Markets in the US and Canada were closed on Monday for national Labor Day holidays. Here is a succinct summary of key developments that will set the backdrop for Tuesday. 1. On September 1, the new round of tariffs in the US-China fight took effect. The US placed a 15% tariff on around 3000 Chinese goods that thus far had escaped action. China put a 10% level on 1700 US goods. No date has been given for the next round of face-to-face talks that were expected this month. 2. China’s Caixin manufacturing PMI unexpectedly rose to 50.4 from 49.9. The official manufacturing PMI, which was reported over the weekend, slipped to 49.5 from 49.7. It focuses on large businesses, while Caixin has a greater emphasis on small business. Meanwhile, although the PBOC continues to

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, ARS, Brexit, China, China Caixin Manufacturing PMI, Eurozone Manufacturing PMI, Featured, newsletter, U.K. Manufacturing PMI, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Markets in the US and Canada were closed on Monday for national Labor Day holidays. Here is a succinct summary of key developments that will set the backdrop for Tuesday.

1. On September 1, the new round of tariffs in the US-China fight took effect. The US placed a 15% tariff on around 3000 Chinese goods that thus far had escaped action. China put a 10% level on 1700 US goods. No date has been given for the next round of face-to-face talks that were expected this month.

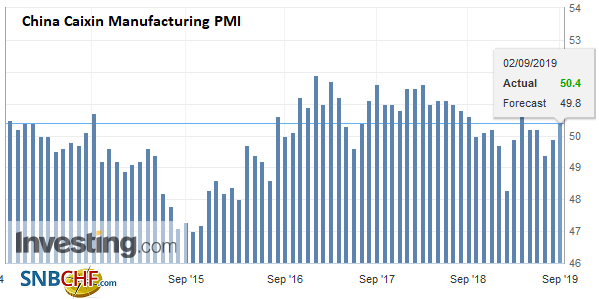

| 2. China’s Caixin manufacturing PMI unexpectedly rose to 50.4 from 49.9. The official manufacturing PMI, which was reported over the weekend, slipped to 49.5 from 49.7. It focuses on large businesses, while Caixin has a greater emphasis on small business. Meanwhile, although the PBOC continues to set the dollar’s reference rate below where bank models suggest, the greenback continues to climb against the yuan, closing near CNY7.1720. Against the offshore yuan, the dollar traded to almost CNH7.1960. |

China Caixin Manufacturing PMI, August 2019(see more posts on China Caixin Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

3. Asian manufacturing PMI readings generally weakened. Japan’s August manufacturing PMI eased to 49.3 from the 49.5 flash estimate and 49.4 in July. Taiwan’s was trimmed to 47.9 from 48.1. India’s fell to 51.4 from 52.5. South Korea was a notable exception, with an increase to 49.0 from 47.3. Over the weekend, South Korea reported a smaller than expected August trade surplus ($1.72 bln). Exports fell 13.6% year-over-year after the 11.0% pace in July and expectations for a 12.5% decline. Imports fell 4.2% after dropping 2.7% year-over-year in July.

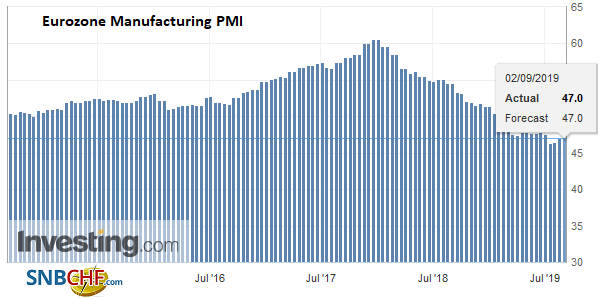

| 4. The eurozone manufacturing was unchanged from the 47.0 flash reading and stabilized after the 46.5 reading in July. German and French revisions were small and offsetting (the former lower and latter higher). German’s manufacturing is still distressed at 43.5, while France is expanding, albeit slowly (51.0). French production has gradually been recovering. The PMI bottomed last December. The manufacturing PMI for Italy and Spain came in better than expected, but are still both below 50 at 48.7 and 48.8 respectively. |

Eurozone Manufacturing PMI, August 2019(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

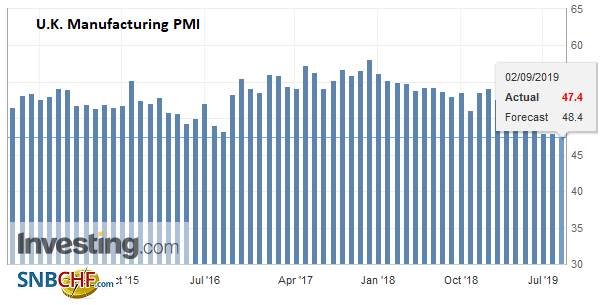

| 5. The UK manufacturing PMI fell to 47.4, the lowest since 2012, from 48.0 in July. However, it as not the disappointing economic news that drove sterling back to the 2.5 years lows set last month a little above $1.20. It was politics, and Brexit to be more precise. A motion will likely be submitted by Labour tomorrow that essentially seeks to delay Brexit until the end of January 2020 unless Parliament approves an agreement by mid-October. Prime Minister Johnson has indicated a two-prong response. First, tomorrow’s vote will be regarded as a vote of confidence and should the government lose, an election motion will be submitted on Wednesday. Second, Johnson has threatened to expel any Tory MP that votes against the government. Meanwhile, in an interview in a British newspaper, EC negotiator Barnier rejected (again) Johnson’s demand to drop the backstop. |

U.K. Manufacturing PMI, August 2019(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

6. Although the AfD gained support in both Saxony and Brandenburg, it carried neither. In Saxony, the SPD came in fifth place and in Brandenburg, it barely held on to a plurality. The CDU got the most vote in Saxony but may need to include a third partner with the Left to govern. The CDU and SPD saw their support continue to slip. An immediate political crisis may have been averted, but both parties need to come up with strategies to counteract what appears to be a realignment toward the AfD and Greens. Merkel’s handpicked heir-apparent AKK (Annegret Kramp-Karrenbauer) seemed to rebuff the call for the CDU to tack right to protect its flank, which may cost her support. Meanwhile, Italy’s Prime Minister Conte is expected to present a new government formed by the Five Star Movement and the Democrat Party to President Mattarella tomorrow. If so, a vote of confidence would likely be held next week. Italian bonds remained bid on Monday even as some lift profit-taking was seen in most other bond markets.

7. The US dollar began the new week on a firm note. Sterling was the weakest of the majors, falling about 0.7% to trade near $1.2065 in late dealings. The dollar-bloc currencies remained on the defensive. The Aussie, Kiwi, and the Canadian dollar are taking six and seven-week losing streaks into this week. The euro made a margin low 2.5 year low just below $1.0960. The yen was trading a touch firmer before the Asia Pacific opening on Tuesday, while the Scandi’s recouped some of the ground lost at the end of last week, which some attributed to month-end flows. Capital controls in Argentina saw the peso spike higher, jumping 6.2% against the dollar. It fell almost 8% last week. Soft inflation figures and declining support for President Bolsonaro weighed on the Brazilian real. It lost about 0.8% against the dollar, the most among emerging markets.

Tags: #USD,$CNY,ARS,Brexit,China,China Caixin Manufacturing PMI,Eurozone Manufacturing PMI,Featured,newsletter,U.K. Manufacturing PMI