Swiss Franc The Euro has fallen by 0.13% at 1.1128 EUR/CHF and USD/CHF, July 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equity benchmarks are headed for their third consecutive loss today as caution prevails at the start of Q3 after a strong first half. Ten-year benchmark yields are edging higher after a soft start in Asia. Italian bonds continue to outperform. Greek bonds have been set back as the new government reiterated its commitment to ease fiscal commitments as if Tsipras did not try, and got a similar rebuff. The dollar is firmer against the major currencies and most emerging market currencies. The South Korean won edged higher after

Topics:

Marc Chandler considers the following as important: 4) FX Trends, CAD, EUR/CHF, Featured, FX Daily, Japan, newsletter, South Korea, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

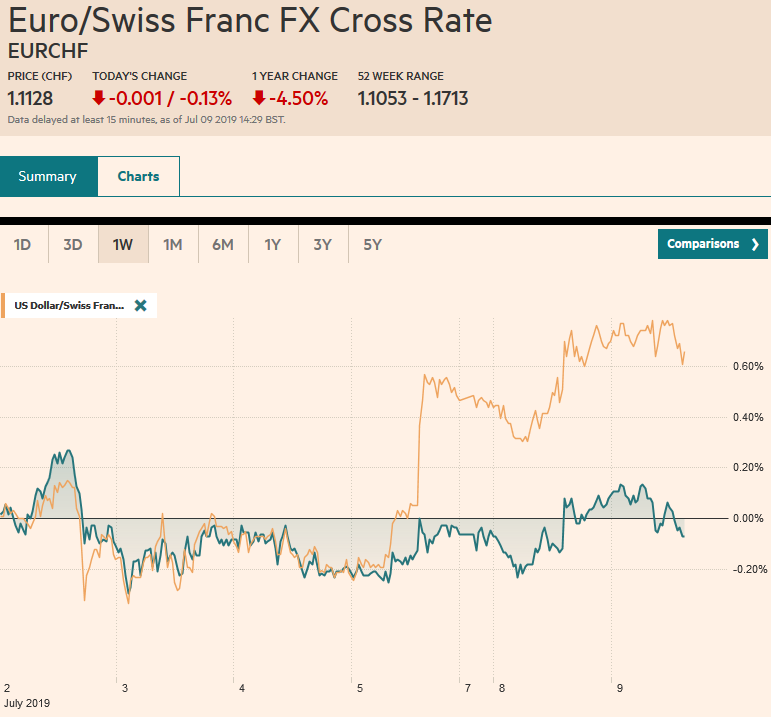

Swiss FrancThe Euro has fallen by 0.13% at 1.1128 |

EUR/CHF and USD/CHF, July 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

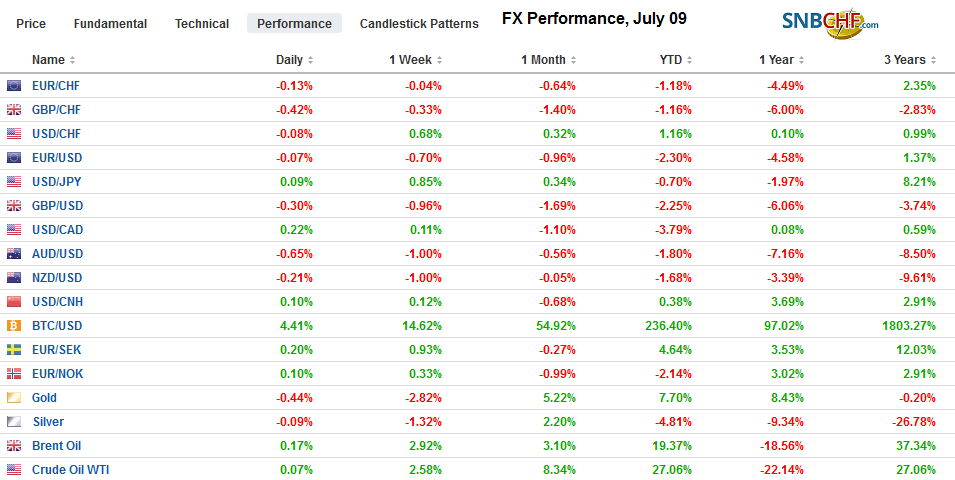

FX RatesOverview: Global equity benchmarks are headed for their third consecutive loss today as caution prevails at the start of Q3 after a strong first half. Ten-year benchmark yields are edging higher after a soft start in Asia. Italian bonds continue to outperform. Greek bonds have been set back as the new government reiterated its commitment to ease fiscal commitments as if Tsipras did not try, and got a similar rebuff. The dollar is firmer against the major currencies and most emerging market currencies. The South Korean won edged higher after falling in five of the past six sessions, and the Turkish lira is consolidating after yesterday’s drubbing. Gold and oil are modestly lower. |

FX Performance, July 09 |

Asia Pacific

Contrary to some reports, Japan and South Korea are not engaged in a trade war. Prime Minister Abe requires the new licenses are needed by South Korean companies to purchase three essential materials required for the fabrication of semiconductors and the new screens for mobile phones and tablets. Reports suggest the license may take up to 90-days to process. This is a work slowdown. Japanese producers of materials will suffer, and like the US threatening to cut Huawei out of the updates to the mobile operating systems, it will be a card that can be played one. A consumer boycott against Japanese goods may also be spurred. South Korea must become less dependent on Japan-based inputs and must eye with suspicions those companies that have set-up plants within its country and in China. It is not a trade war between Japan and South Korea, and the US has not triggered a global trade war yet (note too EU’s new trade deal with Mercosur and Vietnam), but there are some troubling if arguable, similarities. Japan actions are driven by one man, the move appears likely to hurt its own economy, the use of trade as a weapon to express displeasure at a non-trade issue. Working-level talks between the two countries are expected to be held in Tokyo this week.

Japan’s labor cash earnings fell 0.2% in May from a year ago. It has fallen every month this year for at an average pace of -0.6%. In the first five months of 2018, it rose at an average pace of 1.0%. Nevertheless, the weakness in labor cash earnings is not the only source of household income, such as bonuses and capital income from stocks. Note that even though Japan has negative interest rates, the dividend yield of Japan’s Topix is 2.4% compared with a little less than 1.90% of the S&P 500. In any case, the point that the decline in cash wages has not curbed consumption. Household spending rose 4% in May year-over-year, the strongest pace in four years.

The biggest sell-off in Australian stocks in five weeks appears to weigh on the Australian dollar, which is trading near 2.5-week lows. It is the fourth consecutive losing session, losing around 1.5% cumulatively. The next support is seen near $0.6915, though a potential double top suggests near-term potential extends toward $0.6880. Meanwhile, the dollar has taken out last month’s high in the yen and is edging closer to formidable resistance near JPY109. There is an $850 mln option struck that that expires today. A break above there would lift the technical tone and suggest the next immediate target of JPY109.60, which is the (50%) retracement of the dollar’s loss from the year’s high in late April. A potential head and shoulders formation (with a neckline near JPY109) has a measuring objective of near JPY111.00.

Europe

Sterling may find greater support is an amendment submitted by Grieve is accepted. It would effectively block the threat that the next prime minister, likely Johnson, would facilitate the dissolution of Parliament to push through a no-deal exit. The amendment requires Parliament to be in session on September 4, October 9 and every two weeks until December 16. If the amendment is accepted by the Speaker, a vote could be held later today. The prospect of a no-deal exit, which some try to re-spin as an exit to the WTO, has weighed on sterling. It is the weakest of the major currencies, losing about 4.5% over the past three months.

The data calendar is light for Europe today, and the main feature was a disappointing 0.7% decline in Italy’s May retail sales. It is the largest monthly decline this year, which has averaged a 0.12% decline. In the first five months of 2018, the average was a gain of the same magnitude.

The euro has been pushed through $1.12 for the first time since June 19. A break below $1.1180 warns of a re-test on the year’s lows seen in April and May near $1.1100. Ideas that the ECB will ease before or more extensive than the Fed is weighing on the single currency. Resistance is seen in the $1.1220-$1.1240 band. On an intraday basis, the euro is overextended, and early North American dealers may buy back the euro sold yesterday and look to re-set on a bounce today. Sterling is trading at its lowest level since January’s flash crash (~$1.2440). Sterling had forged a base near $1.20 in Q4 16 and Q1 17, and there is beginning to be some thoughts of a retest. Meanwhile, the euro-sterling cross continues to be capped near GBP0.9000. Note that the correlation between sterling and the euro (percentage change, rolling 60 days) stands near 0.65, which is twice as high as prevailed for most of Q2.

America

While strategists and analysts are spilling (proverbial) ink over last week’s comments by Trump seemingly implicitly threatening intervention, the market seems to have paid it no heed. What is generally not appreciated is that the Federal Reserve’s real broad trade-weighted dollar index fell almost 0.9% in H1 19. A greater response may be spurred by Bank of Canada Governor Poloz after tomorrow’s meeting. Only two currencies in the world have appreciated more than the Canadian dollar’s 4.0% appreciation against the US dollar, the Russian ruble (9.5%) and the Thai baht (5.8%). With most other central banks with easing biases, the Bank of Canada stands out as staying neutral. The risk then maybe for more Canadian dollar appreciation, which theoretically could short the recovery that appears underway as trade and investments picks up some of the slack of the softer household. Poloz could be more tactful that Trump and emphasize the risks to the economy from the global headwinds (slowing world trade, China’s attempt to punish Canada for possibly cooperating with the US on extradition of Huawei executive Meng Wanzhou).

The US JOLTS data is more for economists than traders who may look for hints today of Powell’s testimony before Congress over the next two sessions. Powell and Quarles speak today on the stress tests, while regional presidents Bullard and Bostic speak in St. Louis. Canada reports housing starts and permits figures, which are overshadowed by the Bank of Canada meeting tomorrow. Mexico reports June inflation figures, and although a dip back into the central bank’s range (below 4%) is expected, price pressures are still seen as too high to give officials the latitude to cut rates. However, the high real and nominal rates are weighing on the economy, and Friday’s industrial production report is expected to show that the contraction on a year-over-year basis has extended for the seventh consecutive month.

For the past three sessions, the US dollar has carved out a little shelf in the CAD1.3040-CAD1.3050 range. The upper end of the range is seen near CAD1.3150. The daily technical indicators (MACD and Slow Stochastics) suggest the risk in the days ahead is for a stronger US dollar. The US dollar is steadying against the Mexican peso after falling to its lowest level since May 1 yesterday (~MXN18.86). During what we anticipate to be a short consolidation period, the dollar may test resistance now seen near MXN19.10. The Dollar Index consolidated the gains scored in response to the pre-weekend employment data yesterday but is extended the move today by punching through the 97.50 area. The next target is last month’s high (97.75-97.80).

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CAD,EUR/CHF,Featured,FX Daily,Japan,newsletter,South Korea,USD/CHF