Scottsdale, Ariz, May 3, 2019—Monetary Metals® announces that it has leased silver to Money Metals Exchange® to support the growth of its business of selling gold and silver at retail and wholesale. Investors earn 2.2% on their silver, which is held in Money Metals’ vault in the form of silver products. Monetary Metals has a disruptive model, leasing gold and silver from investors who own it and providing it to businesses who need it, typically for inventory or work-in-progress. Investors benefit, because they earn a return rather than pay storage costs on their metal. Gold- and silver-using businesses benefit, as the lease is their lowest-cost capital. And the lease is more user-friendly, with no need to be hedged

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, Featured, Gold Standard, interest on silver, newsletter, Press Releases, silver lease, silver standard

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Scottsdale, Ariz, May 3, 2019—Monetary Metals® announces that it has leased silver to Money Metals Exchange® to support the growth of its business of selling gold and silver at retail and wholesale. Investors earn 2.2% on their silver, which is held in Money Metals’ vault in the form of silver products.

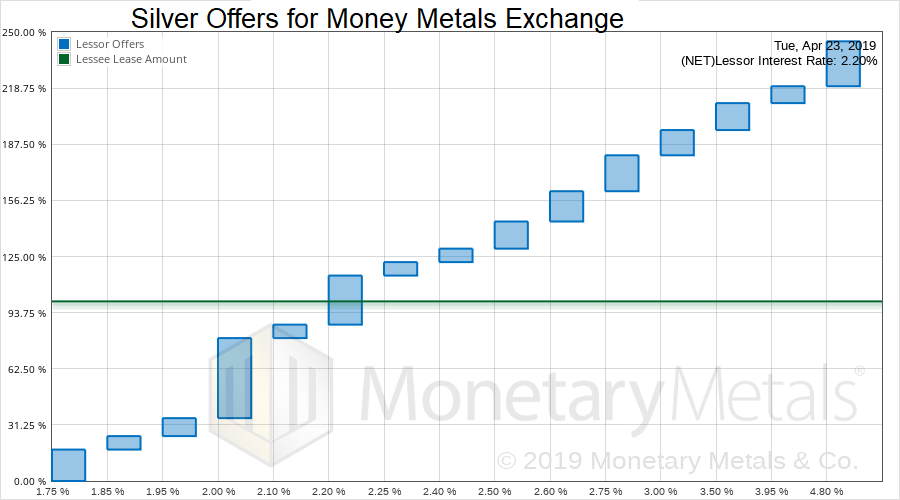

Monetary Metals has a disruptive model, leasing gold and silver from investors who own it and providing it to businesses who need it, typically for inventory or work-in-progress. Investors benefit, because they earn a return rather than pay storage costs on their metal. Gold- and silver-using businesses benefit, as the lease is their lowest-cost capital. And the lease is more user-friendly, with no need to be hedged as it is off balance sheet. Monetary Metals provides a fair rate of interest, to both investors and businesses, by conducting a competitive auction. Each investor decides how much metal to offer and the minimum interest rate. The rate-setting auction phase finds the rate that will raise enough metal for the total business need, 2.2% in this lease. This graph shows the offers, and 250% oversubscription. The second phase, the call for metal, was 300% oversubscribed. |

Silver Offers for Money Metals Exchange |

“Money Metals is very productive in working its inventory,” said Keith Weiner, CEO of Monetary Metals. He added, “It is a simple business case of adding more metal to add more sales revenue.”

“Monetary Metals has put together a very attractive lease program to help my company further expand the breadth and depth of our silver offerings—and at rates that beat most banks. Sadly, it seems most banks don’t yet grasp the high-quality nature of the inventory which precious metals dealers hold, so it is a real pleasure to do more business with those who do,” said Stefan Gleason, president of Idaho-based Money Metals Exchange.

The two companies are not affiliated, despite their similar names.

Tags: Featured,gold standard,interest on silver,newsletter,Press Releases,silver lease,silver standard