With the ECB’s asset purchases due to end this month and forward guidance set to remain unchanged, a focus at next week’s policy meeting will be staff forecasts for growth and inflation.At its Governing Council meeting next week, we expect the European Central Bank (ECB) to confirm that its asset purchases will cease at year’s end. However, it is likely to stress that the end of the net asset purchase programme does not represent a tightening of its policy stance. We also think the ECB will keep its forward guidance unchanged, with interest rates to remain at their present levels at least through the summer of 2019, or longer if necessary.We continue to expect a first 15bp hike in the ECB’s deposit rate in September 2019, followed by a 25bp hike in all policy rates in December 2019.

Topics:

Nadia Gharbi considers the following as important: ECB asset purchases, ECB policy, ECB preview, ECB staff forecasts, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

With the ECB’s asset purchases due to end this month and forward guidance set to remain unchanged, a focus at next week’s policy meeting will be staff forecasts for growth and inflation.

At its Governing Council meeting next week, we expect the European Central Bank (ECB) to confirm that its asset purchases will cease at year’s end. However, it is likely to stress that the end of the net asset purchase programme does not represent a tightening of its policy stance. We also think the ECB will keep its forward guidance unchanged, with interest rates to remain at their present levels at least through the summer of 2019, or longer if necessary.

We continue to expect a first 15bp hike in the ECB’s deposit rate in September 2019, followed by a 25bp hike in all policy rates in December 2019. Nevertheless, as we have been stressing, the risks to this scenario are tilted to the downside given recent data. We will reassess our ECB scenario in the wake of next week’s meeting.

Communication is likely to be tricky for the ECB next week as, broadly speaking, data have disappointed of late. But the ECB could maintain that risks are broadly balanced, emphasising the temporary nature of some of the recent data weakness and asserting that the main drivers of domestic demand remained in place. This would make it easier for the bank to communicate its intention to end net asset purchases.

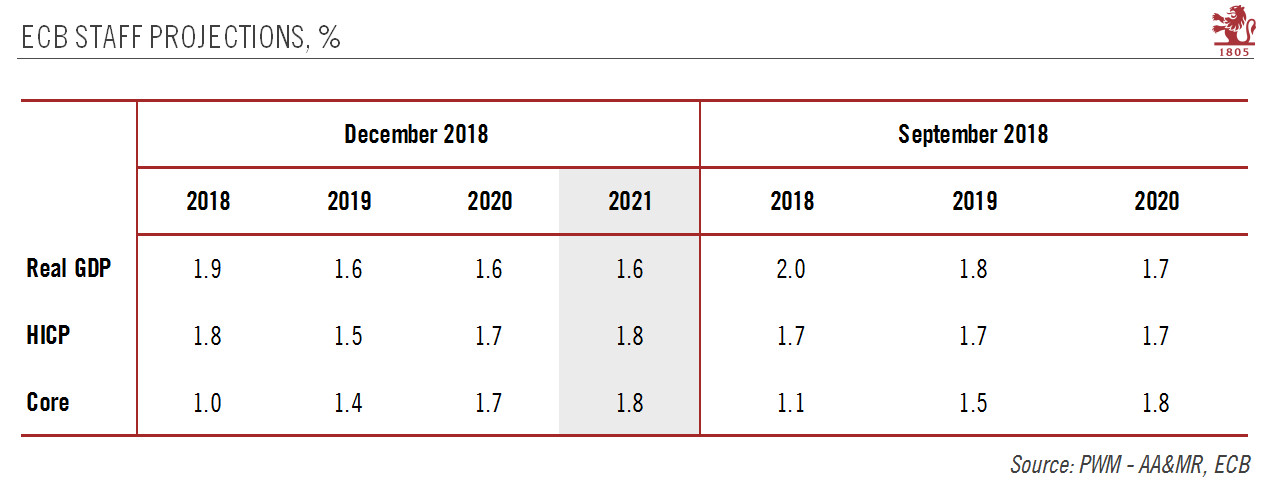

The ECB will also publish its new staff macroeconomic forecasts, including its preliminary forecasts for 2021. We expect a small downward revision in the macroeconomic projections for GDP growth this year and next, reflecting weakness in Q3. Headline HICP and core inflation forecasts are likely to be revised down as well (see Table).

The ECB is also due to unveil the details of its reinvestment programme next week. We expect the ECB to maintain its broad principles (capital keys, market neutrality and operational flexibility) and keep things as simple as possible. A twist whereby the ECB announces, for example, the purchases of longer-maturity bonds or a change in the asset classes it invests in (i.e. fewer government bonds and more corporates bond) seems unlikely.

As in previous months, ECB president Mario Draghi will likely hint that discussions have taken place about extending the TLTRO programme for banks. An extension could be announced sometime in the first half of next year in our view, but an announcement next week is probably premature.