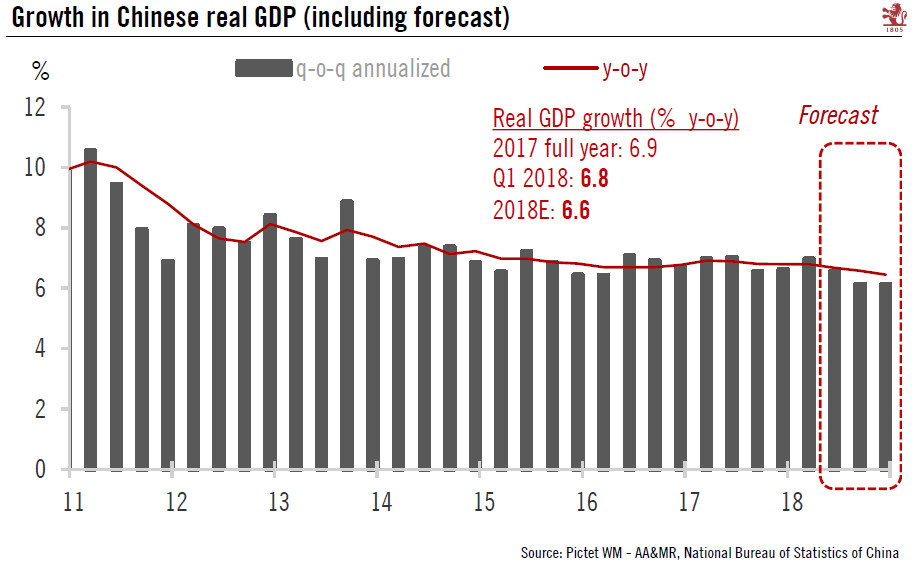

China’s GDP growth figure in Q1 of 6.8% was fractionally ahead of forecasts but seasonal consumption masked changing patterns in underlying activity.Chinese GDP in Q1 2018 came in at Rmb19.9 trillion (about USD3.2 trillion), rising 6.8% year-over-year (y-o-y) in real terms. The growth rate is the same as in H2 2017 and beats the market consensus (6.7%) and our own forecast (6.6%).Details of the GDP report show strong signs of economic rebalancing. Traditional drivers of growth such as fixed asset investment and industrial production decelerated in Q1, but the slack was offset by strong momentum in consumption and services.With the strong Q1 growth figure, we have decided to revise up our full-year Chinese GDP forecast for 2018 slightly to 6.6% from the previous 6.5%.However, this does not

Topics:

Dong Chen considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

China’s GDP growth figure in Q1 of 6.8% was fractionally ahead of forecasts but seasonal consumption masked changing patterns in underlying activity.

Chinese GDP in Q1 2018 came in at Rmb19.9 trillion (about USD3.2 trillion), rising 6.8% year-over-year (y-o-y) in real terms. The growth rate is the same as in H2 2017 and beats the market consensus (6.7%) and our own forecast (6.6%).

Details of the GDP report show strong signs of economic rebalancing. Traditional drivers of growth such as fixed asset investment and industrial production decelerated in Q1, but the slack was offset by strong momentum in consumption and services.

With the strong Q1 growth figure, we have decided to revise up our full-year Chinese GDP forecast for 2018 slightly to 6.6% from the previous 6.5%.

However, this does not change our view that Chinese growth will likely moderate going forward. Policy mistakes in the government’s deleveraging efforts and a trade war with the US are the two major downside risks to our fairly bullish views about the Chinese economy.