Summary:

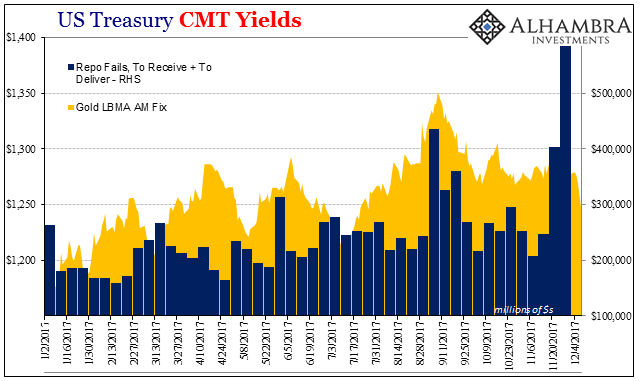

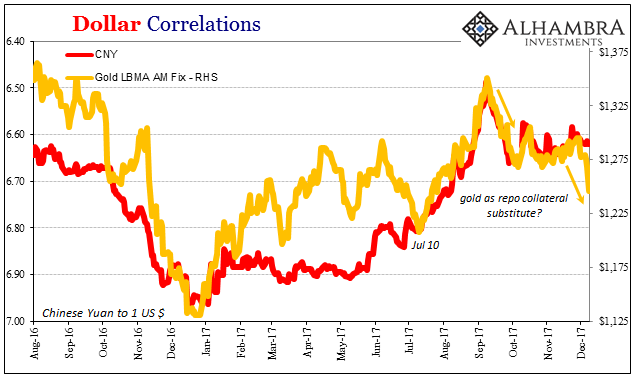

It’s been a week of quite righteous focus on collateral. The 4-week bill equivalent yield closes it at just 114 bps, with only three days left before the RRP “floor” is moved up by the FOMC to 125 bps. That’s too much premium in price, though we know why given what FRBNY reported for repo fails last week. With all that, there’s really nothing much to say about what’s below. OK, there is, but I’ll save that for next week. In the meantime, you can go back to 2013 to review the mechanics of gold as collateral-of-last-resort. US Treasuries, Jan 2017 - Dec 2017(see more posts on U.S. Treasuries, ) - Click to enlarge Dollar Correlations, Aug 2016 - Dec 2017 - Click to enlarge

Topics:

Jeffrey P. Snider considers the following as important: Collateral, currencies, economy, Featured, Federal Reserve/Monetary Policy, Gold, Markets, newsletter, Repo, The United States, U.S. Treasuries

This could be interesting, too:

It’s been a week of quite righteous focus on collateral. The 4-week bill equivalent yield closes it at just 114 bps, with only three days left before the RRP “floor” is moved up by the FOMC to 125 bps. That’s too much premium in price, though we know why given what FRBNY reported for repo fails last week. With all that, there’s really nothing much to say about what’s below. OK, there is, but I’ll save that for next week. In the meantime, you can go back to 2013 to review the mechanics of gold as collateral-of-last-resort. US Treasuries, Jan 2017 - Dec 2017(see more posts on U.S. Treasuries, ) - Click to enlarge Dollar Correlations, Aug 2016 - Dec 2017 - Click to enlarge

Topics:

Jeffrey P. Snider considers the following as important: Collateral, currencies, economy, Featured, Federal Reserve/Monetary Policy, Gold, Markets, newsletter, Repo, The United States, U.S. Treasuries

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| It’s been a week of quite righteous focus on collateral. The 4-week bill equivalent yield closes it at just 114 bps, with only three days left before the RRP “floor” is moved up by the FOMC to 125 bps. That’s too much premium in price, though we know why given what FRBNY reported for repo fails last week. With all that, there’s really nothing much to say about what’s below. OK, there is, but I’ll save that for next week. In the meantime, you can go back to 2013 to review the mechanics of gold as collateral-of-last-resort. |

US Treasuries, Jan 2017 - Dec 2017(see more posts on U.S. Treasuries, ) |

Dollar Correlations, Aug 2016 - Dec 2017 |

Tags: collateral,currencies,economy,Featured,Federal Reserve/Monetary Policy,Gold,Markets,newsletter,repo,U.S. Treasuries