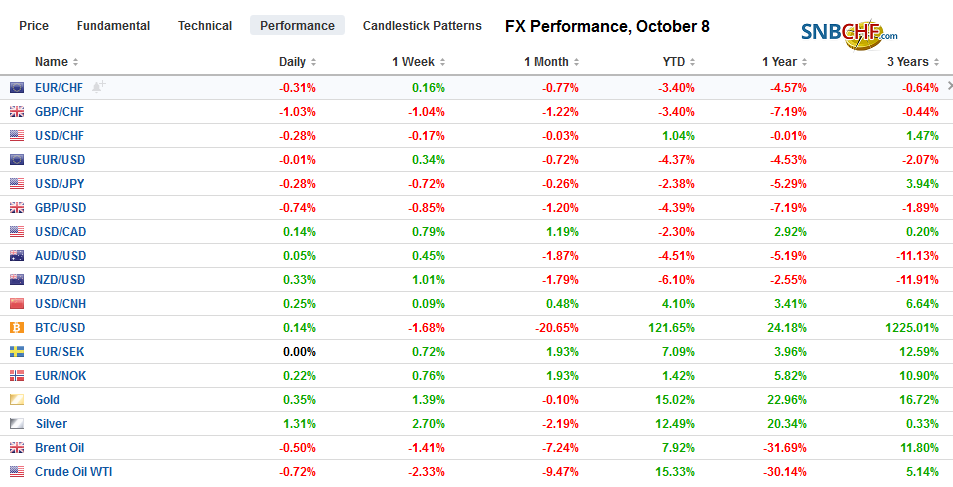

Swiss Franc The Euro has fallen by 0.27% to 1.0881 EUR/CHF and USD/CHF, October 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The re-opening of Chinese markets after a long holiday did not produce the volatility that many expected. Chinese stocks alongside most Asia markets traded higher today, and the yuan advanced. After opening higher and extending its recent rally, Europe’s Dow Jones Stoxx 600 turned down, even though Germany announced an unexpected gain in August industrial output. US shares are trading a bit lower. Benchmark 10-year bonds are little changed. The dollar is mostly softer. Among emerging market currencies, the South Korean won, aided by a better than expected Samsung earnings, and the

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, China, China Caixin Services PMI, EUR/CHF, Featured, FX Daily, Germany, Gold, Japan Current Account n.s.a., newsletter, trade, Turkey, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.27% to 1.0881 |

EUR/CHF and USD/CHF, October 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The re-opening of Chinese markets after a long holiday did not produce the volatility that many expected. Chinese stocks alongside most Asia markets traded higher today, and the yuan advanced. After opening higher and extending its recent rally, Europe’s Dow Jones Stoxx 600 turned down, even though Germany announced an unexpected gain in August industrial output. US shares are trading a bit lower. Benchmark 10-year bonds are little changed. The dollar is mostly softer. Among emerging market currencies, the South Korean won, aided by a better than expected Samsung earnings, and the Chinese yuan is leading with around a 0.25% gain. The major currencies are firmer, with the exception of sterling. Gold and oil are a little higher as well. |

FX Performance, October 8 |

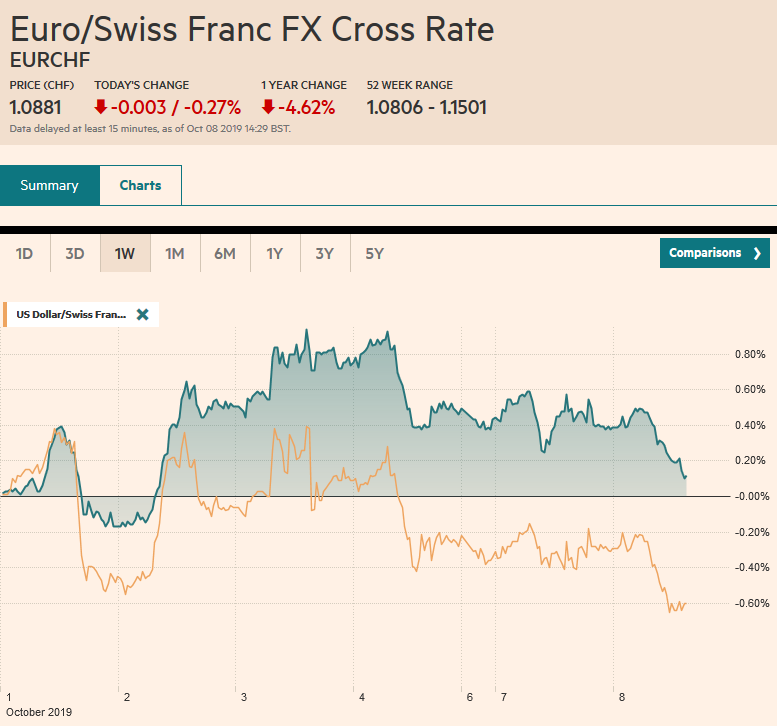

Asia PacificCaixin reported its service PMI softened to 51.3 from 52.1, but the beat on manufacturing (51.4 from 50.4) was sufficient to lift the composite reading to 51.9 from 51.6. It is the third consecutive gain for the composite, which now stands at its highest level since April. It still may be premature to suspect that the world’s second-largest economy has bottomed. Separately, the PBOC set the dollar’s reference rate at CNY7.0726, while bank models projected closer to CNY7.0826. Leaving aside quarter-end, which was also the last session before the long holiday, the yuan is little changed. |

China Caixin Services Purchasing Managers Index (PMI), September 2019(see more posts on China Caixin Services PMI, ) Source: investing.com - Click to enlarge |

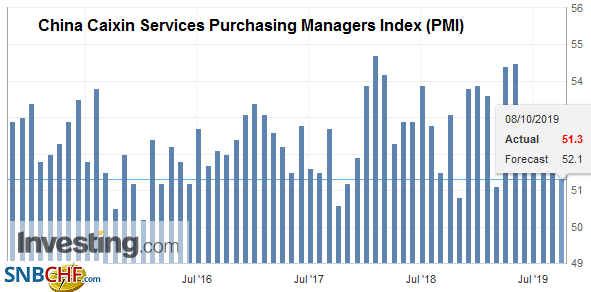

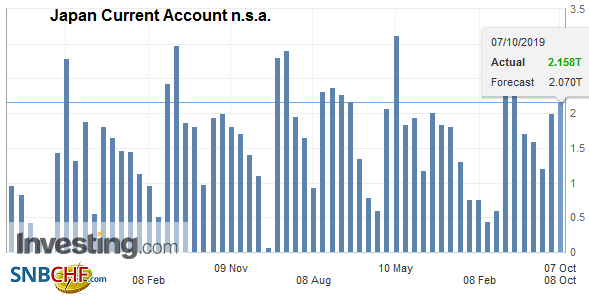

| Japan reported household spending rose 1% in August, the ninth month of year-over-year gains. However, cash earnings slipped by 0.2% in August year-over-year, the seventh decline this year. The sales tax increase on October 1 and falling wages will likely weigh on the economy in the coming months even though the government has offered tax breaks for house and auto purchases. Japan also reported the August current account. |

Japan Household Spending YoY, August 2019(see more posts on Japan Household Spending, ) Source: investing.com - Click to enlarge |

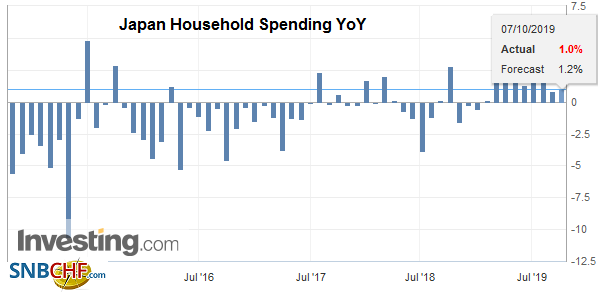

| The surplus stood at JPY2.16 trillion. It is a good reminder that Japan’s current account surplus, like Switzerland’s, is not driven by the trade balance but by the capital account. Japan reported a JPY50 bln trade surplus. |

Japan Current Account n.s.a., August 2019(see more posts on Japan Current Account n.s.a., ) Source: investing.com - Click to enlarge |

News that China bought 5.4 tonnes of gold in September to bring the year-to-date purchase to around 96 tonnes got drew much attention. Most of the write-ups and comments lack perspective. Gold China bought this year is worth about $4.6 bln. The value of China’s currency reserves fell by $15 bln in September to $3.09 trillion. The value of all of China’s gold holdings is around $93 bln. The US estimates that China’s holdings of US Treasuries as of July was about $1.11 trillion. The holdings peaked in November 2013, near $1.31 trillion. China’s gold holdings are roughly 8% of its Treasury holdings. Is that really diversification? Is China dumping Treasuries for gold? China is trapped by its large reserve holdings. The gold market is not big enough to absorb a significant part of these reserves or overall currency reserves that stood near $11.73 trillion at the end of H2 19.

The World Gold Council reports that central banks bought more gold last year than in any year since 1971 when the last official link between the dollar and gold was severed. Many private investors also bought gold not because a new global architecture will restore gold to its central place, but because the opportunity cost of holding it fell as some $15-$16 trillion European and Japanese bonds offered negative yield (of which as much as $1 trillion were corporate bonds). Central banks bought gold, but they also bought dollars. The IMF’s COFER data shows dollar reserves rose by $620 bln in 2017 and $343 bln in 2018. Admittedly some of this reflects the gradual inclusion of China’s reserves from the unallocated to the allocated, as it adopted the IMF’s best practice, perhaps related to its inclusion in the SDR. The latest report that was released at the end of September showed another $171 bln increase in dollar holdings in the first half of 2019. The last time that the overall dollar holdings of central banks fell was in Q3 15.

The dollar traded on both sides of its pre-weekend range against the yen and closed above the high yesterday. Although the outside up day is seen as favorable price action, there was no follow-through buying, and the dollar has slipped from around JPY107.45 back toward JPY107.00. The intraday technical indicators suggest some consolidation is likely in the North American morning, perhaps ahead of JPY106.80. The Australian dollar is also trading within yesterday’s range, and the downside momentum seen yesterday eased. It needs to rise above the $0.6765-$0.6775 area to lift the technical tone, but the intraday technicals are not very promising.

Europe

Germany provided one of the few pleasant surprises this year with a 0.3% rise in August industrial output. It is the strongest gain since March. Economists had looked for a flat to weaker report, especially after the larger than expected decline in factory orders reported yesterday. The year-over-year decline of 4% compares with a revised decline in July of 3.9% (was initially -4.2%). As we noted with the Chinese Caixin composite PMI, it is too early to assume the worst has passed.

According to a press report, the British government has accepted that there will be no agreement with the EU. It will blame Ireland and the EU. Reports suggest that the EU is insisting that the hard border (customs check) is between Northern Ireland and the rest of the UK rather than between Northern Ireland and the Irish Republic. French President Macron had said that the UK has until the end of the week to convince the EU ahead of next week’s summit. Both sides now seem to accept that there will not be a deal. The question is whether there will be a delay as Parliament has instructed if there was not an agreement.

The Turkish lira is consolidating yesterday’s losses amid broad confusion over US signals. Turkey’s dollar and lira bonds are weaker, with yields rising three and seven basis points respectively. Some reports suggest retail demand for the lira today. This environment is not conducive for institutional investors, even if the underlying fundamentals were better. The geopolitical situation is unclear, but Trump has reiterated why the US is abandoning the Kurds. They cannot trust the US and must turn away, which would appear to be in Russia and Iran’s interest. Separately, though less noticed, the US is threatening to pull out of the Open Skies Treaty that allows the US and European allies to monitor Russia’s military deployments.

For the fourth session, the euro is knocking on $1.10 without satisfaction. There is a 1.1 bln euro option struck at $1.1005. The 20-day moving average is a little below there, and the euro has not closed above this moving average since September 17. The intraday technicals suggest a break higher today is unlikely. Support is seen near $1.0965. The poor news on Brexit has pushed sterling to a four-five day low near $1.2220. The low from last week was near $1.2210. A little below $1.22 is the (61.8%) retracement of the bounce from early September. Any news that plays up the likelihood of a delay or extension could see sterling find a bid, but barring that, downside pressure may mount. That early September low is a little below $1.20.

America

Ahead of the high-level trade talks between the US and China, both sides have signaled that not much will come from it. Chinese officials let it be known that some core issues, like industrial policy and government subsidies, will not be discussed. Shortly after the US markets closed, the US opened a new front in its confrontation with China. It named eight Chinese tech firms to its blacklist. What makes this a new foray is that until now, the declaratory reason has been national security, but this time it is human rights. The companies sanctioned are providing technology for human rights violations of the Uighur Muslims. A score of public security bureaus have also been sanctioned. China, of course, will retaliate. Meanwhile, a comment on social media from the general manager of a professional basketball team supporting the protesters in Hong Kong has seen China respond by halting NBA broadcasts in China.

The US reports September PPI figures. They are not typically market-moving. Considerable more interest is on consumer prices, which will be reported later this week. Suffice it is to say that, like the CPI, the core rate of PPI is rising faster than the headline (~2.3% vs. ~1.8%). Two regional Fed presidents speak today, Evans and Kashkari, but the spotlight is on Chairman Powell, who speaks at the National Association of Business Economists in mid-afternoon. Canada reports September housing starts (expect softer) and August permits (small gain expected).

For a third session, the US dollar is making a lower high and lower low against the Canadian dollar. It is finding support near the 200-day moving average (~CAD1.3290), which had previously offered resistance. Rather than signaling a move lower for the greenback, we suspect a bullish flag pattern is being formed. The risk is for a test on last week’s highs near CAD1.3350. The peso is quietly trading in yesterday’s range. It appears vulnerable to deteriorating risk appetites. A dollar move through MXN19.60 gives scope for a near-term move toward MXN19.68-MXN19.72.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,China,China Caixin Services PMI,EUR/CHF,Featured,FX Daily,Germany,Gold,Japan Current Account n.s.a.,newsletter,Trade,Turkey,USD/CHF