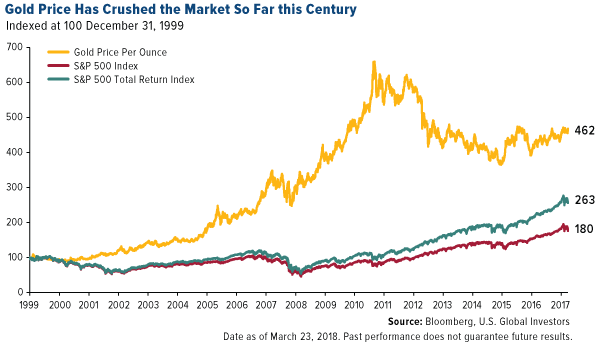

– Gold outperforming stocks in 2018 and this century (see chart) – Gold up close to 2% in 2018 while S&P 500 is down 2%– Trump trade wars and Kudlow as Trump chief economic advisor is gold bullish – Given gold’s performance, Kudlow’s dismissal of gold as “end of the world insurance” is “irrational”– Market volatility could drive gold to ,500/oz in 2018 – Holmes Editor: Mark O’Byrne In a January post, I showed how the price of gold rallied in the months following the 2015 and 2016 December interest rate hikes—as much as 29 percent in the former cycle, 17.8 percent in the latter. Gold ended 2017 up double digits, despite pressure from skyrocketing stocks and massive cryptocurrency speculation. Gold Price, 1999 -

Topics:

Mark O'Byrne considers the following as important: Daily Market Update, Featured, gold prices, GoldCore, newsletter, S&P 500, S&P 500, U.S. Dollar Index

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

– Gold outperforming stocks in 2018 and this century (see chart)

– Gold up close to 2% in 2018 while S&P 500 is down 2%

– Trump trade wars and Kudlow as Trump chief economic advisor is gold bullish

– Given gold’s performance, Kudlow’s dismissal of gold as “end of the world insurance” is “irrational”

– Market volatility could drive gold to $1,500/oz in 2018 – Holmes

Editor: Mark O’Byrne

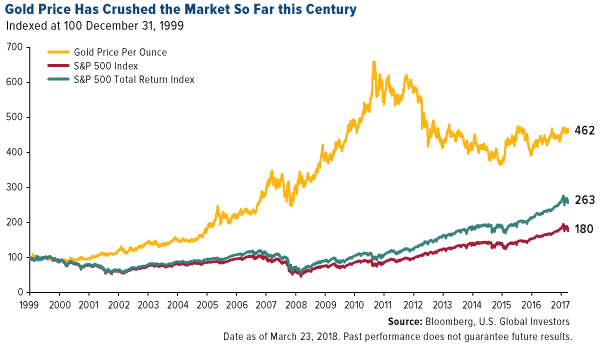

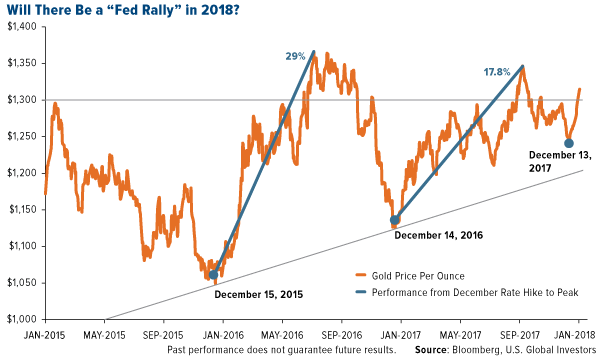

| In a January post, I showed how the price of gold rallied in the months following the 2015 and 2016 December interest rate hikes—as much as 29 percent in the former cycle, 17.8 percent in the latter. Gold ended 2017 up double digits, despite pressure from skyrocketing stocks and massive cryptocurrency speculation. |

Gold Price, 1999 - 2018(see more posts on Gold prices, ) |

| I forecast then that we could see another “Fed rally” this year following the rate hike in December 2017. Hypothetically, if gold took a similar trajectory as the past two cycles, its price could climb as high as $1,500 this year.

As I told Kitco News’ Daniela Cambone last week, I stand by the $1,500 forecast. Before last week, investors might have been slightly disappointed by gold’s mostly sideways performance so far this year. But now, in response to a number of factors, it’s up close to 3 percent in 2018, compared to the S&P 500 Index, down 2.4 percent. |

Gold Price per Ounce and Performance Rate Hike to Peak, Jan 2015 - 2018 |

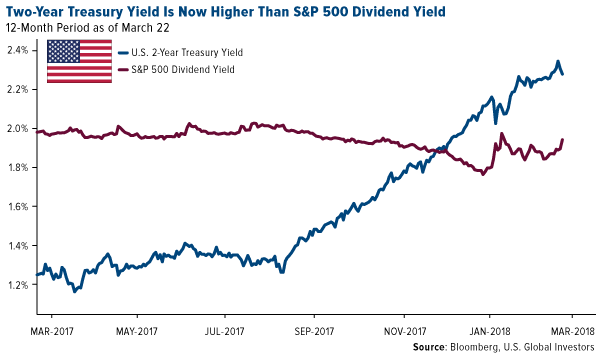

Living with VolatilityWhile I’m on the topic of equities, the S&P 500 dividend yield, for the first time in nearly a decade, is now below the yield on the two-year Treasury. Historically, the economy has slowed around six months after dividends stopped paying as much as short-dated government paper. This could spur some stock investors to trim their exposure and rotate into other asset classes, including not just bonds but also precious metals, which I believe might help gold revisit resistance from its 2016 high of $1,374 an ounce. |

S&P 500 and US Treasury Yield, Mar 2017 - 2018 |

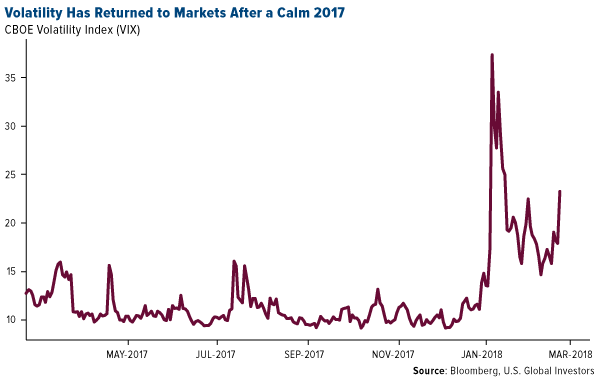

| Volatility has also crept back into markets. It began with the positive wage growth report in February, implying the possibility of faster inflation. More recently, the CBOE Volatility Index (VIX), or “fear gauge,” has surged on the departures of Gary Cohn as chief economic advisor and Rex Tillerson as secretary of state, as well as the application of tariffs on steel and aluminum imports.

Last week, President Donald Trump ordered tariffs on at least $50 billion of Chinese goods, stoking new fears of a U.S.-China trade war. In response, the Asian giant proposed fresh duties on as much as $3 billion of U.S. products, including wine, fruits, nuts, ethanol and steel pipes. As I see it, there could be other contributing factors pushing up the price of gold. A good place to start is with Trump’s recent appointment of former CNBC star Larry Kudlow as White House chief economic advisor. |

CBOE Volatility Index, May 2017 - Mar 2018 |

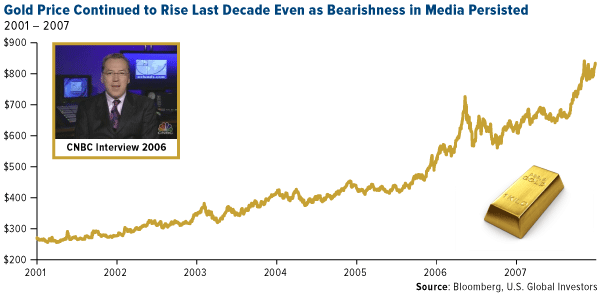

Kudlow’s Kerfuffle Over GoldBetween 2001 and 2007, I appeared on Kudlow’s various CNBC shows a number of times, and though he always struck me as highly intelligent, informed and accomplished—he served as Bear Stearns’ chief economist and even advised President Ronald Reagan—it was clear he had a strong bias against gold. This was the case even as the price of the yellow metal was on a tear, rising from $270 in 2001 to more than $830 an ounce by the end of 2007. |

Gold Price, 2001 - 2007(see more posts on Gold prices, ) |

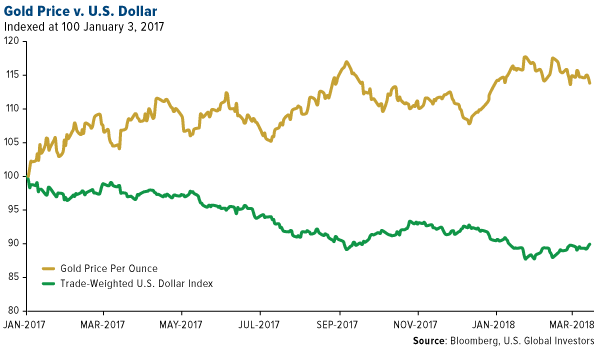

| Kudlow showed his true colors toward gold as recently as this month, telling viewers: I would buy King Dollar and I would sell gold. As you can see below, this has’t been a prudent trade for more than a year now. |

Gold Price vs US Dollar, Jan 2007 - Mar 2018(see more posts on Gold prices, U.S. Dollar Index, ) |

| Earlier this month, Kudlow wrote that falling gold is good, as it “bodes well for the future economy.” He said he agreed with a friend, who called the metal an “end-of-the-world insurance contract.”

While there are those who would agree with him, it’s important to remember that gold is used for much more than as a portfolio diversifier, and its price is driven by a number of factors. These include Fear Trade factors, from inflation to negative real interest rates, and Love Trade factors such as gift-giving during cultural and religious festivals. The precious metal has important industrial applications as well. And since I first went on Kudlow’s program, gold has outperformed the S&P 500’s price action nearly two-to-one, as I showed you back in December. Even with dividends reinvested, the market is still trailing the yellow metal. So it’s fine if gold isn’t your favorite asset, but to dismiss it wholesale as Kudlow has again and again is, with all due respect, irrational. |

Gold Price and S&P 500 Index, 1999 - 2017(see more posts on Gold prices, S&P 500, ) |

| Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below |

It’s Not About Steel, It’s About Stealing

Kudlow isn’t just anti-gold, however.

He’s also anti-China, and even though he’s traditionally opposed tariffs in general, he supports Trump’s efforts to levy taxes on Chinese imports. Specifically, the duties are designed to offset the cost of intellectual property allegedly stolen by the Chinese over the past several years.

China’s J-31 fighter jet, for example, is believed to be a knockoff of Lockheed Martin’s F-35, the most expensive piece of U.S. military equipment. It’s for this reason that Lockheed’s CEO, Marillyn Hewson, was present when Trump signed the authorization to impose new tariffs.

Our intellectual property is hugely important to the U.S. economy. As important as steel and aluminum are, they account for only 2 percent of world trade, and in the U.S., it’s even less than a percent of gross domestic product (GDP). Technology exports, on the other hand, represent about 17 percent of U.S. GDP.

That said, the implications of a trade war with the world’s second-largest economy certainly have many investors concerned—all the more reason to consider adding to your gold allocation at this time. As always, I recommend a 10 percent weighting, with 5 percent in gold bullion, 5 percent in high-quality gold mining stocks and ETFs.

Is Trump Betting on the Wrong Guy?

On a final note, we were pleased to have an old friend visit our office last week. Michael Ding, a veteran of the U.S. Global investments team, joined us to share some laughs and his thoughts on what’s happening in Asian markets right now.

Specifically, Michael said that Ray Dalio, founder of mammoth investment firm Bridgewater Associates, which manages around $160 billion, has become something of an economic guru for members of the Chinese ruling party’s highest-ranking members, including Premier Li Keqiang.

Dalio—whose most recent book, Principles, nowtops China’s bestseller list—is reportedly advising the country’s top bankers and economists on how to deleverage safely without triggering a so-called “hard landing.”

A trade war between the U.S. and China, Ray Dalio said recently, would be a “tragedy.”

So to put it in perspective: Whereas Trump has just now brought on Kudlow, the Chinese are leaning on a fellow American, Dalio, one of the smartest, most gifted money managers in the world—not just of our time but of all time.

Did Trump make the right call? Which player would you want on your team: Kudlow or Dalio? For my money, I would pick Dalio.

Tags: Daily Market Update,Featured,Gold prices,newsletter,S&P 500,U.S. Dollar Index