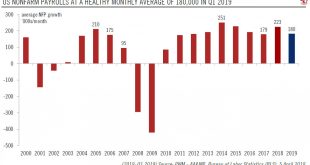

Latest nonfarm payroll report shows the ongoing resilience of the US economy, although some cyclical sectors are being affected by global headwinds.US employment rose by 196,00 in March, bringing the three-month average to a healthy 180,000/month— less than the 2018 average of 223,000, but more than in 2017.The unemployment rate was unchanged at 3.8%, below the Federal Reserve’s (Fed) ‘full employment’ estimate of 4.4%.Wage growth softened to 3.2% year-on-year (y-o-y) from 3.4% in...

Read More »US employment: keeping an eye on the clock

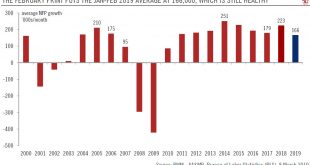

Despite a weaker than expected February employment report, the three-month average remains robust and we would tend to dismiss this weak print as a mere ‘blip’.With only 20,000 job additions, the US employment report for February was weak. However, with the three-month average remaining robust at 186,000, we would tend to dismiss this weak print as a mere ‘blip’. Furthermore, the weak reading is inconsistent with other labour market data and indicators, including recent consumer and business...

Read More »US employment – chugging along

The July employment report confirmed that the US economy is in great shape, and still unaffected by international trade tensions.The US labour market remains in fine fettle, as the three-month average in job growth up to July was 224,000. The unemployment rate dropped to 3.9%, while the ‘broader’ unemployment rate (U6) fell to 7.5%, its lowest level since May 2001.Wage growth remained relatively tame (especially in light of the low unemployment rate), with average hourly earnings growth at...

Read More »US chart of the week – Low macro vol

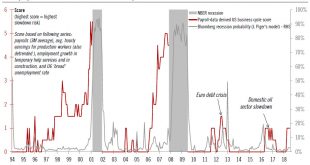

Volatility in US payroll data has remained low lately. We see limited signs of imminent overheating or slowing in the US.Volatility has picked up significantly on US equity markets lately. But does it reflect higher volatility in US macroeconomic data?So far, not really. Take US payroll data. If one looks at the one-year rolling standard deviation of the monthly data, one can see volatility is still subdued: it now stands at 68,000 (new payrolls/month), which is close to the average since...

Read More »Slow wage growth to keep Fed on prudent normalisation track

The November employment report showed another ‘Goldilocks’ set of conditions for investors: employment growth remained firm, especially in cyclical sectors like manufacturing and construction. At the same time, wage growth stayed soft – which means the Federal Reserve is unlikely to shift its current prudent communication on interest -rate hikes (although it is still very likely to hike 25bps on 13 December)....

Read More »Slow wage growth to keep Fed on prudent normalisation track

But latest employment report shows the US economy remains in fine fettle. The November employment report revealed another ‘Goldilocks’ set of conditions for investors: employment growth remained firm, especially in cyclical sectors like manufacturing and construction. At the same time, wage growth stayed soft – which means the Federal Reserve is unlikely to shift its current prudent communication on interest-rate hikes (although it is still very...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org