For many, this will be the last week of the summer. However, in an unusual twist of the calendar, the US August employment report will be released on September 2, the end of the following week, rather than after the US Labor Day holiday (September 5). The main economic report of the week ahead will be the preliminary estimate of the August PMI. The policy implications are not as obvious as they may seem. For example, in July, the eurozone composite PMI slipped...

Read More »What’s Going On, And Why Late August?

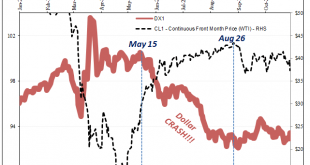

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here? What you’ll hear or have already heard is something about Europe and more lockdowns, fears about a second wave of the pandemic. No, that doesn’t fit the herdlike change in direction you can observe across many different markets (below)....

Read More »FX Daily, August 22: Fischer Joins Dudley; Waiting for Yellen

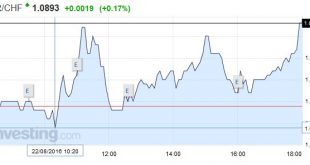

Swiss Franc As usual, when discussions about rate hikes go on, then both the dollar and the euro gain against the Swiss Franc. Click to enlarge. Federal Reserve Last week, some market participants were giving more credence to what seemed like dovish FOMC minutes than to NY Fed President Dudley’s remarks that accused investors of complacency over the outlook for rates. Yesterday, Vice-Chairman of the Federal Reserve...

Read More »FX Weekly Preview: Yellen at Jackson Hole

Lastly, a brief word about next week. I will not post my usual piece on macro considerations on Sunday. Here, though, is a brief thumbnail sketch of the top five things I will be watching: 1. Yellen at Jackson Hole at the end of next week: To the extent that she shares her assessment of the economy, I would expect to largely echo the broad sentiment expressed by NY Fed President Dudley. Click to enlarge. 2....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org