The general improvement in hard data holds out the possibility of a positive surprise when preliminary GDP figures are announced next week.Next week will be a busy one for Europe, with lots of data releases: European Commission business survey (April); advance GDP (Q1); M3 money supply (March); HICP flash estimate of inflation (April); and final manufacturing purchasing manager indices (PMIs, April). The advance Q1 GDP will be especially closely watched. No euro area GDP breakdown will be published, but we will have some clues on growth composition when euro area countries such as France publish their own GDP figures the same day (on Tuesday, 30 April).There have been some interesting developments in the euro area recently, notably the divergence between hard and soft data. Survey data

Topics:

Nadia Gharbi considers the following as important: euro area GDP, euro area growth, euro area growth forecast, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The general improvement in hard data holds out the possibility of a positive surprise when preliminary GDP figures are announced next week.

Next week will be a busy one for Europe, with lots of data releases: European Commission business survey (April); advance GDP (Q1); M3 money supply (March); HICP flash estimate of inflation (April); and final manufacturing purchasing manager indices (PMIs, April). The advance Q1 GDP will be especially closely watched. No euro area GDP breakdown will be published, but we will have some clues on growth composition when euro area countries such as France publish their own GDP figures the same day (on Tuesday, 30 April).

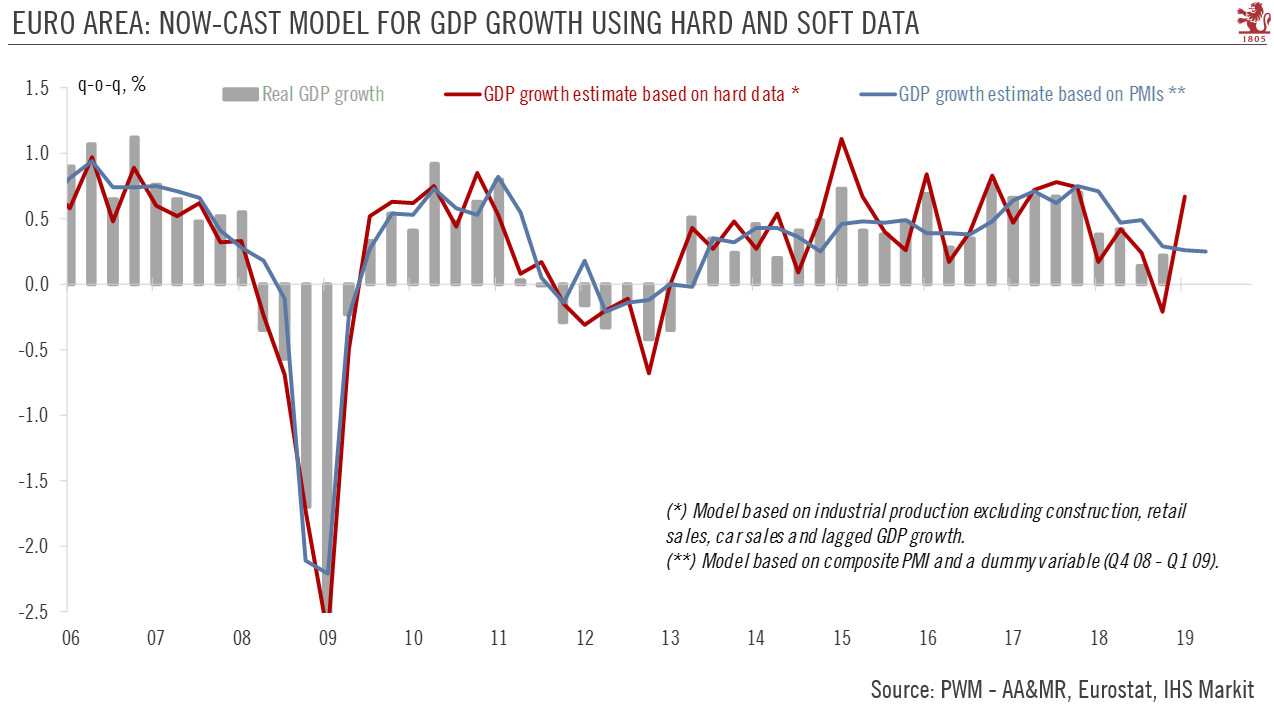

There have been some interesting developments in the euro area recently, notably the divergence between hard and soft data. Survey data have been generally weak, signalling GDP growth of just 0.2% quarter on quarter (q-o-q) in Q1, although there are some discrepancies. For example, Markit PMIs have tended to be softer than the national (Ifo, Insee, Istat) and European Commission surveys. And weak manufacturing surveys contrast with resilient services (the divergence is especially noticeable in German PMIs). In contrast, hard data show a clear improvement in Q1 2019 suggesting that GDP growth might have accelerated to 0.6% q-o-q at least (see chart).

Industrial production (ex-construction) in the euro area came in better than expected in February, recording a smaller contraction (0.2% month on month (m-o-m)) than expected. In addition, January figures were revised up. Assuming zero growth in March, production is likely to have increased by more than 0.7% q-o-q in Q1 19 versus a fall of 1.1% in Q4. Retail sales have also performed well, surprising on the upside in February. Car registrations rebounded in Q1, following the fall in H2 2018 caused by the introduction of new exhaust emission standards and weaker external demand. Furthermore, construction activity was quite strong in Q1 in the euro area thanks to a milder-than-normal winter.

Thus, the advance estimate of Q1 GDP growth in the euro area is likely to surprise positively and be above what is suggested by PMI surveys (0.2% q-o-q), although inventories remain a key uncertainty. Overall, at this stage, we continue to see euro area GDP expanding by 1.4% in 2019, but with risks tilted to the downside.