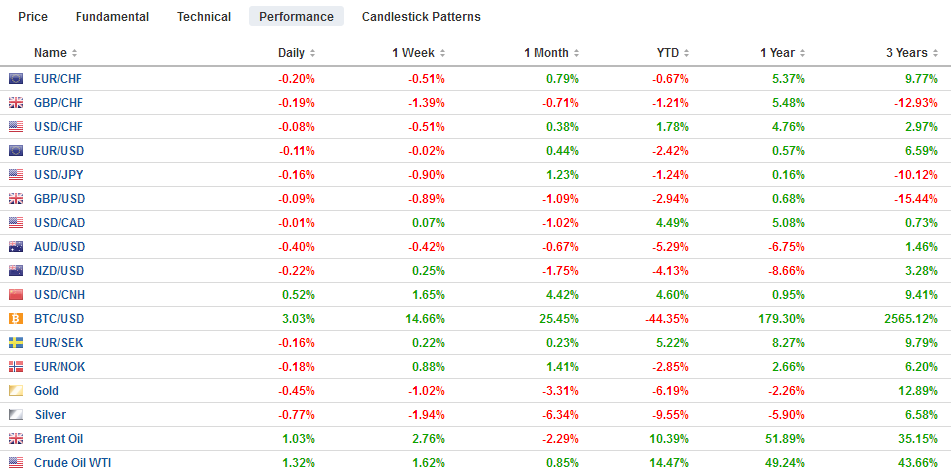

Swiss Franc The Euro has fallen by 0.24% to 1.1609 CHF. EUR/CHF and USD/CHF, July 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US Treasury Secretary Mnuchin told G20 finance ministers and central bankers that President Trump was not trying to interfere in the foreign exchange market or encroach upon the Federal Reserve’s independence. Trump’s comments and tweets last Thursday and Friday effectively capped the dollar as it was looking to break out to the upside. The greenback had been trading at its best level in 10-months against sterling, the highs since January against the yen, and the euro has moved to the lower end of its recent range. In Asia, the dollar’s

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, EUR, Featured, GBP, newsletter, TLT, U.S. Existing Home Sales, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has fallen by 0.24% to 1.1609 CHF. |

EUR/CHF and USD/CHF, July 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

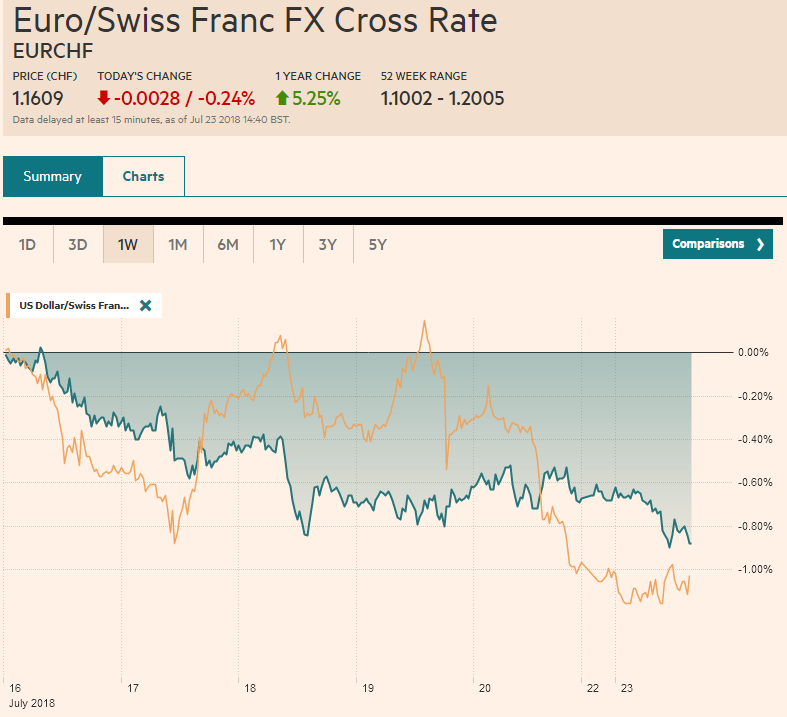

FX RatesUS Treasury Secretary Mnuchin told G20 finance ministers and central bankers that President Trump was not trying to interfere in the foreign exchange market or encroach upon the Federal Reserve’s independence. Trump’s comments and tweets last Thursday and Friday effectively capped the dollar as it was looking to break out to the upside. The greenback had been trading at its best level in 10-months against sterling, the highs since January against the yen, and the euro has moved to the lower end of its recent range. In Asia, the dollar’s pullback was pushed a bit further. The euro reached $1.1750 to briefly trade above last week’s high. The single currency was sold in the European morning and was pushed a little below the $1.1700 area. There is a 2.1 bln euro option expiring today struck at $1.17 and a 1.1 bln euro option expiring at $1.1750. Initial support is seen near $1.1680. Sterling rose through the pre-weekend high to reach almost $1.3160. Last week’s high, though, is near the most distant $1.33. The EC negotiators have reportedly indicated that May’s 2.0 plan for financial services (“advanced equivalence”) to the extent that there the regulatory decisions are made jointly by the EU and UK. EU governments, including in this case the UK, are increasing preparation for a “no-deal Brexit”. Initial support is seen in the $1.3060-$1.3080 band. There is a GBP209 mln option that expires today struck at the lower end of that area, while there is another GBP252 mln option struck at $1.3115 that is also on the bubble. |

FX Performance, July 23 |

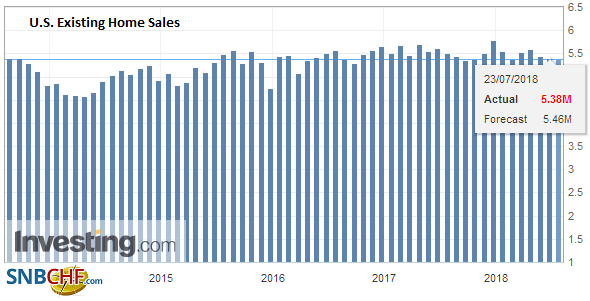

United StatesThe US reports existing home sales for June. Existing home sales fell in three of the first five months of 2018, including April and May. Rising yields and changing tax benefits may be taking a toll. Recall that last week, housing starts and permits were considerably weaker than expected. The pace peaked last November near 5.72 mln (SAAR). It was a 5.43 mln pace in May. The six and 12-month moving average converge near 5.49 mln. The data highlight of the week is the first look at Q2 GDP. The US will be raising over $200 bln this week, almost evenly divided between bills and coupons. The yield curve (2-10) steepened ahead of the weekend by a little more than five basis points to 30 bp. It was the largest move since February. It is steady to firmer and will be watched closely to see if this marks anything of importance. We are skeptical that a turn significant turn is at hand. |

U.S. Existing Home Sales, June 2018(see more posts on U.S. Existing Home Sales, ) Source: Investing.com - Click to enlarge |

Japan

Japan is very much in the spotlight. The greenback had reached almost JPY113.20 on July 19. Trump’s comments caught the market leaning the wrong way. Ahead of the weekend, it had fallen to JPY111.40. Follow-through selling today took it to JPY110.75. In addition to the US comments, there were press reports that played up speculation that the BOJ would tweak its policy at the month end meeting and this could include a higher target for the 10-year yield under the Yield Curve Control. This saw JGB futures prices decline. The 10-year JGB yield slipped to the week[‘s low near 3.2 bp on July 20.

Today the cash yield jumped almost six basis points. The BOJ stepped in and offered to buy unlimited amounts at 11 bp. There were no sellers, which is what happened the last time (February) the BOJ took such a stand. The yield initially eased a little but still finished firmly near 8.6 bp. The rising yields and yen proved too much for Japanese shares. The Nikkei gapped lower and was never able to recover. The 1.33% drop is the largest in three weeks. Financials were the only sector to have bucked the trend and were 2.5% better. The Topix held up much better, losing only 0.35%, for a third declining session.

China

More broadly, the MSCI Asia Pacific Index consolidated the pre-weekend gain and was marginally lower. The Shanghai Composite was the region’s best performer. It added another 1% to the 2% pre-weekend rally. Korea’s shares are among the largest losers in the area. Foreign investors sold almost $82 mln worth of shares, which is more than half of the month-to-date net sales. The KOSDAQ is bearing the burden. It was off 4.4% today and about 19% below the high set in early February.

The PBOC appeared to signal its willingness to allow public funds to invest in some wealth management products. Before the weekend, there were also reports that officials had instructed banks to buy more high yield bonds in exchange for MLF loans. The PBOC offered CNY502 bln one-year MLF loans for 3.3% (unchanged rate). This is a record injection for the facility that was launched in 2014.

The reference rate for the yuan was set higher for the first time in eight sessions. The fix was set at CNY6.7593 today, up from CNY6.7671 before the weekend. However, the dollar traded higher and is back near CNY6.80. The offshore yuan (CNH) opened at 6.7524 (previous close 6.7680), but it is now near 6.8070. Mnuchin may have tried softening Trump’s comments, but he did not back off of China, where he questioned whether the recent decline was a result of market forces or government interference. Our suggestion is both. Chinese officials are letting market forces push the yuan lower as the macro considerations lift the dollar higher against most of the world’s currencies. However, the situation must be monitored closely.

Eurozone

European shares are mixed, and the Dow Jones Stoxx 600 is flat. It had slipped about 0.4% over the past two sessions. Core bond yields are one-to-two basis points higher while peripheral yields are lower. The European highlight this week include the flash PMI and the ECB meeting. No change in policy or outlook is likely before the summer recess.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CNY,$EUR,$TLT,Featured,newsletter,U.S. Existing Home Sales