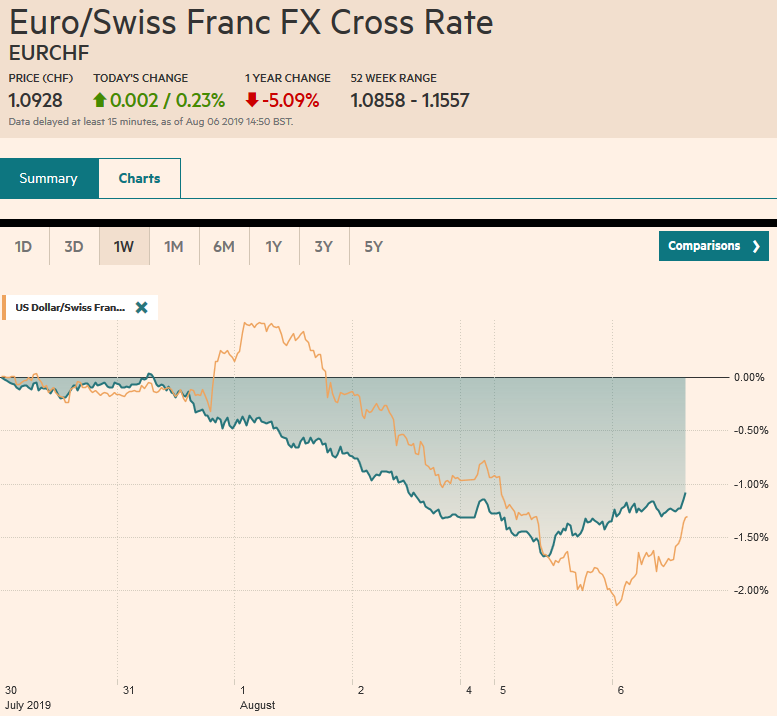

Swiss Franc The Euro has risen by 0.23% to 1.0928 EUR/CHF and USD/CHF, August 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The escalation of the economic conflict between the world’s two largest economies is dominating the capital markets. The US cited China as a currency manipulator after the North American markets closed, ensuring the troubled start to Asian trading after the US equities and yields plummeted on Monday. The VIX surged to 25%, doubling in the past week. The dollar sold off not just because of the aggressive easing the market now judges will be necessary, but many fear that the next step in the escalation ladder could be US intervention.

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, 4.) Marc to Market, Currency Movements, EUR/CHF, Featured, newsletter, trade, USD, USD/CHF

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has risen by 0.23% to 1.0928 |

EUR/CHF and USD/CHF, August 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

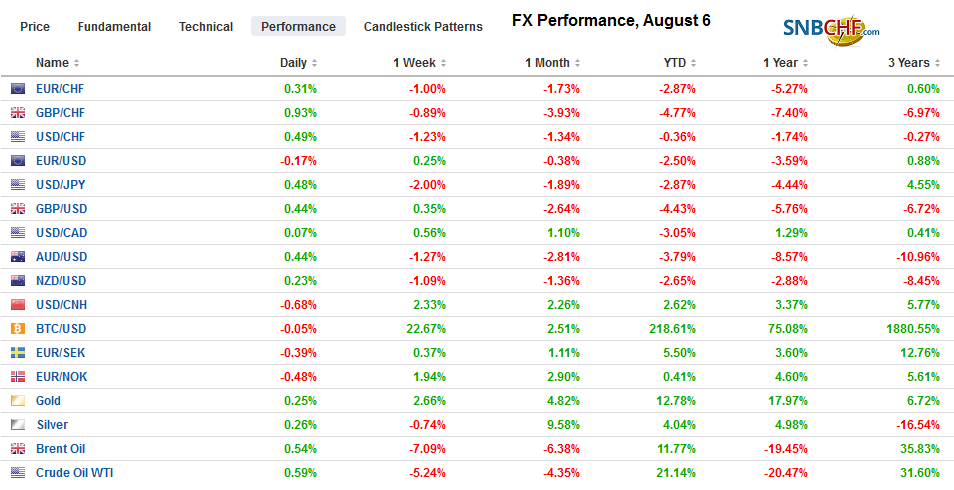

FX RatesOverview: The escalation of the economic conflict between the world’s two largest economies is dominating the capital markets. The US cited China as a currency manipulator after the North American markets closed, ensuring the troubled start to Asian trading after the US equities and yields plummeted on Monday. The VIX surged to 25%, doubling in the past week. The dollar sold off not just because of the aggressive easing the market now judges will be necessary, but many fear that the next step in the escalation ladder could be US intervention. The combination of the stronger than expected CNY fix and a recovery in German factory orders is helping the capital markets stabilize today. Asia Pacific shares still mostly fell, but the closes in Japan, China, Taiwan, and Hong Kong were near session highs. The positive momentum has carried into Europe, where several of the major bourses opened firmer, and US shares are higher. Benchmark yields are mixed, but of note, the 10-year German Bund yield is at a new low near minus 53 bp, while the 10-year US Treasury yield is bouncing back by five basis points to about 1.76% after falling about 14 bp yesterday. The Swiss, German, and Dutch 30-year bond yields are below zero. The dollar is mostly softer, but the Swiss franc and yen are seeing yesterday’s gains pared. Emerging market currencies, led by the South African rand, Turkish lira, and Russian ruble, are leading the way. Indian shares and rupee are lower ahead of a rate cut that the central bank is widely expected to deliver tomorrow. Gold is seeing yesterday’s strong gains pared. Oil is slightly higher with September WTI near $55. |

FX Performance, August 6 |

Asia Pacific

China did not escalate tensions today. The PBOC fix was set at CNY6.9683. This was higher than Monday’s CNY6.90 fix but was below the CNY6.9870 median forecast in the Bloomberg survey. It also announced a sale of CNH30 bln bills in Hong Kong next week (August 14), which drains liquidity. The offshore yuan is snapping a four-day drop and clawing back about 0.5% after falling 1.75% yesterday. The US dollar had strengthened to almost HKD7.85 yesterday the upper-end of its band but came back offered today and pulled back toward HKD7.83. The irony of the US accusation of currency manipulation is that it is predicated on China reluctance to resist market forces yesterday. US Treasury Secretary Mnuchin had warned, according to reports, in June that China could be cited as a manipulator if it stopped intervening to support its currency.

The Reserve Bank of Australia kept rates steady as widely expected after delivering cuts in both June and July. However, the accompanying statement was more constructive than anticipated. The RBA could deliver another reduction in the cash rate (1.0%) if needed, but it sounded almost upbeat and cited preliminary signs of recovery in the housing market. Separately, Australia reported a larger than expected trade surplus (June is a record A$8.04 bln surplus after A$6.17 bln in May). Exports rose one percent while imports fell three percent on the month. Record Chinese steel production and iron ore supply disruptions abroad flattered Australia’s report. The Reserve Bank of New Zealand will announce its decision first thing tomorrow in Wellington, and a rate cut is widely expected. The dovishness of the RBNZ may be tempered by today’s employment report that saw the unemployment rate fall to 3.9% (from 4.2%), which is an 11-year low. Wage growth was also stronger than expected.

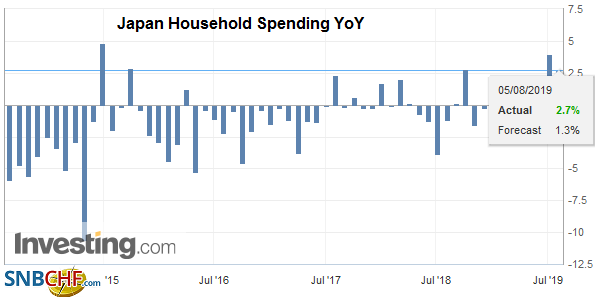

| Japan reported somewhat better than expected income and consumption data. Household spending rose 2.7% year-over-year in June. While this is softer than the 4% reported in May, it held up better than anticipated. |

Japan Household Spending YoY, June 2019(see more posts on Japan Household Spending, ) Source: investing.com - Click to enlarge |

| The median forecast in the Bloomberg survey was for a 1.1% gain. Cash earnings rose 0.4% in the through June. They had been expected to fall by 0.6%. However, the anticipated weakness was pushed into May, where the initial 0.2% decline was revised to -0.5%. |

Japan Average Cash Earnings YoY, June 2019(see more posts on Japan Average Cash Earnings, ) Source: investing.com - Click to enlarge |

The dollar initially extended its losses against the yen, falling to nearly JPY105.50 before recovering. It has traded on both sides of yesterday’s range making the close today an important technical indicator of the near-term direction. The settlement today above yesterday’s high of roughly JPY106.70 would help lift the tone. Note that the lower Bollinger Band is around JPY106.30. There is a modest option for a little less than $400 mln at JPY106.50 expiring today. The intraday technicals favor consolidation now. The Australian dollar is trading inside yesterday’s range and has returned to the upper end. A move above $0.6800, and ideally $0.6820 likely signal trade able low is in place. The New Zealand dollar shot up to a four-day high before caution ahead of the central bank meeting kicked back.

Europe

Better than expected German factory orders is preferable to the alternative, but do little to suggest the worst is past for the German manufacturing sector. Orders rose 2.5% compared with a 0.5% gain expected by the median Bloomberg forecast. However, domestic and EMU orders contracts. Foreign orders increased (5%), but this was due to an 8.6% surge in non-European orders. German factory orders are still off 3.6% year-over-year. Germany reports Q2 GDP in the middle of next week. The Bundesbank warned of a small contraction. There is little reason to disagree. German reports industrial output figures tomorrow. The median forecast calls for a 0.5% decline after a 0.3% gain in May.

When the UK Parliament returns in early September, it will hold a confidence vote. If Johnson loses it, which seems likely, the battle between Parliament and the Prime Minister will escalate. If the House of Common can cooperate across party lines, it can avoid a no-deal Brexit. The prerogative measure that would allow Parliament to be suspended to ostensibly take the UK out of the EU without an agreement ultimately requires the Queen’s support. Although the Crown has avoided politics to a large extent, it may ironically be pulled into the democratic dispute.

The euro initially rose to $1.1250 in response to China being labeled a currency manipulator. The market sold into the gains, and it leaves the single currency struggling to hold above $1.12 in late-morning turnover in Europe. There is a nearly 530 mln euro option struck there that will be cut today. The magnitude and shape of the euro’s pullback will provide some insight into the underlying strength/weakness. A break below $1.1140-$1.1165 would undermine the near-term outlook. Sterling is edging to a four-day high near $1.22. The GBP270 mln option at $1.2175 that expires today may still be in play. A move above $1.2250 is needed to lift the tone. The euro rose to a new high near GBP0.9250 but is reversing lower and may need to return toward GBP0.9100 to find better support.

America

Citing China as a currency manipulator is more symbolic than substantive. It requires negotiations with the alleged manipulator under the auspices of the IMF for a year. The first problem is in the past month, the IMF shared its assessment that the yuan was fairly valued. China’s actions do not meet the quantitative measures that the Treasury Department uses its is semi-annual report to Congress, which is why it has not been cited in more than 20 years. It was a mostly toothless measure, to begin with, and the escalating use of tariffs has stolen whatever bite was left. It is why the Treasury Department’s statement cited 1988 legislation that had left the judgment to the discretion of the Secretary.

Some in Trump Administration seem to want to intervene in the foreign exchange market. It is not the “currency war” accusations or some ideological predisposition that prevents it, but practical questions. For example, if China is manipulating its currency, the US could intervene to offset it by selling dollars and buying yuan. Will the US will help fund the Belt Road Initiative by buying Chinese bonds? The rising tensions with China buy Europe some time. The US does not seem prepared to wage a two or three-front war. The US cannot cite China as a currency manipulator and then sell dollars for euros or yen, but if it did, will the US pay Germany or Japan to warehouse its savings (reserves)? The US has the same problem China has when it comes to reserve management. If they want to diversify more away from dollars, what is a reasonable alternative?

The North American economic calendar is light. Today’s features include the US JOLT survey and Mexico’s auto production and exports. Arguably the most important event today is the Fed’s Bullard’s speech on the US economy near midday in Washington. Bullard had dissented from the June decision to leave rates steady, facing a 25 bp move. He was alone, but a month later, he had convinced a majority. He also brushed aside calls for a larger cut and seemed to anticipate Powell’s language of a midcourse correction.

The US dollar’s upside correction against the Canadian dollar appears to have run its course. It peaked at the end of last week near CAD1.3265 having bottomed on July 19 near CAD1.3020. The daily technical indicators are turning against the greenback, and the Bank of Canada remains one of the few major central banks not considering easing. Initial US dollar upticks toward CAD1.3220 may offer a better opportunity to buy Canadian dollars, for which the daily technical studies are set to turn its favor. A break of CAD1.3180 may signal the move lower has begun. The US dollar spiked to almost MXN19.74 in thin activity before Asian markets opened. It has reversed lower and is around MXN19.55 in European turnover. During this pullback, we look for the US dollar to ease toward MXN19.45. It may take a move below MXN19.35 to persuade speculative players that a peso low is in place. Having been burned, it may take the carry-trade strategies some time to recover. After approaching 99.00 on August 1, the Dollar Index approached 97.20 earlier today. It has stabilized but remains near the trough. Retaking the 98.00 area would lift the tone.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Currency Movements,EUR/CHF,Featured,newsletter,Trade,USD/CHF