Swiss Franc The Euro has fallen by 0.02% to 1.0850 CHF. EUR/CHF - Euro Swiss Franc, June 13(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of the same magnitude. The year-over-year pace slowed but not as much as expected. The greenback had bounced 1.7% in recent days, through earlier today before reversing low. The early June low new SEK8.60 was the low print for the dollar since last October. A return to it, and perhaps even toward

Topics:

Marc Chandler considers the following as important: CAD, EUR, EUR/CHF, Eurozone ZEW Economic Sentiment, Featured, FX Daily, FX Trends, GBP, Germany ZEW Economic Sentiment, JPY, newslettersent, Norwegian Krone, SEK, Spain Consumer Price Index, U.K. Consumer Price Index, U.K. House Price Index, U.S. Core Producer Price Index, U.S. Producer Price Index, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.02% to 1.0850 CHF. |

EUR/CHF - Euro Swiss Franc, June 13(see more posts on EUR/CHF, ) |

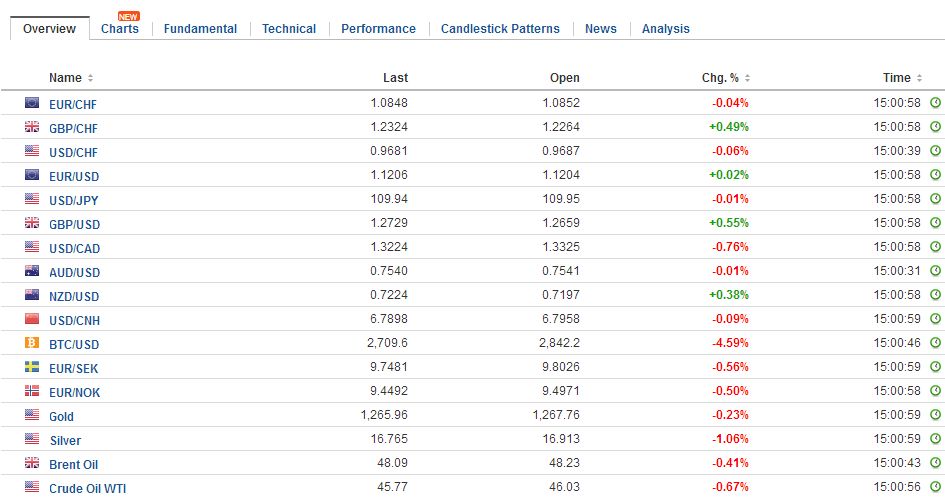

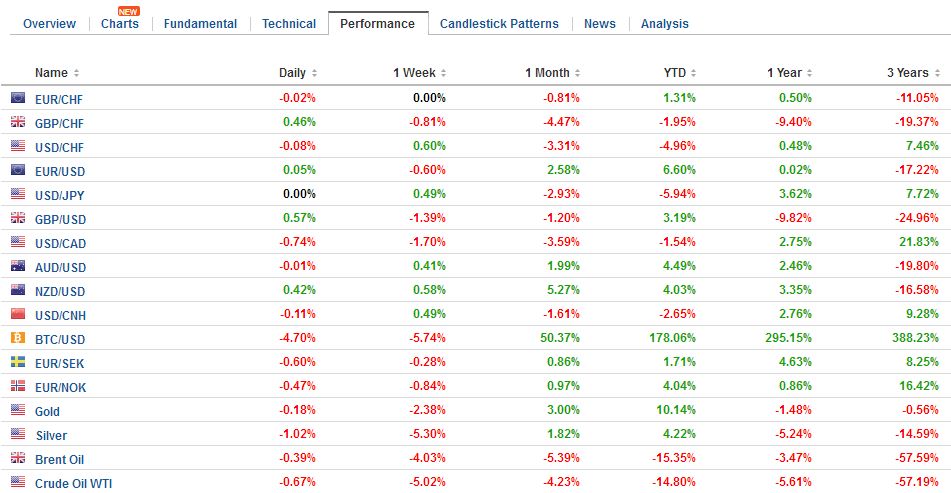

FX RatesThe US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of the same magnitude. The year-over-year pace slowed but not as much as expected. The greenback had bounced 1.7% in recent days, through earlier today before reversing low. The early June low new SEK8.60 was the low print for the dollar since last October. A return to it, and perhaps even toward SEK8.45-SEK8.50 looks likely. Norway reported strong regional economic surveys. The outlook for output over the next six months rose to its highest level in nearly 4 1/2 years. The central bank cited public investment, stronger private sector demand, and a smaller decline in the energy sector. The Norwegian krone is the second strongest major currency, up about 0.6% ($=NOK8.4265), while the Swedish krona is up around 0.8% ($=SEK8.6800). Sterling is stabilizing after the markdown after the election. May’s speech yesterday appears to have stabilized the situation for the moment as a formal agreement with the DUP is negotiated. Meanwhile, the Queen’s Speech, where the Prime Minister lays out the government’s legislative agenda has been delayed a few days, according to reports. Brexit negotiations, which were a support to start next week have also been delayed. Given that both the Tory and Labour manifesto called for leaving the EU, there may be grounds for a bipartisan approach, but it is not clear the extent of the appetite for such an approach. The UK 10-year Gilt yield pushed below 1.0% yesterday but is popping back above now. Core bond yields are firmer in Europe by two-three basis points. Peripheral yields are one-two basis points lower. US 10-year Treasuries are little changed just below 2.22% yield. This may be helping the dollar try to re-establish a foothold above JPY110.00 Canada’s 10-year yield rose six basis points yesterday to just shy of 1.50%. Last month’s high print was a little above 1.60%. The two-year yield jumped 10.5 bp to 84 bp yesterday. It is the highest level since March. The 88 bp was the highest since early 2015. |

FX Daily Rates, June 13 |

| The Canadian dollar is extending yesterday’s rally. It is up about 0.5% today after gaining about 1% yesterday. The trigger was comments by the Senior Deputy Governor Wilkins whose economic optimism spurred a reassessment of the prospects for a rate hike. She cited the broadening recovery and improving labor market as considerations when deciding how much accommodation the economy requires. The Bank of Canada next meets on July 12. That seems too soon to expect a hike, but the market is on notice that the next move will likely be a hike.

In effect, Wilkins signaled a shift in the neutral stance of the central bank, or that is the way the market understood it. Interpolating from the OIS, the market had discounted about a one-in-five chance of a hike before the end of the year as of June 1. After the June 9, strong employment report, the odds increased to one-in-four. After Wilkin’s comments, a 40% chance is discounted. Speculators appear to have been caught wrong-footed. Speculators in the CME futures had amassed a record net and gross short Canadian dollar position in late May. It has only begun to be pared as of a week ago. The record net short position reached at the end of May was 99.1k contracts. It stood at 94.5k contracts as of June 6, the most recent data point. The gross short position reached 137k contracts in the middle of May. It stood at 121k a week ago. As the shorts get squeezed, there is scope for the US dollar to fall toward CAD1.30-CAD1.31. Global equities are recouping yesterday’s losses. Of particular interest, technology shares stabilized after a two-day drubbing. MSCI Asia Pacific snapped a three-day fall and gained almost 0.3%. The Dow Jones Stoxx 600 is up 0.5% in late morning turnover. Information technology is the strongest sector, gaining almost 1%. |

FX Performance, June 13 |

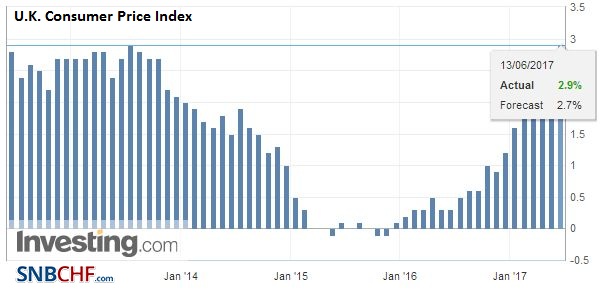

United KingdomSeparately, the UK consumer prices were firmer than expected. Headline CPI rose 0.3% for a 2.9% year-over-year pace. It was 2.7% in April. The preferred CPIH also rose 2.7% year-over-year. The core rate ticked up to 2.6% from 2.4%. The headline is the highest in four years, and the core is the highest since June 2012. It is suspected to be near the peak. Energy is already fading, leaving the past decline of sterling (~8% June 2016) as the remaining culprit. |

U.K. Consumer Price Index (CPI) YoY, May 2017(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

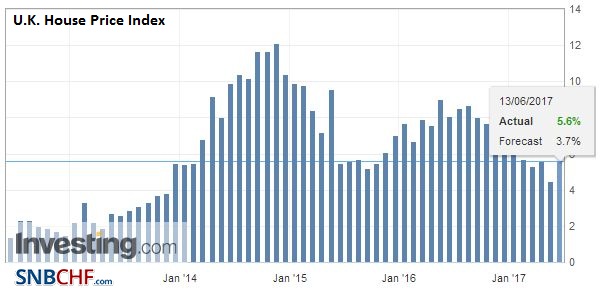

U.K. House Price Index YoY, May 2017(see more posts on U.K. House Price Index, ) Source: Investing.com - Click to enlarge |

|

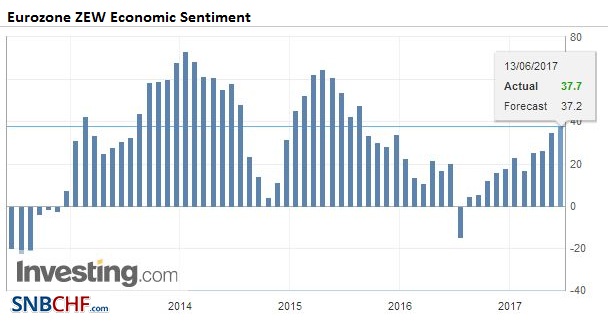

Eurozone |

Eurozone ZEW Economic Sentiment, May 2017(see more posts on Eurozone ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

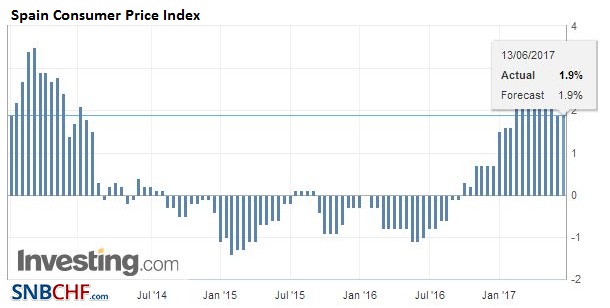

Spain |

Spain Consumer Price Index (CPI) YoY, May 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

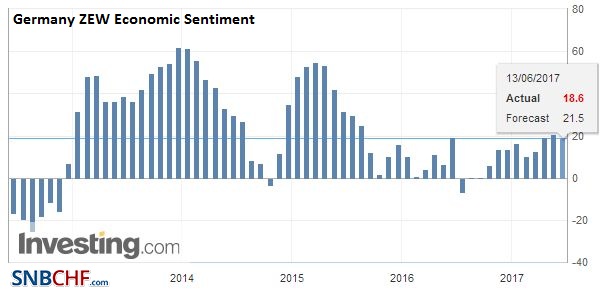

GermanyGermany’s ZEW survey showed a further gain in the assessment of the current situation to new multi-year highs. It has risen every month this year but February. In H2 2106 it alternated monthly between gains and declines. The expectations component slipped to 18.6 from 20.6. Many had expected an increase. It is the second decline of the year and snaps a three-month advance. This suggests that maybe some are beginning to think that this is the best it get, and we note the at the DAX set record highs earlier this month and is less than 1% of it now. For its part, the euro, having lost its upside momentum is consolidating and straddling the $1.12 level. |

Germany ZEW Economic Sentiment, June 2017(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

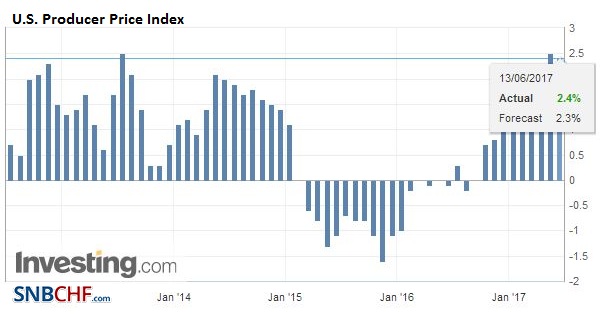

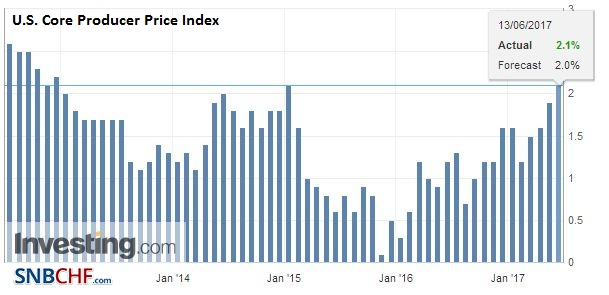

United statesThe US reports May producer prices. Small month-over-month rises are expected, which will be insufficient to prevent the year-over-year pace from softening. However, tomorrow’s CPI and retail sales reports are more important for investors. US Attorney General Sessions is scheduled to testify before the Senate Intelligence Committee, but barring some bombshell, it is unlikely to move markets. |

U.S. Producer Price Index (PPI) YoY, May 2017(see more posts on U.S. Producer Price Index, ) Source: Investing.com - Click to enlarge |

U.S. Core Producer Price Index, May 2017(see more posts on U.S. Core Producer Price Index, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone ZEW Economic Sentiment,Featured,FX Daily,Germany ZEW Economic Sentiment,newslettersent,Norwegian Krone,SEK,Spain Consumer Price Index,U.K. Consumer Price Index,U.K. House Price Index,U.S. Core Producer Price Index,U.S. Producer Price Index