The outcome of German wage negotiations will have important implications for the broader inflation outlook in the euro area, and thus for ECB policy.German wage negotiations are in full swing amid growing calls for strikes. This comes at a crucial time for the ECB as strong growth and falling unemployment are expected to feed into higher inflation. IG Metall is by far the most important union to watch, representing almost 4 million German workers and being seen as a benchmark, including in the car industry or the construction sector this year. Importantly, the focus has shifted to some extent from wage increases to flexible hours and other forms of soft compensation, which makes the whole process more complicated.In the end, the markets are likely to focus on the wage settlements. We see

Topics:

Frederik Ducrozet considers the following as important: ECB staff projections, European wage growth, German wages, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The outcome of German wage negotiations will have important implications for the broader inflation outlook in the euro area, and thus for ECB policy.

German wage negotiations are in full swing amid growing calls for strikes. This comes at a crucial time for the ECB as strong growth and falling unemployment are expected to feed into higher inflation. IG Metall is by far the most important union to watch, representing almost 4 million German workers and being seen as a benchmark, including in the car industry or the construction sector this year. Importantly, the focus has shifted to some extent from wage increases to flexible hours and other forms of soft compensation, which makes the whole process more complicated.

In the end, the markets are likely to focus on the wage settlements. We see reasons to expect significant rises, with important implications for the ECB. IG Metall has asked for a 6% pay hike in the metal and engineering sector, well within the range of their past demands. Historically, they would get less than half of this, or slightly less than 3% in nominal annualised terms once one-off payments are included. This time looks different, with economic conditions the most favourable in decades and bottlenecks increasingly visible in several segments of the German labour market.

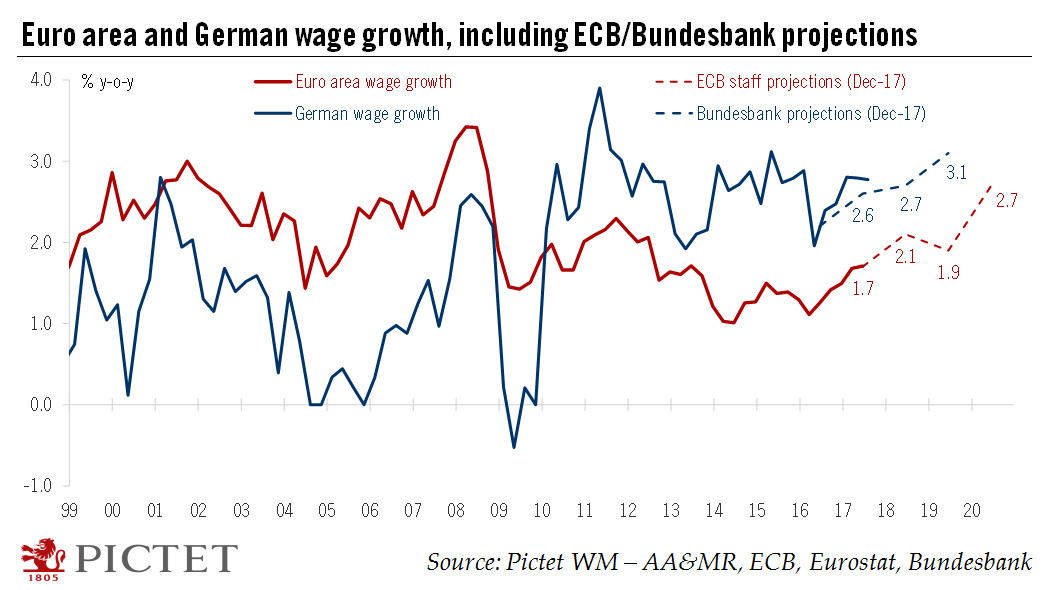

German wages can be seen as a proxy for the necessary rebalancing between core and peripheral countries, in order for the latter to regain some degree of price competitiveness and for the former to help the ECB meet its mandate. The Bundesbank projections which fed into ECB staff forecasts in December have compensation per employee rising only gradually to 2.7% in 2018 (from 2.6%), and to 3.1% in 2019. This suggests that an IG Metall deal setting wage increases at around 3.5%, for example, would have the potential to surprise the ECB positively, adding to the current hawkish communication shift.