Overview: There is an eerie calm in the capital markets today as the G20 meeting gets underway. There is much uncertainty, and the event calendar is chock full next week, with the Brexit debate getting underway in the UK Parliament, the CDU picks a new leader to replace Merkel, possible partial US government closure, Powell’s testimony before Congress, OPEC+ meeting, and US employment data. In Asia, the rise of Japanese and Greater China (mainland, HK, and Taiwan) rose, solidifying a weekly gain for the MSCI Asia Pacific Index and snaps a three-month slide. Australia is an exception. Broad-based selling saw the ASX 200 fall 1.6%. Only it and Malaysia recorded a decline this week. Australia’s market was off 2.8% and

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Overview: There is an eerie calm in the capital markets today as the G20 meeting gets underway. There is much uncertainty, and the event calendar is chock full next week, with the Brexit debate getting underway in the UK Parliament, the CDU picks a new leader to replace Merkel, possible partial US government closure, Powell’s testimony before Congress, OPEC+ meeting, and US employment data. In Asia, the rise of Japanese and Greater China (mainland, HK, and Taiwan) rose, solidifying a weekly gain for the MSCI Asia Pacific Index and snaps a three-month slide. Australia is an exception. Broad-based selling saw the ASX 200 fall 1.6%. Only it and Malaysia recorded a decline this week. Australia’s market was off 2.8% and was down for the third consecutive month. European shares are struggling. This week’s gains are being pared, and it means that the Dow Jones Stoxx 600 will extend its losing streak for a second month. The MSCI Emerging Markets Index is breaking a three-month, ~12% fall. Yields in the core bond markets were 1-2 bp lower, while peripheral European 10-year benchmark yields were a little firmer. On the week, 10-year yields are 4-6 bp lower. The US dollar is slightly firmer against most major and emerging market currencies, with the yen and Swiss franc holding their own. Among emerging market currencies, the Indonesia Rupiah and Thai baht are firmer, but most others are lower, led by the Russian ruble and South African rand. On the month, the New Zealand and Australian dollars were the strongest (~4.7% and 2.8% respectively), while the Japanese yen, Canadian dollar and Norwegian krone recorded losses (~-0.3%, -1.5%, and -1.7% respectively).

Dinner tomorrow between Chinese President Xi and US President Trump may be high drama, but the latest signals warn of the risk of an anti-climactic conclusion. Specifically, it now appears likely that as we suggested previously, a resumption of a sustained dialogue, such as those established by Bush and Obama may be announced. In addition, a decision to go ahead with an increase in the 10% tariff on $200 bln of Chinese goods to 25% and the threat to levy a new tariff on the remaining Chinese imports are unlikely to be decided this weekend. Instead, it appears that it will hinge on a follow-up meeting in Washington with China’s Liu He, President’s Xi, closest economic adviser, according to reports.

JapanJapan’s industrial sector bounced back in a big way in October after natural disasters struck in Q3. Industrial output jumped more 2.9%, more than twice what economists expected and the largest rise in more than three years. Industrial output had fallen in the past six months, but the rise in October lifts the year-over-year rate to 4.2%, the best since the middle of last year. Separately, the labor market remained firm though softened slightly as the unemployment rate ticked up (2.4% vs. 2.3%) and the job-to-applicant ratio slipped back to 1.62 from 1.64. Separately, for the fourth consecutive month, the Bank of Japan has made a minor adjustment to its bond-buying program. It announced that it will only buy bonds 10-year and longer four times in December after entering the market five times this month. Although the BOJ is buying few bonds and less often, it has persuaded investors that it is not tapering, which speaks to the signaling effect of the central bank asset purchases. The 10-year reached four-month lows today, just below eight basis points. |

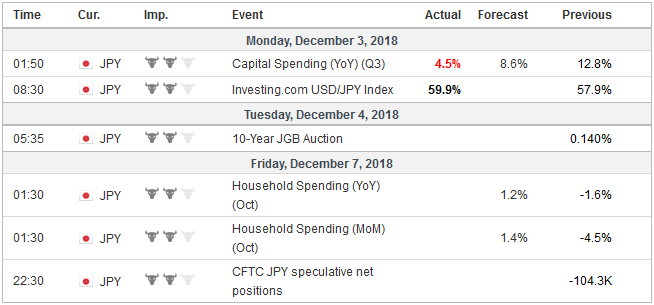

Economic Events: Japan, Week December 03 |

ChinaChina’s November PMI disappointed, but given the new measures to support economic activity, it may not be that significant (yet). The manufacturing PMI eased to 50.0 from 50.2, and the non-manufacturing PMI fell to 53.1 from 53.9. The result is a new cyclical low in the composite (52.8 from 53.1). As widely anticipated South Korea’s central bank lifted the seven-day repo rate by 25 bp to 1.75%. Its last hike was November 2017. The hike was not because the economy is overheating. The 2.0% expansion in Q3 was the weakest since 2009. The jump in October industrial output (10.7%) was largely a function of the base effect and holiday (Chuseok) distortions. Inflation is at its target. A final look at Q3 GDP and the first estimate of November CPI will be seen next week. The main motivation for the rate hike is primarily due to the hikes by the Federal Reserve and the one anticipated next month. The wider differentials lead to capital spur capital outflows, so the central bank argues. It makes intuitive sense, but it is factually mistaken or the result or incomplete analysis. It is true that through this week, foreign investors have liquidated $5.85 bln of Korean equities this year after buying $8.27 bln last year. However, look at the bond flows. Foreign investors bought $40.8 bln of Korean bonds this year after buying $32.4 bln in 2017. There are two important takeaways. Bond flows, as is typically the case, outstrip equity flows, and South Korea is continuing to import portfolio capital but a bit less than last year. The dollar has been confined to less than a quarter of a yen range today, hardly straying more than ten ticks the close. There is around a $400 mln option at JPY113.40 that is set to expire today. Support is seen in the JPY113.00-20 area. The dollar may struggle to get above the JPY113.70-80, and if it does the $900 mln option at JPY114.00 may suffice to cap it. |

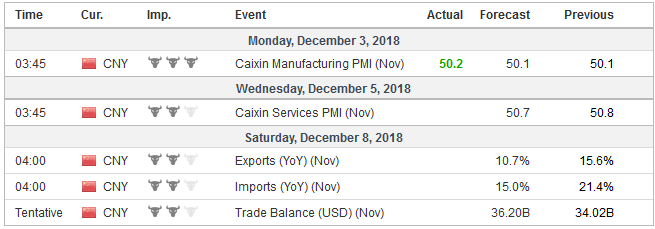

Economic Events: China, Week December 03 |

EuropeThere had to be a downward bias to expectations for today’s EMU preliminary estimate of this month’s CPI after investors learned yesterday that Spain and Germany price pressures eased. Spain’s harmonized measure fell to 1.7% from 2.3%. Germany’s slowed to 2.2% from 2.4%. Headline CPI for EMU eased to 2.0% from 2.2%, and the core rate unexpectedly slipped to 1.0% from 1.1%. Separately, the unemployment rate in the area remained at 8.1% October, where it has been since falling from 8.2% in July. Italy’s data were troubling. The unemployment rate in October jumped to 10.6% from a revised 10.3% in September (initially 10.1%). Also, while other EMU members to report preliminary November CPI figures, it has been the only one not to report a decline in the year-over-year rate. The EC may be going forward with their excessive debt procedures against Italy, while the government appears to offer some minor compromises worth 0.1%-0.2% in the deficit/GDP ratio. The markets have not sustained the pressure on Italy. The yield on the 10-year benchmark is off five basis points this week and 25 bp on the month. Rather than high-interest rates offsetting the government’s fiscal efforts, which is still possible, the worsening of the economy could shrink the denominator (GDP) and produce a higher deficit/GDP even numerator (deficit) was smaller. The euro, like the yen, has been confined to yesterday’s ranges. The intraday technicals suggest yesterday’s low near $1.1350 may be safe. A 1.2 bln euro option struck there expires today. The $1.1400 area corresponds to an important technical area, and there is a 1.1 bln euro expiring option there too. The shifting views of the Federal Reserve have seen the June 2019 Eurodollar-Euribor spread narrow by 17 bp over the past three weeks, and with the speculative market short euros, it appears an increasing number of participants are looking for a short-squeeze. Today, on an upside range extension, they will have to overcome the 1.46 bln euro options in the $1.1420-30 area. For its part, sterling has been sold in the European morning through yesterday’s lows (~$1.2755). This month’s low is roughly $1.2725. It had dipped a smidgen through $1.27 at the end of last month and the low for the year was seen in mid-August near $1.2660. The intraday technicals that additional losses today will likely be modest. The debate in the UK Parliament gets underway next week. From the outside, it still appears to be a stretch to see how the Withdrawal Bill passes in its current form. The EC refuses to re-open negotiations on the withdrawal and will drive a hard bargain when (if) the focus of negotiations shift to the post-divorce relations. |

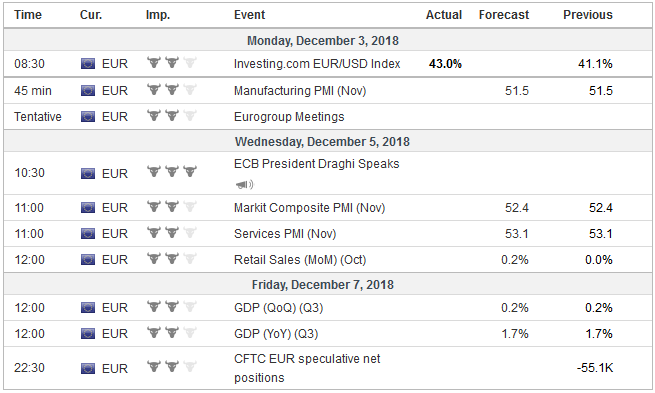

Economic Events: Eurozone, Week December 03 |

United States

For a period in which many Fed views apparently are in flux, it is noteworthy that the US two-year yield (~2.80%) is virtually unchanged this week and this month. It finished September near 2.82%. The 10-year yield, at 3.015% is off 2.5 basis points this week and six basis points on the month. It is five basis points lower than at the end of September. The implied yield of the June 2019 Eurodollar futures contract is 2.915%. It slipped two basis points on the week and nine basis points on in the month. It is seven basis points lower than the end of September. We had long argued in favor of the Fed adopting the best practices from other major central banks and hold a press conference after every meeting. It would help achieve several objectives, including tactical flexibility. The Fed has only raised rates at meetings that have been followed by a press conference. This limited the Fed’s degrees of freedom. The flexibility that was discussed in the FOMC minutes, which struck so many observers as new, directly follows from the announcement of press conferences after every meeting. To be sure, this does not mean that every meeting is live. For example, assuming the Fed raises rates in December, is the end of January meeting really live? Whatever gradual means, it does not mean back-to-back hikes. |

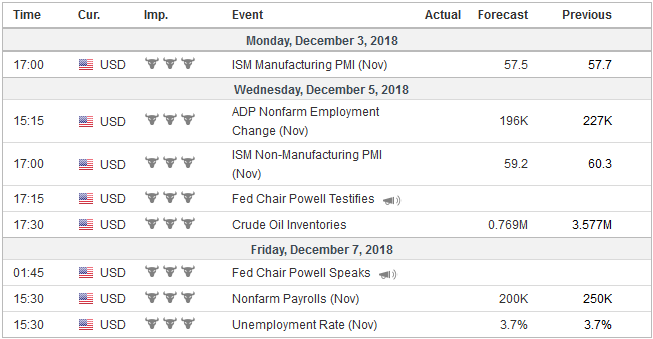

Economic Events: United States, Week December 03 |

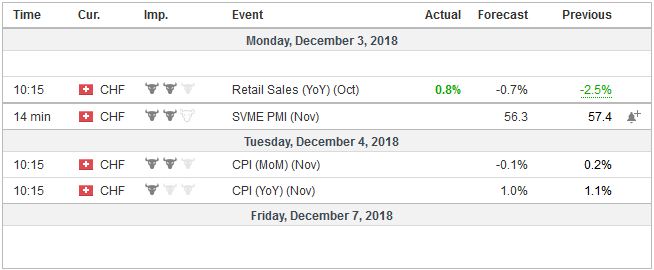

Switzerland |

Economic Events: Switzerland, Week December 03 |

Many observers also think that Fed officials are revealing something new when they talk about data-dependence. This too follows from the Fed’s forecasts that saw three rate hikes next year as likely to be appropriate. Again, assuming the Fed raises rates in December, it would have hiked rates four times this year, which means that three hikes next year already signaled a pause. The few hikes also give the Fed a bit more of a choice than it did this year (four hikes four press conferences) and that also means that data can play a bigger role in its discretion.

If there as one real surprise in the minutes, it was the Fed’s elevated concern about losing control over short-term rates. It indicated that officials were prepared, if necessary, to cut the interest on reserves before the December FOMC meeting. This confirms our suspicions that the Fed interest on reserves will only rise 20 basis points instead of reflecting the full 25 bp that the fed funds target range will likely be lifted.

The Bank of Canada meets next week, and like the Reserve Bank of Australia which also meets, no change is expected. Canada reports Q3 GDP today. It is expected to have slowed to around 2.0%, from 2.9% in Q2. Growth averaged 2.1% in H1. The Canadian dollar has faced persistent selling, and with this week’s loss (~0.6% at ~CAD1.3310), it has fallen in nine of the past ten weeks. Technical indicators are stretched, as one would expect on such a streak, but there is no sign of an imminent reversal.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Featured,newsletter