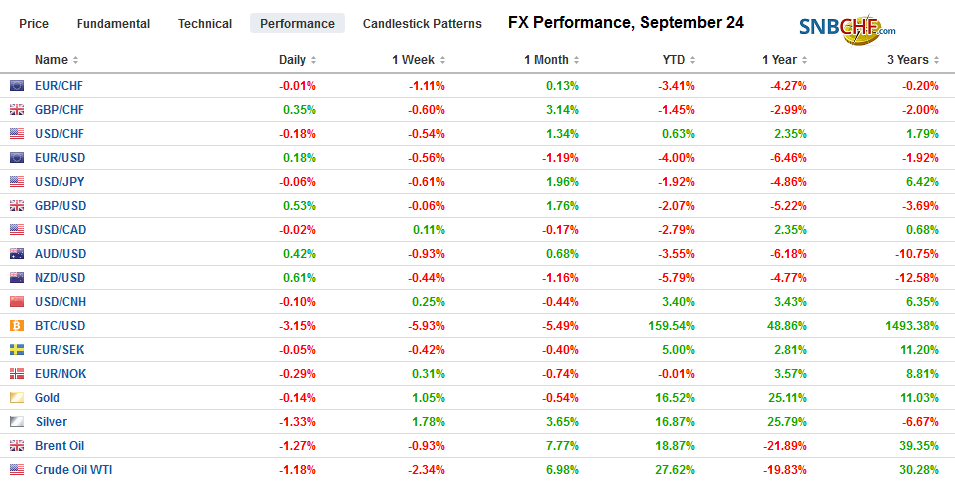

Swiss Franc The Euro has fallen by 0.03% to 1.0874 EUR/CHF and USD/CHF, September 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A fragile calm hangs over the capital markets today. Equities in Asia Pacific were narrowly mixed. Japan, China, and HK advanced. India saw some profit-taking after a two-day surge in response to the unexpected corporate tax cuts but recovered in late dealings. European shares are recovering after posting its largest loss in a month yesterday (-0.8%). US shares are trading firmer in Europe. Benchmark bond yields are little changed. Bonds in the European periphery are a little firmer, while the core is a touch lower. The US 10-year yield hovers a little above 1.70%. The US

Topics:

Marc Chandler considers the following as important: $HUF, 4) FX Trends, 4.) Marc to Market, Brexit, China, Currency Movement, Featured, newsletter, trade, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has fallen by 0.03% to 1.0874 |

EUR/CHF and USD/CHF, September 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: A fragile calm hangs over the capital markets today. Equities in Asia Pacific were narrowly mixed. Japan, China, and HK advanced. India saw some profit-taking after a two-day surge in response to the unexpected corporate tax cuts but recovered in late dealings. European shares are recovering after posting its largest loss in a month yesterday (-0.8%). US shares are trading firmer in Europe. Benchmark bond yields are little changed. Bonds in the European periphery are a little firmer, while the core is a touch lower. The US 10-year yield hovers a little above 1.70%. The US dollar is sporting a softer profile in Europe after trading firmer in Asia. Sterling jumped following news that the UK Supreme Court ruled it has jurisdiction in the matter and that the prorogation of Parliament was not “normal”. Among the mixed emerging market currencies, Turkey, Russia, and South Africa are firm. |

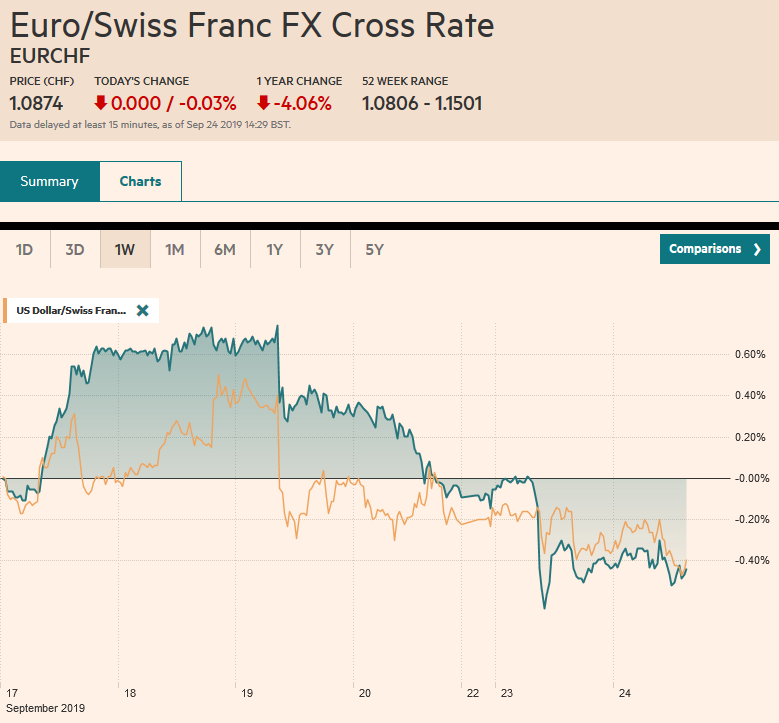

FX Performance, September 24 |

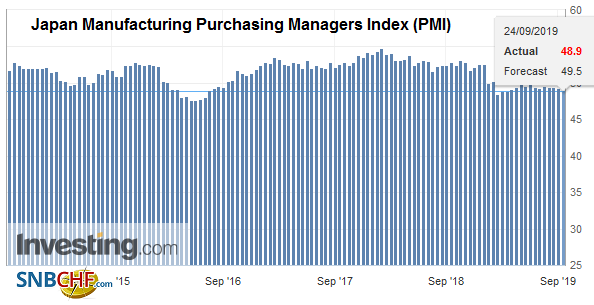

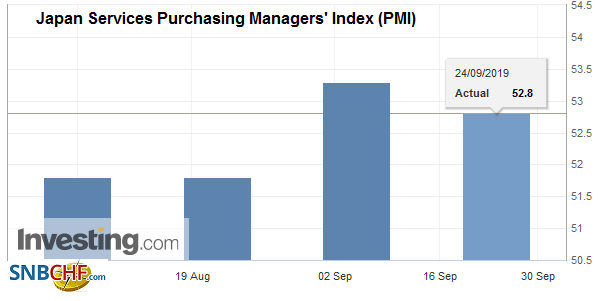

Asia PacificLast week, President Trump informed Congress that an executive trade agreement with Japan was reached. The deal was to be signed Wednesday when Trump and Prime Minister Abe met at the UN. Trump’s declaration of victory appears premature. Japan is pressing harder for a guarantee that it will not be subject to auto and/or auto part tariffs. Trump has said that such levies are not under consideration now, but this is not very convincing. Tokyo is insisting that tariffs on Japan’s auto or parts exports would nullify the agreement. In 2018, Japan’s auto and parts exports to the US were around $40 bln. Japan, which was on holiday yesterday, saw its flash PMI data today. The manufacturing PMI slipped back to 48.9 from 49.3 to match the cyclical low from February. The service PMI eased to 52.8 from 53.3, but keep it in perspective. |

Japan Manufacturing Purchasing Managers Index (PMI), September 2019(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| It averaged 51.9 in H1 and 51.5 in 2018. The same is true of the composite. It is at 51.5, down from 51.9 in August. The puts the Q3 average at 51.3 and 50.8 in Q2. Nevertheless, it does seem that Japan will be raising its sales tax into an economy that has lost some momentum. |

Japan Services Purchasing Managers' Index (PMI), August 2019(see more posts on Japan Services PMI, ) Source: investing.com - Click to enlarge |

PBOC Governor Yi Gang ruled out large stimulus. Separately, China appears to be stepping up its purchases of US soy ahead of next week’s face-to-face talks. Reports suggest 15 cargoes of soy has been bought for October and November shipments. Separately, since September 3 and without fail, the yuan has been alternative daily between gains and falls. It has not moved in the same direction two consecutive sessions since September 3 when the dollar peaked.

Over the past three sessions, the dollar has pulled back from testing JPY108.50 to JPY107.30 yesterday. It is inside yesterday’s range and is firm in Europe near the Asian high of JPY107.70. There is a $1.1 bln option at JPY108 that expires today. The Australian dollar is firm ahead of RBA Governor Lowe’s speech in Australia’s evening. It appears to be trying to form a base around $0.6760-$0.6765. An A$560 mln option at $0.6790 today stands in the way of resurfacing above $0.6800. A move above pre-weekend high near $0.6810 would lift the technical tone. The dollar extended its decline against the Indian rupee for the third consecutive session, but momentum appears to be easing. It recovered a little after approaching the one-month low (~INR70.68) a the end of last week.

Europe

The UK Supreme Court found that the judiciary does have the power to review the prorogation of Parliament. It concluded that it was not a “normal” suspension of Parliament. It was designed to prevent Parliament from carrying its functions and is therefore illegal. The advice given to the Queen was illegal and therefore void. Parliament has not been prorogued. Parliament, the court said, should be as soon as possible.

On the sidelines of the UN General Assembly, UK Prime Minister Johnson is trying to press his case that he compromised and that now the EU should. It is a non-starter. Johnson has suggested an “All Ireland” zone that checks plants and livestock for pest and disease. This, he says, is the alternative to the backstop. The problem is that the UK is the only one that thinks so. On the other side, Labour’s position is about as clear and compelling as mud. Rather than actual voting based point of views, it seemed to morph into a personal victory for Corbyn’s position on three grounds: Win an election, seek to renegotiate Brexit, and hold a referendum to give people the choice of the agreement or opting to say in the EU. Brexit is one of the most important issues the UK has chosen to grapple with in a generation arguably, and Labour is reluctant to make a principled stand. Many suspect most of Labour prefer to remain in the EU and so Labour is unlikely to get much of a post-conference boost. It will reinforce the perception of Labour’s weak leadership.

French and German surveys today were not as dismal as yesterday’s PMI. In France, the business and manufacturing surveys did not match the PMI deterioration. Germany’s IFO had something for everyone. The assessment of the climate edged up to 94.6 from 94.3. While the current assessment improved (98.5 vs. 97.4), the expectations component worsened (90.8 vs. 91.3).

The euro is in a particularly narrow range of about 10 ticks on either side of $1.0990. There is a 1.3 bln euro option at $1.10 that expires today. It needs to resurface above there to stabilize the technical tone. Even then, a move above $1.1025 may be needed, which is where another option (~805 mln euros) is struck that will also be cut today. Sterling is pinned near yesterday’s low just above $1.24 before the Supreme Court’s decision and shot up to almost $1.2490 before calming down. There is an option for nearly GBP230 mln at $1.25 that rolls off today. Intraday support by maybe seen near $1.2440 now. The Hungarian forint is the weakest of the emerging market currencies this month, off a little more than 1% against the US dollar. It is at new record lows against euro (HUF3.36) ahead of the central bank’s decision later today. Hungary’s base and repo rate are at 90 bp, while the deposit rate stands at minus five bp.

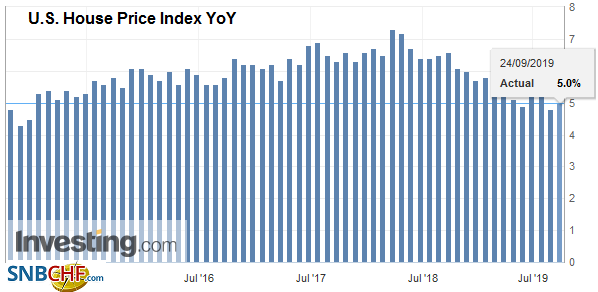

AmericaThe US flash PMI contrasts with the eurozone. The EMU composite fell to 50.4 from 51.9. The median forecast in the Bloomberg survey called for a small tick higher. In the US both the manufacturing and service PMI edged higher sequentially and lifted the composite to 51.0 from 50.7. Surprisingly the manufacturing reading rose to a five-year high. The service PMI rose less than economists expected, but the cloud in the silver lining was the drop in the employment index. The 49.1 reading is the lowest since the end of 2009. It was at 50.4 in August. It suggests that despite some better economic readings of late, especially relative to forecasts, the labor market is continuing to slow. The September jobs report is out a week from Friday (October 4), and the PMI suggests that at best it may match the 96k private-sector jobs created in August (130k overall). Today’s data includes house prices, Richmond Fed manufacturing index for September, and Conference Board surveys. Despite the concern expressed in some circles that worrisome headlines would sap consumer confidence and bring on a self-inflicted downturn, the Conference Board’s measure of consumer confidence remains near the cyclical high set last October just below 138. In August it was at 135.10. The median forecast in the Bloomberg survey is for 133. It averaged 127 in H1. |

U.S. House Price Index YoY, July 2019(see more posts on U.S. House Price Index, ) Source: investing.com - Click to enlarge |

Yesterday’s weekly US bill auction saw better reception than the previous week’s sales. The bid-to-cover was stronger, and the yields were a little lower. With the help of the Fed’s temporary injections, the money markets are more orderly. While the pre-announced overnight repos and two-week repos address the current situation, the issue is how will the Fed address what appears to be a lack of sufficient reserves given the regulatory requirements and the various demands on reserves, including record Treasury auctions and the rebuilding of the Treasuries cash balances. The choices range from a standing repo facility, organic growth of the balance sheet, which had been the case historically before the crisis, or new quantitative easing. In the years after the Great Financial Crisis, the Fed was more worried about the floor than the cap of rates, so its operations were one-sided. Now the Fed is operating in a true corridor system that is the operational challenge (plumbing) not monetary policy itself.

The US dollar has been in a clear trading range against the Canadian dollar in recent days. The CAD1.3300 area, where the 200-day moving average is found continues to frustrate attempts to drive the greenback higher. On the other hand, a base has been forged in the CAD1.3235-CAD1.3240 area. As North American dealers take their stations, the dollar is near the lower end of the range, but the intraday technicals warn that the break may not take place today. The greenback tested a five-day high against the Mexican peso above MXN19.50 yesterday and is coming better offered today. Last week’s low was near MXN19.38. That may mark the range ahead of the central bank meeting in two days. Speculation of a follow-up cut after the surprise move last month appears over the last few days.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$HUF,Brexit,China,Currency Movement,Featured,newsletter,Trade