Swiss Franc The Euro has fallen by 0.11% to 1.1398 CHF. EUR/CHF and USD/CHF, August 16(see more posts on EUR/CHF, USD/CHF, ). FX Rates The Japanese yen and Swiss franc remain heavy as the markets continueto shift away from the geopolitical risks. A return to the macroeconomic agenda is being deterred by new drama from Washington and reports suggesting that ECB’s Draghi will not be discussing the central bank’s monetary policy course at Jackson Hole confab, which will take place next week. The dollar is pushing at the lower end of a band of technical resistance that extends from about JPY110.95 to roughly JPY111.30. In a bigger view, the dollar has been moving between a little below JPY109 and JPY114 for the past

Topics:

Marc Chandler considers the following as important: EUR, EUR/CHF, Eurozone Gross Domestic Product, Featured, FX Daily, FX Trends, GBP, Italy Gross Domestic Product, JPY, newsletter, U.K. Average Earnings ex Bonus, U.K. Unemployment Rate, U.S. Crude Oil Inventories, U.S. Housing Starts, USD, USD/CHF

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

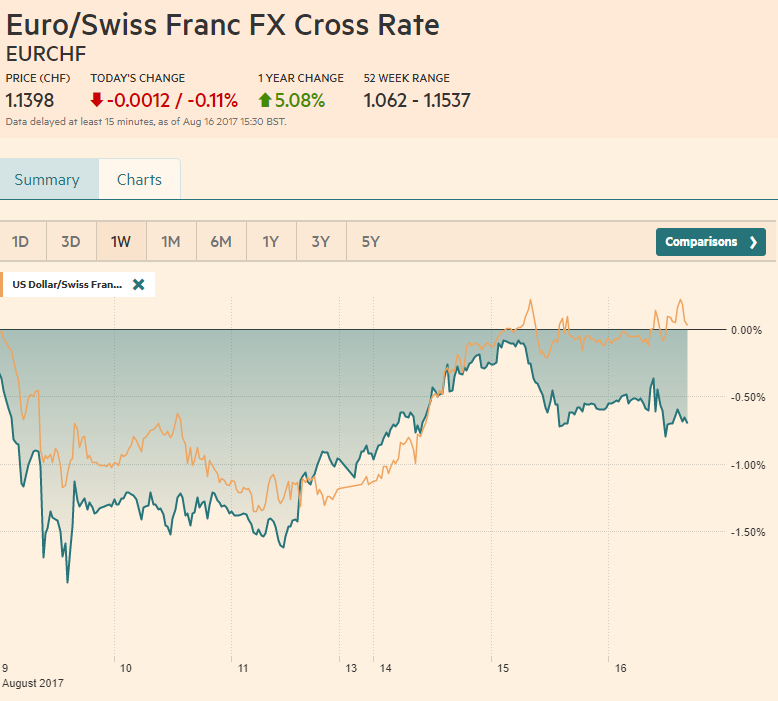

Swiss FrancThe Euro has fallen by 0.11% to 1.1398 CHF. |

EUR/CHF and USD/CHF, August 16(see more posts on EUR/CHF, USD/CHF, ) |

FX RatesThe Japanese yen and Swiss franc remain heavy as the markets continueto shift away from the geopolitical risks. A return to the macroeconomic agenda is being deterred by new drama from Washington and reports suggesting that ECB’s Draghi will not be discussing the central bank’s monetary policy course at Jackson Hole confab, which will take place next week. The dollar is pushing at the lower end of a band of technical resistance that extends from about JPY110.95 to roughly JPY111.30. In a bigger view, the dollar has been moving between a little below JPY109 and JPY114 for the past five months, with a few exceptions. The lower end of the range held again at the end of last week. |

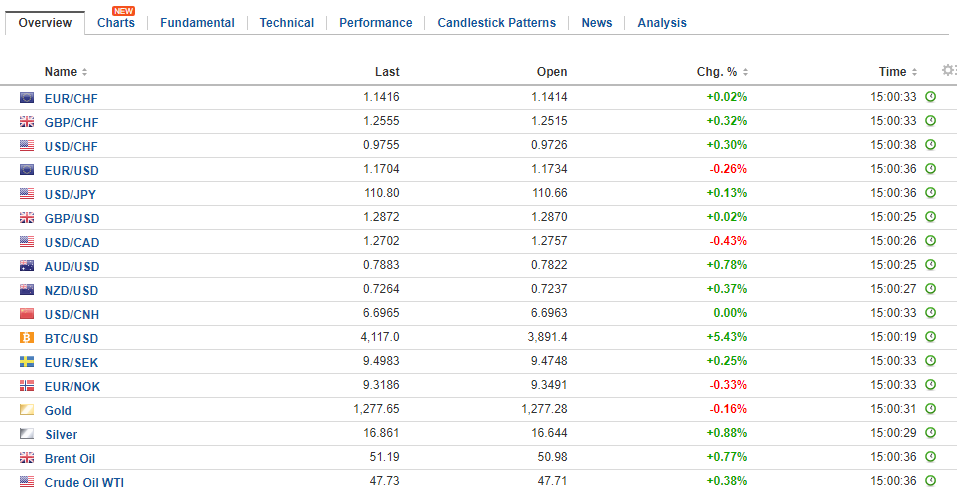

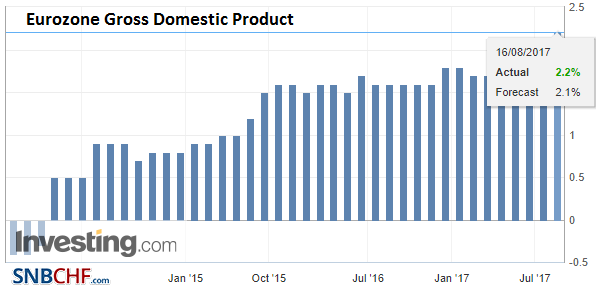

FX Daily Rates, August 16 - Click to enlarge |

| Although Draghi will return to Jackson Hole for the first time in a few years, we did not see it is a likely venue for him to talk about what the ECB would likely do in a fortnight (September 7). Even though there is some precedent, we saw the decision about extending the purchases past the year end albeit at a reduced pace as being sufficiently nuanced that the ECB’s leadership would prefer home turf and an increased chance avoiding misunderstandings.

In early European turnover, sterling had been sold off to marginal extend its recent losses. However the technical support near $1.2840 we discussed yesterday held. The timing of the Jackson Hole story and the UK employment data helped lift sterling toward $1.29 (where there is a GBP240 mln option expiring today). After poking briefly through GBP0.9140, the euro came back offered and did not find a bid until close to GBP0.9080. The December 2018 short sterling futures contract is unchanged suggesting that the employment data is not altering views on the trajectory of BOE policy. |

FX Performance, August 16 - Click to enlarge |

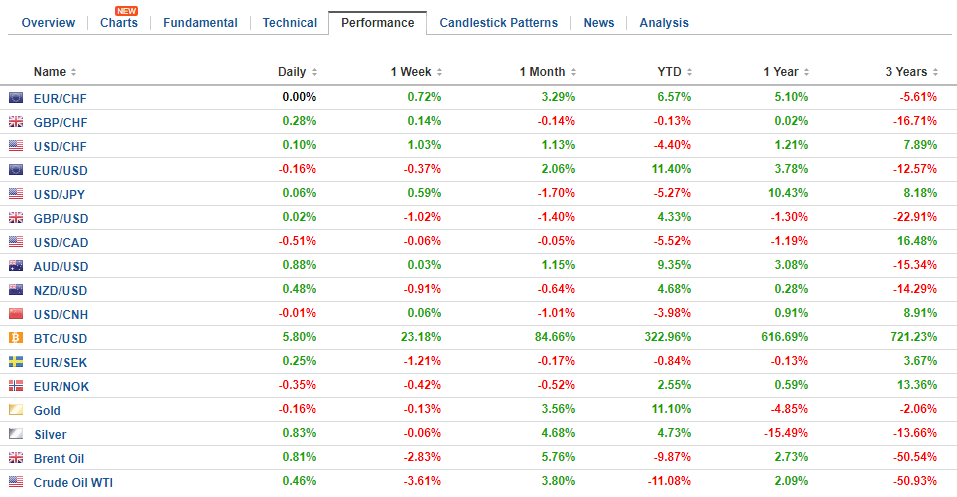

EurozoneSome suggest that the German Constitutional Court recognition of reasonable arguments that the ECB is overstepping its authority in QE operations would encourage the ECB to wind up its operations before the European Court of Justice hears the case. We do not think this is particularly likely. The German finance minister and the president of the Bundesbank quickly came out and supported the ECB against such charges. The ECB must act with the confidence that it is within its mandate until proven otherwise. |

Eurozone Gross Domestic Product (GDP) YoY, Q2 2017(see more posts on Eurozone Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

| In any event, the euro was knocked off its highs (~$1.1760) to session lows, just below $1.17. Over the last several sessions the euro has found new bids on a dip below the figure. It has happened three times in the past five sessions, and without a close below $1.17 since July 27. New buying emerged today as well. There are no significant options near current levels that expire today, but tomorrow is one the busiest days in months, with large options expiring at various strikes within the recent ranges. |

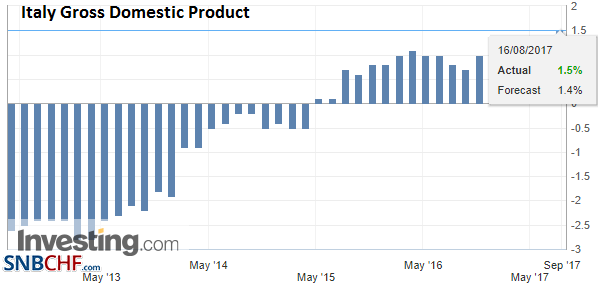

Italy Gross Domestic Product (GDP) YoY, Q2 2017(see more posts on Italy Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

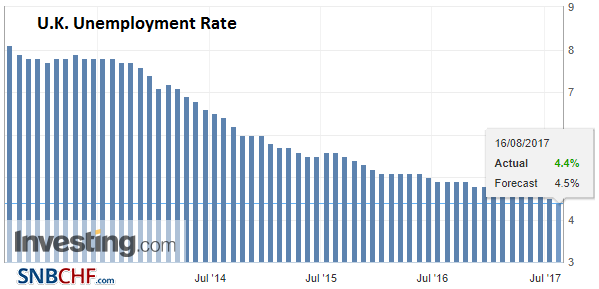

United KingdomThe euro was also weighed down as cross positions against sterling were unwound on news that the UK unemployment fell to a new generation (42 years) low of 4.4%. The claimant could fell 4.2k; while the June increase was pared to 3.5k from 5.9k. It was the first decline since February. The UK economy grew 125k jobs in Q2, which is better than expected (~100), but less than the 175k increase in Q1. |

U.K. Unemployment Rate, Jun 2017(see more posts on U.K. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

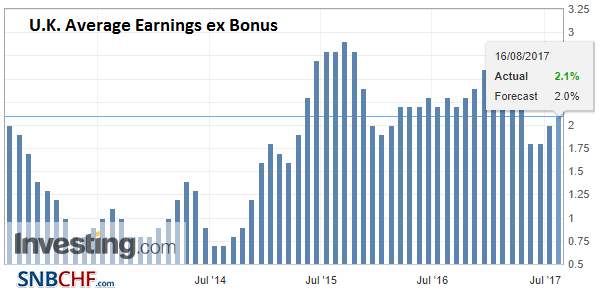

| Earnings growth still lags inflation but improved marginally. Average weekly earnings rose 2.1% (three months, year-over-year) up from a revised 1.9% pace in May (was 1.8%). Excluding bonus payment, weekly earnings also rose 2.1%, up from 2.0%. |

U.K. Average Earnings ex Bonus, Jun 2017(see more posts on U.K. Average Earnings ex Bonus, ) Source: Investing.com - Click to enlarge |

| United States

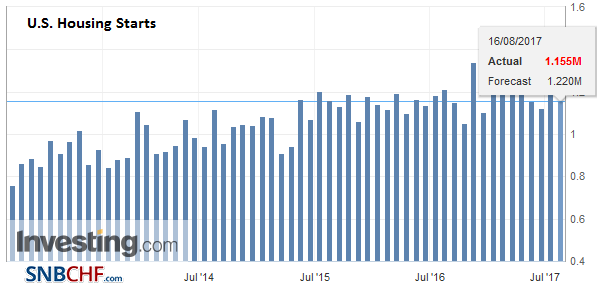

The rise in US yields yesterday (10-year yield rose a little more than five basis points, the biggest increase in three weeks), and the dollar holding on to gains that had lifted it above JPY110.50 failed to help Japanese share, which edged lower despite the 0.2% rise in the MSCI Asia Pacific Index, the third gain this week. After being on holiday yesterday, the Korean equity market continued to recover from last week’s slide and matched Monday’s 0.6% gain. Before getting to the FOMC minutes, investors will digest the July housing start and permits data. Large increases in June warns of an adjustment in July. However, given yesterday’s news, which included a strong bounce back in July retail sales and a surge in the Empire State manufacturing survey for August, confidence that the world’s largest economy gained momentum at the start of Q3 is unlikely to be undermined by today’s data. |

U.S. Housing Starts, Jul 2017(see more posts on U.S. Housing Starts, ) Source: Investing.com - Click to enlarge |

| We have played down the likely significance of the FOMC minutes from last month’s meeting. The market does not expect a September hike. Therefore, a debate about the significance of the weakness in inflation is unlikely to change that. We note that the June minutes said that most participants understood the decline in price pressures to be due to transitory factors. Also, we see place emphasis on Dudley’s recent comments. We suspect he reflected the views of the Fed’s leadership more broadly. |

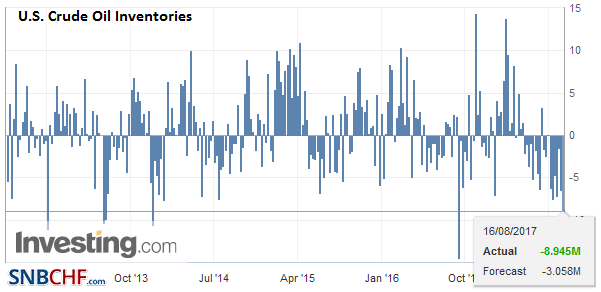

U.S. Crude Oil Inventories, Aug 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

Lastly, two highlights from the emerging market space today. First, the central bank of Thailand left its benchmark rate unchanged at 1.5%. There had been some talk of a cut in the face of the strong currency appreciation and low inflation. However, instead of the centralbank provided a verbal warning against further currency appreciation. Second, Czech and Hungary reported Q2 GDP. The former beat expectations with a stunning 2.3% quarter-over-quarter expansion. The year-over-year rate rose to 4.5%. Hungary disappointed, but with a 0.9% quarterly expansion, its growth enviable. The year-over-year pace slowed to 3.2% from 4.2%. The koruna and forint, like most of the regional currencies, are losing a little ground to the dollar today.

Tags: #GBP,#USD,$EUR,$JPY,EUR/CHF,Eurozone Gross Domestic Product,Featured,FX Daily,Italy Gross Domestic Product,newsletter,U.K. Average Earnings ex Bonus,U.K. Unemployment Rate,U.S. Crude Oil Inventories,U.S. Housing Starts,USD/CHF