Summary Indonesia’s parliament approved a revised budget for 2017 that sees a wider deficit. Pakistan’s Supreme Court has ousted Prime Minister Sharif. Polish President Duda vetoed portions of the judicial reform bill submitted by the Law and Justice party. The European Commission (EC) is preparing possible sanctions against Poland. The US House of Representatives voted to impose new sanctions against Russia, Iran, and North Korea. Brazil President Temer’s approval rating dropped to a record low.. World Bank’s IFC issued its first sol-denominated global bond Stock Markets In the EM equity space as measured by MSCI, China (+1.4%), Indonesia (+1.3%), and Peru (+1.3%) have outperformed this week, while Korea (-2.9%),

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

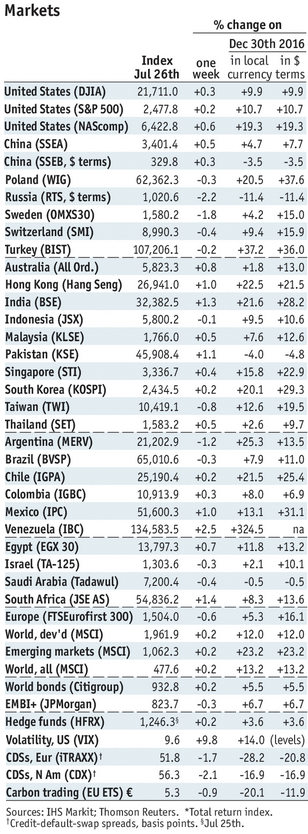

Stock MarketsIn the EM equity space as measured by MSCI, China (+1.4%), Indonesia (+1.3%), and Peru (+1.3%) have outperformed this week, while Korea (-2.9%), Mexico (-1.9%), and Egypt (-1.8%) have underperformed. To put this in better context, MSCI EM rose 0.1% this week while MSCI DM fell -0.1%. In the EM local currency bond space, Brazil (10-year yield -9 bp), Peru (-4 bp), and Hong Kong (-3 bp) have outperformed this week, while Colombia (10-year yield +26 bp), Turkey (+9 bp), and South Africa (+7 bp) have underperformed. To put this in better context, the 10-year UST yield rose 7 bp to 2.30%. In the EM FX space, COP (+0.7% vs. USD), TWD (+0.6% vs. USD), and CNY (+0.4% vs. USD) have outperformed this week, while ARS (-1.9% vs. USD), ZAR (-0.7% vs. USD), and MXN (-0.6% vs. USD) have underperformed |

Stock Markets Emerging Markets, July 29 |

IndonesiaIndonesia’s parliament approved a revised budget for 2017 that sees a wider deficit.At a proposed -2.9% of GDP, the gap would be just shy of the -3% mandated ceiling. The government had previously estimated the gap at -2.4% of GDP this year. PakistanPakistan’s Supreme Court has ousted Prime Minister Sharif. All five members of the court voted to disqualify Sharif from office due to corruption. Sharif said he would accept the court’s verdict and resigned. His party (Pakistan Muslim League) said it will not hold snap elections and plans on finishing out the parliamentary term until elections are due in 2018. No word yet on who will be the next leader. PolandPolish President Duda vetoed portions of the judicial reform bill submitted by the Law and Justice party. He struck down the proposal to dismiss the entire Supreme Court and to revamp the Judicial Council, which makes key personnel decisions for the courts. Duda has asked lawmakers to craft a more conciliatory bill, but party officials (including Prime Minister Szydlo) have vowed to press on. The European Commission (EC) is preparing possible sanctions against Poland. It noted that “In the commission’s assessment, this reform amplifies the systemic threat to the rule of law in Poland already identified in the rule of law procedure started by the Commission in January 2016.”The EC gave Poland one month to address these concerns. In the meantime, the EU is discussing what measures to take next. The worse-case scenario is that Article 7 is triggered, which would lead to penalties and could suspend Poland’s voting rights in the EU. United StatesThe US House of Representatives voted to impose new sanctions against Russia, Iran, and North Korea. The bill was passed by an overwhelming 419-3 vote. The bill also constrains President Trump’s ability to waive the sanctions. The bill now heads to the Senate. Note that the EU “expressed their concerns notably because of the draft bill’s possible impact on EU energy independence.” BrazilBrazil President Temer’s approval rating dropped to a record low.According to the latest Ibope poll, Temer’s government was rated as good or very good by 5% of respondents vs.10% previously, and was rated as bad or terrible by 70% vs. 55% previously. Temer’s personal approval rating dropped to 11% vs. 20% previously. World Bank’s IFC issued its first sol-denominated global bond. It issued PEN175 mln of 3-year bonds to raise money for loans to the private sector. This issue should pave the way for Peruvian corporates to sell sol-denominated bonds in international markets.This follows a sale of MXN2 bln in 10-year bonds by the IFC, which suggests strong investor interest in bonds denominated in Latin American currencies. |

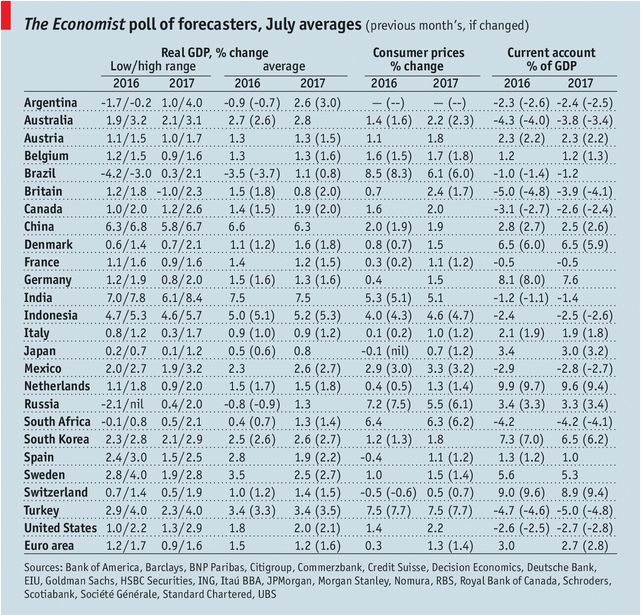

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, July 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter