This is an extract and summary from “New Gold Pool at the BIS Basle, Switzerland: Part 1” which was first published on the BullionStar.com website in mid-May. Part 2 of the series titled “New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil” is also posted now on the BullionStar.com website. “In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.” 13 December 1979 – Kit McMahon to Gordon Richardson, Bank of England A central bank Gold Pool which many people will be familiar with operated in the gold market

Topics:

Ronan Manly considers the following as important: Bank for International Settlements, Bank of England, Bank of International Settlements, Bank of New York, banque de France, Belgian central bank, Belgium, Board of the BIS, Bundesbank, Business, Central Bank Council, Central Banks, De Nederlandsche Bank, Deutsche Bundesbank, Dutch central bank, economy, European Economic Community, European Monetary Cooperation Fund, European System of Central Banks, Featured, Federal Reserve, Federal Reserve Bank, Federal Reserve Bank of New York, Finance, Foreign Central Banks, Foreign exchange market, France, Germany, Gold & Switzerland, Gold as an investment, Gold Standard, International Monetary Fund, London Gold Pool, Money, National Bank of Belgium, Netherlands, Netherlands central bank, newslettersent, None, OPEC, Organization of Petroleum-Exporting Countries, Paul Volcker, Precious Metals, recovery, Saudi Arabia, Saudi Arabian Monetary Authority, Swiss National Bank, Switzerland, U.S. Treasury, World Health Organization

This could be interesting, too:

investrends.ch writes Deutsche Bundesbank warnt vor wachsenden Systemrisiken

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

This is an extract and summary from “New Gold Pool at the BIS Basle, Switzerland: Part 1” which was first published on the BullionStar.com website in mid-May.

Part 2 of the series titled “New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil” is also posted now on the BullionStar.com website.

| “In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.” 13 December 1979 – Kit McMahon to Gordon Richardson, Bank of England

A central bank Gold Pool which many people will be familiar with operated in the gold market between November 1961 and March 1968. That Gold Pool was known as the London Gold Pool. This article is not about the 1961-1968 London Gold Pool. This article is about collusive central bank discussions relating to an entirely different and more recent central bank Gold Pool arrangement. More than 11 years after the London Gold Pool had been abandoned, the very same central banks convened in late 1979 and early 1980 for a series of collusive central bank discussions aimed at reaching agreement on joint central bank action to subdue and manipulate downwards the free market gold price. These new discussions took place at the headquarters of the Bank for International Settlements (BIS) in Basle, Switzerland, in the actual office of the President of the BIS, and were attended by a handful of the world’s most powerful central bankers. These discussions also took place in an era of soaring free market gold prices, in the midst of the run-up in the gold price to US$850 in January 1980. Central to illustrating how the most powerful central bankers in the world colluded to attempt to establish a new Gold Pool are a number of internal documents from the Bank of England which provide a detailed blueprint on the evolution of these collusive discussions at the BIS, as well as providing detailed insights into the thinking of the senior Bank of England executives involved in the meetings. These internal correspondence documents from 1979 and 1980 can be thought of as the equivalent of internal emails in the era before corporate email systems. Above all, these collusive BIS meetings show intent. Intent by a group of the world’s most powerful central banks to manipulate a free market gold price so as to distort free market gold pricing signals. Therefore, these documents are timeless in that regard. The documents also illustrate the concern that a rising gold price in the free market creates for senior central bankers, and importantly, also shows that these same central bankers have no qualms, at least from a legal or moral perspective, of intervening to manipulate a gold price when they see it as a threat to their fiat currency monetary system. Since many names of high level central bankers crop up in the discussions and documents, to provide context, it is helpful to provide some short background summaries on who these people were and what roles they occupied. It is also helpful to provide some brief context on gold price movements during the period under discussion. |

|

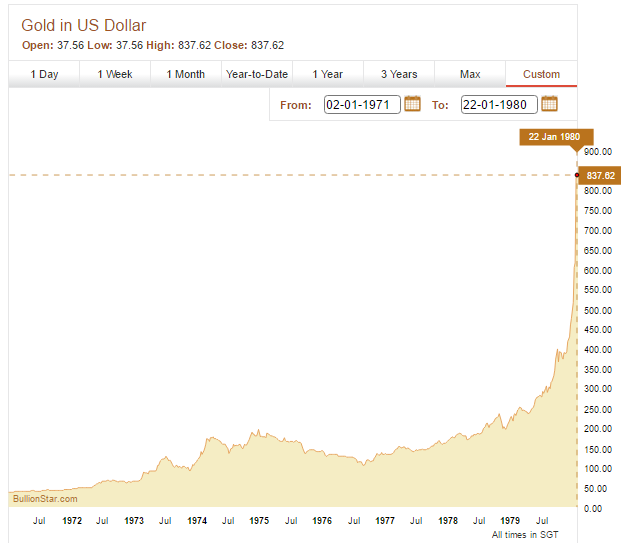

The Gold Price Run-up during 1979 and 1980When the London Gold Pool collapsed in mid-March 1968, a two-tier gold market took its place, with the private market gold price breaking higher, while central banks continued to trade gold with the Federal Reserve Bank of New York (FRBNY) and US Treasury at the official price of US$ 35 per ounce. However, in August 1971, Nixon closed this FRBNY / Treasury ‘Gold Window’ by ending the convertibility of US dollar liabilities into gold that had up to then still been an option for foreign central banks and foreign governments. This was the birth of the free-floating gold price. By the end of 1974, the US dollar gold price had soared to $187 per troy ounce. Following this, the next 3 years saw the gold price first trade down to near $100 during August 1976 before resuming its uptrend. Year-end gold prices over this period were in the $135 – $165 range. In 1978, the price again broke to a record high and finished the year at $226 per ounce. See chart below. |

Gold Price, January 1971 - January 1980(see more posts on gold price, ) |

| But it was in 1979 that the US dollar gold price really took off, setting record after record, a bit like the records that are being set by cryptocurrencies right now. In July 1979, the $300 level was breached for the first time. During October 1979, the gold price then took out $400 for the first time. During December 1979, the gold price hit $500. While these late 1979 price increases were in themselves phenomenal, what then occurred in January 1980 was even more striking, for in the space of a few weeks, the price rocketed up first through $600, then $700, and then through the $800 level before peaking in late January 1980 at a then record of $850 per ounce. See chart below.

The mid-1970s saw a flurry of official gold sales to the market which although strategically designed in part to subdue the gold price, in practice didn’t achieve that goal over the medium term. Between June 1976 and May 1980, the International Monetary Fund sold 25 million ounces (777 tonnes) of gold in 45 public auctions. Between May 1978 and November 1979, the US Treasury sold 8.05 million ounces of high grade gold (99.5% fine) and 7.75 million ounces of low grade gold (90% fine) in 23 auctions to the private market. That’s just over 15 million ounces (466 tonnes) of gold in total auctioned by the Treasury. The last US Treasury auctions were on 16 October 1979 when 750,000 ounces of low grade coin bars were auctioned, and then on 1 November 1979 when the Treasury implemented a variable sales quantity approach and auctioned 1,250,000 ounces of low grade coin bars. On 15 January 1980, the US Treasury Secretary announced an official end of US gold sales. As the 1980 annual report of the bank for International Settlements noted when reviewing the 1979 gold market: “The further increase in [gold] supplies was overshadowed by the dramatic rise in the demand for gold which, in the space of little over a year, caused the London market price to increase more than fourfold to a peak of $850 per ounce in January 1980.” “In addition to its sheer magnitude, last year’s [1979] gold price rise had three other remarkable features: firstly, it took place against all major currencies, including those whose value had increased most during the 1970s. Secondly, it took place at a time of generally rising interest rates in the industrialised world, one effect of which was to increase the cost of holding gold. Thirdly, it took place at a time when, by and large, the dollar was strengthening in the exchange markets.” It is against this background of surging gold prices, pre-existing gold auctions, turmoil in currency markets, slow growth and high inflation, that the first of the collusive Gold Pool discussions took place between September 1979 and January 1980 at the BIS. |

Gold Price, January 1973 - June 1980(see more posts on gold price, ) |

A Who’s Who of Central Banksters

The following document is the 4th main document in the Bank of England series of documents. all of which can be seen in “New Gold Pool at the BIS Basle, Switzerland: Part 1“.

This document, displayed in blue text below, is a briefing letter from Bank of England executive director Kit McMahon to the Bank of England’s Governor Gordon Richardson, written on 13 December 1979, referring to the Gold Pool discussion meeting which took place in the office of the BIS President Jelle Dijlstra on Monday 10 December 1979. This is probably the most important documented featured in Part 1 of the two part article series, since it provides an in-depth insight into one of the collusive Gold Pool discussion meetings which the most powerful central bank governors of the time attended discussing the creation of a syndicate to manipulate down the free market price of gold.

Christopher McMahon, known as ‘Kit’ McMahon, was an executive director at the Bank of England from 1970 to 1980, before becoming Deputy Governor of the Bank of England on 1 March 1980. Prior to McMahon’s promotion, Jasper Hollom was Deputy Governor of the Bank of England. Kit McMahon’s full name is Christopher William McMahon, hence he signed his his internal Bank of England memos and correspondence with the initials ‘CWM’. McMahon left the Bank of England in 1986 to take up the role of Chief Executive and Deputy Chairman of Midland Bank. In 1987, McMahon was also made Chairman of Midland Bank. McMahon left Midland in 1991. Since 1974, Midland Bank had also owned Samuel Montagu, one of the five traditional bullion firms of the London Gold Market. HSBC acquired full ownership of Midland in 1992 after acquiring a 15% stake in 1987 when McMahon was Chairman and Chief Executive of Midland. See profiles of McMahon here and here.

THE GOVERNOR of the Bank of England – Gordon Richardson. Richardson was Governor of the Bank of England for 10 years from 1973 to 1983, and a non-executive director of the Bank of England between 1967 and 1973. He was chairman of J. Henry Schroder Wagg from 1962 to 1972, and chairman of Schroders from 1966 to 1973. Richardson was also a director of Saudi International Bank in London. Saudi International Bank was formerly known as Al Bank Al Saudi Al Alami when it was incorporated in London in 1975, and is now known as Gulf International Bank UK Limited.

The following countries were represented at this 10 December meeting: UK, Switzerland, West Germany, France, Netherlands, Belgium.

The following central banks were represented at the meeting:

- Zijlstra – BIS and Netherlands central bank

- McMahon – Bank of England

- Emminger – Deutsche Bundesbank

- Pohl – Deutsche Bundesbank

- de la Geniere – Banque de France

- de Strycker – Belgian central bank

- Leutwiler – Swiss National Bank

- Larre – Bank for International Settlements

Zijlstra refers to Dr. Jelle Zijlstra, Chairman and President of the Bank for International Settlements (BIS) from 1967 to December 1981. Zijlstra was also simultaneously President of the Dutch central bank, De Nederlandsche Bank (DNB) from 1967 until the end of 1981. Notably, Zijlstra was also Dutch Prime Minister for a short period during 1966-67.

Emminger refers to Otmar Emminger, President of the Deutsche Bundesbank from 1 June 1977 to 31 December 1979. Emminger was one of the principal architects of the IMF’s synthetic Special Drawing Right (SDR) in 1969 which was designed to be a competitor of and replacement for gold.

Pohl refers to Karl Otto Pohl, President of the Deutsche Bundesbank from 1980 to 1991, and vice-President of the Bundesbank between June 1977 to December 1979. Note that Emminger retired in December 1979, with Karl Otto Pohl taking his place.

Leutwiler refers to Fritz Leutwiler, Chairman of the Swiss National Bank (Switzerland’s central bank) from May 1974 to December 1984. Leutwiler was also a member of the board of the BIS from 1974 to 1984, and served as President of the BIS between January 1982 and December 1984, as well as Chairman of the Board of the BIS from January 1982 to December 1984.

De la Geniere refers to Renaud de La Genière, Governor of the Banque de France from 1979 to 1984.

De Stryker refers to Cecil de Strycker, Governor of the National Bank of Belgium from February 1975 to the end of February 1982. At that time, De Stryker was also president of the European Monetary Cooperation Fund and then president of the Committee of Governors of the Central Banks of the Member States of the European Economic Community.

In the meeting document, the name Larre refers to René Larre, General Manager of the BIS. Larre was BIS General Manager from May 1971 to February 1981.

SECRET

[From McMahon]

To: The Governors Copies to : Mr Payton, Mr Balfour, Mr Sangster , Mr Byatt only

GOLD POOL

In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10thDecember to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.

Larre began by outlining a way in which a possible gold pool might be handled. The BIS could undertake all the operations on behalf of a group of central banks on the basis of rather general criteria which would be reviewed monthly. The criteria would take into account not merely the developments of the price of gold but the affect any such developments appeared to be having on the dollar. Thus they would envisage selling only when gold was relatively strong and the dollar relatively weak and buying only in the reverse circumstances. They thought that they at least might start with a sum of around 20 tons (equals around $300 million at present prices). They could take running profits of losses on their books for a considerable period and though participating central banks would have to envisage the possibility of an ultimate loss or gain in gold, in practice all that might be involved would be a loss or gain in dollars. On this point both Zijlstra and Leutwiler emphasised that they were already liable to suffer substantial losses on their dollar reserves and would not be worried by the potential losses that they might they might sustain on this scheme.

In answer to a question from me, Zijlstra confirmed that the US realised that if any gold pool were developed, the European central banks would intend to buy back in due course any gold they sold. He said they were unhappy that the Europeans were not prepared to sell gold outright but they accepted it. Larre pointed out in parenthesis that Tony Solomon was probably the only American now or in the recent past that would be prepared to accept such a line. He knew that Wallich and probably Volcker was against the whole idea.

Page 2

Zijlstra and Leutwiler said they were both strongly in favour of going ahead on the basis Larre had suggested. They then asked what the other thought.

Emminger said that he had put this proposition to his Central Bank Council who were unanimously against it. His hands were therefore at present totally tied.

De Strycker said he was extremely doubtful about the scheme. He thought it was neither desirable nor necessary and carried considerable dangers. De la Geniere was also negative stressing the great political dangers for him of selling any French gold in this indirect way.

Leutwiler then suggested that they should do it the other way round: wait until the gold price went below 400 and then start the operation by buying. When the BIS had bought, say, 20 tons they would have a masse de manoeuvre which they could then sell. La Geniere said that this might be easier for him and he would consider the possibility of doing something along these lines. Emminger also said, though without much confidence, that it was possible that if the operation were to start along these lines and if it appeared to be going well, it might be possible to persuade the Central Bank Council to join in.

Leutwiler and Zijlstra then said that although they did not think a very large group was necessary to undertake the operation it probably had to be bigger than Two: specifically they really needed either the French of the Germans. Zijlstra said that although he had formal powers to do this he did not wish to do it without carrying his Government with him. The Government was still doubtful and would probably need to know that a number of other countries were going along with it.

At various points during the meeting there was a discussion about publicity for the operation and at an early point Zijlstra said that publicity was both inevitable and desirable if the operation was to have a maximum effect. He brushed aside my suggestion that while the publicity for any selling operations would be helpful, that attached to the later (or on the revised scheme, earlier) buying could be rather inflammatory. However, if the scheme were to be

Page 3

simply a BIS one, publicity would not necessarily, or perhaps desirably, arise. This point was not really addressed in the discussion.

I made a number of sceptical points about the failure of commodity stabilisation schemes of all kinds in the past and the dangers of getting drawn in gradually to bigger and bigger commitments. Leutwiler said that there was no danger because the losses would be small. I said that I envisaged political dangers. If it got known that the central banks were involving themselves in the price of gold, however much they said it was only a smoothing rather than a stabilising operation, they would find themselves on a tiger. If the price of gold went on rising they would either have to increase their efforts or add to the upward pressure o gold by pulling out.

None of this carried any weight with anybody except perhaps de Strycker. In any case I was not asked for any commitment from us. There was, in fact, no discussion of whether or how contributions to the scheme would be based, but presumably it would be in relation to gold holdings so that they would not expect much from us.

The meeting ended with Leutwiler saying he would approach the Canadians and Japanese to see how they felt about the idea while Zijlstra would talk to the Italians. All would then think further about it and revert in January.

I must say I remain personally extremely sceptical about the desirability and efficacy of any scheme along the lines so far suggested.

CWM

13th December 1979

The original pages of this meeting briefing written by McMahon can be seen here: Page 1, Page 2 and Page 3. The links may take a little while to load first time clicked.

The following key points are notable from McMahon’s briefing of the 10 December Gold Pool discussions meeting. Zijlstra and Leutwiler acted as the 2 main advocates of the proposed Gold Pool arrangement. This is important to remember because Zijlstra was the President of the BIS at that time and Leutwiler became President of the BIS at the beginning of 1982 taking over from Zijlstra. So the heads of the BIS in the early 1980s were both firm advocates of the need for a new Gold Pool. Zijlstra and Leutwiler probably also represented the two most independent central banks present at the discussions, namey the Dutch and Swiss central banks.

The market mechanics of the proposals discussed in the meeting are also classic collusive Gold Pool tactics to torpedo the gold price by “selling only when gold was relatively strong and the dollar relatively weak and buying only in the reverse circumstances.”

The discussion also made it clear that the preferred approach would be to operate as both a selling syndicate and a buying consortium as “European central banks would intend to buy back in due course any gold they sold.” It was even suggested that the buying could occur first so as to create an inventory of physical gold with which to use to fund the selling interventions, i.e “wait until the gold price went below 400 and then start the operation by buying. When the BIS had bought, say, 20 tons they would have a masse de manoeuvre which they could then sell.”

Given that René Larre, the BIS General Manager, began the meeting shows that he was meeting coordinator in his capacity as BIS General Manager. It is also very interesting that McMahon states that “the BIS could undertake all the operations on behalf of a group of central banks” that could be “reviewed monthly”, which underlines the fact that overall, this could be viewed as a BIS led scheme, controlled and operated out of Basle.

A BIS scheme would also allow the Gold Pool to operate in secrecy, out of public view. In the words of McMahon “if the scheme were to be simply a BIS one, publicity would not necessarily, or perhaps desirably, arise“.

As mentioned, the above is just an extract from much more detailed article titled New Gold Pool at the BIS Basle, Switzerland: Part 1”. That article provides a full background to the above, including:

- There were an entire set of central banker discussions from September to December 1979, that led up to the meeting profile above.

- At the IMF annual conference in Belgrade in early October 1979, the US monetary authority delegation in the form of Paul Volcker, William Miller, Tony Solomon, and Henry Wallich approached Fritz Leutwiler, Chairman of the Swiss National Bank, and discussed a proposal to launch a joint central bank gold selling operation.

- During the discussions at the BIS, Zijlstra, who was BIS President until the end of 1981, and Leutwiler, who became BIS President in January 1982, were both strongly in favour of launching a new joint central bank gold pool to manipulate the gold price.

- The oil-producing cartel OPEC was at that time, “increasingly concerned that gold was outpacing oil”, but Al Quraishi, Governor of the Saudi Arabian Monetary Authority (SAMA) had made an assurance that the Saudi’s “would not rock the boat” and buy gold on the market if a new gold pool was activated. However, Al Quraishi and SAMA were still eager to “diversify” the reinvestment of the Saudi oil revenues into gold.

- The Bank of England recorded market intelligence in October 1979 that the “USA was planning to sell 10 million ounces of gold in four separate unannounced operations” before the end of 1979 so as to “placate the Saudi Arabians.“

- The Bank of England’s foreign exchange and gold specialist at that time, John Sangster, thought that there was “a need to break the psychology of ‘the market can only go one way and that is up’.”

- Sangster’s view was also that there was “no question of any permanent stabilisation of the gold price, merely at a critical time holding it within a target area”, an operation he called a “smoothing operation”.

- The first meeting to discuss a new collusive gold pool took place in the BIS office of Zijlstra on Monday 12 November 1979, whose invitees (in addition to Jelle Zijlstra) were Gordon Richardson, Governor of the Bank of England, Cecil de Strycker, Governor of the National Bank of Belgium, Fritz Leutwiler, Chairman of the Swiss National Bank, Bernard Clappier, Governor of the Banque de France, and Otmar Emminger, President of the Bundesbank.

Following this 10 December meeting, the governors returned to their respective banks and recessed for Christmas and New Year, returning to Basle in early January 1980 where the next Gold Pool meeting took place on 7 January 1980, in a historic month in which the gold price rocket from $515 to $850 in a matter of weeks.

Conclusion

Did these discussions lead to the formation of a new Gold Pool operated out of the BIS in Basle? That is for you to decide. As well as reading “New Gold Pool at the BIS Basle, Switzerland: Part 1“, we encourage you to read “New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil“.

Part 2 takes up where Part 1 left off, and begins by looking at developments in the BIS Gold Pool discussions during January 1980, a month in which the US dollar gold price rocketed more than 60% during a three-week period to reach a then record of $850 per ounce. Part 2 then looks at how the discussions involving these central banks evolved over the remainder of 1980 and 1981 as key high level central bankers continued to call for intervention into the gold market. Part 2 also looks at evidence that central bankers party to the discussions began advocating gold for oil exchanges between the West and the Saudi Arabia, exchanges which would provide real wealth (gold) to the Arabs in exchange for oil flowing to the West, while simultaneously keeping a lid on the gold price.

In their own words:

“If any operation were ever contemplated, it would have to be geared at some concept of the developing real price of gold and not attempt to hold any particular nominal level. It would almost certainly not be a pool with any significant potentail for recovery of gold sold. Rather it would enable OPEC to acquire some modicum of the chief inflation-proof asset without an excessive rise in the price.”

“This is not to advocate gold for oil directly; the price haggling would be too acrimonious. Market intermediation should allow the G10 to move with the price while attempting to control its pace as well as break off the experiment when possible or necessary.” – John Sangster to Gordon Richardson, Anthony Loenhis & Kit McMahon, Bank of England, 17 September 1980

“I feel that it is necessary for us, within the Group of Ten and Switzerland, to consider ways to regulate the price of gold, admittedly within fairly broad limits” – Jelle Zjilstra, BIS Chairman and President and Dutch central bank President, 27 September 1981

“First, there is the meeting on the Gold Pool, then, after lunch, the same faces show up at the G-10″ – Bundesbank President Karl Otto Pohl to journalist Edward Jay Epstein, in a conversation at the Bundesbank in 1983

Tags: Bank for International Settlements,Bank of England,Bank of international Settlements,Bank of New York,Banque de France,Belgian central bank,Belgium,Board of the BIS,Bundesbank,Business,Central Bank Council,central banks,De Nederlandsche Bank,Deutsche Bundesbank,Dutch central bank,economy,European Economic Community,European Monetary Cooperation Fund,European System of Central Banks,Featured,Federal Reserve,Federal Reserve Bank,Federal Reserve Bank of New York,Finance,Foreign Central Banks,Foreign exchange market,France,Germany,Gold as an investment,gold standard,International Monetary Fund,London Gold Pool,money,National Bank of Belgium,Netherlands,Netherlands central bank,newslettersent,None,OPEC,Organization of Petroleum-Exporting Countries,Paul Volcker,Precious Metals,recovery,Saudi Arabian Monetary Authority,Saudi-Arabia,Swiss National Bank,Switzerland,U.S. Treasury,World Health Organization