ vote would boost government confidence and marginally help Italian securities, but is unlikely to represent a significant game changer...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org