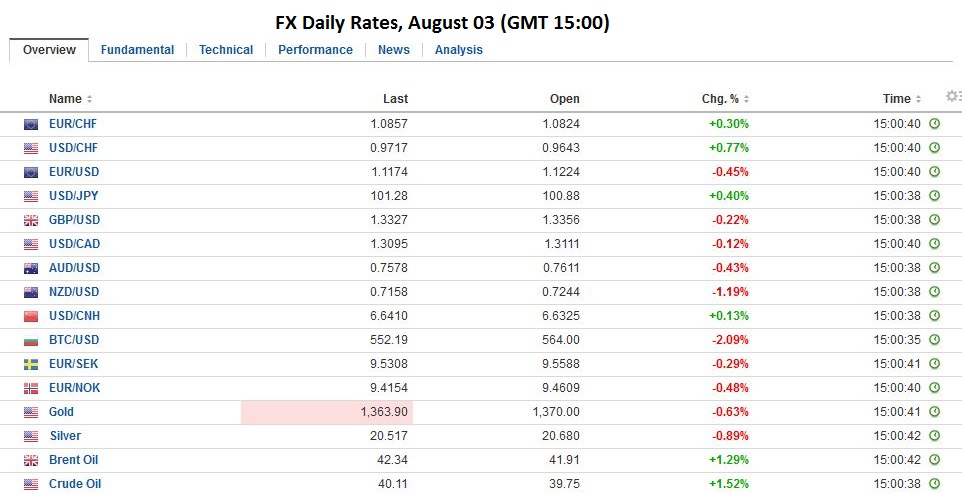

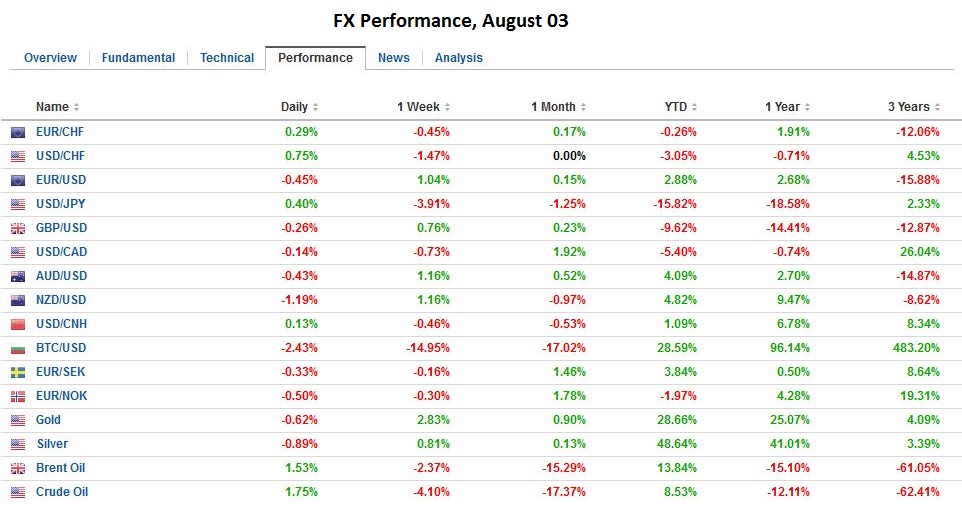

Swiss Franc Click to enlarge. FX Rates The US dollar is consolidating yesterday’s losses. The greenback’s upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week’s RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week. The asset markets are more interesting than the foreign exchange market today. The surge in Japanese bond yields steadied earlier today. After rising nearly 30 bp since the middle of last week ostensibly in disappointment to the BOJ reluctance to increase its bond purchases, the 10-year JGB yield slipped a single basis point today, leaving the benchmark yield at nearly -10 bp. European bond yields appeared to have been pushed higher by the sharp move in Japan have also steadied today. Following the sell-off on Wall Street yesterday, global equity markets are lower. Nearly all the Asian markets were lower. The MSCI Asia-Pacific Index was off almost 1.8%; its biggest loss since the UK referendum. It is the first time in a month (July 5-6) that the index was off two consecutive sessions. Chinese shares were the exception as small gains were posted, and it was the second consecutive advance. Click to enlarge.

Topics:

Marc Chandler considers the following as important: Asia-Pacific Index, AUD, Bank of England, Bank of Japan, China Caixin Services PMI, EUR, European bond yield, Eurozone Markit Composite PMI, Eurozone Services PMI, Featured, FX Daily, FX Trends, GBP, Italian Bank, Italy Services PMI, JPY, newsletter, U.K. Services PMI, U.S. ISM Non-Manufacturing PMI, U.S. Services PMI, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

|

FX RatesThe US dollar is consolidating yesterday’s losses. The greenback’s upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week’s RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week. The asset markets are more interesting than the foreign exchange market today. The surge in Japanese bond yields steadied earlier today. After rising nearly 30 bp since the middle of last week ostensibly in disappointment to the BOJ reluctance to increase its bond purchases, the 10-year JGB yield slipped a single basis point today, leaving the benchmark yield at nearly -10 bp. European bond yields appeared to have been pushed higher by the sharp move in Japan have also steadied today. Following the sell-off on Wall Street yesterday, global equity markets are lower. Nearly all the Asian markets were lower. The MSCI Asia-Pacific Index was off almost 1.8%; its biggest loss since the UK referendum. It is the first time in a month (July 5-6) that the index was off two consecutive sessions. Chinese shares were the exception as small gains were posted, and it was the second consecutive advance. |

|

| European equities are mostly lower, with the Dow Jones Stoxx 600 off about 0.2% near midday. Of note, the financial sector is bucking the trend to post modest gains (~0.6%). News that of a share buyback program from one of the large UK-based banks and a recovery in Italian banks (bank index is up almost 2%, after falling around 11% in the past two sessions).

The euro is stalling at the 61.8% retracement objective of the decline was seen since the UK referendum. That level is seen near $1.1230. Initial support is seen in front of $1.1150. Sterling and the yen are in narrow ranges near yesterday’s best levels. The Australian dollar is holding below a downtrend line drawn off the late-April and mid-July highs. The third point in the line was yesterday’s high just under $0.7640. The euro posted a reversal on the daily bar charts against sterling yesterday, and there has been modest follow through selling today. A break of GBP0.8380 could push it toward GBP0.8330. |

|

ChinaThe main economic news today is the non-manufacturing PMIs. There were few surprises and aside from the incremental addition to the information set, the reports are unlikely to shift policy expectations. China’s Caixin service PMI fell to 51.7 from 52.7 (recall that the official measure edged higher to 53.9 from 53.7). The Caixin composite measure rose to 51.9 from 50.3. This is the highest reading since September 2014 and helps reinforce the sense that the Chinese economy is stabilizing. Separately, Australia’s services PMI rose to 53.9 from 51.3. It is the strongest since last August. |

Click to enlarge. Source Investing.com |

EurozoneIn Europe, the EMU services PMI rose to 52.9 from the 52.7 flash reading. It stood at 52.8 in June. |

Click to enlarge. Source Investing.com |

| The composite PMI rose to 53.2 from 52.9 flash and 53.1 in June. Highlights from the national reports include a 54.4 German reading, down from 54.6 flash, but up from 53.7 in June and France was revised to 50.5 from 50.3 flash and 49.9 in June. |

Click to enlarge. Source Investing.com |

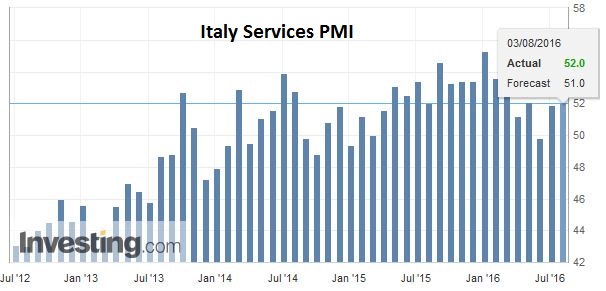

ItalyItaly’s services PMI ticked up to 52.0 from 51.9. It is the best reading since April and follows the lowest manufacturing PMI in 18 months. Spain offered the biggest disappointment. Its service PMI fell to 54.1 from 56.0. Of note, Spain’s composite reading of 53.7 (down from 55.7 in June) is the lowest results since late-2013. It is part of the growing signs that began earlier Q2 that the Spanish economy is moderating. |

Click to enlarge. Source Investing.com |

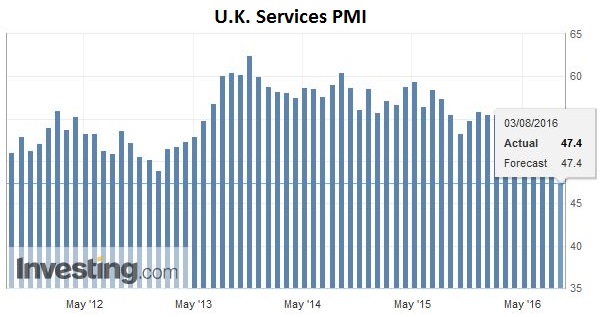

United KingdomThe main takeaway is the eurozone economy does not appear to have been impacted (yet) by the UK decision to leave the EU. The UK is a different story. Today’s services PMI confirmed the preliminary 47.4 estimate. It is down from 52.3 in June and 53.5 in May. What was a slow decline (59.5 in June 2015) has accelerated. The composite reading of 47.5 is a little below the flash reading and contrasts with the 52.5 June report, which was the average for Q2. It is little wonder that NISER warned that the UK economy is likely contracting here in Q3 and estimated a 50% chance that Q4 contracts as well. The market anticipates a rate cut tomorrow but is more divided on the outlook for new asset purchases and other credit easing measures. Recall that tomorrow the BOE will announce the outcome of the meeting, release the minutes, provide updated economic forecasts, hold a press conference. The market may be disappointed if the BOE only cuts rate, but we suspect that there is a risk of “sell the rumor buy the fact” type of activity. |

Click to enlarge. Source Investing.com |

United StatesThe US reports dueling surveys, with the Markit service PMI expected to tick up from the 50.9 flash reading to 51.0. In June it was 51.4 and averaged 51.8 in Q2 and 51.4 in Q1. |

Click to enlarge. Source Investing.com |

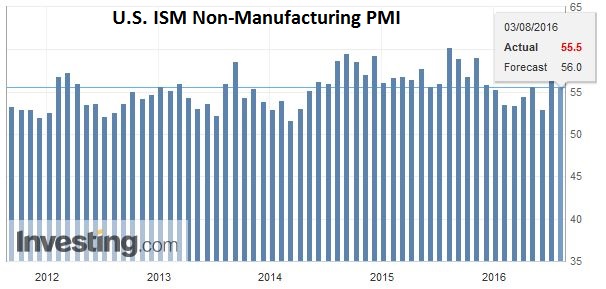

| The ISM non-manufacturing survey is expected to slip to 55.9 from 56.5. It averaged 55.0 in Q2 and 53.8 in Q1. The market reaction may be minimal provided the ADP employment estimate does not come in much below the 172k in June. The DOE energy report will draw interest after the 1.3 mln barrel drawdown in the API estimate, which may be helping prices stabilize today. |

Click to enlarge. Source Investing.com |

Graphs and additional information on Swiss Franc by the snbchf team.