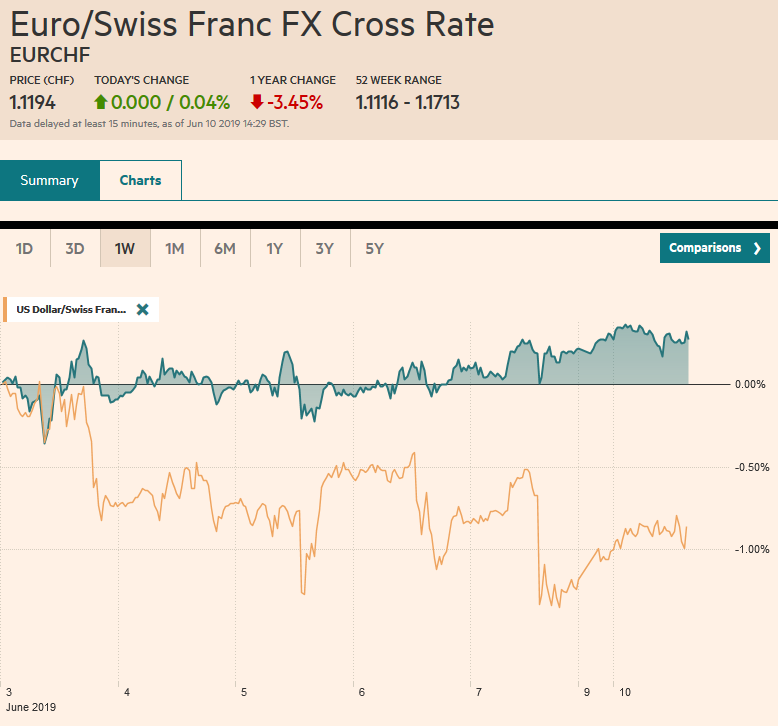

Swiss Franc The Euro has risen by 0.11% at 1.1186 EUR/CHF and USD/CHF, June 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A global sigh of relief that the US will not tariff all its imports from Mexico. Equities are all higher, and the weekend demonstrations in Hong Kong over a bill allowing extraditions to the mainland for the first time did not deter investors from bidding up the Hang Seng over 2.3%, the most this year. European equities are following suit. The more modest 0.4% gain through the morning session is the fifth gain in the past six sessions. US shares are trading higher and the S&P 500 looks set to open near the pre-weekend high and test the

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, CAD, China Trade Balance, EUR, Featured, Japan Gross Domestic Product, MXN, newsletter, U.K. Gross Domestic Product, U.K. industrial production, U.K. Manufacturing PMI, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.11% at 1.1186 |

EUR/CHF and USD/CHF, June 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

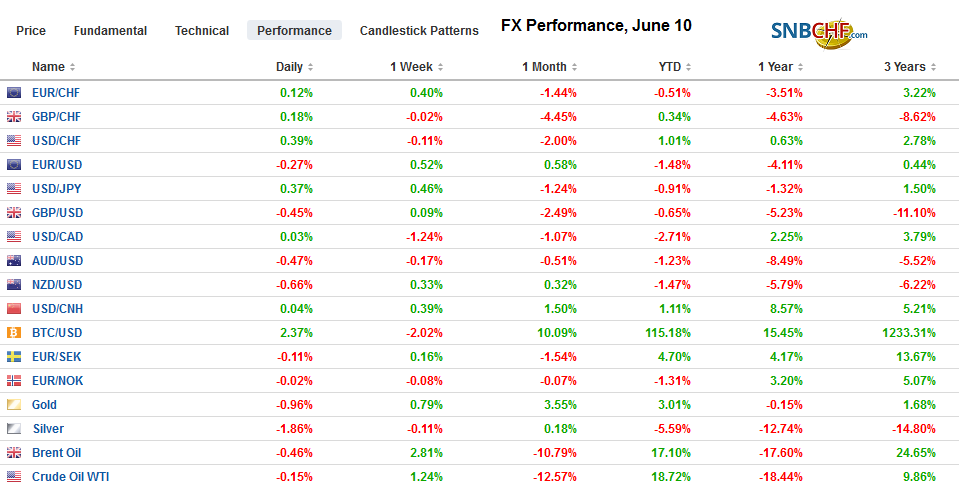

FX RatesOverview: A global sigh of relief that the US will not tariff all its imports from Mexico. Equities are all higher, and the weekend demonstrations in Hong Kong over a bill allowing extraditions to the mainland for the first time did not deter investors from bidding up the Hang Seng over 2.3%, the most this year. European equities are following suit. The more modest 0.4% gain through the morning session is the fifth gain in the past six sessions. US shares are trading higher and the S&P 500 looks set to open near the pre-weekend high and test the 2900-level. Bonds are seeing last week’s gains pared. European benchmark 10-year yields are mostly two-four basis points higher, but Italy is seeing a six basis point jump after falling more than 30 bp last week. The US 10-year finished last week near 2.08% and is now trading hands near 2.13%. The dollar is doing well, gaining against all the major currencies to recoup some of the ground lost before the weekend on the disappointing employment data. The Mexican peso is soaring over 2%. The US dollar closed around MXN19.62 ahead of the weekend and dipped below MXN19.14 today before recovering toward MXN19.20. Although the PBOC set the yuan’s reference rate a little firmer, the market sold onshore yuan to play catch-up with the offshore yuan’s move before the weekend when the mainland’s markets were closed. Near CNY6.9350, the dollar is at its strongest level of the year against the yuan. |

FX Performance, June 10 |

Asia Pacific

Large-scale demonstrations in Hong Kong against a law that would allow China to extradite people, though ostensibly not for political offenses, are unlikely to have much lasting economic impact. The protest is unlikely to be sustained like the Umbrella Movement. However, like the Umbrella Movement, it will do little to endear themselves to people in other parts of China, who often see people in Hong Kong already have more freedoms and liberty than mainlanders. Many suspect that at some point in the future, Shanghai would largely assume Hong Kong’s role as a financial center.

| Mnuchin said his discussion with the PBOC Governor Yi as “candid and constructive,” but apparently it does not represent a resumption of trade talks. Mnuchin was quoted in the press sounding as if Trump’s meeting with Xi is a done deal and the unknown is the outcome. Yet we still think the risk is that Xi does not agree to such a meeting where the outcome is not known beforehand. In that particular environment, Xi is at a disadvantage, A meeting between the two, and even renewed talks would allow the US to play the tariff card again and again. This what happened to Mexico: the existing NAFTA agreement did not prevent the US form imposing tariffs on steel and aluminum on national security ground, a levy on tomatoes for dumping, and across-the-board tariffs over migration. The US suspended the tariffs indefinitely, but as Trump made clear, what we had already understood, the tariffs remain on the books, as does the presidential emergency authority, and can be re-introduced at the will or whim of the president.

China’s reserves rose by about $6 bln in May to $3.101 trillion. The increase likely reflects valuation adjustments offsetting what was probably a small drawdown. The dollar rose against the other reserve currencies in May and, perhaps more importantly, their bonds rallied strongly. There is much discussion about the CNY7.0 level after PBOC Governor Yi indicated that there was no key level he had to defend. Current implied three-month volatility is near 5% (annualized). If we make a band around spot that is based by the implied volatility, it would suggest a range of CNY6.7430 and CNY7.1450 in three-months time. |

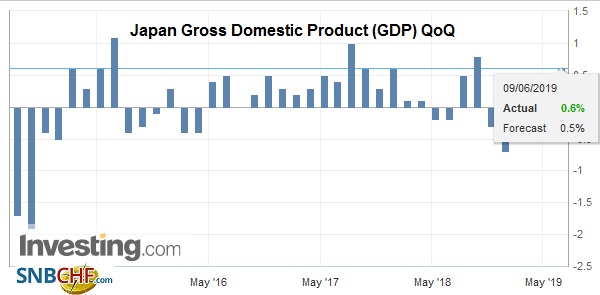

Japan Gross Domestic Product (GDP) QoQ, Q1 2019(see more posts on Japan Gross Domestic Product, ) Source: investing.com - Click to enlarge |

| China’s trade surplus swelled in May to $41.65 bln from $13.77 bln in April. While exports fared better than expected (+1.1% vs. -3.9% median forecast in the Bloomberg survey), the yawning surplus was due to an unexpectedly large (8.5%) drop in imports. The trade figures are likely skewed by businesses trying to game the tariffs by building inventories and increasing shipments ahead of the increases. Recall, Trump’s tweets announcing the end of the tariff truce were on May 5 and China’s retaliatory tariff increases went into effect on June 1. At the same time, China’s economy does appear to be slowing after a better than expected Q1 and agriculture challenges, like the African swine flu, may also be distorting trade. The 11.2% fall in crude oil imports in May and the 12.2% decline in soy imports (year-to-date) seem to reflect these issues. We caution against reading much into the 15.9% decline in rare earth exports in May, the series is volatile, but it deserves monitoring. In the first five months of the year, China’s rare earth exports are off 7.2%.

The dollar rose above the previous day’s high against the yen for the fourth consecutive session. It has recovered from the shelf is forged last week a little below JPY107.90 and test the JPY108.70 area. An option, set to expire today, at JPY109 for $1.1 bln may help cap today’s gains. Intraday support is seen in the JPY108.20-JPY108.40 band. Australian markets were closed today but the market has traded the Aussie on both sides of the pre-weekend range. A close below $0.6965 could put the bears back in change. |

China Trade Balance (USD), May 2019(see more posts on China Trade Balance, ) Source: investing.com - Click to enlarge |

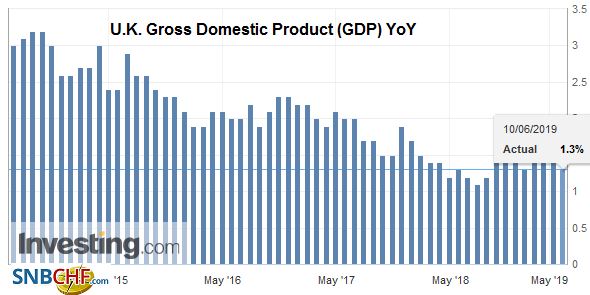

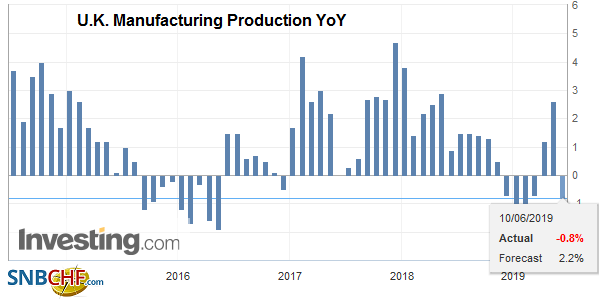

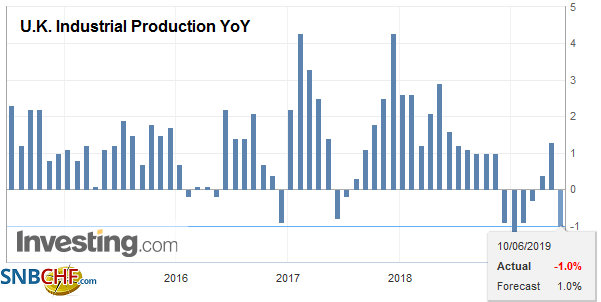

EuropeSterling’s losses were extended as participants expressed their disappointment with the unexpected poor April UK data. The monthly GDP reading fell an unexpected 0.4%. It was the second consecutive monthly contraction. The Bloomberg median had anticipated a 0.1% decline. Separate reports indicated what happened. Industrial output fell 2.7%, nearly three times larger than forecast, led by a 3.9% drop in manufacturing. Vehicle output fell by 24%. |

U.K. Gross Domestic Product (GDP) YoY, Q1 2019(see more posts on U.K. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

| The contraction was widespread, though, with pharma, metals, and chemical output weakening. Construction output fell 0.4% in contrast to expectations for recovery after the 1,9% tumble in March. The index of services was flat in April, defying expectations for a small increase. If a bright spot is to be found, it may be that the trade shortfall was smaller than projected. However, the GBP2.74 bln deficit, the smallest since last September, reflects the weak domestic economy and is also blunted by the $700 mln revision to the March series to show a deficit of GBP6.15 bln. The UK reports April employment data tomorrow. |

U.K. Manufacturing Production YoY, Apr 2019(see more posts on U.K. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| The eurozone will report April industrial production figures later this week, but early signs are not good. Before the weekend Germany reported a 1.9% drop, nearly four times more than expected. Today Italy had its own dismal report. Industrial output fell 0.7% in April. Economists had expected a flat report. The March series was revised slightly lower to show a 1% decline (rather than 0.9%). Last week Spain reported a 1.8% rise in April industrial production and France reported a 0.4% gain. For the area as a whole, output has fallen consistently since last September with January being the sole exception and April is unlikely to break the streak. |

U.K. Industrial Production YoY, Apr 2019(see more posts on U.K. Industrial Production, ) Source: investing.com - Click to enlarge |

The upside momentum that saw the euro gain 1% in the last two sessions has stalled and the single currency is consolidating in the pre-weekend range. After approaching $1.1350 ahead of the weekend, the euro was pushed below $1.1300 in late Asia. We peg support in the $1.1260-$1.1280 and note a 1.1 bln euro option at $1.13 will be cut today and there are 3.8 bln euros in options between $1.1350-$1.1360 that expire tomorrow. Initial support for sterling, post GDP disappointment, is near $1.2670. A break of $1.2630 would warn of a return to the $1.2550 low.

America

The market has pulled expectations for a September rate cut into July after the disappointing US employment report. Although few expect a rate cut when the Fed meets on June 18-19. The July meeting concludes the last day of next month, so the July fed funds futures contract is a clean metric of expectations for the June meeting. It implies a yield of 2.34% compared with the average effective rate of 2.37%. In contrast, the August contract, the best metric for the July meeting, implies a yield of 2.15%.

Canada reports housing starts (May)) and (April) permits data. March and April housing starts were strong, rising by more than a third off the February low. Economists look for a modest pullback in May. Permits may have risen for the second month. Canada saw another robust employment report last week and this reinforces the sense that economic soft patch ended and the Bank of Canada may sit patiently.

After the markets closed last week, Chile’s central bank announced a surprise 50 bp rate cut bringing the overnight rate to 2.50%. This takes back the two 25 bp rate hikes (Oct 2018 and Jan 2019) None of the economists in Bloomberg’s survey expected the move. The move pushes the real near zero (May CPI 2.3% year-over-year).

The US dollar began last week near CAD1.3530 after the US threatened Mexico with across the board tariffs to resolve migration issue, which, among other things, put the new continental trade agreement at risk. The US dollar began this week near CAD1.3250. It fell to about CAD1.3225 before finding a bid and has spent most of the European morning between CAD1.3260 and CAD1.3280. Initial resistance in North America maybe near CAD1.3300. The dollar was marked sharply lower against the Mexican peso, now that the US threat of tariffs has been suspending. The dollar finished last week near MXN19.62 and is currently trading below MXN19.20. Resistance is now seen near MXN19.30. Funding cetes purchases with short yen and/or Swiss franc positions remains a popular play in the levered community as an expression of risk-on and the chase for yield. The Dollar Index is trading inside its pre-weekend range. Resistance is seen near the pre-jobs report high, a little below 97.20, which is also the (38.2%) retracement of this month’s decline.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CAD,$CNY,$EUR,China Trade Balance,Featured,Japan Gross Domestic Product,MXN,newsletter,U.K. Gross Domestic Product,U.K. Industrial Production,U.K. Manufacturing PMI