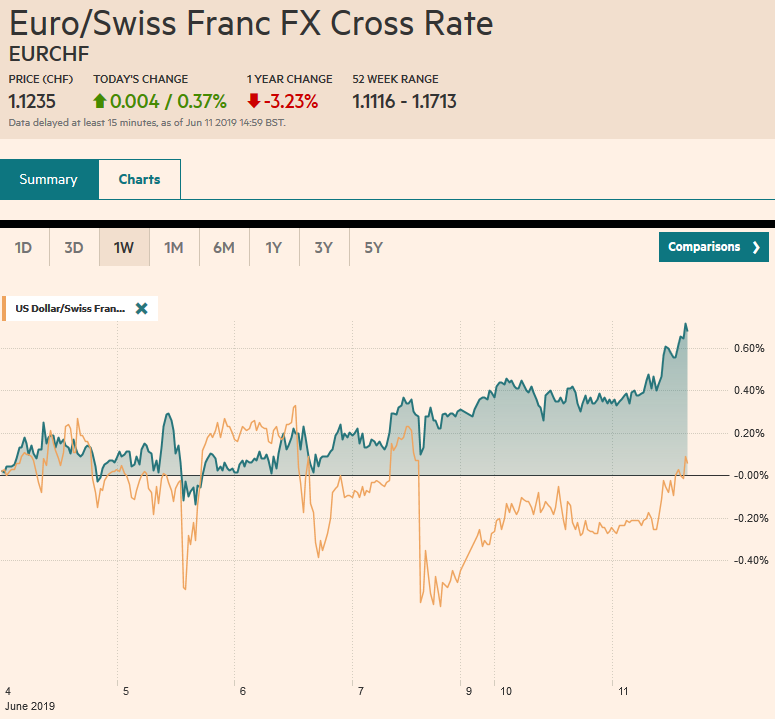

Swiss Franc The Euro has risen by 0.37% at 1.1235 EUR/CHF and USD/CHF, June 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The recovery in equities continues today in light news day. Nearly all the bourses in the Asia Pacific region rose, led by a 2.6% gain of the Shanghai Composite. The MSCI Asia Pacific Index rose for a third session. European equity benchmarks are rising for the sixth time in the past seven sessions. The Dow Jones Stoxx 600 peaked a week before the S&P 500 (April 24 vs. May1) but has not retraced (61.8%) of its decline, though the S&P has surpassed a similar retracement objective. Benchmark 10-year yields are little changed, though

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, EUR/CHF, Featured, Mexico, newsletter, trade, U.K. Unemployment Rate, U.S. Core Producer Price Index, U.S. Producer Price Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.37% at 1.1235 |

EUR/CHF and USD/CHF, June 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

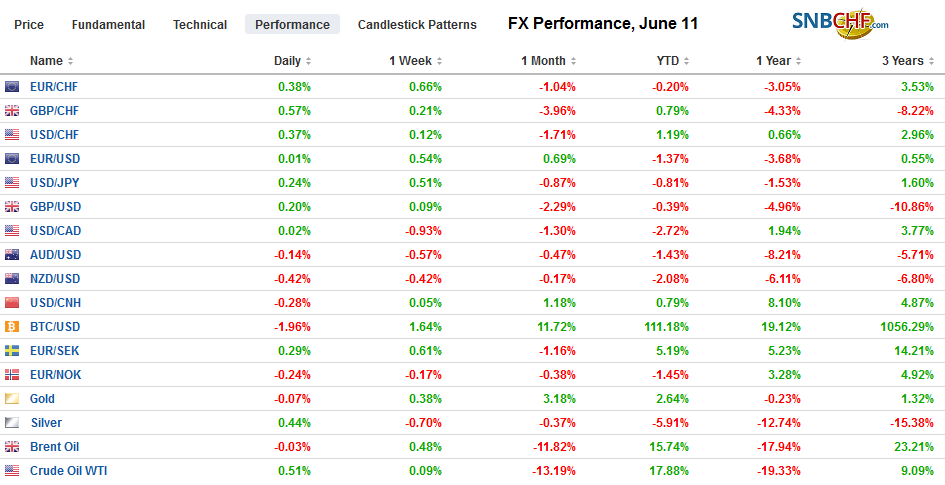

FX RatesOverview: The recovery in equities continues today in light news day. Nearly all the bourses in the Asia Pacific region rose, led by a 2.6% gain of the Shanghai Composite. The MSCI Asia Pacific Index rose for a third session. European equity benchmarks are rising for the sixth time in the past seven sessions. The Dow Jones Stoxx 600 peaked a week before the S&P 500 (April 24 vs. May1) but has not retraced (61.8%) of its decline, though the S&P has surpassed a similar retracement objective. Benchmark 10-year yields are little changed, though Australia’s two basis point decline was enough to push it to new record lows of 1.45%. Most European bonds yields are softer, while the US 10-year yield is steady near 2.15%. The US dollar is narrowly mixed. The Chinese yuan firmed by about 0.25%, snapping a four-day slide with its largest gain in nearly two months. |

FX Performance, June 11 |

Asia Pacific

Trump accused China of devaluing the yuan, but few believe this to be the case. The fact of the matter is that since Trump tweeted the end of the tariff truce, Chinese markets are among the worst performing. The Shanghai Composite was off 3% before today, and the 10-year bond yield had eased three basis points. The S&P 500 is virtually flat, while the 10-year yield had fallen 25 bp. The combination of underperforming asset markets, fears that the US tariffs will slow the already weakening economy and that officials will respond by easing policy, weigh on the yuan. In addition, the offshore market (CNH) suggests some asset managers may be hedging the risk that the dollar rises through CNY7.0, making it a bit of a self-fulfilling prophecy, or an example of Soros’s reflexivity principle. At most, China has been accepting a weaker yuan and moderating its decline. The PBOC took two steps today to lean against the downside pressure on the yuan. First, it set the reference rate (fixing) stronger than expected, and second, the PBOC announced it will sell CNH-denominated bills in Hong Kong later this month. The timing appears a bit unusual and could be an attempt to mop up liquidity in the offshore market to relieve some pressure on the yuan (CNY).

Trump has threatened new to impose tariffs on China if Xi does not meet him later this month. The process by which the US can impose a 25% tariff on the remaining Chinese exports to the US has begun. If Xi meets with Trump, there are no assurances that these tariffs will not be imposed anyway. By ending the tariff truce, the US ended the negotiations. After a round of tariffs and retaliatory tariffs, the US says it is ready to resume talks as they were. Trump has threated to lift tariffs to more than 25%. Some argue that the US and China economies are so intertwined that they have no choice but to reconcile, but this seems naive. Weren’t the Germany and French economies integrated at the start of the 20th century? The unscripted nature of a meeting on the sidelines of the G20 meeting puts China at a disadvantage. Trump’s threats make it so a meeting now would make it appear as if Xi was capitulating to US demands (what in less friendly company might be called blackmail).

The dollar has been confined to yesterday’s range against the yen (roughly JPY108.35-JPY108.70). The intraday technical studies warn that a push toward JPY109 resistance is unlikely and there is a $676 mln option struck there that expires today. There is a larger $1.1 bln option at JPY108.50 that also will be cut today. The Australian dollar traded on both sides of its pre-weekend range yesterday and closed below that low. The outside down day saw follow-through selling today that took the Aussie a little below $0.6950 before finding bids ahead of the $0.6925-$0.6930 area, which is where about A$1.3 bln of options have been struck that are expiring today. Tomorrow, there is are A$1.1 bln in options at $0.7000 that will be cut. The May employment data is due out early Thursday in Sydney. A poor report will fan expectations for a July rate cut, the odds of which presently are a little better than one in three, judging from the derivatives market.

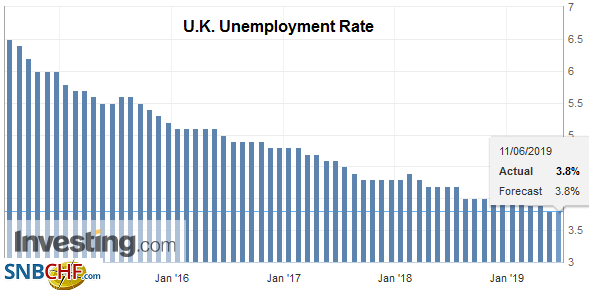

EuropeThe UK labor market was more robust than economist expected. In the three months through April, it created 32k jobs, will above the 4k expected from the Bloomberg survey. Pay was somewhat stronger than expected too. Average weekly earnings, excluding bonus payments, rose 3.4% (3-months year-over-year), which ended two months of softening wage growth (peaked at 3.5% in January and slowed in February and March). The unemployment rate remained at the cyclical low of 3.8%. The data plays into BOE’s Saunders argument that rates may have to rise before the uncertainty over Brexit is lifted. The market is unpersuaded by the hawkish rhetoric. Investors are persuaded more by the back-to-back monthly contraction in GDP that while there may be a hawk or two, or even a dissent in favor of a hike at an upcoming meeting, it is not where the majority can be found. Meanwhile, Thursday will be the first vote among Tory MPs to narrow the field of contenders to succeed May. By the end of the month, the field will be down to two candidates, who then face the rank-and-file members of the Conservative Party. |

U.K. Unemployment Rate, Apr 2019(see more posts on U.K. Unemployment Rate, ) Source: investing.com - Click to enlarge |

The naysayers emphasized the non-binding resolution in Italy’s parliament last week on the “mini-BoTs.” Ostensibly, these a small T-bills, issued in small denominations (similar to the euro). Draghi was clear: there is only one currency in EMU, and that is the euro. If the mini-BoTs are not money, then they are debt and need to be calculated as such. This will be the ruin of the monetary union, the pundits cried. However, it is not up to the Italian parliament, and the Italian Treasury rejects the plan. Meanwhile, the real news is in the opposite direction. Prime Minister Conte is trying to rein in the dueling deputy prime ministers, and there appears to be an agreement to work together to avert EU action on the excessive debt proceedings for 2018. EU officials meet today and tomorrow with this high on the agenda. The mini-BoTs are a distraction from two related and pressing issues. First, is the action needed to avoid the VAT hike next year (worth ~23 bln euros) that “automatically” kick in unless countermeasures are found. Second, in around three months, Italy needs to have a draft 2020 budget ready, and this is going to be particularly tricky given the conflicting thrusts of the Five Star Movement and the League.

The euro remains firm, at the upper end of last week’s range in quiet turnover. Any enthusiasm for the euro is likely to be kept in check by the more than five billion euros in options struck between $1.1340 and $1.1360 that expire today. There is also an option for 1.1 bln euros at $1.13 that too will be cut today. Sterling is firm but well within yesterday’s range. Resistance is seen in the $1.2740-$1.2760 area, but we suspect if the high is not in place already today, it was approached. The $1.2700 expiring option for around GBP260 mln may still be in play.

America

The S&P 500 gapped higher yesterday and, although the gap, was not closed it still may attract prices, despite the firmer opening that is expected. It lost the upside momentum that carried it above 2900 for the first time since May 7. Initial support is seen a little below 2870, but even a pullback toward 2850 would likely bring in new buyers. Meanwhile, the US 10-year yield was trading above 2.20% when Trump threatened the tariffs on Mexico. The S&P 500 handily recouped those losses, but the yield remains depressed. The September note futures contract close poorly, suggesting a further back-up in yields and the 2.20% will be tested, perhaps understood as a bit of a concession ahead of this week’s coupon sales.

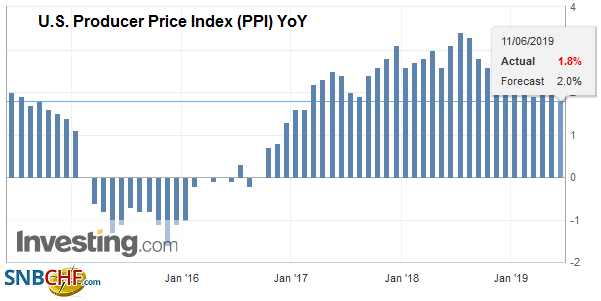

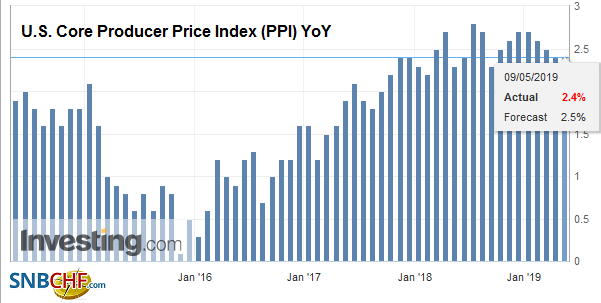

| The key is expectations for Fed policy, but there will be no help from officials Fed officials who have entered the quiet period ahead of next week’s FOMC meeting. Today’s PPI is not much of a market mover, but the CPI on Wednesday and retail sales and industrial production on Friday may help shape expectations. Remember how the year began. |

U.S. Producer Price Index (PPI) YoY, May 2019(see more posts on U.S. Producer Price Index, ) Source: investing.com - Click to enlarge |

| It looked like the US economy was stagnating and yet roared, albeit in a nonrecurring way. Still, there does not seem to be an urgency to cut rates that calls of a 50 bp move, not next week, but at the end of July implies. |

U.S. Core Producer Price Index (PPI) YoY, May 2019(see more posts on U.S. Core Producer Price Index, ) Source: investing.com - Click to enlarge |

The US dollar recovered from a low near CAD1.3225 yesterday, its lowest level in three months. However, the greenback stalled as it approached CAD1.3280. Resistance today begins by CAD1.3265. If equities maintain their momentum, the US dollar could fall toward CAD1.3200. The dollar finished last week near MXN19.62 and fell to almost MN19.1350 yesterday. The peso is firm today, just off yesterday’s best levels. Although a formal review of the progress on the border is to be held in 90 days, comments by US and Mexican officials suggest that if there are not sufficient results in 45 days, Mexico will again take up the US proposal that it is designated as a “safe third country” requiring asylum seekers to apply for safe haven in Mexico and not the US.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,EUR/CHF,Featured,Mexico,newsletter,Trade,U.K. Unemployment Rate,U.S. Core Producer Price Index,U.S. Producer Price Index,USD/CHF