Summary:

Pictet Wealth Management's latest positioning across asset classes and invesment themes.Asset AllocationEconomic and earnings growth continue to offer good momentum and the possibility of upside surprises for 2018, so we remain overweight developed market (DM) equities.However, uncertainties over other key aspects of the outlook mean that investors may be unwise to lower their defences. We are keeping tail risk mitigation in portfolios.Emerging market (EM) equities should continue to perform in 2018, but we remain prudent about low earnings momentum in some sectors.Declining intra-index correlations and rising volatility will favour active management and stock-picking in 2018.CommoditiesOur base scenario is still for the equilibrium oil price to remain at around USD55-USD58 for WTI in the

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management's latest positioning across asset classes and invesment themes.Asset AllocationEconomic and earnings growth continue to offer good momentum and the possibility of upside surprises for 2018, so we remain overweight developed market (DM) equities.However, uncertainties over other key aspects of the outlook mean that investors may be unwise to lower their defences. We are keeping tail risk mitigation in portfolios.Emerging market (EM) equities should continue to perform in 2018, but we remain prudent about low earnings momentum in some sectors.Declining intra-index correlations and rising volatility will favour active management and stock-picking in 2018.CommoditiesOur base scenario is still for the equilibrium oil price to remain at around USD55-USD58 for WTI in the

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management's latest positioning across asset classes and invesment themes.

- Economic and earnings growth continue to offer good momentum and the possibility of upside surprises for 2018, so we remain overweight developed market (DM) equities.

- However, uncertainties over other key aspects of the outlook mean that investors may be unwise to lower their defences. We are keeping tail risk mitigation in portfolios.

- Emerging market (EM) equities should continue to perform in 2018, but we remain prudent about low earnings momentum in some sectors.

- Declining intra-index correlations and rising volatility will favour active management and stock-picking in 2018.

Commodities

- Our base scenario is still for the equilibrium oil price to remain at around USD55-USD58 for WTI in the coming months. However, risks are to the upside.

Equities

- We are bullish on DM equities, in the US, the euro area and Japan. But elevated valuations mean a highly selective approach is needed.

- We favour value over growth stocks for 2018. Sectors we like include industrials and financials.

- We are neutral on tech stocks. But while some high-profile tech stocks with an earnings deficit look overbought, good cash generation means we do not expect a tech bust.

Currencies

- We see limited further downside for the EUR against the USD. We continue to expect a gradual weakening of the dollar in 2018, and estimate an EUR/USD rate of 1.24 for end-2018.

- US 10-year Treasuries should yield 2.60% by end-2018, up from 2.41% at end-2017. Our end-2018 target for 10-year German Bunds is 0.90%, up from 0.63% at end-2017.

- As we expect yields to rise, we would stay underweight core sovereign bonds and short duration.

- We continue to see opportunities in credit. However, as interest rates could rise gradually, we would focus on quality. We favour investment grade, but are cautious on high yield given tight spreads and risk profile, and prefer, selectively, emerging market debt.

Alternatives

- Our outlook for hedge funds remains positive, as monetary and political developments should work in favour of most strategies. We especially like long/short equity, relative value and merger arbitrage strategies.

- Despite high prices, we continue to see opportunities in private equity, which we expect to maintain its illiquidity premium to public equities.

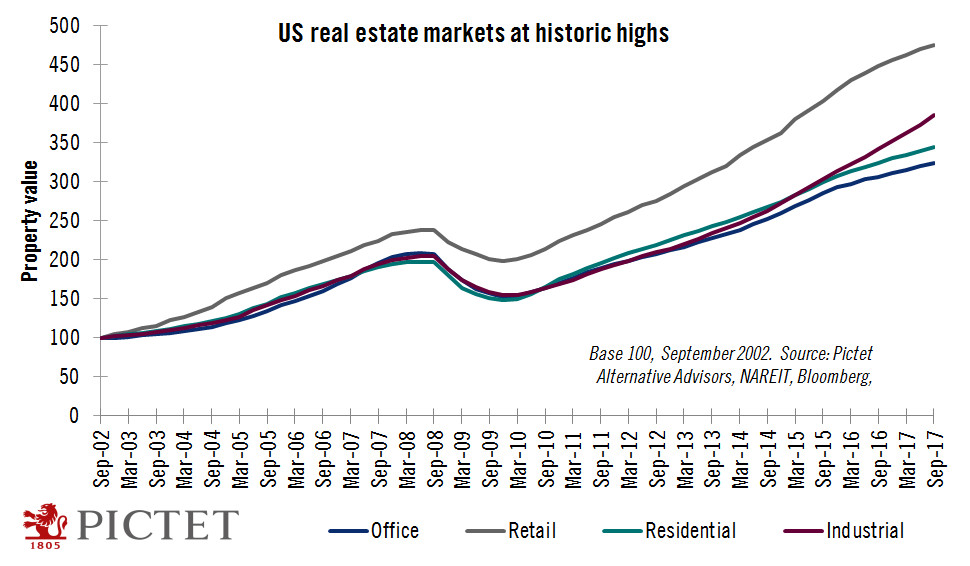

- Uncertainty and high valuations pose challenges for real estate in 2018. However, niche opportunities are set to remain in vogue.