ETF gold demand from investors has soared over the past year. The unprecedented fiscal and monetary stimulus were rolled out to tackle the effects of Covid -19. However, consumer demand, particularly but not surprisingly, jewellery demand slumped. What’s in store for gold demand fundamentals for 2021? Increased consumer demand in China and India will help support the gold price in 2021. There is little doubt that investment demand – especially into Exchange Traded...

Read More »Does the recent spate of Central Bank gold buying impact demand and price?

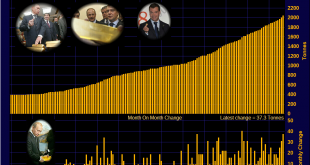

There has been a lot of media coverage recently about the re-emergence of central bank gold buying and the overall larger quantity of gold than central banks as a group have been buying recently compared to previous years. For example, according to the World Gold Council’s Gold Demand Trends for Q3 2018, net purchases of gold by central banks in the third quarter of this year were 22% higher than Q3 2017, and the...

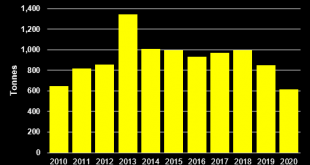

Read More »Annual Mine Supply of Gold: Does it Matter?

The topic of how much extractable gold is left in the world has become increasingly discussed within the last few years. This is because of increased focus on ‘peak gold’ and also a concern about remaining levels of unextracted gold reserves. Peak gold is a term referring to the phenomenon of annual gold mining supply peaking (i.e. the rate of gold extraction increases until it peaks at maximum gold output and...

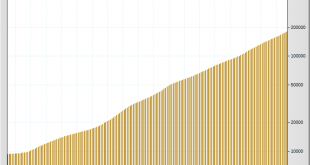

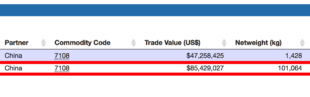

Read More »China’s Secret Gold Supplier Is Singapore

Since 2013 China continues to absorb physical gold from the rest of the world at a staggering pace. Worth noting is that gold imported into the Chinese domestic market is not allowed to be returned in the foreseeable future. Because ownership and the disposition of these volumes of gold likely will be of great importance next time around the international monetary system is under stress, it’s well worth tracking...

Read More »Why Switzerland Could Save the World and Protect Your Gold

Precious metals advisor Claudio Grass believes Switzerland can serve as an example to rest of world Switzerland popular for gold storage due to understanding of the risks inherent in fiat money and gold’s value as a store of wealth. International investors opt to store gold in Swiss allocated accounts due to tradition of respecting private property. Country respects the importance of gold ownerships and 70% of...

Read More »Contrasting outlooks for precious metals

We remain constructive on gold, but some other precious metals face issues stemming from a moderate slowdown in global growth and changes in the auto industry.While gold prices have risen about 12% per troy ounce since the beginning of this year, we still have a constructive view of the gold price over the next 12 to 18 months. But does this mean that the outlook for precious metals in general is positive?Notwithstanding fluctuations in the US dollar, gold has generally benefited from a low...

Read More »Gold loses some of its lustre

While gold prices may not fall back to their end-2015 levels, there are few compelling reasons for a fresh acceleration in the near term. After a strong performance in the first half of this year, gold has been moving within a range of USD1300- USD1375 per troy ounce. While physical supply and demand favour a gradual rise in gold prices over time, some of the main drivers of investment demand (financial stress, inflation, real interest rates, the USD) do not suggest significant upside...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org