The topic of how much extractable gold is left in the world has become increasingly discussed within the last few years. This is because of increased focus on ‘peak gold’ and also a concern about remaining levels of unextracted gold reserves. Peak gold is a term referring to the phenomenon of annual gold mining supply peaking (i.e. the rate of gold extraction increases until it peaks at maximum gold output and...

Read More »Macro Surprises and their Effects on the CHF

On VoxEU, Adrian Jäggi, Martin Schlegel and Attilio Zanetti report that the safe-haven currencies Swiss franc and Japanese yen react strongly to non-domestic macro surprises, and did so especially during the financial crisis. For European macro surprises, only German data influence safe-haven currencies.

Read More »FX Weekly Review, July 25 – July 29: Dollar Hobbled; Technicals Warn of More Losses

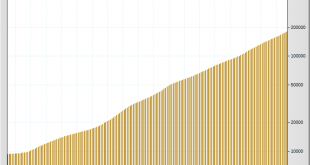

Swiss Franc Currency Index The Swiss Franc continued its bad performance against the dollar index that started with Brexit until the middle of the week. From the mid of the week the two indices converged again, because the U.S. had two bad data releases: Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket) On a three...

Read More »FX Weekly Review, July 18 – July 22: Will the FOMC Halt the Dollar’s Advance?

Swiss Franc Currency Index The Swiss Franc continues its bad performance against the dollar index that started with Brexit. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket) On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. The dollar makes up 40% of the SNB...

Read More »FX Weekly Review, July 11 – July 15: It is not About the Dollar, but About Other Currencies

Swiss Franc Currency Index The Swiss Franc continues to under-perform the dollar index in the month after Brexit. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket) On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. The dollar makes up 40% of the SNB portfolio and of...

Read More »FX Weekly Review, July 04 – July 08: Further SNB Interventions, Good Dollar Week

Swiss Franc Currency Index In the Brexit month, the Swiss franc index clearly underperformed the dollar index. The major reason is that the dollar is seen as a better safe-haven than the Swiss Franc, possibly because Swiss sales are affected more when British demand falls. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency...

Read More »FX Weekly Review: June 27 – July 01: Swiss Franc Strength Reversed

Swiss Franc Currency Index The Swiss franc (-0.3%) and the yen (-0.5%) were the worst performers as so-called “safe haven” buying was reversed during the week after Brexit. But the Swiss Franc index is still stronger in the last month. Via Financial Times. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance. On a three years interval, the Swiss...

Read More »SNB & CHF, the blog on a beleaguered central bank, its currency, on gold and astute investments

Over four years our association of supporters of Austrian Economics from Switzerland, Germany and Austria and helpful hands from all over the world expressed opposition against the CHF cap in in-numerous pages. Finally the SNB agreed to the wishes of Swiss consumers and gave up the cap that effectively represented a tax on consumption and extra-profits for companies and close friends of the central bank. Swiss Inflation Watch: Swiss inflation As monetarists & Austrians we expect Swiss...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org