The net result is we have an economy that’s supposedly expanding smartly while our well-being and financial security are collapsing.

Gross Domestic Product (GDP) and other metrics of economic activity don’t measure either broad-based prosperity or well-being. Elites skimming financialization profits by expanding corporate debt and issuing more loans to commoners while spending more on their lifestyles boosts GDP quite nicely while the security and well-being of the bottom 90% plummets.

Under the hood of “recovery” and a higher GDP, life has gotten harder and more insecure for the bottom 90%. The key is not to look just at wages (trending up, we’re assured) or inflation (near-zero, we’re assured) but at aspects of daily life (lived experience) that cannot be captured by conventional economic / financial attempts at quantifying the economy.

How do we quantify the cost of the financial anxiety provoked by huge insurance deductibles or staggering healthcare bills? What matters isn’t just whether the patient or their family has to declare bankruptcy because they can’t afford the enormous co-pays: what matters is the debilitating stress caused by having to decide between risking an operation and bankrupting the family or foregoing the operation and hoping for a miracle.

Or how about the eventual cost of foregoing healthcare except in emergencies due to having to pay cash for any care due to the high deductibles?

Small stresses add up, leading to chronic stress and a host of debilitating consequences. Consider the daily commute to work, which has become longer and more stressful due to increasing congestion and the limits of public transport infrastructure that hasn’t been improved or expanded in decades.

Why New York City Stopped Building Subways (via Mark G.)

Unlike most other great cities, New York’s rapid transit system remains frozen in time: Commuters on their iPhones are standing in stations scarcely changed from nearly 80 years ago.

Then there’s financial insecurity. Where is the measure of financial insecurity? How do we quantify the erosion of secure pensions and stable home prices? The average Social Security monthly benefit for 2019 is $1,462, which isn’t enough to rent a studio in many urban areas, and tens of millions of lower-income retirees receive considerably less than this princely sum.

The family home remains the mainstay of middle-class wealth, but its value is now determined by credit bubbles and busts and the relative burdens of property taxes. In the pre-financialization / pre-neoliberal era, house prices tended to rise by a modest percentage over time, more or less the equivalent of a savings account drawing interest as the homeowner paid down the principal and accrued equity.

Now every homeowner has been transformed into a gambler who must time the market swings when buying or selling. One mistake can wipe out decades of paper gains. How do we quantify this erosion of the reliability and safety of homes’ market valuations?

Everyone with their retirement savings in a 401K or IRA is also now a gambler whether they accept that reality or not. In a global economy of historically low yields on safe investments such as government bonds, households playing it safe are punished with near-zero or negative returns, while households that put all their money oin the stock market roulette game have been richly rewarded to date.

But the security of stock market gains is illusory: rather than reflect the fundamentals of the corporations, stock valuations reflect the Federal Reserve’s decision to make the stock market the signifier of economic growth: if the market is rising, the economy is doing well.

Why did they do this? Manipulating stocks higher is easy: just push low-cost liquidity into the financial system and much of it will end up in stocks or corporate buybacks which boost shares valuations by reducing the number of shares outstanding.

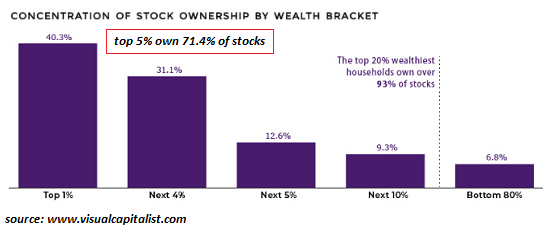

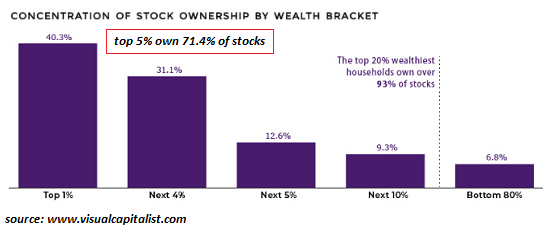

The other factor is the concentration of stock ownership in the politically powerful hands of elites. Should the market threaten to crash, wealthy donors and their lobbyists will let the regulators and politicos know they’re not happy that their enormous wealth is at risk of dwindling.

Fed goosing and corporate buybacks are not solid foundations. All such manipulations eventually founder on the shoals of reality, and everyone who thought their retirement funds in stocks was as safe as a savings account will discover that risk can be masked but it can’t be made to disappear.

The Neoliberal Project of making everything into a tradable market has dominated the 21st century economy. The concept is appealing: by making everything into a competitive market, prices will drop as efficiencies and innovations take hold, and financial markets will benefit as everything that’s being commoditized can be packaged, marketed and sold globally.

So a designed-to-default subprime mortgage security can be sold to a pension fund in Norway as “low-risk,” heh.

| This happy story of the wunnerful benefits of turning everything into a tradable market is not what actually happened. What actually happened is that the new markets were quickly dominated by monopolies and cartels, and previously safe assets were financialized and securitized, in effect stripmining the unwary of their income and assets.

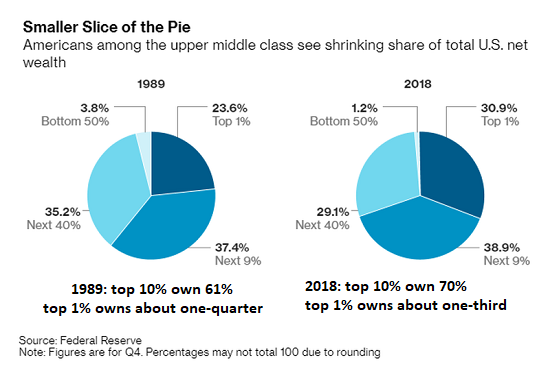

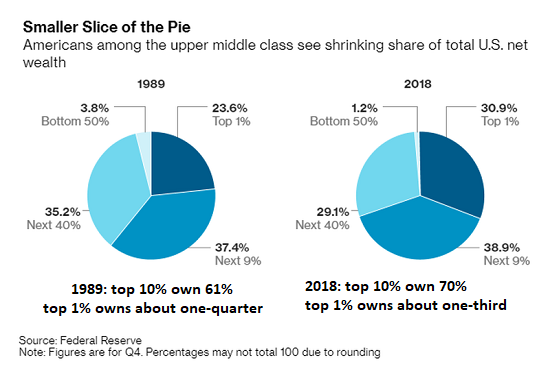

Neoliberal financialization and Fed goosing of risk assets are why the nation’s wealth has become increasingly concentrated in the hands of financial elites.As you can see in the charts below, the gains reaped by the top 10% were concentrated in the top 1%, and the gains of the top 1% have been concentrated in the top .01%.

A Breakdown of Wealth, from Middle Class to the Top 1% |

Smaller Slice of the Pie - Click to enlarge |

| As I noted in Burnout Nation, the precarious nature of employment and rising workloads are reducing well-being across the board. Again, the tools to accurately quantify the internal states of security and well-being are not the equivalent of measuring GDP: much of the data comes from self-reporting, which is skewed by Americans’ belief that everybody should be upbeat and positive, so we tend to report what others want to hear.

The net result is we have an economy that’s supposedly expanding smartly while our well-being and financial security are collapsing. As I often note here: we optimize what we measure, and if we measure what doesn’t really matter then we’re optimizing the wrong things. |

Concentration of Stock Ownership by Wealth Bracket - Click to enlarge |

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the

book's website.

Tags:

Featured,

newsletter