We agree with the consensus that the markets are in a transition phase. The consensus sees this transition phase as a new economic convergence. European and Japanese economic growth continues above trend. Large emerging markets, including BRICs, are also expanding. Central banks are gradually moving away from the extreme accommodation. We recognize the robust economic growth, but we do not see this economic convergence has yet to produce a shift in policy. Our argument is stronger yet. Peak divergence still lies ahead. This divergence has two components: central bank balance sheets and policy rates. Not to put too fine a point on it, but the Fed’s balance sheet is going to begin shrinking, while the ECB and BOJ

Topics:

Marc Chandler considers the following as important: $CNY, EUR, Featured, FX Trends, GBP, JPY, newsletter, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We agree with the consensus that the markets are in a transition phase. The consensus sees this transition phase as a new economic convergence. European and Japanese economic growth continues above trend. Large emerging markets, including BRICs, are also expanding. Central banks are gradually moving away from the extreme accommodation.

We recognize the robust economic growth, but we do not see this economic convergence has yet to produce a shift in policy. Our argument is stronger yet. Peak divergence still lies ahead. This divergence has two components: central bank balance sheets and policy rates. Not to put too fine a point on it, but the Fed’s balance sheet is going to begin shrinking, while the ECB and BOJ balance sheets are going to continue to expand. Like it did earlier this year, ahead of the March rate hike, the Fed’s leadership again taken the market by its hand and convinced it a rate hike in December was likely despite the undershoot of measured inflation. The ECB seems several quarters away from raising rates, and the BOJ longer still.

Still, a transition is taking place. The agenda is changing. Investors know that eurozone growth appears stable at above trend levels. This creates an asymmetrical risk with the September PMI that will be reported in the week ahead. Strong readings will confirm what we already know; disappointing data will surprise.

United StatesWeakness in the key US labor market report will be quickly shrugged off as adversely skewed by the record storms. There is great uncertainty in estimating the magnitude of the distortion. The median from the Bloomberg survey is for an 85k increase in non-farm payrolls compared with an average this year of 176k. The December Fed Funds futures contract was unchanged before the weekend despite the new decline in the core PCE deflator to 1.3%, the lowest level since October 2015. The two-year note yield closed at its highest level since late ’08 before the weekend and is now only at the upper end of what the new Fed funds target range is expected to be at the end of the year. It is also the level that the Federal Reserve pays on all reserves (not just excess reserves). For the record, the ECB charges 40 bp to use its deposit facility, and the BOJ takes 10 bp. Investors have gotten some measure of the US President and his unorthodox negotiating style. The first talk of the unwinding of the Trump trade can be found near the start of the year. Lest we forget, the dollar peaked against the Mexican peso, which was seen as the ultimate Trump trade, a few days before the inauguration. The repeated health care reform fiascoes and serial dramas have served to lower expectations. Yet US yields did rise after a few more details were offered on a tax plan that the White House supports, which had been broadly negotiated by six officials. However, the 10-year yield had already recovered from 2.01%, the low for the year to nearly 2.30% before the surge in the second half of last week to almost 2.36%. The trend was already in place. And where did the yield move? Simply to the upper end of the range that has been in place since the end of Q1. In fact, last week’s high-yield print marked the third point on a trend line connecting the May and July highs as well. |

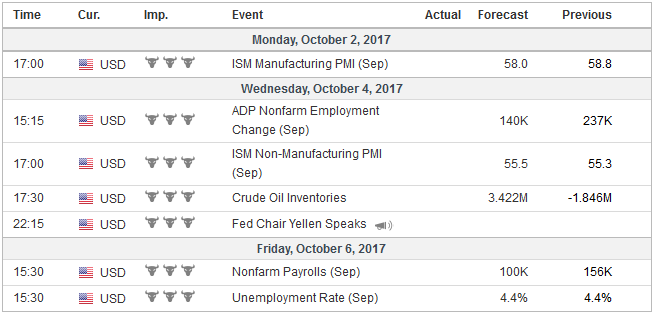

Economic Events: United States, Week October 02 |

EurozoneAlso, the betting website PredictIt attributes a 31% chance of a tax cut this year at the end of last week. On the other hand, the relative outperformance of stocks of high and low taxed companies suggests some pricing in of corporate tax cuts. What is new now are the political dynamics in Europe and Japan. Since late April when the euro gapped higher after it became clear that Le Pen was not going to win in France, the unwind of the populist fear trade (short euro), may have been just as important as the unwind of the Trump trade. The Europe political elite generally survived the crisis better than in the US. The consensus seems to see Macron an exception. He is not. He offers a new skin for the old wine. His agenda of labor reforms and tax and spending cuts are the neoliberal solution for nearly every problem for the past several decades. Lest we forget, it was the program that was imposed on Greece by its official international creditors. Merkel maybe Chancellor for the fourth time and it could be the most challenging term. Finance Minister Schaeuble appears to be the first casualty. However, the longer-term cost of including the FDP into the government is to rein the kind of institutional reforms that will be part of the post-Brexit, post-crisis Europe. Macron’s recently shared European vision will join the other numerous speeches and reports from the same genre that will be looked back upon as quaint period pieces. European politics that was seen as a headwind on the euro at the start of the year became a tailwind for most of Q2 and Q3. Now post-German election, it is a tailwind again. It is likely to take Germany most of Q4 to forge a new governing coalition. While that is taking place, little in Europe can get done. And this says nothing about the escalating tensions between Catalonia and Madrid, or Italian elections next spring, for which no electoral law has been set. Trump’s public low level of public approval is well known. What will surprise many is that it is not worse than the support for Europe’s Three Ms—Merkel, Macron, and May. |

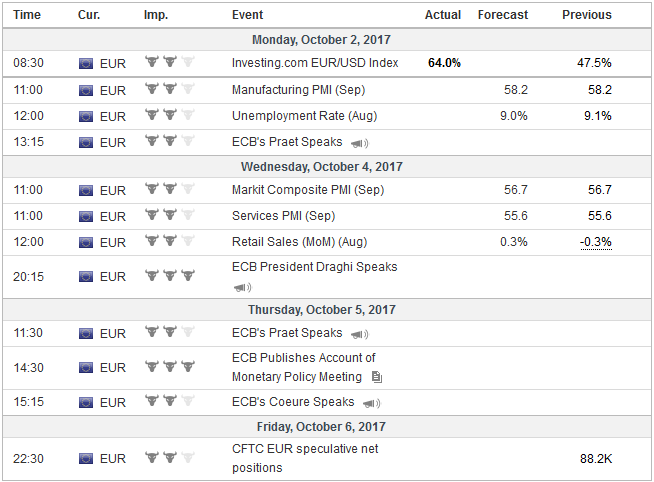

Economic Events: Eurozone, Week October 02 |

JapanJapanese politics have erupted on the stage as well. The low-level but persistent allegations wrongdoing in the Abe Administration came to a head in a stunning defeat for the Liberal Democrats by a renegade from the party. A cabinet reshuffle and the tough response to the threats posed by North Korea saw Abe support increase. Seeking to strike while the iron is hot, Abe called a snap election. The main opposition party, the Democrat Party of Japan, is folding itself into the Party of Hope, led by the Koike, the Governor of Tokyo. This may be a more formidable challenge to the LDP. There seems to be little real chance that the Party of Hope will dethrone the LDP in the October 22 election. They are simply not running a sufficient number of the candidate in what will be a 465-seat chamber (down from 475 seats currently). However, in the Japanese politics that might not be necessary. An embarrassing loss of a large number of seats, or a particularly poor showing in Tokyo districts. The risk of this should not be under-estimated. The Party of Hope has seized upon two popular issues—cancel the sales tax increase slated for 2019 and abolish nuclear power. That said, there does to appear to be an economic alternative to Abenomics, which is the traditional LDP easy monetary and fiscal policy. Abe, who previously justified the sales tax increase in terms of reducing Japan’s debt-to-GDP ratio of well over 200%. However, now he suggests some of the proceeds can be used to fund pre-school and higher education. He has proposed spending another JPY2 trillion (~$18 bln) on the initiative which will be funded by the sales tax increase. BOJ Governor Kuroda’s term ends next year. A one-term governor is a tradition. Strong support for the LDP would encourage Abe to break from tradition, while an embarrassingly large loss of seats could force Abe to hew to tradition. Kuroda’s activist approach now dominates the Board. The dissent from the recent meeting was in the direction of doing more not less. Yellen’s term is up early next year. The market believes that Cohn does not have a strong chance to replace her. The betting markets favor Warsh, who is visiting Trump at the end of last week. Trump indicated he would likely announce his decision in the coming weeks. While we had previously thought the market was under-estimating the changes that Yellen would be reappointed. The odds have moved in her favor, and we are not convinced that it is better than a one-in-three chance. |

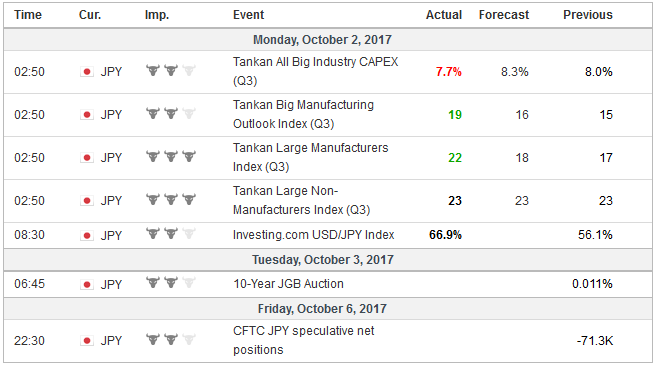

Economic Events: Japan, Week October 02 |

United KingdomThe Bank of England meeting in early September again put the market on warning that a rate hike may be delivered as early as the next MPC meeting in November. It was the first time since 2015 that Governor Carney provided such forward guidance. This helped drive sterling its strongest monthly gain (3.6%+) in four years. But here too all may not be as it seems. Inflation is expected to peak in the coming months, as last year’s sharp currency depreciation works its way out of year-over-year comparisons. The economy is slowing, and this week’s PMI readings are likely to show that momentum was still weakening as the Q3 wound down. Brexit dynamics are also changing. May’s recognition of financial obligations to the EU and her request for a transition period inches the negotiations forward. The key issue at this juncture is whether it is sufficient to persuade the EC to allow the start of parallel negotiations on the post-Brexit relationships as well the terms the separation. As Brexit talks continue and May’s position has evolved, tensions have intensified anew within the Tory Party. The week’s Conservative Party conference will likely give play to these divisions. That said, the Labour Party conference the previous week did nothing to alleviate the concerns of investors. |

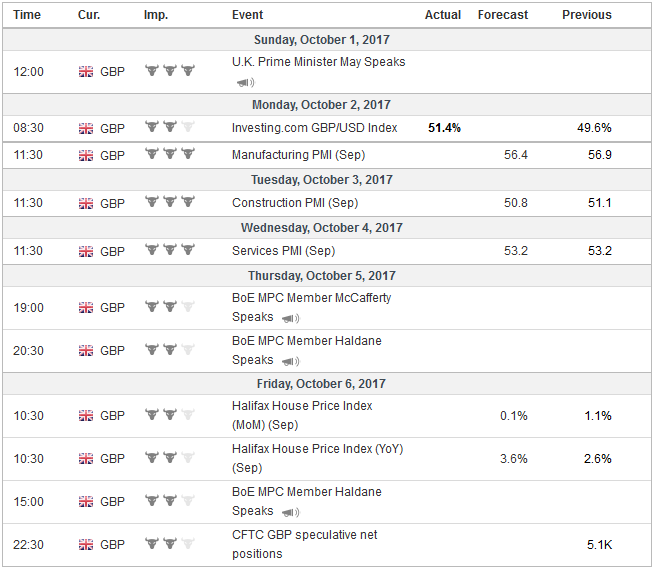

Economic Events: United Kingdom, Week October 02 |

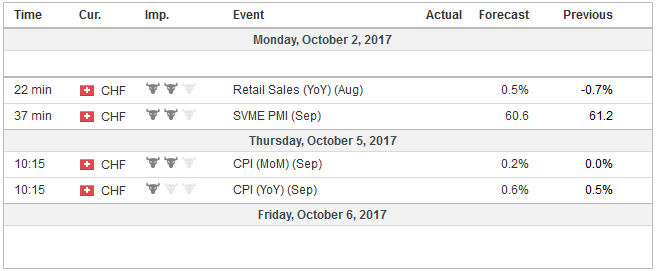

Switzerland |

Economic Events: Switzerland, Week October 02 |

China

Chinese dynamics are also changing. The strength of the economy continues to defy expectations, and the yuan’s appreciation is one of the many surprises this year. Before a week-long holiday at the start of October, China again surprised the market. Many economists expect China’s economy to slow in H2 this year, but China reported its manufacturing PMI rose to 52.4 in September, a five-year high. The median forecast was for a 51.5 reading. The Caixin measure, which weighs small business activity more, slipped to 51.0 from 51.6. The non-manufacturing PMI rose to 55.4 from 53.4 in August. The construction sector was particularly strong, while the services activity also broadly increased.

Separately, the PBOC announced that for banks that lend to small businesses the required reserve ratio will be cut by between 50 and 100 bp at the start of next year. Required reserves vary considerably in China. Across deposits at large banks, required reserves are 17%, which is among the highest in the world. The selective reduction that was announced is probably best understood not as an easing of monetary policy or providing more fuel for the credit bubble. Rather, like other policies recently introduced, it is to ensure the transmission mechanism reaches small and medium businesses.

Tags: #GBP,#USD,$CNY,$EUR,$JPY,$TLT,Featured,newsletter