Swiss Franc Improving US job data also helped to increase demand for EUR/CHF long. For last week’s sight deposits see here. Click to enlarge. The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put together another fiscal stimulus package and the Bank of England may cut rates late this week are helping global equities. The MSCI Asia-Pacific Index gained nearly 2%, the largest gain in nearly four months, led by a nearly 4% rise in the Nikkei. Today’s gain snaps a four-session drop and recoups nearly everything lost in that streak. Of note, Chinese stocks struggled, with a minor 0.25% gain in the Shanghai Composite and a 0.6% decline in Shenzhen. Eurozone European shares are mostly higher. The Dow Jones Stoxx 600 is 0.75% higher in late morning turnover, led by materials, information technology, and industrials. Energy is the only sector lower. Some observers, including Nobel-prize winner Krugman, have marveled at the performance of the FTSE 100. However, as nearly 3/4 of the FTSE earnings are from overseas, it is really played on sterling’s decline.

Topics:

Marc Chandler considers the following as important: AUD, CAD, Chairman Fischer, Dudley, EUR, Featured, FX Daily, FX Trends, GBP, Janet Yellen, Japan Core Machinery Orders, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancImproving US job data also helped to increase demand for EUR/CHF long. For last week’s sight deposits see here. |

The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put together another fiscal stimulus package and the Bank of England may cut rates late this week are helping global equities.

The MSCI Asia-Pacific Index gained nearly 2%, the largest gain in nearly four months, led by a nearly 4% rise in the Nikkei. Today’s gain snaps a four-session drop and recoups nearly everything lost in that streak. Of note, Chinese stocks struggled, with a minor 0.25% gain in the Shanghai Composite and a 0.6% decline in Shenzhen.

Eurozone

European shares are mostly higher. The Dow Jones Stoxx 600 is 0.75% higher in late morning turnover, led by materials, information technology, and industrials. Energy is the only sector lower. Some observers, including Nobel-prize winner Krugman, have marveled at the performance of the FTSE 100. However, as nearly 3/4 of the FTSE earnings are from overseas, it is really played on sterling’s decline. Today’s the FTSE100 is lagging behind the FTSE’s broader measures. The other market to note is Italy, where the FTSE Milan is off 0.4%. Bank stocks initially built on the pre-weekend (9.7% gain), but have reversed and are now off 2%.

Global bonds are mixed. Japan and Australia’s 10-year yields rose 1-2 bp, while in Europe core bond yields are slightly lower, while peripheral bond yields are 1-2 bp higher. European finance ministers are meeting today, and part of the discussion is whether Spain and Portugal should be sanctioned for fiscal excesses. A decision is likely tomorrow. The US 10-year yield is nearly two bp higher at 1.37%.

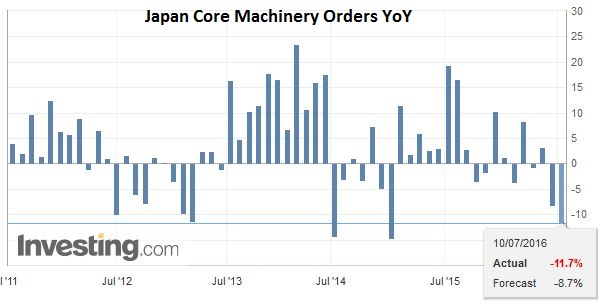

JapanIt is not just Japanese stocks that have snapped a four-day decline; so has the dollar against the yen. The 1.6% gain is the largest since the day of the UK referendum. The greenback tested support in front of JPY100 but is now holding above JPY102. in the European morning. A close of the North American session above JPY102.10 would be technically constructive. Near-term potential extends toward JPY103, with the 20-day average just above JPY103.20. The dollar has not closed above its 20-day moving average against the yen since June 1. Many observers are emphasizing that the weekend election in Japan has given a super-majority to those parties that want to change the constitution, a relax the restraints on the military. We suspect it is not so easy as the LDP’s coalition party is not nearly as sympathetic. Moreover, it is clear that Abenomics has still not won the hearts and minds of the Japanese people. The first focus is not on changing the constitution, but on reviving the economy. The poor machinery orders (-1.4% in May vs. Bloomberg median of +3.2%) illustrates the need to action. We have often argued that Abenomics was largely traditional LDP medicine of stimulative fiscal and monetary policy with a weaker yen. Between as much as JPY20 trillion (~$200 bln) and BOJ efforts expected at the end of the month, it appears we have come in a full circle. |

Click to enlarge. Source Investing.com |

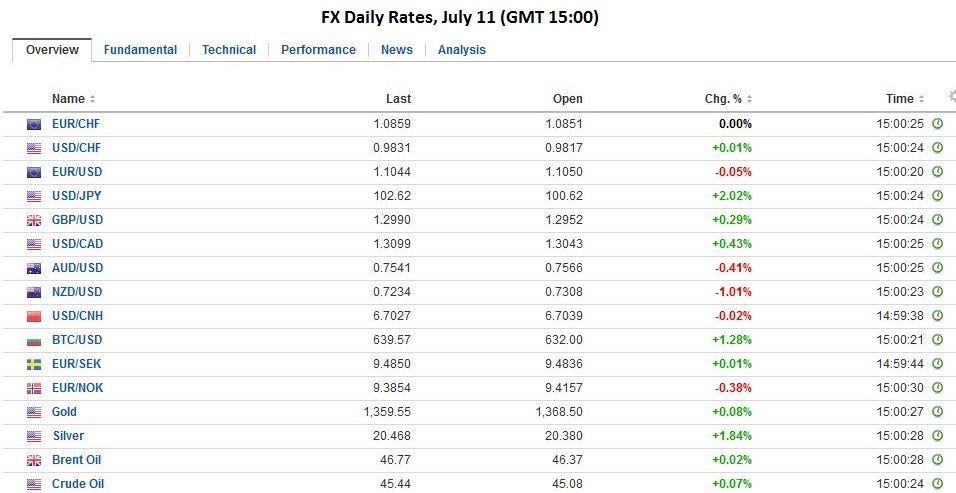

FX RatesEuroIn the days that followed the UK referendum, the euro appeared to have carved out a pennant of a flag pattern. This ended with an outside down day last Tuesday, and the euro has been working lower since. Another outside down day was recorded before the weekend, helped by a 287k increase in US non-farm payrolls. The euro has yet to break the $1.10 level, but the reaction bounces appear to be getting smaller. The low on June 24 was near $1.0910 and the low from June 27 was $1.0970. On the top side, today (thus far) is the first session since June 27 that the euro has not traded above $1.11. Initial resistance is seen near $1.1060-$1.1080 and then $1.1120. Dollar-BlocThe dollar-bloc currencies are under pressure. The New Zealand dollar is reversing lower after initially extending gains to new highs for the year. It is approaching its first retracement objective near $0.7225. A break of the pre-weekend low near $0.7215 would be a particularly bearish development. The Australian dollar made marginal new highs to $0.7575 before succumbing to profit-taking pressures. Bids were found near $0.7535, and the technical tone does not look at weak as the Kiwi. Ahead of the Bank of Canada meeting tomorrow, the Canadian dollar is extending its recent losses. The greenback is near CAD1.31. Resistance is seen in the CAD1.3120-CAD1.3140 range. |

|

BrexitSterling continues to struggle. It has slipped to $1.2850, a three-day low. The low from the middle of the last week was just below $1.2800. The market’s focus is on the BOE meeting later this week. A Bloomberg survey of 53 economists shows a close call: 24 expect no change, while 23 looks for a 25 bp cut and the remaining 5 see a larger cut. UK politics remain in disarray. The leading Tory candidate to replace Cameron sounds like a social democrat, concerned about disparity and worker representation on corporate boards, while Corbyn’s challenger is a Labour MP, who is pro-business, supported the war in Iraq and voted for some of Tory’s welfare cuts. |

United States

The US economic calendar begins slowly, with highlights (retail sales and CPI) at the end of the week. The Q2 earnings season begins today with Alcoa’s report. It is a busy week for Fed officials. No few than ten Fed officials speak this week, but not any from the Troika (Yellen, Fischer, and Dudley) from which we argue policy emanates. During the North American session today, George speaks. While she dissented earlier the spring for an immediate hike, the poor May employment data appears to have prompted her to rejoin the majority in June.

Graphs and additional information on Swiss Franc by the snbchf team.