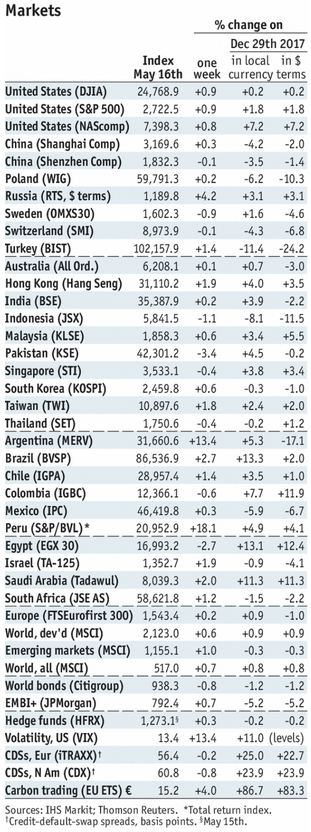

Stock Markets EM FX ended Friday on a weak note and extended the slide. For the week as a whole, the best EM performers were PHP, TWD, and SGD while the worst were ARS, ZAR, and TRY. With US rates continuing to move higher, we believe selling pressures on EM FX will remain in play this week. Our recently updated EM Vulnerability Table supports our view that divergences within EM will remain. Stock Markets Emerging Markets, May 16 - Click to enlarge Korea Korea reports trade data for the first 20 days of May Monday. Bank of Korea meets Thursday and is expected to keep rates steady at 1.5%. CPI rose 1.6% y/y in April, below the 2% target for the seventh straight month. KRW has remained fairly steady during

Topics:

Win Thin considers the following as important: 5) Global Macro, Brazil, emerging markets, Featured, Hungary, Korea, Malaysia, Mexico, newsletter, Poland, Singapore, South Africa, Taiwan, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended Friday on a weak note and extended the slide. For the week as a whole, the best EM performers were PHP, TWD, and SGD while the worst were ARS, ZAR, and TRY. With US rates continuing to move higher, we believe selling pressures on EM FX will remain in play this week. Our recently updated EM Vulnerability Table supports our view that divergences within EM will remain. |

Stock Markets Emerging Markets, May 16 |

KoreaKorea reports trade data for the first 20 days of May Monday. Bank of Korea meets Thursday and is expected to keep rates steady at 1.5%. CPI rose 1.6% y/y in April, below the 2% target for the seventh straight month. KRW has remained fairly steady during this EM sell-off. However, with the yen weakening, the JPY/KRW cross has moved further below the key 10 level. PolandPoland reports April industrial and construction output and PPI Monday. All are expected to pick up from weak March readings. April real retail sales will be reported Wednesday, which are expected to rise 7.5% y/y vs. 8.8% in March. Yet price pressures remain low and the central bank is sticking to its pledge to keep rates steady through 2019. TaiwanTaiwan reports April export orders and Q1 current account data Monday. Orders are expected to rise 7.1% y/y. April IP will be reported Wednesday, which is expected to rise 5.3% y/y vs. 3.1% in March. The economic recovery continues, but we think low price pressures should allow the central bank to remain on hold this year. BrazilBrazil COPOM releases its minutes Tuesday. At that meeting, COPOM unexpectedly left rates steady at 6.5%. Brazil then reports mid-May IPCA inflation Wednesday, which is expected to rise 2.82% y/y vs. 2.80% in mid-April. While this would be near the bottom of the 2.5-6.5% target range, the weak BRL is likely to make the next move a hike. April current account and FDI data will be reported Thursday. HungaryNational Bank of Hungary meets Tuesday and is expected to keep rates steady at 0.9%. Like Poland, Hungary’s central bank has retained a very dovish stance. CPI rose 2.3% y/y, which is near the bottom of the 2-4% target range. We see steady rates well into 2019. MalaysiaMalaysia reports April CPI Wednesday, which is expected to rise 1.6% y/y vs. 1.3% in March. Bank Negara does not have an explicit inflation target, but low price pressures should allow it to remain on hold for much of this year. Next policy meeting is July 11, and no change is expected then. SingaporeSingapore reports April CPI Wednesday. CPI rose only 0.2% y/y in March. While the MAS does not have an explicit inflation target, low price pressures should allow it to remain on hold at its next policy meeting in October. April IP will be reported Friday. South AfricaSouth Africa reports April CPI Wednesday, which is expected to rise 4.7% y/y vs. 3.8% in March. If so, inflation would move back into the top half of the 3-6% target range. SARB then meets Thursday and is expected to keep rates steady at 6.5%. The weak rand is likely to keep the central bank on hold for the foreseeable future. MexicoMexico reports mid-May CPI Thursday, which is expected to rise 4.4% y/y vs. 4.69% in mid-April. If so, inflation would still be above the 2-4% target range. Next Banxico meeting is June21 and much will depend on how the peso is trading ahead of July elections. April trade and Q1 current account data will be reported Friday. |

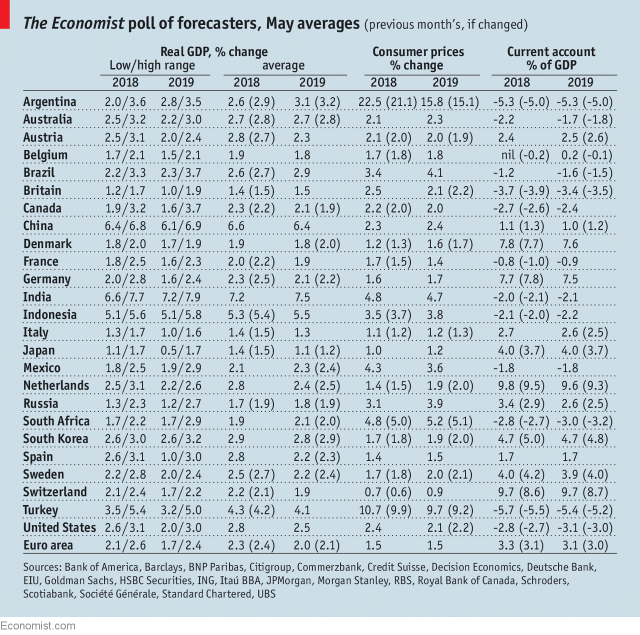

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, May 2018 Source: economist.com - Click to enlarge |

Tags: Brazil,Emerging Markets,Featured,Hungary,Korea,Malaysia,Mexico,newsletter,Poland,Singapore,South Africa,Taiwan,win-thin