Everyone must ask himself the question. Do you want the world to move to an honest money system, or do you just want gold to go up (we italicize discussion of apparent moves in gold, because it’s the dollar that’s moving down—not gold going up—but we sometimes frame it in mainstream terms). Gold’s Going Up We have written about the tension between these two goals before. Many people start with the former. They come to gold, as they begin to realize that the dollar is going off the rails, that there is something wrong with bail-outs, bail-ins, Quantitative Easing, Zero Interest Rate Policy, and negative interest rates. But a funny thing often happens along the way. They buy into the story of gold to ,000 (or ,000). They become speculators on its price. They

Topics:

Keith Weiner considers the following as important: 6a.) Keith Weiner on Monetary Metals, 6a) Gold & Bitcoin, Basic Reports, central planning, command economy, coordination problem, diktat, dollar price, fascism, Featured, gold basis, Gold co-basis, gold price, gold silver ratio, newsletter, silver basis, Silver co-basis, silver price, Trump

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Everyone must ask himself the question. Do you want the world to move to an honest money system, or do you just want gold to go up (we italicize discussion of apparent moves in gold, because it’s the dollar that’s moving down—not gold going up—but we sometimes frame it in mainstream terms).

Gold’s Going UpWe have written about the tension between these two goals before. Many people start with the former. They come to gold, as they begin to realize that the dollar is going off the rails, that there is something wrong with bail-outs, bail-ins, Quantitative Easing, Zero Interest Rate Policy, and negative interest rates. But a funny thing often happens along the way. They buy into the story of gold to $5,000 (or $65,000). They become speculators on its price. They use gold the way most people use stocks and real estate: as just another chip in Casino Federoyale, a way to make dollars. We don’t blame the players. We blame the Federal Reserve for forcing everyone to play. Everyone must bet on capital gains, as the Fed has sucked the yield out of the markets and thus destroyed investing (and if you think the Fed has been bad on this count, look at Switzerland, Germany, Japan, and others!) There is not an intrinsic contradiction between the goal of speculating to make dollars to pay living expenses, and advocacy of honest money. However, there are times when they can come into conflict. On Friday, President Trump issued orders to US companies. Federal Reserve Chairman Powell hinted at further cuts to interest rates. And the price of gold went up nearly 2%. The gold market hasn’t seen action like this since the halcyon days when the Obama administration was just getting started, unlimbering massive bailouts, and the Bernanke Fed launched Quantitative Easing. Is this a good thing? Those who just want to sell their gold to make more dollars, may think it’s fantastic. Almost as good as Obama’s shovel-ready pork barrel spending and Bernanke’s threat to drop bags of cash from a helicopter. Trump, like Obama before him, created a fear-bid on gold, which is now over $1,525. This price has not been seen since the week of April 1 2013, when the price dropped from $1,580 to $1,480. But if one is interested in the direction that America is headed, and the future of civilization—if civilization is to have a future—it is quite concerning. We have worn out a keyboard writing so often about the destruction wrought by falling interest rates. So today we will take a break and address Trump’s comment. Why This Essay?First, we want to clarify our policy regarding political discussions. We generally avoid them, and prefer to keep our commentary to matters of monetary economics. We certainly do not promote any particular party (we don’t like either of the major American parties). Martin Luther King, Jr. said: “On some positions, Cowardice asks the question, “Is it safe?” Expediency asks the question, “Is it politic?” And Vanity comes along and asks the question, “Is it popular?” But Conscience asks the question “Is it right?” And there comes a time when one must take a position that is neither safe, nor politic, nor popular, but he must do it because Conscience tells him it is right.” We write this essay today, knowing it may be unsafe and unpopular. We do not write with intention to insult anyone (other than John Maynard Keynes and the Modern Monetary Cargo Cultists), though we risk that some may take it that way. We take this risk because we are fighting to preserve civilization. Our modern civilization is on a trajectory that will lead to a very dark place. History provides examples of what can happen. We refer to the period 1929-1945, and course to 476AD. If the monetary system is not changed, 476AD is where we will end. The raison d’etre of Monetary Metals is to try to help bring about that change. A Chilling DirectivePresident Trump’s statement is chilling. He began: “Our great American companies are hereby ordered…” Every word in this sentence is significant, starting with the first one. We must ask, whose companies does he think they are? We are reminded of the vision of Benito Mussolini (who, not incidentally, praised Keynes): “Everything within the state, nothing outside the state, nothing against the state.” Mussolini’s idea was for nominal private ownership of the means of production—but under government control. Which meant his control. The means of production was “ours”, in the sense of the Royal We (as opposed to when we say the word “we”, to mean this is the Monetary Metals Report and not just Keith’s personal blog). By the principle of Mussolini’s fascist system, Trump is telling companies what to do. He wants them to: “…bringing your companies HOME emphasis in original and making your products in the USA.” We are not here to analyze the geopolitical implications to this. Nor the predictable—dare we say intended—consequences such as higher prices for goods, lost profits, investment write-downs, layoffs and unemployment, etc. We want to look at something we don’t usually address directly: the nature of social systems. Man is a social being. He thrives in an environment where there are (many) others, not so much isolated on a desert island. The Social SystemBut the benefit depends on the nature of the social system under which he lives. For example, the Soviet system made life all but impossible. It killed tens of millions of its own citizens—in peacetime—and rendered the rest into miserable, half-starved slaves. Life was all but impossible, because coordination between productive people was made all but impossible. That’s what government intrusion into the economy does (Keith proved it in his dissertation, by looking at spreads). The more the government overrides individual decisions, the more coordination breaks down. This is not merely due to corruption. Of course, the people who decide which company to make and which to break are corrupt. Such power attracts corrupt people to begin with, and even if they were Snow White initially, such power tends to corrupt people. Professor J.R.R. Tolkien wrote a very good story about this. The breakdown is not merely due to stupidity, though most economic dictators are stupid (Alan Greenspan was the notable exception). Nor incompetence. Nor certainly lack of data. Today, they are buried in data purporting to tell them what we need. Coordination is impossible under government control, for two reasons. One, the central planner does not know, and cannot know, what each of the market participants knows. The central planner is trying to use aggregate statistics in lieu of knowledge about the margin—the millions and millions of margins in an economy of any size. Two, a diktat does not operate by the same mechanism as the market. Even if the planner knew the right price to set, he would not cause the same economic effects as the market would in setting that price. If you think of economic diktats as an assault on producers, a breakdown of coordination, and impoverishment of society, then that is the right picture. And there is another dimension. When the government makes some businesses and breaks others, everyone of course has to work overtime to position themselves to be in the former group. Even if the government is not directly breaking some, if it is just taxing everyone, the consequence is the same. People naturally want to be on the receiving end of the subsidy, not stuck paying endless taxes for no benefit. All History Is the History of Class ConflictCentral planning specifically, and socialism generally, sets man against man. Claiming there is an inherent conflict between classes, it creates classes and puts them into conflict. So not only does socialism and its central planning impoverish people, but it stokes their anger and gives them reason to direct their anger at members of other groups in society. This is a dynamic system, much like the monetary system, with positive feedback loops. First one group gets control over the levers of power. And uses it to direct other people’s wealth to its members. Then another group gets control, and does not remove government from its role of economic planner, but merely seeks to benefit from the looting. With each cycle, new precedents are set, and the level of resentment rises. Few can understand why members of other groups—whom they now hate—are angry. Only their own anger is justified. Others are to be demonized, which is a prelude to committing atrocities against them. If this sounds far-fetched, we encourage you to read about the rise of the Nazi party in Germany. Making Winners and LosersIt is in this light that we look at President Trump’s order to American companies to move their operations and manufacturing home. This move will make a few businesses, particularly those that can supply components that are currently being supplied by Chinese firms. And it may bid up wages for workers to make these products. However, it will impose massive losses on every firm forced to move its manufacturing to the US. And on every firm who supported them in being offshore. This includes obviously Chinese firms, but also American shipping, logistics, consultants, and others. And there will be exemptions. It will prove to be impossible for some manufacturers to move on command. This will be either due to the lack of factories in America that have the capabilities and skills. Or the lack of a massive workforce trained and willing to do the technical but tedious tasks required. Unlike in China, there are not a million people in America that can be hired to do circuit board assembly. Some of these companies will have a compelling argument and/or good media presence and well-connected lobbyists. They will demand—and get—special permission to keep operating as they do now. Others will fail to get such permission, and be forced to take whatever loss up to going out of business. This new economic directive will make some and break others. And cause strife between groups who previously had no reason to hate one another. Consider those who are broken by this demand. When they get their guy into power, sometime in the future, what new policies will they want to impose? One thing is virtually certain: he won’t roll back the government’s power and try to return to a freer market. He will seek to impose some new injustice, to compensate for the prior injustice and also simply to take what’s there for the taking. And then he’s out of power, and the cycle continues. Or perhaps more accurately, the downward spiral from free markets and prosperity, to more controls, more poverty, and hence more group conflict. It takes on a life of its own, with its own momentum and inertia. Trump said, “This is a GREAT emphasis in original opportunity for the United States.” There are few cases where all 300M Americans have a common interest (e.g. an invasion). This is not one of them. For example, the wage-earner who can afford a smart phone at $500, but not one priced at $2,500, does not have a common interest with the US circuit board soldering company. So it is not true that it is a great opportunity for “America”. It is a good opportunity for those who would seek the power to decide who is made and who is broken. It is a great opportunity for the gold speculators, who plan to sell their gold for more dollars. And it is a great opportunity for the bond speculators. Just on Friday alone, not counting the move it’s been making since November last year, the 10-year Treasury yield fell another 5%. This is delivering big capital gains to those who plan to sell their bonds for more dollars. It is a good opportunity for those who would seek to profiteer on the back of every government program. It is a good opportunity for the vultures, and the cockroaches who will feast on the spoils of our once-great civilization, now carelessly spilled onto the floor. For the love of America, if you are an American, and for the sake of civilization itself, we hope you will oppose this ill-conceived move to take control over a major part of the economy. Supply and Demand FundamentalsThe price action was pretty intense this week, most of it on Friday. The statement by President Trump, not to mention Fed Chairman Powell’s hint of further cuts, impelled people to buy gold and silver, whose prices went up $14 and $0.29. Oh, and the interest rate on the 10-year Treasury lost over 5% of its juice on Friday. We said last week: “…there is no magic interest rate, that drives up the gold price. What we need is a spread, or a ratio. We should compare the market interest rate to marginal time preference.” Did marginal time preference drop this week? We don’t know, but we doubt it. If not, then the drop in interest rates compresses that spread interest-time preference spread. Or pushes deeper into negative territory. That is a force which impels people to buy gold. And with silver still near a historic low compared to gold, the savvier ones are buying silver. Thus the gold-silver ratio is slowly declining. Monetary Metals is excited to be bringing the first gold bond to market. Please contact us if you are interested in investing. |

|

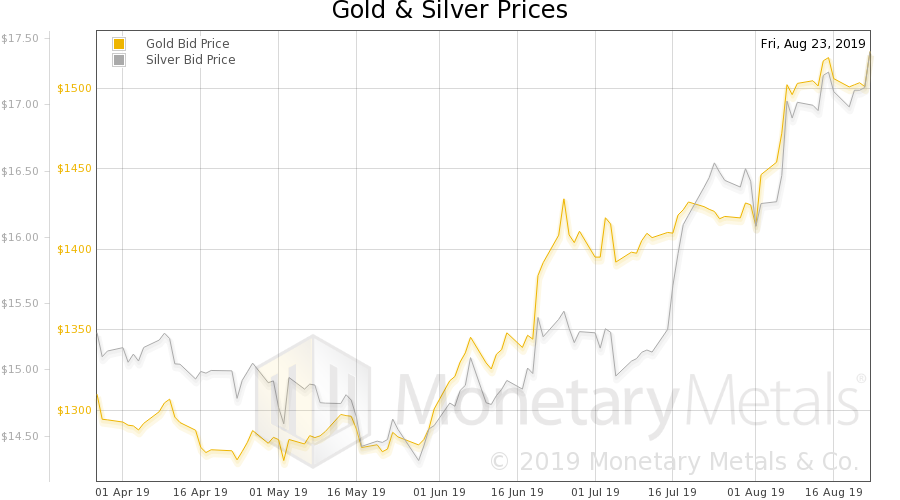

Gold and Silver PricesNow let’s look at the only true picture of supply and demand for gold and silver. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

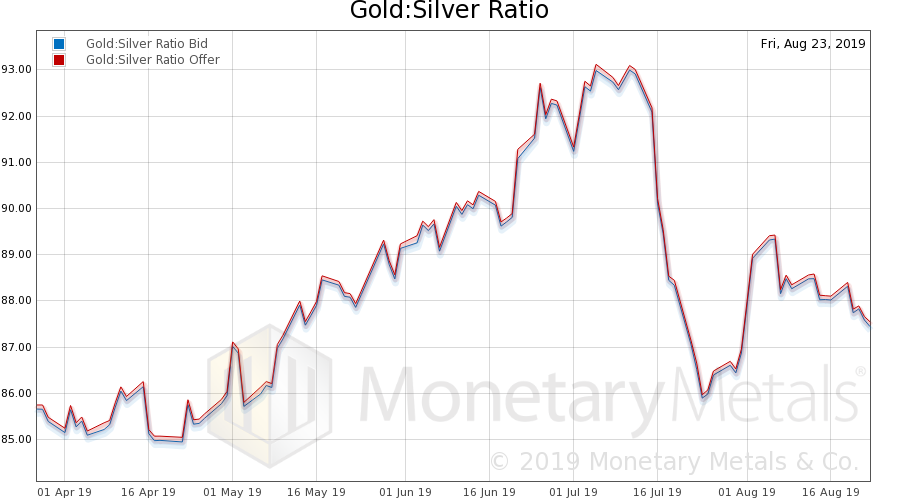

RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio dropped this week. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

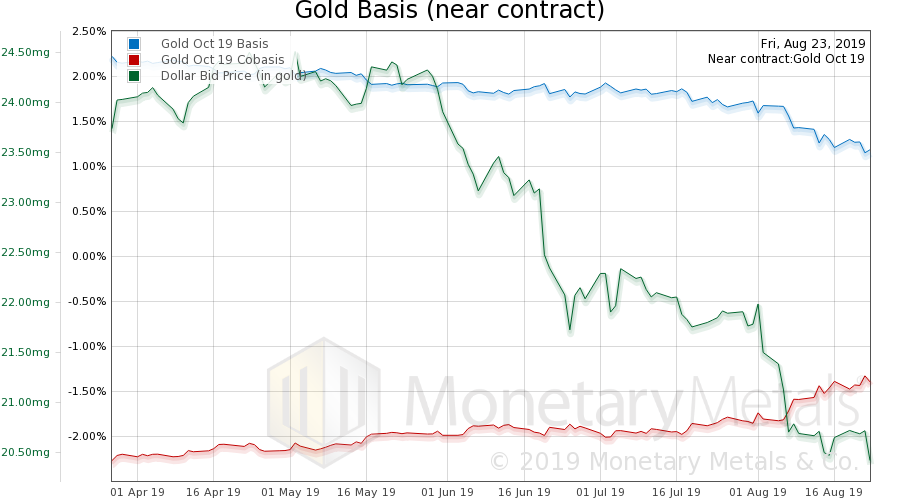

Gold Basis and Co-basis and Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. Big drop in the dollar (priced in gold, the inverse of the price of gold in dollars) and the scarcity (i.e. cobasis) is basically unchanged. This is almost incredible to watch. All that time, when there were many false price breakouts (trumpeted as real price breakouts at the time by the usual suspects), we said “look at rising price with falling scarcity and rising abundance.” We said when it’s real, there will be rising price with rising scarcity (as we have had) or at least flat scarcity. It almost seemed an act of faith at the time—but now it’s happening. This week, the Monetary Metals Gold Fundamental Price went up an additional $27, to $1,543. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

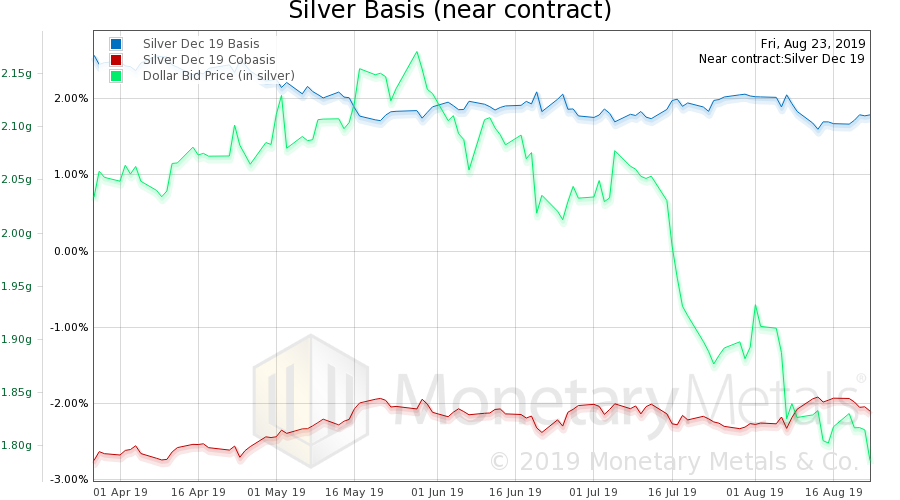

Silver Basis and Co-basis and Dollar PriceNow let’s look at silver. Is the cobasis rolling over? There is a bit of a drop this week, but it’s just back to where it was two weeks ago when the price of the dollar was 1.826 grams of silver. Now it’s 1.786, or 2.2% lower. The key question is whether silver becomes more and more abundant as its price rises, or whether it holds here. The fundamental price moved up a bit, to $17.04. Note that the market price of silver is above the fundamental, but not in gold. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2019 Monetary Metals

Tags: Basic Reports,central planning,command economy,coordination problem,diktat,dollar price,fascism,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,newsletter,silver basis,Silver co-basis,silver price,Trump