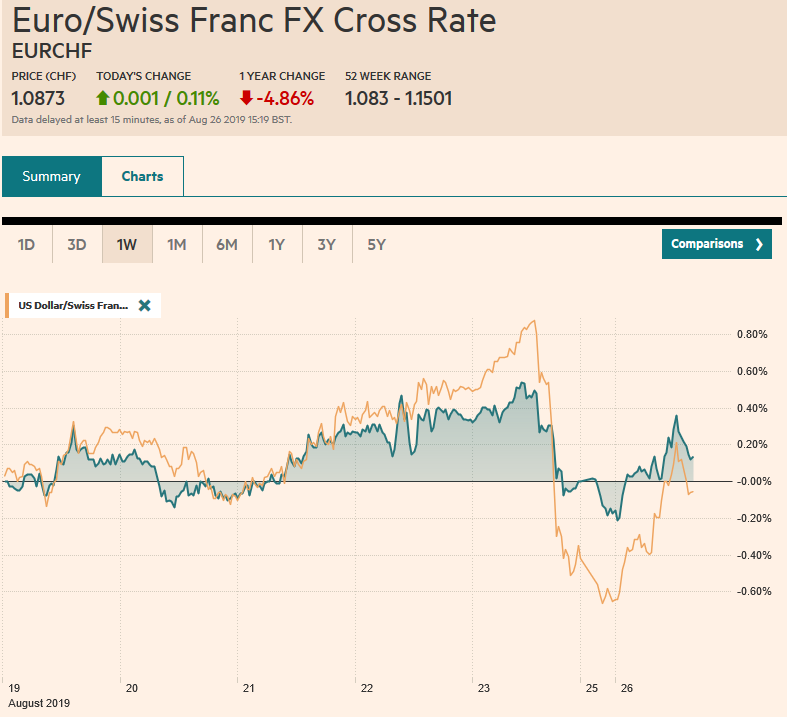

Swiss Franc The Euro has risen by 0.11% to 1.0873 EUR/CHF and USD/CHF, August 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The anticipated growth implications of the heightened tensions between the world’s two largest economies is dominating activity at the start of the new week. These considerations that drove the 2.6% drop in the S&P 500 before the weekend is carrying over into today’s activity. The dollar was driven below JPY105 support, while global equities and emerging markets slumped. Gold was lifted to a six-year high to flirt with 55 area. However, it is remarkable how quickly China appeared to respond to the market disruption, and President Trump claimed that China called, wanting to

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Currency Movements, Featured, newsletter, trade, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.11% to 1.0873 |

EUR/CHF and USD/CHF, August 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The anticipated growth implications of the heightened tensions between the world’s two largest economies is dominating activity at the start of the new week. These considerations that drove the 2.6% drop in the S&P 500 before the weekend is carrying over into today’s activity. The dollar was driven below JPY105 support, while global equities and emerging markets slumped. Gold was lifted to a six-year high to flirt with $1555 area. However, it is remarkable how quickly China appeared to respond to the market disruption, and President Trump claimed that China called, wanting to resume trade talks, which had already been reported to have re-started earlier this month. The US negotiating team was to go to China next month before last week’s tariff increases. Equities trimmed losses, and the dollar recovered broadly, including against the yen. Most Asia Pacific markets fell 1%, though India, open late closed higher. European bourses, excluding London, which is on holiday were marginally lower, with the Dow Jones Stoxx 600 was off by about 0.25% in late morning turnover. US shares were trading firmer, pointing to around a 0.75% higher opening. Bond yields tumbled in Asia but are a little firmer in Europe. The US 10-year yield fell a little through 1.45%, a new three-year low before stabilizing. After beginning the Asian session on its back foot, the dollar has steadily recovered and is now firmer against nearly all the major and emerging market currencies. |

FX Performance, August 26 |

Asia Pacific

The PBOC continued to resist the full pressure on the yuan, reinforcing the sense that if the yuan were to truly float, it would sink. The reference rate was set at CNY7.0570 while the market’s model’s suggested it ought to have been near CNY7.0628. In its money market operations, the PBOC also drained a small amount of liquidity. The offshore yuan (CNH) fell, with the dollar rising to CNH7.1926 before backing off.

The dollar is firm against the Hong Kong dollar, but below the cap of HKD7.85. The demonstrations in Hong Kong intensified, and China stepped up its warnings. Hong Kong reported a July trade deficit that was smaller than expected (HKD32.2 bln vs. HKD42.8 bln in June). The drop in exports moderated to -5.7% year-over-year from -9.0% in June. Imports were weaker, falling 8.7% year-over-year after a 7.5% decline in the 12-month through June. Singapore offered an upside surprise. Industrial output rose 3.6% in July. Economists surveyed by Bloomberg expected a 1.6% decline. The favorable news was blunted by the downward revision to the June series that took the 1.2% gain initially reported and cut it to a 0.3% decline.

Amid the US-China’s tit-for-tat tariff action, the US and Japan appear near a trade agreement. The broad outlines have been known for months. US farmers are at a disadvantage since a Trans-Pacific Partnership and a free-trade agreement with the EU. It is less clear what the US will concede. Auto duties will not change, but Lighthizer suggested some levies on industrial goods may be reduced. Abe may think he is securing goodwill from the mercurial American president. Yet one cannot help but be skeptical. As the framework agreement was announced, there already was the basis for disagreement. Trump, as he is wont to do, may have oversold Japan’s agriculture purchases, saying for example that there will be “very, very large orders for corn” shortly. Abe said that Japan’s private sector will look at US agriculture products and that there was still work to be done. A deal is hoped to be reached by the UN General Assembly session in the second half of September.

The dollar initially gapped lower against the yen and fell to JPY104.45, a new three-year low before rebounding smartly. It is flirting with JPY106 late in the European morning. Recall the pre-weekend high was near JPY106.75. The intraday technicals are stretched ahead of the start of the North American session. The Australian dollar was sold through $0.6700 to approach the low set earlier this month ($0.6675). It has also recovered to return to little changed levels. It has not closed above its 20-day moving average since late July. It is found near $0.6780 today, which is a couple ticks above the pre-weekend high.

Europe

Journalists are getting much mileage from BOE Carney’s call for a new global reserve asset to replace the dollar. He rejected the idea of replacing the dollar with another national currency, recognizing the contradiction economists like Triffin noted more than 50 years ago. He called for some digital currency. If it sounds familiar, it is because it is. This is a modern reiteration of Keynes’ bancor he proposed at Bretton Woods. Like then, it will have many advocates. Yet, how to get from here to there is not clear or obvious, and even Carney recognized that it is nowhere close to materializing. Ultimately, the US may lack the power and/or will to impose a new world order, such as Bretton Woods II, but it is strong enough to block the imposition of one on it.

GermanyGerman business confidence continues to fall. The August IFO survey showed the overall assessment of the business climate falling to 94.3 from 95.8. It has risen once this year, and that was in March. It now stands at a seven-year low. |

Germany Ifo Business Climate Index, August 2019(see more posts on Germany IFO Business Climate Index, ) Source: Investing.com - Click to enlarge |

| The expectations component slipped to 91.3 from 92.1, and the current assessment eased to 97.3 from 99.6. |

Germany Business Expectations, August 2019(see more posts on Germany Business Expectations, ) Source: Investing.com - Click to enlarge |

The US and France have struck a tentative agreement. France has agreed to respect the digital tax decision by the OECD and would adjust its tax (and rebate) if the OECD tax is lower. In exchange, the US appears to have promised not to retaliate against French wines, as Trump has repeatedly threatened to do. Macron is given high marks for the G7 meeting, though the invitation to the Iranian foreign minister may set the precedent that allows Trump to invite Putin next year when the US is host. Macron’s criticism of Brazil may have not had Merkel’s blessing, but it appears to have succeeded in spurring Brazil President Bolsonaro into calling on the army to help put out the Amazon fires.

The euro was initially extended its pre-weekend gains and made it to almost $1.1165 before hitting a wall of offers that saw it surrender half a cent by mid-morning in Europe. The $1.1095 corresponds to a (61.8%) retracement of the two-day rally. There is an option for 1.6 bln euros struck at $1.11 that expires today. Sterling did not see any follow-through buying. Before the weekend, it stalled in front of $1.23. Today it peaked near $1.2285. The pre-weekend low was a little below $1.22, but we suspect it may find support near $1.2225 today.

Trump’s “order” for US companies to begin looking for an alternative to China may not have much legal status in its current form, but the White House is arguing the president has the power under the International Economic Powers Act. Trump has not formally triggered the act. However, the implicit threat will likely have a cooling effect on new direct investment flows. On the other hand, these flows appear to have been disrupted by the escalating tariffs with no end in sight. What once was dubbed as “Chimerica” will become less entangled and will spur another shift in the global division of labor. Vietnam, and to a less extent, Thailand looks like early beneficiaries, for example.

The US dominates the North American calendar today. The main report is the preliminary estimate for July durable goods orders. In the first six months of the year, durable goods orders fell in half the months. Most recently it rebounded in June from contractions in April and May. In addition to late-cycle hesitancy about the new investment and the trade uncertainties, Boeing’s problems also weighed on durable goods orders. Also, the oil and gas have been driving US capex, and this has also slowed. Consider that the report before the weekend showed the number of oil rigs fell 16 to 754, which is the lows since January 2018 and is about 14% below their peak.

The US dollar is trading inside its pre-weekend range against the Canadian dollar (roughly CAD1.3275 to CAD1.3340). It continues to find bids below CAD1.33. Despite the Bank of Canada’s insistence that monetary stance is neutral, the market suspects that it will succumb to global pressures and the slowdown in the US economy, and cut rates as early as October. The thinking is that the central bank will use next week’s meeting (September 4) to lay the groundwork. Of note, there is a $630 mln option at CAD1.3310 that is very much in play ahead of today’s expiration. The dollar spiked to MXN20.1265 in Asia as the market reacted to the pre-weekend developments. It is the first time this year that the dollar rose above MXN20.00. However, the dollar has reversed lower, and the peso is slightly firmer ahead of the open of the local markets. US dollar support is seen above MXN19.80. There was no follow-through selling of the Dollar Index after the pre-weekend downside reversal. It retraced (61.8%) of the losses suffered this past Friday. A push now above 98.00 would re-target the recent highs near 98.50.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,Currency Movements,Featured,newsletter,Trade