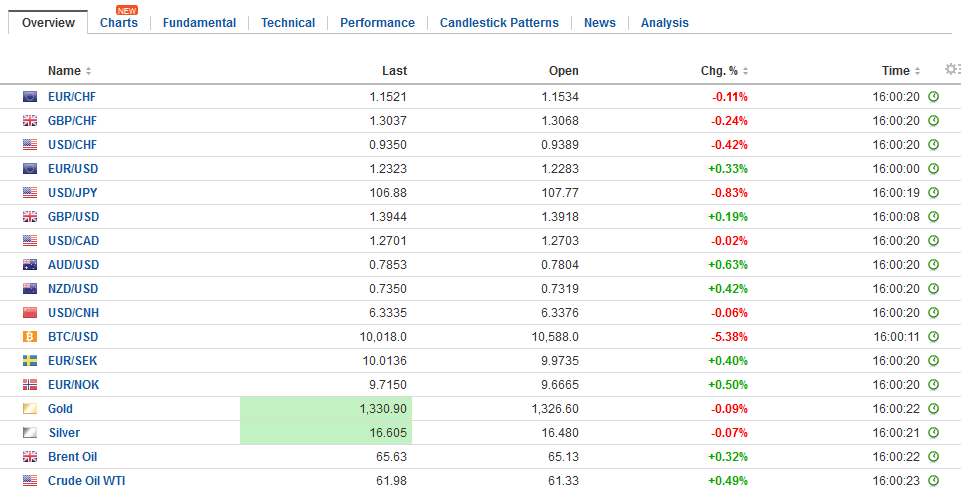

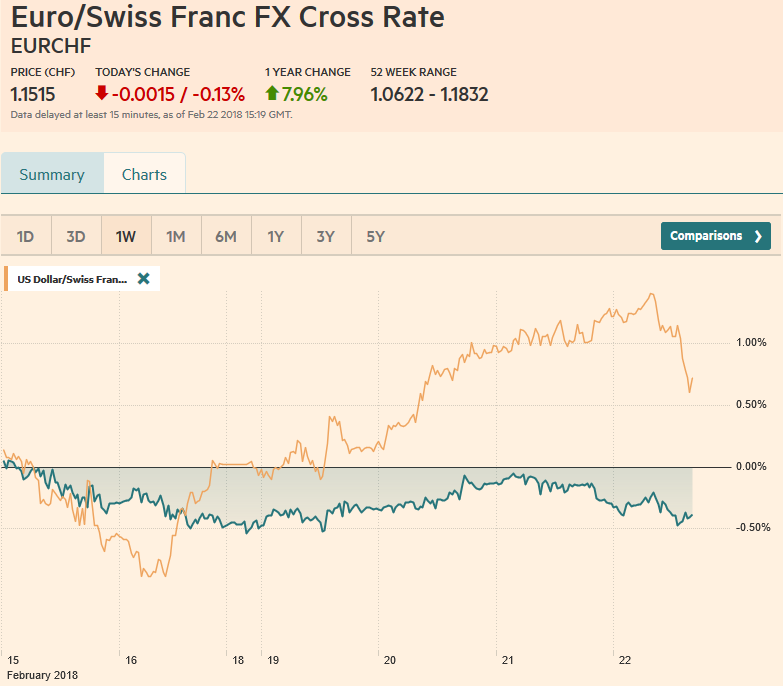

Swiss Franc The Euro has fallen by 0.13% to 1.1515 CHF. EUR/CHF and USD/CHF, February 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dramatic reversal of US shares yesterday in the last hour of trading has once again pulled the proverbial rug beneath the feet of investors. The turn down, moreover, occurred near important technical levels, seemingly adding to the significance. Global equities have followed suit. The MSCI Asia Pacific Index fell 0.8%, despite a 2% rally in Chinese markets re-opening after the holiday celebration. European bourses have been market down and the Dow Jones Stoxx 600 is off by little less than 1% in late morning turnover. That said,

Topics:

Marc Chandler considers the following as important: CAD, EUR, EUR/CHF, Featured, France Consumer Price Index, FX Trends, Germany Business Expectations, Germany Current Assessment, Germany IFO Business Climate Index, Italy Consumer Price Index, JPY, newslettersent, SPY, TLT, U.K. Gross Domestic Product, U.S. Crude Oil Inventories, U.S. Initial Jobless Claims, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.13% to 1.1515 CHF. |

EUR/CHF and USD/CHF, February 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe dramatic reversal of US shares yesterday in the last hour of trading has once again pulled the proverbial rug beneath the feet of investors. The turn down, moreover, occurred near important technical levels, seemingly adding to the significance. Global equities have followed suit. The MSCI Asia Pacific Index fell 0.8%, despite a 2% rally in Chinese markets re-opening after the holiday celebration. European bourses have been market down and the Dow Jones Stoxx 600 is off by little less than 1% in late morning turnover. That said, European shares opened lower still but have stabilized, perhaps waiting for fresh cues from the US markets. The S&P 500 is straddling unchanged levels. |

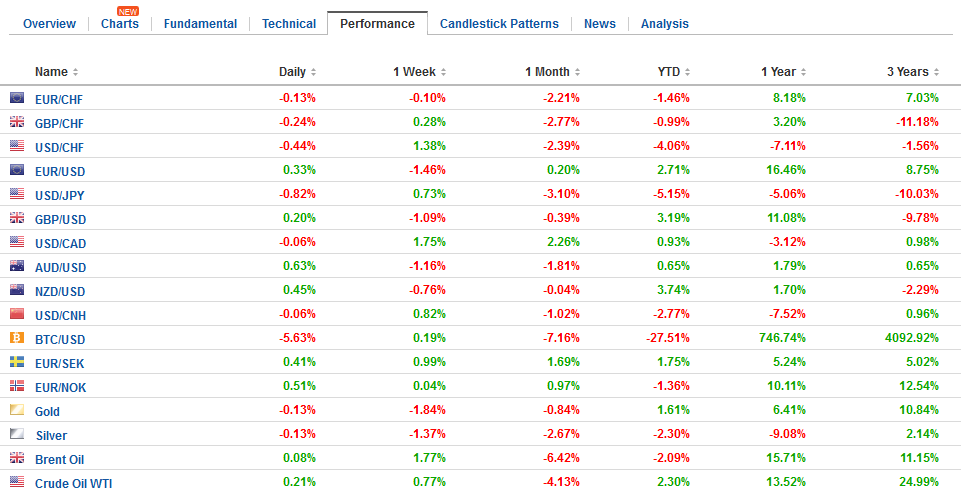

FX Daily Rates, February 22 |

| The S&P 500 traded on both sides of Tuesday’s range yesterday and closed below its low. The outside down day is bearish price action. The S&P 500 was unable to take out Monday’s high and it just nicked the 2743-level we have identified as key. The S&P 500 had bounced from 2532.7 to 2754.4 since February 9. Before anticipating a return to the lows, there are some mile markers on the way that will be watched. First, the 2669.7 area is a 38.2% retracement of the bounce and 2643.5 is 50%. Similar levels for the Dow Industrials are found at 24640.8 and 24396.3 respectively.

The VIX actually closed a little lower yesterday (20.02 vs. 20.60). It is slightly firmer today but it is below the 21.6 high seen at the start of the week or even the 21.0 seen yesterday. Meanwhile, the Treasury market has steadied. Yields are off 1-3 bp through coupon curve. It has a great deal of new supply to digest, and there is another $29 bln (seven-year notes) that will be raised today. When looking at the price action closely, it as if the S&P 500 made its highs about 25 minutes after the FOMC minutes were released, and did not slip to new lows for a little more than half an hour. The 10-year yield initially slipped a basis point, but then climbed. Yields peaked a little before the S&P 500 made new lows for the day. |

FX Performance, February 22 |

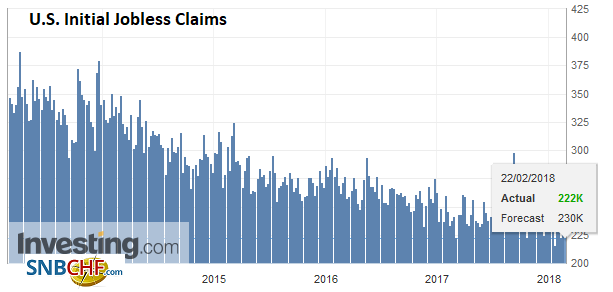

United StatesWe have argued that there is an accumulation of evidence that the US economy is showing some classic sign of being late in the expansion cycle. These included, metrics like the 12-month moving average of non-farm payrolls, auto sales, credit card delinquencies, and financial speculation (cyber-currencies?). |

U.S. Initial Jobless Claims, 22 February(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

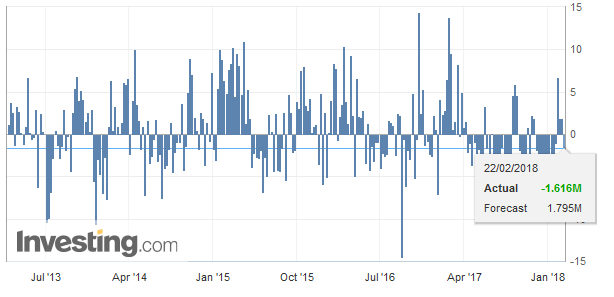

U.S. Crude Oil Inventories, Jan 2018(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

|

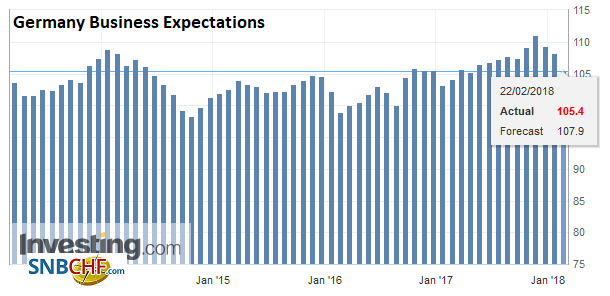

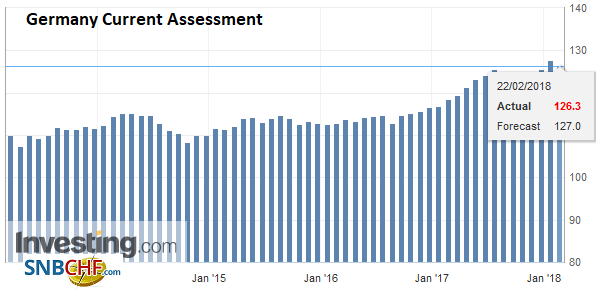

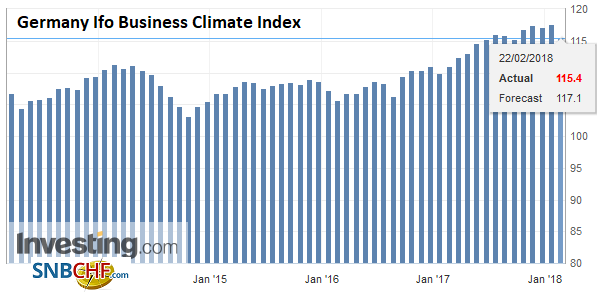

GermanyThe eurozone economy in contrast was seemingly accelerating. However, after softer PMIs, Germany reported softer ZEW and weaker IFO survey. Of note, the German IFO expectations component fell the most in two years (105.4 from 108.3) and is at its lowest level in five months. |

Germany Business Expectations, Feb 2018(see more posts on Germany Business Expectations, ) Source: Investing.com - Click to enlarge |

Germany Current Assessment, Feb 2018(see more posts on Germany Current Assessment, ) Source: Investing.com - Click to enlarge |

|

Germany Ifo Business Climate Index, Feb 2018(see more posts on Germany IFO Business Climate Index, ) Source: Investing.com - Click to enlarge |

|

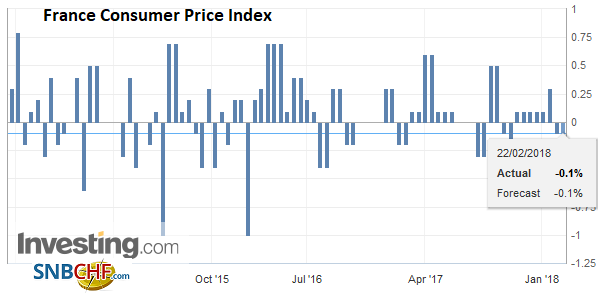

FranceFrance reported all its February business confidence readings decline in February. |

France Consumer Price Index (CPI), Jan 2018(see more posts on France Consumer Price Index, ) Source: Investing.com - Click to enlarge |

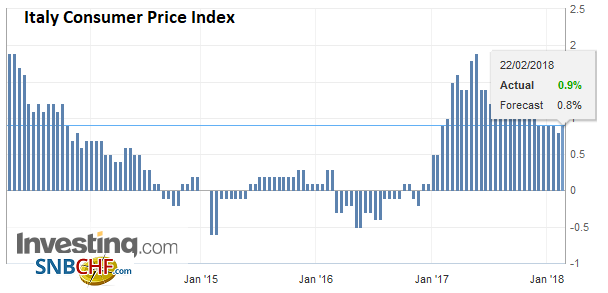

Italy |

Italy Consumer Price Index (CPI) YoY, Feb 2018(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

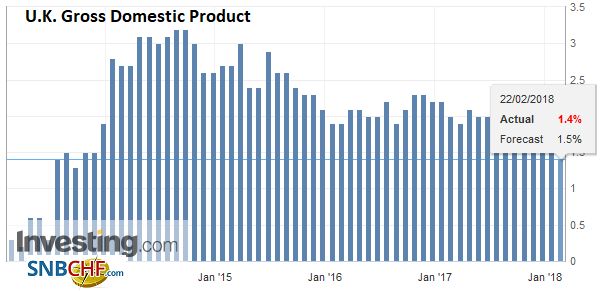

United Kingdom |

U.K. Gross Domestic Product (GDP) YoY, Q4 2017(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

We do not see much new news in the FOMC minutes. The January meeting was seen in real time as a hawkish hold and the statement reflected an upgraded economic assessment and greater confidence that inflation would move toward target. It seems clear that the fiscal stimulus helped boost the near-term confidence. While much attention has been devoted to debating whether the March dot plots will point to four hikes this year instead of three, which was the case in December, seems, the fact is that the Fed funds futures are not fully pricing in three hikes this year. That gap between the market and the Fed is closing gradually, but remains and it is that adjustment that seems key for the investment climate.

The US dollar is mixed. The yen is the strongest currency, up 0.4% followed by the dollar-bloc, up about 0.2%. The Scandia and sterling are nursing small losses, while the euro is flat after having fallen to$1.2260, a ten-day low, in early European turnover. There is a large ($1.4 bln) option struck at JPY107.50 that expires in North America today. We suspect the greenback will take its directional tone from the equity market.

The US economic data is not what moves the market today, with initial jobless claims the leading economic indicators, and the KC Fed’s manufacturing survey. In light of the minutes, Fed officials may draw attention. Quarles has already spoken and in his first public remarks recognized the economy is strong than before the crisis. NY Fed’s Dudley, though it is less than six months before he steps down, he has often had his finger on the pulse of Fed thinking (10 am EST) and Bostic and Kaplan speak later.

Canada reports December retail sales. The headline is expected to have been restrained by weaker auto sales, without which retail sales may have risen about 0.3% after the heady 1.6% rise November. The market continues to discount a little less than a 50% chance of a hike in April. The US dollar has risen from CAD1.2550 to CAD1.2710 in the past five sessions. It overshot our retracement target near CAD1.2665, but has come back offered. A move back below the CAD1.2660 area may suggest a near-term top is in place.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,Featured,France Consumer Price Index,Germany Business Expectations,Germany Current Assessment,Germany IFO Business Climate Index,Italy Consumer Price Index,newslettersent,SPY,U.K. Gross Domestic Product,U.S. Crude Oil Inventories,U.S. Initial Jobless Claims,USD/CHF