The week ahead is eventful. The Federal Reserve, the European Central Bank, and the Bank of Japan hold policy meetings. This would make for a busy week by themselves, but there is more. Trade tensions are likely to escalate further, if the US, as scheduled provides a list of bln of Chinese goods that will face another 25% tariff for intellectual property violations. If the US does so, China has threatened to retract some of the concessions it has made. The US Administration is claiming to be a victim of past US leaders apparently going back to before WWII and nearly every country with which the US trades. Trump who has positioned himself as an outsider at the G7 summit, and his policies, particularly the claim

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, EUR, Featured, GBP, JPY, newsletter, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The week ahead is eventful. The Federal Reserve, the European Central Bank, and the Bank of Japan hold policy meetings. This would make for a busy week by themselves, but there is more. Trade tensions are likely to escalate further, if the US, as scheduled provides a list of $50 bln of Chinese goods that will face another 25% tariff for intellectual property violations. If the US does so, China has threatened to retract some of the concessions it has made. The US Administration is claiming to be a victim of past US leaders apparently going back to before WWII and nearly every country with which the US trades.

Trump who has positioned himself as an outsider at the G7 summit, and his policies, particularly the claim that steel and aluminum imports (and possible auto imports down the road), from countries that have long been military allies, are threats to US national security, have isolated the US. The US President did not even deign the summit of sufficient importance to stay for the entire meeting. Although presidential advisor Kudlow claims this is simply a family squabble, the dysfunctionality is palpable and likely to prove more profound than the spat like W.Bush’s steel tariffs.

Trump is leading America’s defection in spirit if not in fact from the multilateral system that it was instrumental in erecting. Moreover, the opinion polls suggest Trump’s support has risen in the polls. The likelihood that the Democrats capture both houses of Congress seems increasingly remote. Macron is no doubt correct that leaders don’t last forever but a second-term for Trump cannot be ruled out by foreign policymakers or investors.

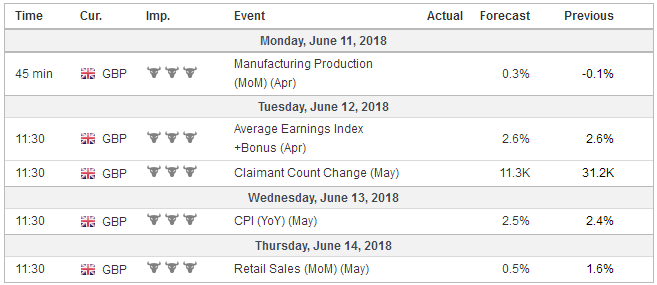

United KingdomThe central bank meetings will overshadow the high-frequency economic data on tap in the week ahead. Before turning to the central bank meetings, we should address the exception to this generalization, the UK. The market is confident that the Bank of England will raise rates this year. It is a question of when. The wage, inflation, and retail sales data may spur speculation that a hike can take place in Q3 rather than in Q4. While this would be supportive of sterling, Brexit developments could undermine it. The House of Commons will take up the “withdrawal bill” which the House of Lords attached 15 amendments to that would serve to soften exit from the EU. Prime Minister May faced down another threat from her cabinet last week. This time from her Brexit Minister Davis who is thought to be a likely contender as her successor. May’s compromise may be sufficient to keep the Tory rebels satisficed for the time being. However, we suspect it may defer the inevitable confrontation until the trade bill is taken up after the EU heads of state summit later this month. The EU’s chief negotiator Barnier will meet with Davis on Monday, but it is clear that the EU is not satisfied with the UK efforts. The possibility that the negotiations can be wrapped up by the end of October seems increasingly unlikely, and risks of a hard Brexit are understood as sterling negative. |

Economic Events: United Kingdom, Week June 11 |

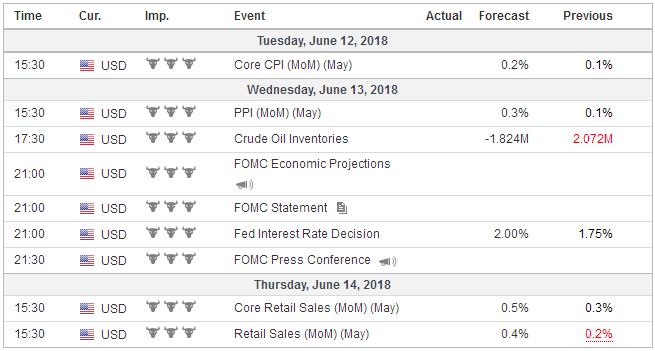

United StatesThe Federal Reserve two-day meeting concludes Wednesday. There is little doubt that the FOMC will hike the Fed funds target rate 25 bp, the seventh hike in the cycle that began in December 2015. With some repo rates pushing through the upper end of the Fed funds target range, the Fed has already pre-announced that the interest paid on reserves (both required and excess) will no longer be at the top end of the range, but 5 bp inside it. It is an innovation that investors will be anxious to see if it works. One metric would be where the effective Fed funds trade relative to the range. It has crept up in recent months to a few basis points from the upper end rather than near the middle. The key to the market’s response will not lie so much with what the Fed does, which is just about taken for granted now, but what it says. The FOMC statement may reflect officials growing confidence that it has achieved its mandate of full employment and price stability (as it defines it). There is some thought that the Fed may alter its characterization of monetary policy as accommodative. The Fed may acknowledge that monetary setting may move need to move beyond neutral to slightly restrictive. The second issue is whether the individual forecasts shift toward a fourth hike this year. We think an adjustment in the forward guidance will not be coupled with a signal that the Fed is on the verge of accelerating the pace of hikes. There is no compelling need to do so now. To signal a more aggressive trajectory now would risk an inversion of the yield curve. There seems to be a split on the Fed on the issue. The regional presidents, with the notable exception of Williams who will replace Dudley as NY Fed President, appear more concerned about the short-term rates rising above long-term rates than the Board of Governors. Although the Fed was designed to give the Governors a majority at the FOMC, the unfilled seats on the Board change the dynamics. We do not think that the failure of the Fed to signal a more aggressive path should be read as a dovish hike. The Fed is still most likely to signal continued hikes next year. The combination of rate hikes, the reduction of the Fed’s balance sheet, and the large fiscal stimulus makes for a very aggressive policy mix. We suspect that Bernanke’s recent assessment may have been stated somewhat stronger than current Fed officials would say, but the scenario he painted is one that no doubt is familiar to policymakers. The Fed’s meeting is live, and we assume the September meeting is live in that sense that there is a reasonable chance of the central bank to take action. The August meeting is not live in that sense, though there are a number of issues that will be discussed at the FOMC meeting. The ECB meeting is not live. No one expects the ECB to take fresh action. |

Economic Events: United States, Week June 11 |

EurozoneUntil now, we are told, the ECB has not had formal discussions on what to do after September when the current commitment to buy 30 bln euros of bonds a month ends. All indications point to a formal discussion this week, but it is unlikely to be particularly contentious. It is not exactly rocket science to know that sometime before September the ECB will have to discuss it. The issue now is whether a decision is announced this week or put off until next month. We expect both are right. Draghi will likely acknowledge that prices are moving toward the ECB’s target, but also reiterate that there will not be a hard stop of asset purchases. We expect him to hint, without providing many details, that the purchases will be tapered further after September. He may suggest that the purchases will cease at the end of the year, but we suspect not. The exact pace of the tapering (e.g., 15 bln, 10 bln and then 5 bln in Oct, Nov, and Dec respectively) is unlikely until July. It is not coincidental that the staff’s forecasts will justify the ECB’s course. The last forecasts assumed a stronger euro and lower oil prices. The new forecast will likely see the inflation forecasts lifted. The growth forecast may be pared, but that is not a constraint on policy unless it is projected to fall below the trend pace estimated to be around 1.25%-1.50%. Upon learning there will be a formal discussion about the ECB’s purchases, the market appeared to bring forward the first hike by the ECB to the middle of 2019 from late in the year. It is expected to be a 10 bp point move that would lift the deposit rate to minus 30 bp. We have been penciling in June 2019 as the earliest realistic timeframe. We suspect that it will depend on a host of variables and particular conditions at the time. We expect the market expectations to shift back and forth into Q3 depending on the high-frequency data and market conditions. There seems to be an acceptance now that the Draghi will announce a rate hike among the last actions he takes before his term is over next October. Draghi will likely be asked about Italy. The new Italian government and some in the media have seen the low percentage of Italian bonds bought recently as a sign of the politicization of QE. We do not see this and suspect he may explain the program and the flexibility. The amount of Italian bonds bought remained relatively constant at around 3.4 bln euros. In percentage terms, the Italian share fell due to a technical issue that involved reinvesting maturing German proceeds. In percentage terms, the purchases of French bond fell as well, for example, and there was no unusual jump in yields. |

Economic Events: Eurozone, Week June 11 |

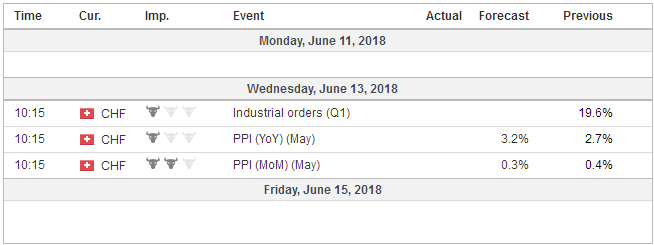

Switzerland |

Economic Events: Switzerland, Week June 11 |

Draghi will likely refrain from commenting about the new Italian government fiscal program, as he typically refrains from discussing any single country. He may press again his point about the need for structural reforms throughout the euro area. At most he will remind us that being a member of the monetary union requires following certain rules and that the polls indicate that the vast majority of Italians want to remain in the EMU.

Before the ECB meetings, both Italy and Greece will sell 12-month T-bills. Italy last sold such bills on May 10. Two months after the election, Italy was paid 36 bp to take the buyers money (i.e., a negative yield of 0.36%). Since then, investors have jacked up Italy’s two-year yield by almost 200 bp. That would put the one-year bill yield near say 1.65%. The following day, June 13, Greece will sell 12-month bills. Back in March, when Greece last raised one-year money, it paid 1.25%. Greece’s coupon curve is not liquid, but we note that the six-month bill yield has fallen 25 bp since the last auction.

This exercise suggests that Italian 1-year bill yields may rise well through Greece’s. That seems to exaggerate the redenomination risk in Italy, It does not mean that exaggeration cannot persist or grow, but it does mean there may be a relative value proposition.

The Fed will continue to normalize monetary conditions. The ECB will talk about. The Bank of Japan may tweak its forecasts but is unlikely to take fresh action. In April, the BOJ abandoned its target date for achieving its inflation target. There is no need to reinstate it. It shaved its previous inflation forecast to 1.3% from 1.4% in April. It will likely do so again. Inflation, the core rate, which excludes fresh food, was stood at 0.7% year-over-year in April down from 1% in February. The market expects around 1% core rate this year. Our contacts suggest that BOJ Kuroda may discuss some of the structural aspects (e.g., falling rents, internet) of Japanese low inflation.

Tags: #GBP,#USD,$CNY,$EUR,$JPY,$TLT,Featured,newsletter