The downward tilt to bond yields means we have revised down our year-end forecast for the 10-year US Treasury yield.The impressive 52 basis points fall in the US 10-year Treasury yield to 1.5% made August a remarkable month.Unsurprisingly, the fall owed much to the fear that additional US tariffs on Chinese imports could prolong the global manufacturing recession, thereby increasing the risk of contagion to the services sector and hence sparking a general US slowdown. It seems that market...

Read More »Core sovereign bond yields – update

We are adjusting downward our year-end targets for the 10-year US Treasury and Bund yields. Taking hold of two important changes to our central macroeconomic scenarios, we are adjusting downward our year-end target for the 10-year US Treasury yield from 3.0% to 2.8% and the Bund yield from 0.5% to 0.3%. The drivers behind this include lower inflation expectations, rising US-China trade tensions against a constant...

Read More »Core sovereign bond yields – update

We are adjusting downward our year-end targets for the 10-year US Treasury and Bund yields.Taking hold of two important changes to our central macroeconomic scenarios, we are adjusting downward our year-end target for the 10-year US Treasury yield from 3.0% to 2.8% and the Bund yield from 0.5% to 0.3%. The drivers behind this include lower inflation expectations, rising US-China trade tensions against a constant monetary policy backdrop.Four consecutive disappointing US inflation prints have...

Read More »STAYING NEUTRAL ON US TREASURIES

With global recession risks on the rise and the US treasury yield curve still threatening to invert, we remain neutral on US Treasuries.Since our December note on the 2019 outlook for US Treasuries, the environment for US bonds has shifted dramatically. The 10-year US Treasury yield reached a low of 2.56% on 3 January, the day before Jay Powell, chairman of the US Federal Reserve (Fed), made a U-turn from a hawkish to a dovish stance. Taking note of this regime shift, we are revising our...

Read More »Spreads for investment grade credits torn in different directions

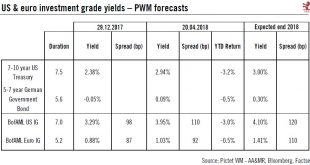

After a difficult start to the year, we remain neutral on prospects for developed market investment grade credits for the coming 12 months.Although US investment grade (IG) and euro IG have posted a negative total return so far this year, credit continues to offer interesting yield pick-up for investors (especially in euro).Overall, we are neutral on prospects for US and euro IG over the coming 12 months. We see US and euro credit yields rising due to higher sovereign yields (especially for...

Read More »Ten-year Treasury yield has further to rise

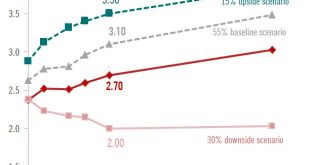

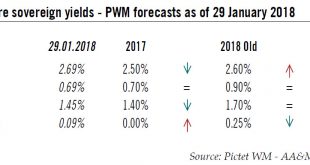

Taking into account last December’s fiscal reforms in the US, we have revised up our end-of-the year target for the 10-year Treasury yield.Given our expectations of a rebound in core inflation, accelerating growth and a faster rise in the Fed funds rate this year, we now expect the 10-year US Treasury yield to rise from 2.7% as of 29 January to 3.0% by the end of 2018 (our previous forecast for end-2018 was 2.6%). This rise is likely to be driven by both inflation expectations and TIPS...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org