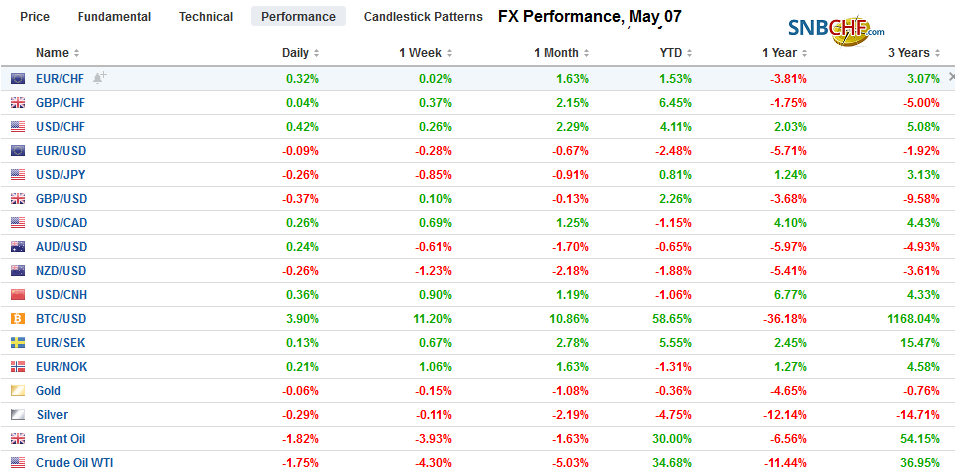

Swiss Franc The Euro has risen by 0.18% at 1.1415 EUR/CHF and USD/CHF, May 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that the US tariff escalation did not scupper trade talks with China has helped the global capital markets stabilize today. China’s Vice Premier Liu He is still leading a delegation to the US. Most Asian equities recouped part of yesterday’s losses, including China, Hong Kong, Taiwan, Australia, and Singapore. Japanese and Korean markets were closed on Monday and bore some selling pressure today. European markets are mixed, leaving the Dow Jones Stoxx 600 little changed through the European morning. The S&P 500, which trended higher

Topics:

Marc Chandler considers the following as important: $TRY, 4) FX Trends, EUR/CHF, Featured, Japan Manufacturing PMI, newsletter, SEK, trade, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.18% at 1.1415 |

EUR/CHF and USD/CHF, May 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

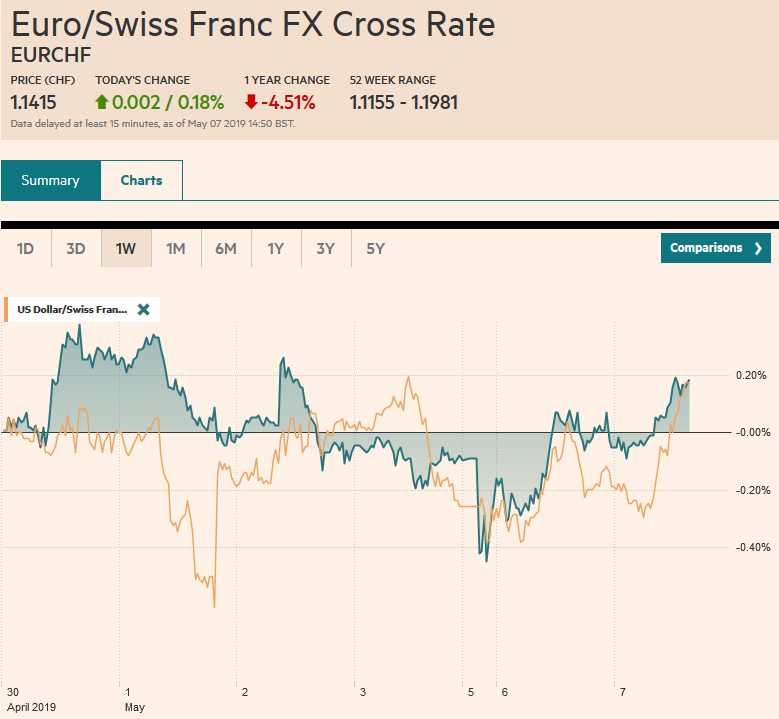

FX RatesOverview: News that the US tariff escalation did not scupper trade talks with China has helped the global capital markets stabilize today. China’s Vice Premier Liu He is still leading a delegation to the US. Most Asian equities recouped part of yesterday’s losses, including China, Hong Kong, Taiwan, Australia, and Singapore. Japanese and Korean markets were closed on Monday and bore some selling pressure today. European markets are mixed, leaving the Dow Jones Stoxx 600 little changed through the European morning. The S&P 500, which trended higher after gapping lower at the open, is trading around 0.3% weaker today. European bonds yields are two-three basis points lower today, and the German 10-year yield is back below zero after disappointing factory orders. Australian yields backed up, and the Australian dollar firmed after the central bank left the cash rate steady at 1.5%. The yen and Scandis are trading firmer, but the other majors are mostly little changed but softer. Among emerging markets, the Turkish lira remains under pressures follow a judicial ruling to re-hold Istanbul elections. The South African rand is steady ahead of tomorrow’s elections. |

FX Performance, May 07 |

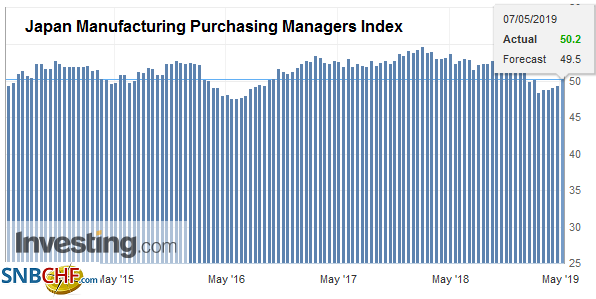

Asia PacificChinese officials hesitated at first and waivered about how to proceed in the wake of the end of the tariff truce, signaled by Trump’s weekend tweets. On the surface, China appeared to absorb the body blow and proceed with the trade talks later this week. The US claims that in the negotiations, China seemed to go back issues that the US team thought were already resolved. The US team pushed back and then saw new language in a draft, which confirmed what it saw as backsliding. According to the Americans, the issue revolved around China’s commitment to change its laws, ostensibly with implications for its “forced technology transfers” and corporate espionage. Japan returned from a long holiday. It has a new Emperor. There was favorable economic news. April’s manufacturing PMI showed a small increase in the preliminary report to 49.5 from 49.2 in March. This played on fears that after recovering in Q4 18 from a Q3 18 contraction, the world’s third-largest economy is struggling to find traction. First quarter GDP will not be released until May 19, but many expect that the economy shrank. The good news was the upward revision in April’s PMI to 50.2, a three month high. |

Japan Manufacturing Purchasing Managers Index (PMI), April 2019(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

A Bloomberg poll showed 14 of 26 surveyed expected the Reserve Bank of Australia to cut rates today, but Governor Lowe led a standpat meeting. The decision was justified by inflation forecasts, and the RBA sees CPI at 1.75% this year and 2.0% next. The monetary policy statement at the end of the week may help investors and economists re-set expectations. The market has not given up on a rate cut this year, and judging from the OIS, appears to have it nearly priced by the end of Q3. Investors will likely take their cues going forward from the labor market and price developments. Separately, Australia reported a slightly smaller March trade surplus (A$4.95 bln after A$5.1 bln in February) and a little better retail sales reported than expected (0.3 vs. 0.2% expected after a 0.6% gain in February). Excluding inflation (volume terms) Australian retail sales in Q1 fell 0.1%. Economists had expected a 0.3% gain after Q4 18 was revised to flat from 0.1%.

The Australian dollar is the strongest of the majors. It has recouped yesterday’s 0.4% decline in full, where, at its worst yesterday, it slipped below $0.6965, its lowest level in four months, Today, it reached almost $0.7050 in the initial reaction to the RBA’s decision. The gains have been pared. A move back below $0.7000 would embolden the bears. The dollar had not traded below JPY111 since April 11 and yesterday gapped below there. The gap remains open, and we expect the market will now try to fill it. The dollar has been confined to a little more than a third of a yen above JPY110.55. It almost reached JPY110.25 yesterday. After a sharp drop yesterday, the Chinese yuan recovered today, though implied volatility remains firm. Last week’s high for the dollar was near CNY6.75. Today’s low was a little below CNY6.76. Chinese reserves were reported little changed after the domestic markets closed but will not be a market factor.

Eurozone

German factory orders disappointed. The March increase, the first in three months, of 0.6% was less than half of what economists expected after a stunning 4.2% fall in February. The idea that the strength of the service sector (both IFO and PMI have it several months highs) shows the resilience of the domestic economy, while the weakness in manufacturing reflects trade disruptions, China slowing, and Turkey’ economic woes, is questioned by today’s data. Domestic orders fell 4.2%. Foreign orders rose by the same amount. Tomorrow, Germany will report industrial output figures. First quarter GDP will be published on May 15.

The cross-party talks between the UK government and Labour resume today. Reports suggest May is offering the first substantial concessions to Labour. Hope is predicated on the desperation of May and Corbyn after the local election drubbing and the success of the pro-EU Lib-Dems and Greens. The cross-party talks are seen as the last opportunity to avoid a more dire situation. The progress of these talks will likely be a key determinant of sterling in the coming days.

The Swedish krona slumped to its lowest level against the euro in a decade yesterday and is recovering a little today. The Riksbank had to turn a bit more dovish in the face of the soft inflation reports. The manufacturing PMI softened in April, and it is vulnerable to global trade disruptions and the risk-off mood after the presidential tweets. Today’s macro news is not better. In fact, it is worse than expected. Private sector output in Mach fell by 0.5%. The impact was partly blunted by the February series revision to 0.4% from zero. On the other hand, March industrial orders imploded, falling 4.9% month-over-month. It was the third consecutive decline, leaving orders some 8.1% lower than a year ago. Technically, the euro looks stretched, and a break below SEK10.67 may indicate a high is in place.

The euro reached almost $1.1220 before sellers reemerged. Support is seen ahead of $1.1180. The broad range may be indicated by the two sets of options expiring today. There are 1.1 bln euros struck at $1.1150 and about 565 mln euros at $1.1265. The firmer tone sterling enjoyed in Asia has been reversed in the European morning, pushing it back to yesterday’s lows near $1.3085. Here too the expiring options may give a sense of the broad range. There are roughly GBP515 mln struck at $1.3025 and GBP270 mln at $1.3130. The dollar reached almost TRY6.20 today after closing last week a little below TRY5.97.

Untied States

The US-China negotiations are the main talking points today, as businesses, investors and policymakers digest the latest developments. Officials have indicated the tariffs announced in the tweets on Sunday will go into effect 12:01 am on May 10. The US-China trade talks are to resume May 9 and carry over the next day. There was some push back that industry needs more warning, but the administration argued that the President has long warned that the 10% tariffs on $200 bln of Chinese imports could go up to 25%. The tariffs on the other $350 bln of Chinese goods that Trump threatened with a 25% levy will need to have public hearings and comment period, which means that they are not imminent.

The Federal Reserve stepped up its warnings over leveraged loans. Covenants and lender protections have deteriorated over the past six months. There have been many media and analysts reports on this sector. Yet, default rates remain low, and some attribute it to the still accommodative monetary policy.

Canada’s IVEY PMI will draw attention today after the Markit version showed a slump to 49.7 from 50.5 in March. The Markit measure increased only once since last July. The IVEY version has not been below 50 boom/bust since July 2016. It has risen four times since last July, including in March when it rose to 54.3 from 50.6. The US dollar seems to be comfortable in a CAD1.34-CAD1.35 trading range.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$TRY,EUR/CHF,Featured,Japan Manufacturing PMI,newsletter,SEK,Trade,USD/CHF