Swiss Franc The franc is off another 0.5% today, to bring its weekly loss to a sharp 2.5%. EUR/CHF and USD/CHF, July 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly lower, though one of the features of recent days has been the dramatic slide of the Swiss franc, and that is continuing today. The euro finished last week near CHF1.1030 and is now near CHF1.1370; its highest level since the cap was lifted in mid-January 2015. The dollar-bloc currencies are underperforming a bit, but the European complex is firm, led by the Swedish krona, which has been buoyed by a sharp jump in Q2 GDP. The 1.7% quarterly expansion in the April to June period was

Topics:

Marc Chandler considers the following as important: equities, EUR/CHF, Eurozone Consumer Confidence, Featured, France Consumer Price Index (harmonized), France Gross Domestic Product, FX Trends, Germany Consumer Price Index, Japan Household Spending, Japan National Core Consumer Price Index, Japan Unemployment Rate, JPY, newslettersent, SEK, Spain Consumer Price Index, Spain Gross Domestic Product, TLT, U.S. Gross Domestic Product, U.S. Michigan Consumer Sentiment, USD, USD/CHF

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

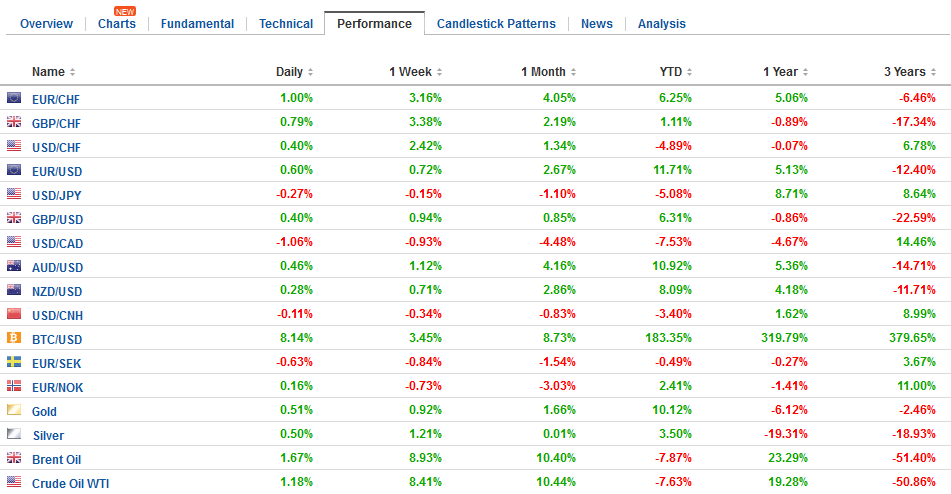

Swiss FrancThe franc is off another 0.5% today, to bring its weekly loss to a sharp 2.5%. |

EUR/CHF and USD/CHF, July 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

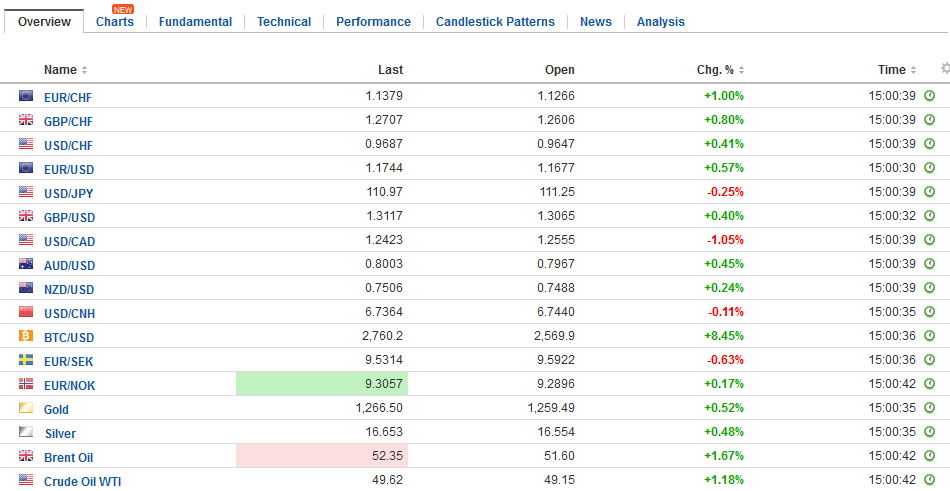

FX RatesThe US dollar is mostly lower, though one of the features of recent days has been the dramatic slide of the Swiss franc, and that is continuing today. The euro finished last week near CHF1.1030 and is now near CHF1.1370; its highest level since the cap was lifted in mid-January 2015. The dollar-bloc currencies are underperforming a bit, but the European complex is firm, led by the Swedish krona, which has been buoyed by a sharp jump in Q2 GDP. The 1.7% quarterly expansion in the April to June period was near twice expectations. The nearly 1% rise of the krona today lifts the weekly gain to 1.25% and extending the rally for a fifth consecutive week. Global equity markets are sliding, as the high flying technology sector succumbs to profit-taking pressures. US S&P technology sector is up 22% year-to-day. The retreat began in the US yesterday, and continued in after hours trading, following the disappointing news from Amazon. The decline carried over into Asia, where the MSCI Asia Pacific Index was off 0.7%, and offset the gains earlier in the week to close fractionally lower for the week, and on its lows. Chinese equities were resilient and were the only large market in the region to close higher. The tech heavy Korean Kospi slid 1.7%, the most since last November. |

FX Daily Rates, July 28 |

| European equities are also heavy. The Dow Jones Stoxx 600 is off 1% in morning turnover. Information technology, telecom, and materials are the hardest hit sectors. The benchmark was up 0.5% on the week coming into today, so without a recovery, it will finish lower for the second consecutive week. It has declined in seven of the past 10 weeks.

The retreat in equities is not providing the bond markets with a good bid. Bond markets are also heavy, and benchmark 10-year yields in Europe are 3-6 basis points and are 6-9 basis points higher on the week. The US 10-year yield is up a single basis point at 2.32%, a six basis point increase on the week. There are several developments to note. In the US, there have been two important legislative events that will likely underscore investor anxiety about Trump Administration’s economic agenda going forward. First, in the House of Representatives, the Border Adjustment Tax (BAT) has been dropped from the tax reform measures being debated. This is important, not so much because it indicates a step away from protectionism, but because without the funds from BAT, significant tax reform is considerably more difficult. Moreover, and secondly, the Senate’s efforts to repeal and replace or even repeal the Affordable Care Act has been defeated, and the bill has been pulled. |

FX Performance, July 28 |

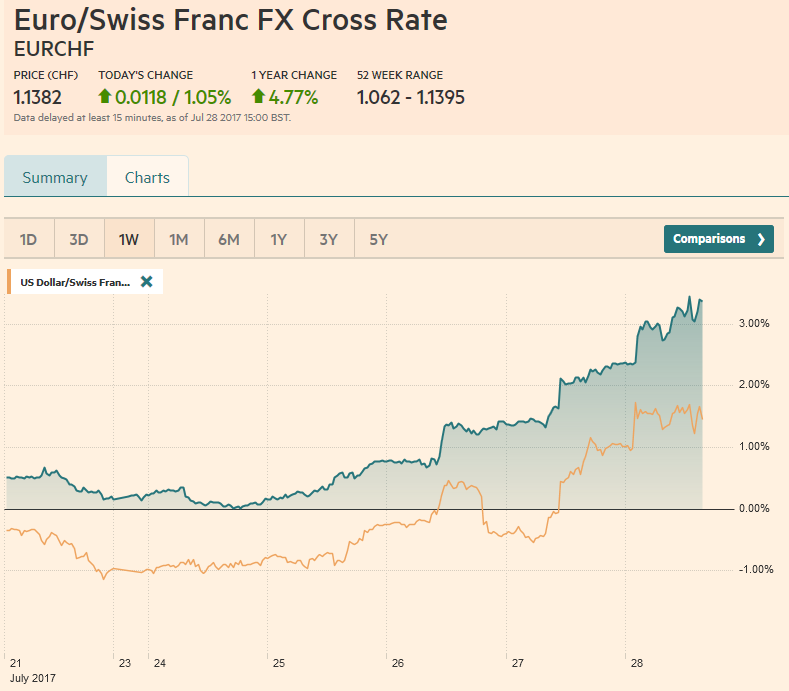

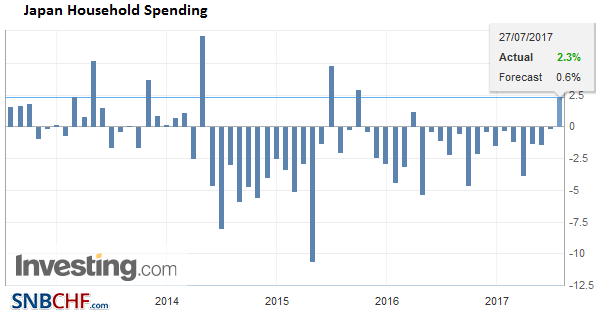

JapanIn Japan, the labor market got tighter, and consumers shopped, but price pressures remained minimal. The unemployment rate unexpectedly fell to 2.8% in June from 3.1%, and that job-to-applicant ratio rose to 1.51 from 1.49. |

Japan Unemployment Rate, June 2017(see more posts on Japan Unemployment Rate, ) Source: investing.com - Click to enlarge |

| On a year-over-year basis, household spending rose 2.3%. It is the first rise in over a year. |

Japan Household Spending YoY, June 2017(see more posts on Japan Household Spending, ) Source: investing.com - Click to enlarge |

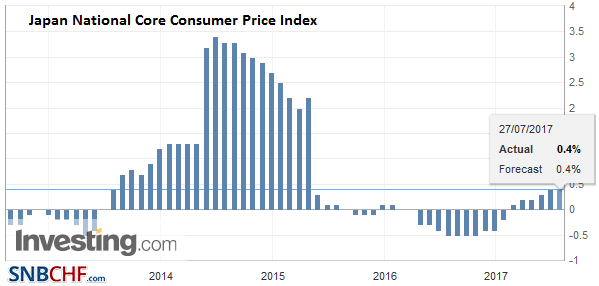

| On the other hand, headline and core CPI was unchanged at 0.4% year-over-year. |

Japan National Core Consumer Price Index (CPI) YoY, June 2017(see more posts on Japan National Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

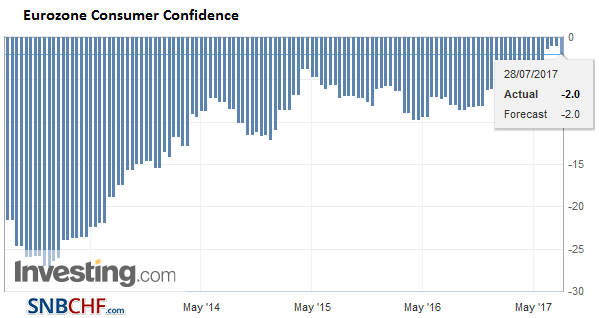

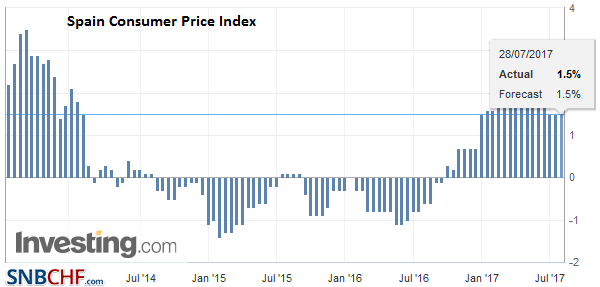

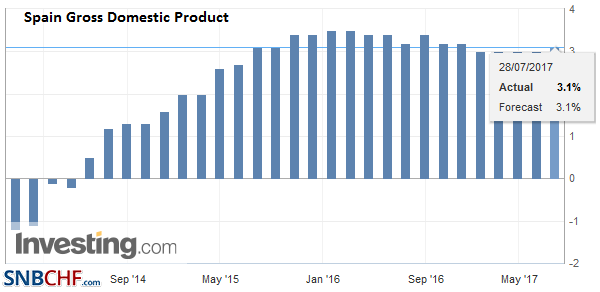

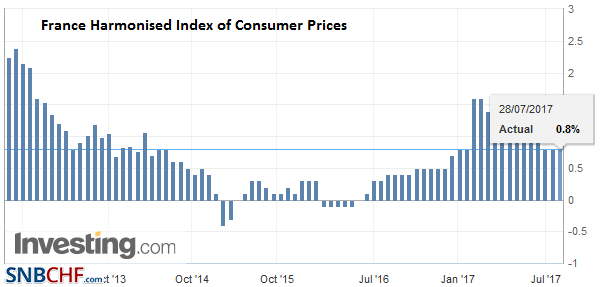

EurozoneIn Europe, Germany and Spain have reported preliminary July CPI figures, while Spain and France have also reported Q2 GDP. The eurozone aggregate figure will be reported next week. It is expected to be unchanged at 1.3% on the headline and 1.1% at the core. |

Eurozone Consumer Confidence, July 2017 (flash)(see more posts on Eurozone Consumer Confidence, ) Source: investing.com - Click to enlarge |

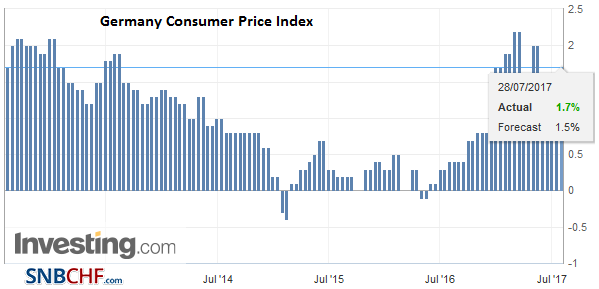

GermanyGerman states have reported, and this suggests a risk that the national figure that will be reported in the German afternoon may have risen 0.3-0.4% on the month for a year-over-year rate little changed from June’s 1.5% pace. |

Germany Consumer Price Index (CPI) YoY, July 2017 (flash)(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

SpainAppears that fuel prices were behind the tick up in Spanish headline CPI which rose to 1.7% from 1.6%. |

Spain Consumer Price Index (CPI) YoY, July 2017 (flash)(see more posts on Spain Consumer Price Index, ) Source: investing.com - Click to enlarge |

| Spain’s GDP expanded 0.9% in Q2, in line with expectations, and lifted the year-over-year pace to 3.1% from 3.0%. |

Spain Gross Domestic Product (GDP) YoY, Q2 2017(see more posts on Spain Gross Domestic Product, ) Source: investing.com - Click to enlarge |

FranceWe noted earlier in the week that there were rising tensions between France and Italy. France had apparently taken credit for developments in Libya that were partly due to Italy’s initiatives. Those tensions intensified following President Macron’s decision to block and Italian takeover of French shipyard company but nationalizing it. It had been owned by a Korean company previously. While Macron’s honeymoon seems over, Japan’s Abe failed to turn the tide of that has seen his public support wane (a poll at the start of the week, put it at 26%, the lowest since he returned to power in 2012). What was seen as an uninspired testimony before the Diet this week failed to lift the cloud of scandal and misuse of power allegations. A cabinet reshuffle is expected next week, and the much-maligned defense minister resigned earlier today. |

France Harmonised Index of Consumer Prices (HICP) YoY, Jul 2017 (flash)(see more posts on France Consumer Price Index (harmonized), ) Source: investing.com - Click to enlarge |

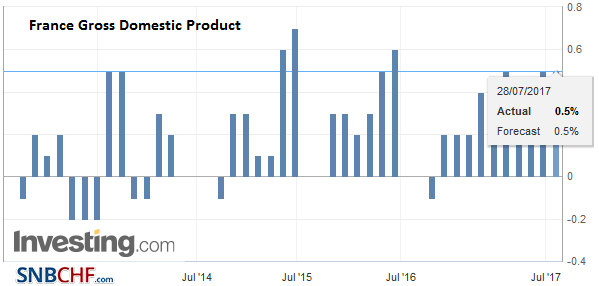

| France’s Q2 GDP rose 0.5%, matching the Q1 increase. This was sufficient to lift the year-over-year pace to 1.8% from 1.1%. It is the fastest growth since Q3 2011. The improvement in net exports appears largely offset by the decline in inventories. Consumption was soft at 0.2%, (separately France reported a 0.8% decline in June consumption, twice the decline expected). |

France Gross Domestic Product (GDP) QoQ, Q2 2017(see more posts on France Gross Domestic Product, ) Source: investing.com - Click to enlarge |

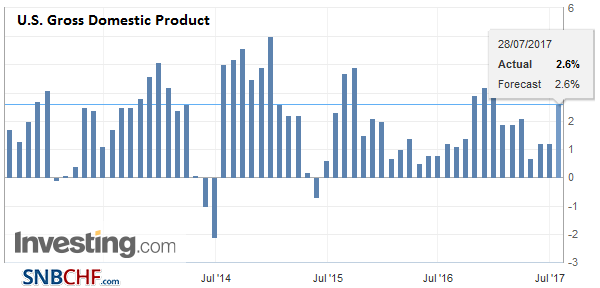

United StatesThe data focus in North America is on GDP. The US reports its first look at Q2 GDP. The Atlanta Fed’s GDP Now sees the economy tracking 2.8% annualized growth. The NY Fed’s tracker put it at 2.0% at the end of last week. The median forecast from the Bloomberg survey is 2.8%. Our own guesstimate is a bit lower. In terms of details, the consumer is expected to have recovered from the 1.1% pace in Q1 to something close to 2.75%-3.0%. On the other hand, the deflator, including the core PCE deflator may have softened considerably. For its part, Canada reports May GDP. A 0.2% gain would lift the year-over-year rate to 4.1% from 3.3% in April. It would be the fastest year-over-year pace in six years. |

U.S. Gross Domestic Product (GDP) QoQ, Q2 2017(see more posts on U.S. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

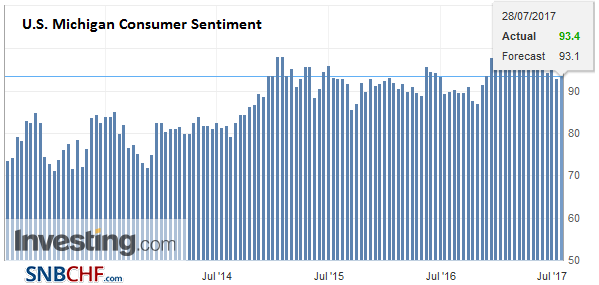

U.S. Michigan Consumer Sentiment, July 2017 (flash)(see more posts on U.S. Michigan Consumer Sentiment, ) Source: investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$JPY,$TLT,equities,EUR/CHF,Eurozone Consumer Confidence,Featured,France Consumer Price Index (harmonized),France Gross Domestic Product,Germany Consumer Price Index,Japan Household Spending,Japan National Core Consumer Price Index,Japan Unemployment Rate,newslettersent,SEK,Spain Consumer Price Index,Spain Gross Domestic Product,U.S. Gross Domestic Product,U.S. Michigan Consumer Sentiment,USD/CHF