As weird as it may seem at first, the primary economic problem right now is that the global economy looks like it is growing again. There is no doubt that it continues on an upturn, but the mere fact that whatever economic statistic has a positive sign in front of it ends up being classified as some variant of strong. That’s how this works in mainstream analysis, this absence of any sort of gradation where if it’s negative it’s bad (though in 2015 lots of negatives were shrugged off as immaterial so as to avoid any acknowledgement of bad) but if it’s positive it can only be good. This is exactly how the US labor market is being treated. The headline payroll number was +228k for November, thus classified as “strong”

Topics:

Jeffrey P. Snider considers the following as important: China, China Exports, China Imports, China Industrial Production, consumer spending, currencies, demand, economy, exports, Featured, Federal Reserve/Monetary Policy, Global Economy, global trade, imports, Labor market, Markets, newsletter, payrolls

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| As weird as it may seem at first, the primary economic problem right now is that the global economy looks like it is growing again. There is no doubt that it continues on an upturn, but the mere fact that whatever economic statistic has a positive sign in front of it ends up being classified as some variant of strong. That’s how this works in mainstream analysis, this absence of any sort of gradation where if it’s negative it’s bad (though in 2015 lots of negatives were shrugged off as immaterial so as to avoid any acknowledgement of bad) but if it’s positive it can only be good.

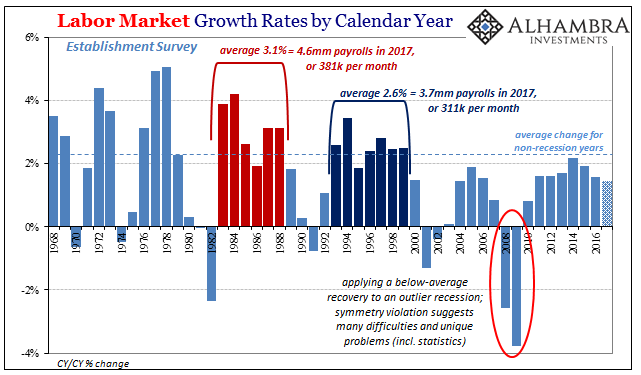

This is exactly how the US labor market is being treated. The headline payroll number was +228k for November, thus classified as “strong” when it is anything but. Using historical comparisons to properly calibrate our interpretations, +228k is significantly less than the average growth required to be reasonably consistent with a truly healthy economy. In fact, that level of growth is serious below where the labor market needs to be, meaning that next month there would have to be +400k in payrolls just for it to get back on track averaging +311k. There’s absolutely no chance of that happening, which means something entirely different than “strong.” |

Labor Market Growth, 1968 - 2017 |

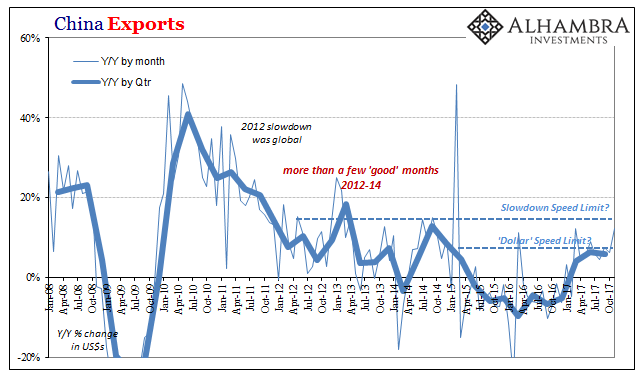

| So it is with other economic statistics around the rest of the world where actual growth levels are such a distant memory what is clearly far short of a minimal gain appears to be otherwise. China’s General Administration of Customs reports that the Chinese export of goods in November 2017 rose 12.3% year-over-year. That’s the highest rate of expansion since March.

Given that, and that the rate was double digits no less, the estimate is being characterized in the same way the US payroll figure is.

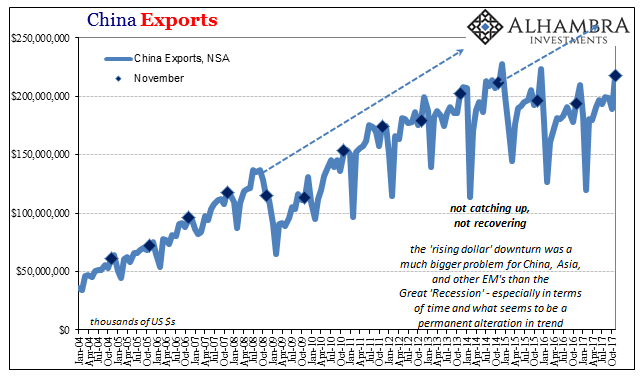

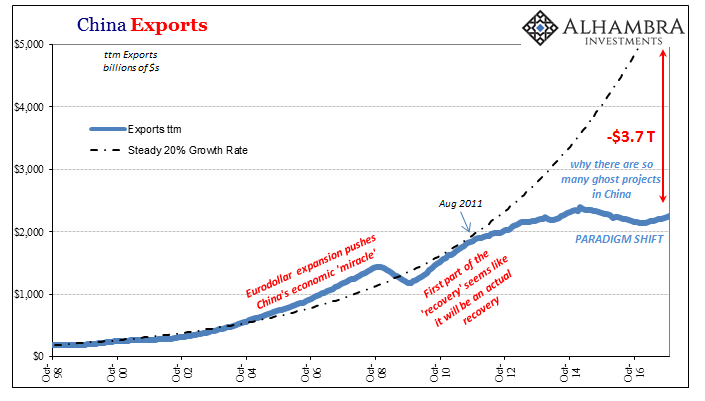

Like the labor report, that just isn’t the case. From 2012 to 2014, as the global economy slowed significantly, impacting China’s export economy more than anywhere else, still export growth was frequently in double digits. In the 36 months between the start of 2012 and the end of 2014, Chinese exports grew by more than 10% thirteen times, including four in 2014 alone just before the drop into prolonged “unexpected” contraction. By contrast, between January 2002 and October 2008, exports failed to register 15% growth or more only four times out of those 82 months; and two of those were early in 2002 at the tail end of the global dot-com recession, the third in early 2007, and the last in February 2008 just before Bear Stearns blew up. That’s a robust trend, unquestionably strong. The occasional double-digit month just doesn’t amount to growth, nor does +12% add up to a good result even in isolation. A real, meaningful economic advance is marked by unambiguously good months not just once in a while but all the time in succession. It takes off and never looks back. Fits and starts, uneven growth here and there, is a sign of continued trouble – especially if it immediately follows a serious downturn. |

China Exports, Jan 2008 - Oct 2017(see more posts on China Exports, ) |

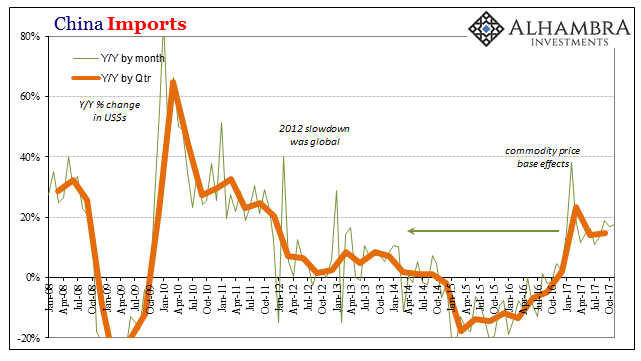

| We can apply the same standards on the import side, too, where growth rates have been more positive than those on the export side. Some of that is the leftover from 2016’s official “stimulus” push, some the continuing base effects of commodity prices, and more than a little has to do with oil payments from Africa in lieu of repaying past China “dollar” lending with eurodollar “currency.” |

China Imports, Jan 2008 - Oct 2017(see more posts on China Imports, ) |

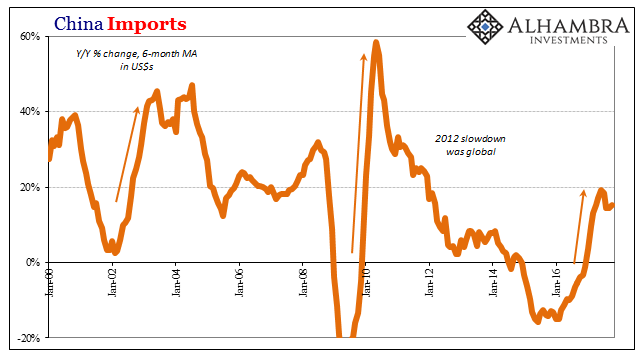

| Imports rose 17.7% year-over-year for China in November, which is nominally better than that side of trade during 2012-14 but again not meaningfully so. By comparison, in prior periods following such sustained contraction as in Chinese imports 2015-16, growth would immediately jump to 40-60% sustained. |

China Imports, Jan 2000 - 2017(see more posts on China Imports, ) |

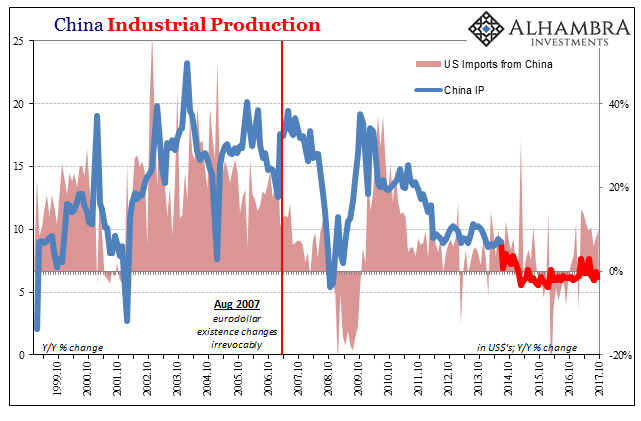

| The current 6-month average of 15.7% sounds terrific if only outside of context. Better than bad isn’t always good, and in a lot of cases there is still some degree of bad between bad and good. Economic growth is subject to gradation, and should never be classified according to some misconceived binary matrix. The lackluster expansion in US jobs is in every way connected to the same in Chinese exports. |

China Industrial prodution, Oct 1999 - 2017(see more posts on China Industrial prodution, ) |

| I’ve written consistently before that this right here amounts to the worst case, which is not recession or even a deep contraction. That might get people’s attention. This mild, uninspired, and ultimately shallow global upturn is in every way insufficient to spark actual growth. That means the global economy will remain stuck without it for however long this mini-cycle ultimately lasts (though if the repo market is any indication, and it certainly has been in the past, it shouldn’t be an extended one). |

China Exports, Jan 2004 - Oct 2017(see more posts on China Exports, ) |

| All the urgency for real solutions that built up through the “rising dollar” period, including casting suspicion finally in the direction of previously infallible and supposedly courageous central banks, has simply vanished because all the numbers turned positive again – just as they did 2013-14. We never get anywhere because just when it seems we might turn the corner in appreciating what’s really wrong the whole thing slides mildly better and the mainstream runs off into a fairy tale.

What’s left isn’t just waiting for the inevitable next one, it’s also realizing that the whole world grows worse, becomes that much farther behind, in the waiting. This is so very clearly the worst case, these good months that aren’t. |

China Exports, Oct 1998 - 2017(see more posts on China Exports, ) |

Tags: China,China Exports,China Imports,China Industrial Production,consumer spending,currencies,demand,economy,exports,Featured,Federal Reserve/Monetary Policy,Global Economy,global trade,imports,Labor Market,Markets,newsletter,payrolls