Summary Hong Kong Monetary Authority intervened to defend the HKD peg. Moody’s upgraded Indonesia by a notch to Baa2 with a stable outlook. MAS tightened policy by adjusting the slope of its S$NEER trading band up “slightly.” Hungary Prime Minister Orban won a fourth term for his Fidesz party. Poland central bank Governor said it’s possible that the next move will be a rate cut. Russia outlined a range of potential retaliatory measures in response to US sanctions announced last week. Serbian central bank delivered a second straight dovish surprise, cutting rates by 25 bp to 3%. Moody’s moved the outlook on Mexico’s A3 rating from negative to stable. Stock Markets In the EM equity space as measured by MSCI, Colombia

Topics:

Win Thin considers the following as important: emerging markets, Featured, Hong Kong, Hungary, Indonesia, Mexico, newsletter, Poland, Russia, Serbia, Singapore, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

|

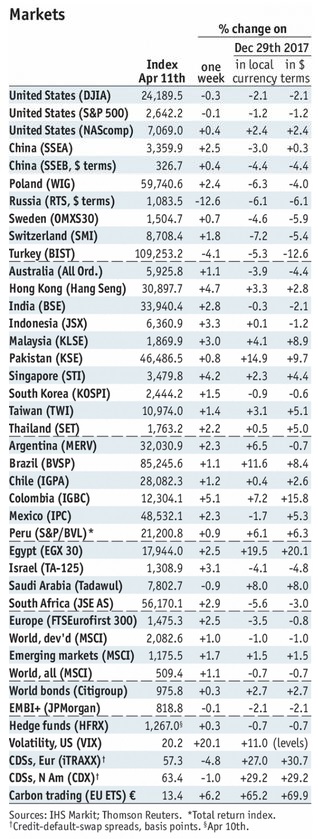

Stock Markets Emerging Markets, April 11 Source: economist.com - Click to enlarge |

Hong KongHong Kong Monetary Authority intervened to defend the HKD peg. This is the first time that it has had to intervene at the band limit since the trading band was put in place back in 2005. The other shoe to drop was a rise in HK money market rates, as HKD liquidity is drained from the system by the intervention. This is the way it’s supposed to work, so no concerns whatsoever about the peg. IndonesiaMoody’s upgraded Indonesia by a notch to Baa2 with a stable outlook. The agency cited an increasingly credible and effective policy framework as the major factor behind the move, as it will contribute to greater macroeconomic stability. This brings Moody’s in line with Fitch, which upgraded Indonesia back in December. Note that our own sovereign ratings model showed its implied rating rising a notch last quarter to BBB+/Baa1/BBB+ so actual ratings of BBB-/Baa2/BBB still enjoy some upgrade potential. SingaporeMonetary Authority of Singapore tightened policy by adjusting the slope of its S$NEER trading band up “slightly” from zero previously. About 2/3 of analysts polled expected the move. It noted that the “measured adjustment” takes trade risks into account, but its cautiousness is justified. Singapore also reported advance Q1 GDP growth of 4.3% y/y, as expected. CPI rose 0.5% y/y in February. While the MAS does not have an explicit inflation target, we think low inflation and high global trade tensions warrants caution for now. HungaryHungary Prime Minister Orban won a fourth term for his Fidesz party. Fidesz won an overwhelming two-thirds majority, winning 133 out of 199 seats in parliament. Jobbik won 26 seats and the Socialists won 20. The two-thirds margin gives Fidesz the ability to amend the constitution. PolandPoland central bank Governor said it’s possible that the next move will be a rate cut. He added that he sees no reason to change rates for two years. This is about as dovish as a central banker can get, but it’s also noteworthy as this is the first time any MPC member has brought up rate cuts. We do think it’s hard for any central bank to give forward guidance out so long, as so many things can happen over the course of a year, much less two. RussiaRussia outlined a range of potential retaliatory measures in response to US sanctions announced last week. These include possible curbs on imports of US farm products as well as a possible ban on titanium sales to Boeing. Still, it would seem that the US has the upper hand with regards of inflicting potential harm. SerbiaSerbian central bank delivered a second straight dovish surprise, cutting rates by 25 bp to 3%. As we wrote last month ahead of the March decision: “Serbia’s central bank meets tomorrow and is expected to keep rates steady at 3.5%. With inflation falling to cycle lows, we see risks of a dovish surprise. The growth outlook remains favorable for equities, while the inflation outlook is favorable for bonds.” MexicoMoody’s moved the outlook on Mexico’s A3 rating from negative to stable. We are surprised at the timing given the July election. The agencies usually wait to see what any new government will likely do before making any new rating moves. AMLO is still a huge risk for Mexico and so I think Moody’s was premature. |

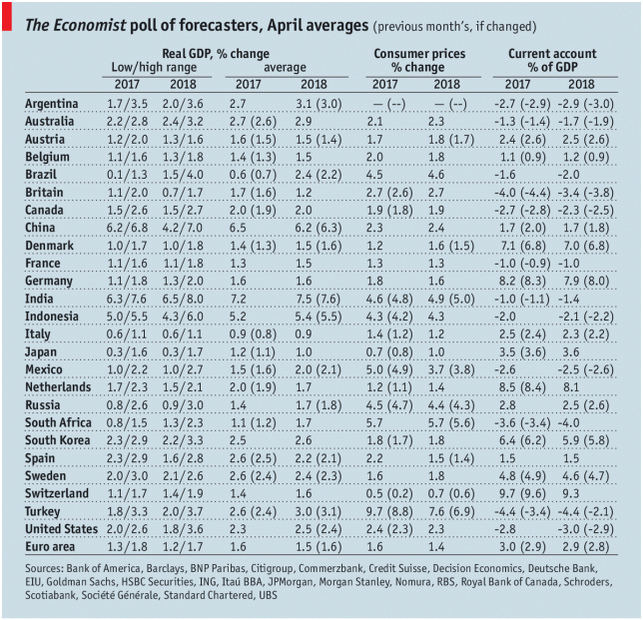

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, April 2018 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,Hong Kong,Hungary,Indonesia,Mexico,newsletter,Poland,Russia,Serbia,Singapore,win-thin