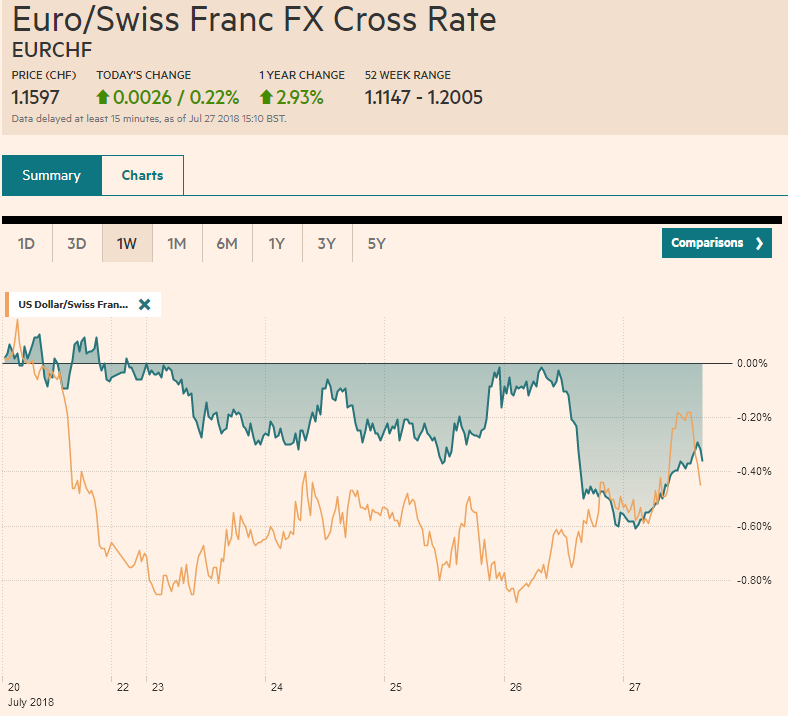

Swiss Franc The Euro has risen by 0.22% to 1.1597 CHF. EUR/CHF and USD/CHF, July 27(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Trends The US dollar is trading firmly in Europe after consolidating yesterday’s gains during the Asian session and ahead of the first look at Q2 GDP. Yesterday’s economic reports, including durable goods orders and inventory data, saw the Atlanta Fed’s GDPNow tracker lower its forecast to 3.8% from 4.5%. Most market surveys likely do not incorporate the impact of yesterday’s reports, suggesting some downside risk. The White House has been playing up a strong report, though in fairness a 3.8% report would still be regarded as strong.

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, Featured, GBP, newsletter, SPX, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.22% to 1.1597 CHF. |

EUR/CHF and USD/CHF, July 27(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX TrendsThe US dollar is trading firmly in Europe after consolidating yesterday’s gains during the Asian session and ahead of the first look at Q2 GDP. Yesterday’s economic reports, including durable goods orders and inventory data, saw the Atlanta Fed’s GDPNow tracker lower its forecast to 3.8% from 4.5%. Most market surveys likely do not incorporate the impact of yesterday’s reports, suggesting some downside risk. The White House has been playing up a strong report, though in fairness a 3.8% report would still be regarded as strong. Nevertheless, there does appear to be widespread recognition that the robust pace is not sustainable and growth in H2 is expected to return to around 2.5%. Quarterly GDP has averaged 2.4% over the past eight quarters and 2.3% over the past 20 quarters. Tax cuts, a smaller trade deficit as some exports were boosted ahead of the tariffs (e.g., soy), a recovery in consumption despite the stagnation of real hourly and weekly earnings appear to have helped boost growth. Consumption, which drives the world’s biggest economy slowed to a five-year low in Q1 of 0.9% and is expected to have bounced back. A 3.0% pace would edge up the average over the past eight and 20 quarters of 2.7% and 2.8% respectively. There is little doubt in the market that the Federal Reserve will hike rates at its late September meeting. Although the FOMC meets next week, there is practically no chance that the Fed will raise rates. There may be a dispute over precisely what “gradual” means but in this context, it does not mean back-to-back rate hikes. All the changes in rates since the normalization cycle began at the end of 2015 took place at a meeting with updated forecasts and a press conference. The market is less convinced, at this juncture, of a December hike with about a 60% chance discounted. Recall that it was the change of one member’s forecast that lifted the median dot plot in June to show that fourth hike for this year. |

FX Performance, July 27 |

Rather than the FOMC meeting, the focus has been on next week’s Bank of Japan meeting. It seems quite clear that the BOJ is considering adjusting its extraordinary policies. The measures that are being discussed by market participants include an increase in the 10-year yield target, a change in the way the bonds are being purchased, and a shift in ETF purchases toward the Topix, Some businesses have also argued against the central bank buying negative yielding corporate bonds.

The Tokyo July CPI ticked higher (0.9% from 0.6%, and excluding fresh food and energy 0.5% vs. 0.4%) but it is hardly sufficient to signal much progress. Recall too that the week began with a disappointing manufacturing PMI. The BOJ seems to be willing to adjust their policies not to take a step toward the exit, but to put the efforts on a more sustainable path, which will allow them to be extended while minimizing the distortion for banks and businesses.

For the second time this week, the BOJ’s pain threshold for the 10-year JGB yield was defended. Earlier in the week, the BOJ offered to buy unlimited bonds at 11 bp. There were no sellers. Today the BOJ offered to buy unlimited bonds at 10 bp and reports indicate that about JPY94 bln were purchased. The yield finished near nine basis points.

France was the first G7 country to report Q2 GDP. It disappointed. The economy expanded by 0.2%, the same as in Q1. The year-over-year pace slowed to 1.7% (from 2.2%), which is the weakest since Q1 17. Consumption slowed to a crawl as the quarter drew to a close. After rising a revised 1.0% (initially 0.9%) in May, consumption slowed to 0.1% in June. The average monthly pace was 0.3% in Q1 and -0.2% in Q2. In addition to consumption, trade also appeared to be a drag. The first look at Q2 GDP for the eurozone will be released on July 31. It is expected to have risen 0.4%-0.5% after 0.7% growth in each of the last three quarters of 2017.

The third macro development to note is that the EU negotiators have rejected May’s proposal for Brexit. Barnier was clear that non-EU members could not be approved to collect it duties which May proposed as a workaround. Barnier suggested instead that the UK remain in the customs union, which seems to be Labour’s position.

In any event, the likelihood of a Brexit without an agreement (in which case, the relationship revert to the WTO rules) appears to be increasing, and preparations for this are moving forward. Although some reports suggest that more people favor a second referendum than are opposed, it is not obvious that another referendum would resolve the issue. The problem seems to be that even if there is a majority to leave, there is no agreement on what it ought to look like in practice.

Asian equities advanced, with the MSCI Asia Pacific Index rising 0.4% to extend its winning streak for a fourth session, the longest advance since March and is at a four-week high. The last leg down began in early June, and the low was made at the start of the month. This benchmark is up for the past three weeks and has retraced nearly 50% of the recent drop. Foreign investors returned to several of the regional equity markets this week, including Korea, Taiwan, Indonesia, and Thailand. Chinese markets eased today but managed to close higher for the week, with the Shanghai Composite adding nearly 1.6%. Speculation of the shift in BOJ equity buying saw the Topix rally 1.75% this week, while the Nikkei rose a little more than 0.5%.

European shares are also moving higher. The Dow Jones Stoxx 600 is up about 0.2% in late European morning turnover. Telecom, financials, and utilities are leading the advance, while consumer discretionary and health care are drags. The easing of trade tensions between the EU and the US, and especially the reduced threat of auto tariffs, helped European equities trade higher in recent days. If the Dow Jones Stoxx 600 closes near current levels, the weekly rise of nearly 1.5% would be the largest since March. It would be the fourth consecutive weekly advance and a six-week high.

In the bond market, core European yields are edging higher, while peripheral yields are a touch softer. The US 10-year continues to hover a little below 3%. Australia and New Zealand 10-year benchmarks rallied, with yields falling around four basis point to 2.64% and 2.72% respectively.

The euro has returned to where it was a week ago before the US President accused the EU and China of currency manipulation. Recall that before Trump complained about the Fed the on July 19, the euro had been traded as low as $1.1575. There is a 1.1 bln euro option at $1.1550 that expires today. Options for 1.9 bln euros at $1.17 and 1.7 bln euros at $1.1735-$1.1750 seem less relevant now. Against the yen, the dollar is confined to narrow range on both sides of JPY111.00. Options may be penning it in today. There is a JPY110.95 strike for about $400 mln that expires today. There is another option for nearly $970 mln struck at JPY111.25 that will be cut and JPY111.50 strike for about $550 mln that also expires.

Sterling pushed above $1.3200 yesterday before selling off through Wednesday’s lows. A break of $1.3050 now warns of a re-test on the 10-month low seen last week near $1.2950. There is a GBP271 mln option struck at $1.30 and another one a little larger at $1.31 that expire today.

The US dollar has found support near CAD1.30, and it is consolidating the week’s move. It finished last week near CAD1.3150. The Australian dollar ran out of steam near $0.7450 yesterday and sold off. So far today it has not been above $0.7400 for the first session this month. There is an A$535 mln option at $0.7375 that expires today. The $0.7300-$0.7500 range has remained intact since the middle of last month. Lastly, we note that although the Dollar Index is making new highs for the week, just below 95.00, last week’s high is a more distant 95.65, which is also a 12-month best.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$TLT,Featured,newsletter,SPX